Daily Forex Report 20-Oct-2022: GBP continues to fall against USD, Euro fights back

Japanese Yen approaches a critical intervention threshold

Cable continues to fall in the latter half of the week despite gilt yields easing off. Currently changing hands at US$1.14, the pair is seeing a modicum of support on the one-hour chart, though the US dollar is unlikely to give in to any significant degree

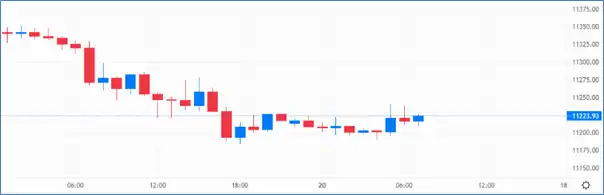

Despite incremental support on the one-hour chart, the pound continues to struggle – Source: capital.com

Despite incremental support on the one-hour chart, the pound continues to struggle – Source: capital.com

The euro is looking buoyant in the morning’s Asia trading hours, including against the Swiss franc, with the EUR/CHF pair adding another 0.2% to bring the exchange rate up to six-week highs of 0.98 francs.

EUR/USD has added around 30 pips, though at slightly below US$0.98, the pair has a while to go before clawing back all of yesterday’s losses.

The EUR/GBP pair is basically in the same position against the day at 87p, and with nothing of note on today’s economic calendar save inevitable turmoil in the UK parliament, is unlikely to budge much from this price point.

USD/JPY is getting seriously close to the 150 yen threshold, which will undoubtedly trigger a second intervention by the Bank of Japan in order to get the country’s plummeting currency under control.

The Aussie dollar is looking bearish against the rest of the G10 set.

Understanding your FX risk and exposure is paramount to your bottom line. Contact Currency Solutions today and find out how we can help you with:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

Click here for find out more.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.