The GBP/USD bounced back to around 1.3569, influenced by the uncertainty surrounding the upcoming trade discussions between the United States and China, which is fostering a cautious market mood. According to the US Bureau of Labour Statistics (BLS), non-farm payrolls (NFP) in the United States increased by 139,000 in May. This figure follows a revised gain of 147,000 in April (down from a previously reported 177,000) and exceeded the market expectation of 130,000. Additional insights from the report indicate that the unemployment rate remained stable at 4.2%, as expected, while the labour force participation rate decreased slightly to 62.4% from 62.6%. Lastly, annual wage inflation, as indicated by the change in average hourly earnings, held steady at 3.9%, outperforming the market prediction of 3.7%. US President Donald Trump expressed confidence in a post on Truth Social over the weekend, stating that trade discussions between negotiators from both nations would proceed smoothly. "I am pleased to announce that Secretary of the Treasury Bessent, Secretary of Commerce Lutnick, and US Trade Representative, Ambassador Greer, will be meeting in London on Monday, June 9, 2025, with Representatives of China, with reference to the Trade Deal. The meeting should go very well," Trump wrote. Additionally, stronger-than-anticipated US jobs data bolstered market expectations that the Fed will keep its benchmark interest rate steady during its next two monetary policy meetings, putting pressure on the US dollar. Federal Reserve Bank of Philadelphia President Patrick Harker warned that worsening economic indicators, coupled with significant policy fluctuations and an increasing federal budget deficit, might hinder potential rate cuts.

On the sterling front, the market appears confident following the faster-than-expected growth in the UK Consumer Price Index (CPI) data for April; the Bank of England (BoE) is expected to maintain the same interest rates, which influence the currency. On Friday, Megan Greene, a member of the BoE Monetary Policy Committee (MPC), cautioned during a conference in Croatia that the recent rise in price pressures might be persistent, reflecting her recent experiences with inflation, "The last time, we had a lot of second-round effects. We're hoping that we won't have second-round effects this time around, but we're not sanguine about it." Upcoming UK employment data for the three months ending April and the monthly Gross Domestic Product (GDP) data for April, due on Tuesday and Thursday, may provide support to the pound.

In the absence of relevant market-moving economic data from the UK or the US, the broader market sentiment around the US-China negotiations will drive the GBP/USD exchange rate.

