GBP/USD rose to 1.3595 as a global risk rally, sparked by the ceasefire between Israel and Iran, has reduced demand for the safe-haven US Dollar. Additionally, a sudden shift in the Federal Reserve (Fed) officials' outlook on monetary policy has impacted bond yields and the US dollar. On Monday, Fed Governor Michelle Bowman indicated she is open to cutting interest rates as early as the July meeting amidst rising concerns over the job market. "It is time to consider adjusting the policy rate, and we [Fed] should put more weight on downside risks to the job market going forward," Bowman stated. Federal Reserve Bank of Chicago President Austan Goolsbee acknowledged that tariff impacts have been much less severe than many policymakers initially feared, but he cautioned that the Fed must continue monitoring "soft" data closely to avoid being caught between interest rate adjustments and inflation. Meanwhile, Federal Reserve Bank of San Francisco President Mary Daly noted on Friday that the Fed's monetary policy stance is "in a good place," with risks to its US employment and price stability mandates considered roughly equal. US private sector economic activity kept growing steadily in June, with the S&P Global Composite PMI at 52.8 (initial estimate), slightly down from 53 in May. The Manufacturing PMI remained steady at 52, while the Services PMI dipped slightly to 53.1 from 53.7. Both numbers exceeded market expectations. The Philly Fed's general activity index was steady at -4.0 in June, reflecting ongoing weakness in regional manufacturing. The employment index dropped to -9.8, the lowest since May 2020, as more companies cut jobs than hired. Meanwhile, new orders decreased to 2.3, and shipments increased to 8.3, indicating mixed but still fragile demand signals.

On the other hand, positive initial UK S&P Global PMI data for June, released on Monday, along with the Bank of England's (BoE) guidance of "gradual and calibrated" monetary easing, bolstered the pound. The PMI report indicated that overall business activity expanded faster than expected. Service sector activity continued its steady rise, while factory activity declined but at a slower rate than anticipated. Additionally, the report showed that new business volumes returned to growth after six months of contraction. However, firms reduced jobs due to higher staffing costs following increased employer contributions to social security schemes. On the data front, the seasonally adjusted S&P Global/CIPS UK Manufacturing PMI improved to 47.7 in June from 46.4 in May, surpassing the forecast of 46.6. The Preliminary UK Services Business Activity Index also increased to 51.3 in June from 50.9 in May, meeting the expectations of 51.3. Retail sales dropped 2.7% month-on-month in May after a 1.3% rise in April (revised from 1.2%), which was worse than the predicted 0.5% decline. Core retail sales, excluding automotive fuel, decreased by 2.8% MoM, contrasting with the previously revised growth of 1.4% and the forecasted 0.5% fall. Yearly retail sales declined by 1.3% in May, down from a 5% increase in April, while core retail sales also decreased by 1.3%, compared to a prior revision of a 5.2% rise.

Investors will observe BoE Governor Andrew Bailey's testimony, along with the Federal Reserve's (Fed) Chair Jerome Powell's semiannual testimonies and speeches from Monetary Policy Committee (MPC) member Megan Greene and Deputy Governor Dave Ramsden, for fresh insights on the GBP/USD exchange rate.

NZD/USD Tumbles as Iran-Israel Truce Boosts Appetite for Risk

NZD/USD plunged to near 0.6022 following the announcement of a ceasefire in the Middle East, which triggered a relief rally that sent the US Dollar tumbling, strengthening the risk-sensitive New Zealand Dollar. US President Donald Trump thanked Tehran for its measured response to this weekend's significant attack on key nuclear sites and announced a "complete and total" ceasefire in the Middle East conflict. Iran's Foreign Minister affirmed that Iran will cease its attacks if Israel halts its airstrikes, while Tel Aviv confirmed that all its targets have been reached, offering hope for a long-lasting truce. Moreover, recent stronger-than-expected New Zealand's Q1 Gross Domestic Product (GDP) data has lent support to the kiwi. The market anticipates the Reserve Bank of New Zealand (RBNZ) to reduce the interest rates one more time in the current easing cycle in the November meeting, which could inject volatility into the NZD.

On the other hand, the announcement of a ceasefire between Israel and Iran has indicated an easing of geopolitical tensions, which has reduced demand for safe-haven assets and dampened the US Dollar. US private sector economic activity continued to grow steadily in June, with the S&P Global Composite PMI at 52.8 (initial estimate), a slight decrease from 53 in May. During the same period, the Manufacturing PMI remained at 52, while the Services PMI declined slightly to 53.1 from 53.7. Both figures surpassed analysts' expectations. The Philly Fed's general activity index stayed at -4.0 in June, indicating ongoing weakness in regional manufacturing. The employment index fell to -9.8, the lowest since May 2020, as more companies cut jobs rather than hiring in June. While new orders dropped to 2.3, shipments rose to 8.3, showing mixed but still fragile demand signals. Federal Reserve Bank of Chicago President Austan Goolsbee noted that tariff impacts have been much lower than initially feared. Still, he cautioned that the Fed must carefully monitor "soft" data to avoid conflicts between interest rates and inflation. Moreover, traders are anticipating further rate cuts by the Fed, prompted by Fed Governor Christopher Waller's speech on Friday. He suggested the Fed should consider lowering rates at the July meeting. Investors are also awaiting Chair Jerome Powell's semiannual testimony before Congress on Tuesday, as it may provide a crucial update on the Fed's outlook. Following the Fed's latest dot plot, which projects two rate cuts in 2025, Powell's remarks on inflation, growth, and global uncertainty are expected to influence the US Dollar's short-term movements.

In today's session, Federal Reserve (Fed) Chair Jerome Powell's semiannual testimonies will significantly influence the NZD/USD exchange rate.