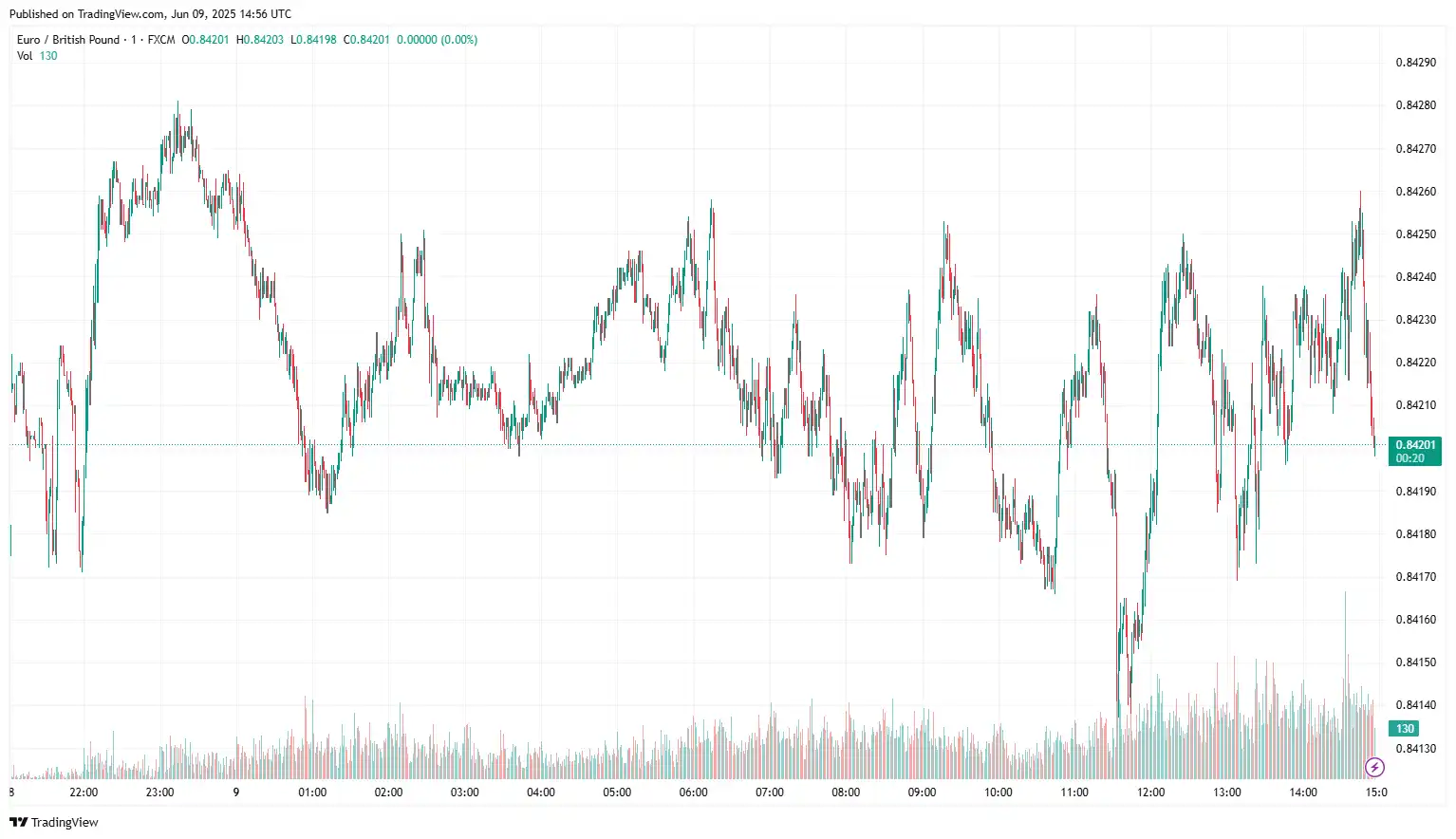

EUR/GBP softens ahead of UK labour market data

EUR/GBP edged lower to 0.8421 as investors await the UK employment report for the three months ending April. The job market report is anticipated to reveal that the ILO Unemployment Rate has accelerated to 4.6% from the previous reading of 4.5%. Average Earnings, both including and excluding bonuses, have grown by 5.5% year-on-year. Recent remarks from BoE Monetary Policy Committee (MPC) member Megan Greene, made during a conference in Croatia, warned that the recent increase in price pressures could prove persistent, given her recent experience with inflation, with comments, "The last time, we had a lot of second-round effects. We're hoping that we won't have second-round effects this time around, but we're not sanguine about it." The ongoing US-China trade discussions are expected to influence the pound, given that China maintains a low-cost competitive advantage worldwide. UK business owners could face the strain of a price war in the international market if the world's two largest nations fail to reach a trade agreement.

On the Euro's front, the European Central Bank's (ECB) decision to lower interest rates to 2.0% from 2.25%, combined with an upward revision to first-quarter Eurozone GDP, influences the shared currency. Last week's key economic data release from the Eurozone indicated that the seasonally adjusted retail trade volume experienced a 0.1% rise in the euro area and a 0.7% increase in the EU in April, compared to 0.4% in the euro area and 0.3% in the EU the previous month. The calendar-adjusted retail sales index improved by 2.3% in the euro area and 2.8% in the EU year-on-year. The seasonally adjusted GDP rose by 0.6% in both the euro area and the EU in the first quarter, up from the previous 0.3% and 0.4%, respectively. GDP grew by 1.5% in the euro area and by 1.6% in the EU, compared to earlier increases of 1.2% and 1.4% in the same period last year. The number of employed individuals in the euro area increased by 0.2%, indicating a slight improvement; however, it remained flat in the first quarter of 2025. In the previous quarter, employment had risen by 0.1% in the euro area and by 0.2% in the EU. On Friday, Germany's industrial sector activity declined more than anticipated in April. In the Eurozone's economic stronghold, industrial output decreased by 1.4% month-on-month, as reported by the federal statistics authority Destatis, which adjusted figures for seasonal and calendar variations. This was against an anticipated drop of 1% and a revised 2.3% growth reported for March. Year-on-year, German industrial production declined by 1.8% in April, compared to March's revised figure of -0.7%. Additionally, Germany's trade balance for April was EUR 14.6 billion, compared to the expected EUR 20.2 billion and the prior EUR 21.2 billion.

European Central Bank (ECB) policymaker Peter Kazimir remarked on Monday that, "I think we're nearly done with, if not already at the end of the easing cycle." He further stated, "I see clear downside risks to growth, but it would be a mistake to overlook upside inflation risks. We need to keep all options open; data throughout summer will show whether further adjustments are necessary." Earlier on Sunday, ECB Governing Council member Joachim Nagel noted that the central bank can afford to be patient regarding interest rates, as monetary policy now stands at a neutral level that is no longer restrictive. Additionally, ECB board member Isabel Schnabel shared over the weekend that the central bank can take its time on interest rates, emphasising that inflation is now nearly aligned with the ECB's target. She mentioned, "We are no longer restrictive. I believe that we can take the time to assess the situation first. We now have maximum flexibility at this interest rate level. The European Central Bank can take its time on interest rates with monetary policy now established at a neutral, non-restrictive level."

As the week begins with little in the way of Eurozone data, investors will pay attention to the UK-US trade agreement and EU-US trade negotiations for further insights on the EUR/GBP exchange rate.

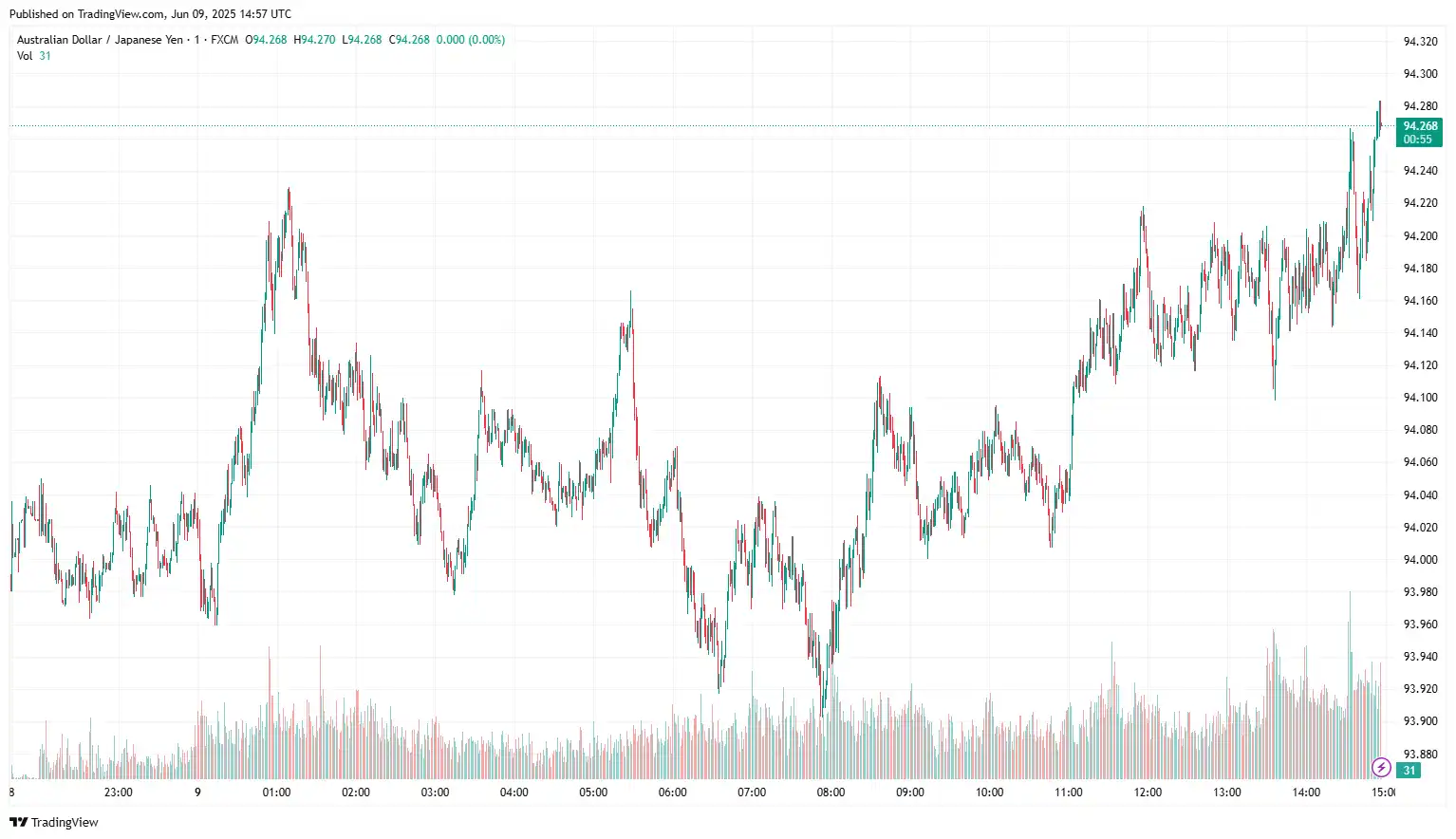

AUD/JPY hovers amid hopes of US-China trade talks

AUD/JPY narrowly traded near the 94.01 range as the market observers are cautiously watching today's US-China trade negotiations taking place in London. US President Trump expressed optimism about the trade talks with China following a conversation with Chinese leader Xi Jinping. He also shared his thoughts through social media. "I am pleased to announce that Secretary of the Treasury Bessent, Secretary of Commerce Lutnick, and United States Trade Representative, Ambassador Greer, will be meeting in London on Monday, June 9, 2025, with Representatives of China, with reference to the Trade Deal. The meeting should go very well." Data released by the National Bureau of Statistics of China on Monday indicated that the country's Consumer Price Index (CPI) declined by 0.1% year-on-year in May, compared to a decline of 0.1% seen in April. This figure exceeded the market expectation of a 0.2% drop. On a monthly basis, Chinese CPI inflation eased to a decrease of 0.2% in May, in contrast to April's rise of 0.1%. Additionally, China's Producer Price Index (PPI) fell by 3.3% year-on-year in May, following a 2.7% decline in April. The data fell short of the market consensus of 3.2%. China's Trade Balance (CNY) stood at CNY743.56 billion in May, expanding from the previous surplus of CNY689.99 billion. Meanwhile, exports rose by 6.3% year-on-year, compared to 9.3% in April. The country's imports decreased by 2.1% year-on-year during the same period, having previously recorded a rise of 0.8%.

On the domestic front, the market sentiment around the Reserve Bank of Australia's (RBA)) monetary policy outlook will influence the Aussie. Australia's Trade Balance recorded a $5,413M surplus in April, missing expectations of $6,100M and down from the revised $6,892M in March. Exports declined 2.4% MoM, following a revised 7.2% rise, while imports rose 1.1% after a 2.4% fall in March. The Australian Bureau of Statistics (ABS) reported GDP growth of 0.2% QoQ in Q1, below the 0.4% forecast and down from 0.6% in Q4. Annual growth remained steady at 1.3%, missing the expected 1.5%.

On the yen's front, the Japanese yen gained ground following the upward revision of Japan's Q1 GDP print, despite signs of rising inflationary pressures in Japan, reaffirming market anticipation that the Bank of Japan (BoJ) will continue to raise interest rates. Japan's Gross Domestic Product (GDP) contracted at an annual rate of 0.2% in Q1, compared to the initial estimate of a 0.7% decline. Meanwhile, the Japanese economy recorded no growth during the first quarter (Q1) of 2025, surpassing market expectations and the previous estimate of -0.2%. Japanese Prime Minister Fumio Kishida stated on Monday that Japan needs to recognise that increasing interest rates will raise the government's debt financing expenses and influence its budget plans, according to reports. He mentioned, "Japan has experienced low interest rates for a very long period. Thus, some segments of the public are unfamiliar with the implications of rising interest rates. When interest rates increase, the costs associated with government debt financing will rise, impacting spending. The government needs to maintain public and market confidence in Japan's financial situation."

In the upcoming sessions, key factors influencing the AUD/JPY exchange rate will include Westpac Consumer Sentiment, US inflation numbers, MI Inflation Expectations, and US weekly unemployment claims.

USD/CAD weakens ahead of US-China talks

USD/CAD declined to around 1.3676, as investors are making cautious market bets ahead of trade negotiations between the US and China. On the data front, the latest jobs data showed a net gain of 8.8K in May's employment figures, following a 7.4K decrease in April. These results exceeded expectations of a 15K drop; however, optimism was tempered by an uptick in the unemployment rate, which rose to 7% from 6.9%, reaching its highest point since the pandemic. The seasonally adjusted index climbed to 48.9 from 47.9 in April, with a reading below 50 indicating reduced activity. Employment improved to an adjusted 51.1 from 48.0 in April, while the prices index fell to 66.9 from 70.0. The unadjusted PMI rose to 53.8 from 52.3. Canada recorded its ninth consecutive monthly trade deficit in November, which was smaller than anticipated, as exports increased at a faster rate than imports, and the trade surplus with the US grew, as shown in data released on Tuesday. Canada's trade deficit reached C$7.1 billion ($5.2 billion) in April, an increase from C$2.3 billion. Total exports experienced a 10.8% decline in April, the lowest point since June 2023, marking the third consecutive monthly decrease and the steepest percentage drop since December 2008 amid the global financial crisis. Exports to the US fell by 15.7%, with shipments of cars and light trucks down approximately 23%, while trade with other nations hit an all-time high. The Prime Minister's Office announced on Friday that Prime Minister Mark Carney spoke with Chinese Premier Li Qiang to discuss trade and bilateral relations. In their conversation, Prime Minister Carney and Premier Li exchanged perspectives on the importance of engagement and agreed to create regular channels of communication between Canada and China. They also focused on strengthening economic connections and enhancing trade between the two nations. Furthermore, both leaders pledged their governments to collaborate in addressing the ongoing fentanyl crisis. However, the positive sentiment surrounding the US-China trade talks also eases concerns that US steel and aluminium tariffs would hinder Canadian exports.

On the greenback front, prevailing uncertainties tied to the imminent trade discussions between the United States and China are cultivating a cautious market sentiment. The US Bureau of Labour Statistics (BLS) reported that non-farm payrolls (NFP) in the US rose by 139,000 in May, following a revised increase of 147,000 in April (down from an earlier estimate of 177,000), surpassing the market expectation of 130,000. Additional findings from the report reveal that the unemployment rate remained steady at 4.2%, as anticipated, while the labour force participation rate dipped slightly to 62.4% from 62.6%. Moreover, annual wage inflation, reflected in the change in average hourly earnings, stabilised at 3.9%, exceeding the market forecast of 3.7%. US President Donald Trump expressed optimism in a weekend post on Truth Social, noting that negotiations between representatives of both nations are likely to proceed effectively. "I am pleased to announce that Secretary of the Treasury Bessent, Secretary of Commerce Lutnick, and US Trade Representative, Ambassador Greer, will be meeting in London on Monday, June 9, 2025, with Representatives of China, with reference to the Trade Deal. The meeting should go very well," Trump stated. Furthermore, stronger-than-expected US jobs data enhanced market expectations that the Fed will maintain its benchmark interest rate during its next two monetary policy sessions, which is putting pressure on the US dollar. Federal Reserve Bank of Philadelphia President Patrick Harker cautioned that deteriorating economic indicators, significant policy shifts, and a growing federal budget deficit might impede potential rate reductions.

Broader market sentiment around the US-China trade talks and oil price dynamics will drive the USD/CAD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.