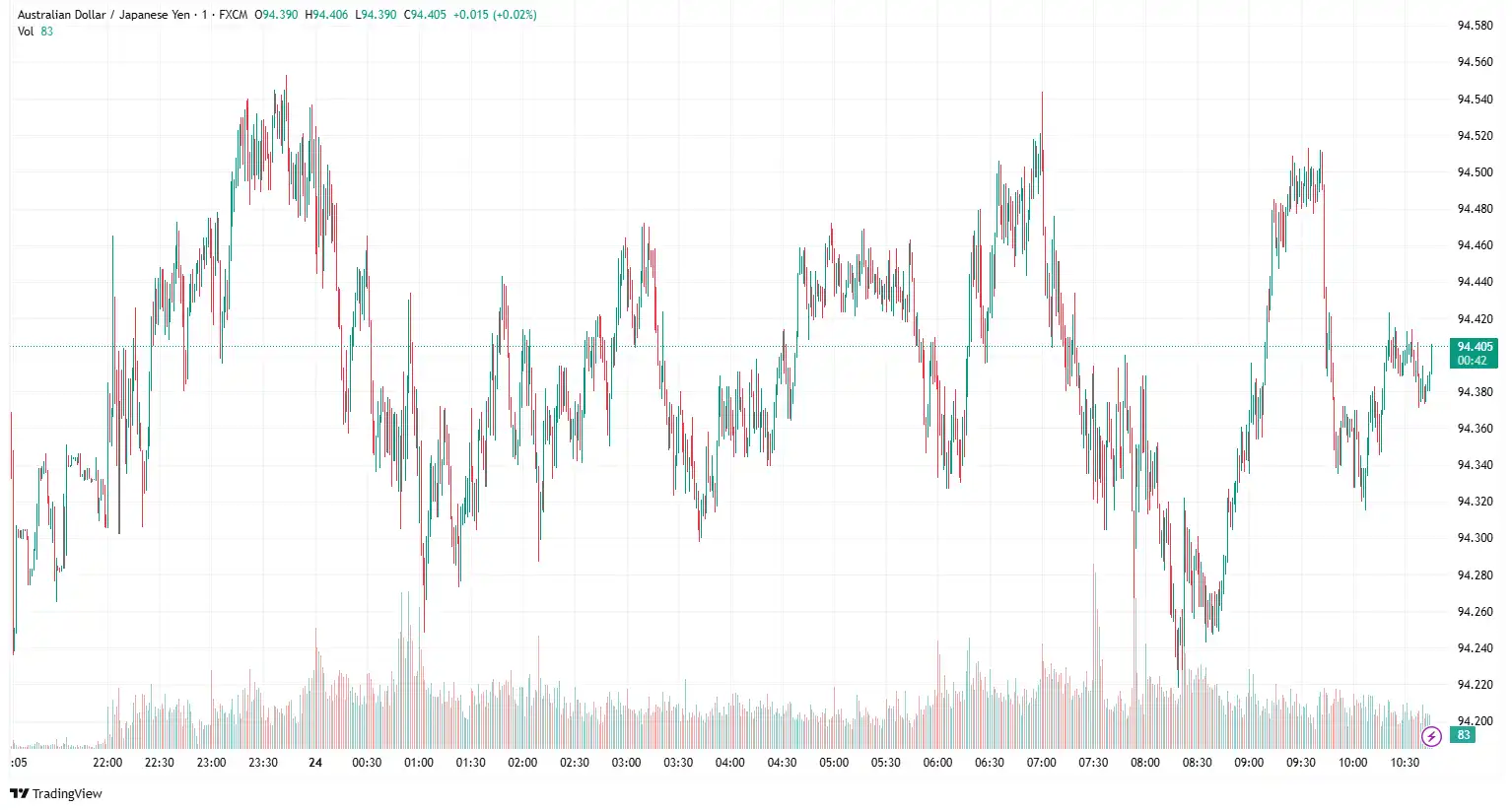

AUD/JPY Wobbles Due to Risk-On Mood

AUD/JPY struggled near 94.32, as increased risk appetite following US President Donald Trump's announcement of a "complete and total" ceasefire between Israel and Iran supported the Australian Dollar. Market sentiment remains positive despite Iran's retaliatory strike on Al Udeid, a US military base in Qatar. Qatar officials confirmed that the missile attack was intercepted, and the base had been evacuated beforehand. Markets reacted positively as Tehran decided not to target the strategic Strait of Hormuz. Following Iran's missile attack on Monday, Trump made remarks on the situation. Qatar authorities again emphasised that the missile barrage was intercepted and the base had been evacuated before the attack. On the data front, the preliminary reading of Australia's S&P Global Manufacturing Purchasing Managers Index (PMI) was 51.0 in June, remaining the same as the previous figure, according to the latest data published by S&P Global on Monday. The S&P Global Australian Services PMI rose to 51.3 in June from the prior reading of 50.6, while the Composite PMI increased to 51.2 in June from the earlier 50.5. The upbeat PMI figures have indicated that Australia's private sector grew at its second-fastest pace in ten months, tempering the short-term rate cut expectations by the Reserve Bank of Australia (RBA).

On the yen's front, market confidence that the Bank of Japan (BoJ) will hike interest rates again amid the broadening inflation in Japan continues to support the Japanese yen. Monday's Flash PMI data showed that Japan's private sector activity is gaining momentum but failing to influence the yen. The au Jibun Bank Japan Composite PMI increased to 51.4 in June from 50.2 in May, marking its fastest growth since February and the third consecutive month of expansion. Importantly, the Manufacturing PMI returned to growth for the first time since May 2024, rising to 50.4 from 49.4 and exceeding forecasts of 49.5. Meanwhile, the Services PMI slightly increased to 51.5 from 51.0. Furthermore, Japan's stronger-than-expected PMI data, released on Monday, suggests that the Bank of Japan may consider future rate increases. Additionally, news that the first ministerial tariff discussions since the Japan-US summit in Canada might occur as soon as June 26 alleviates worries about the economic impact of high US tariffs and offers extra support to the Japanese yen.

Market expectations regarding the timing of the next interest rate hike by the Bank of Japan (BoJ) to Q1 2026 continue to influence the Japanese yen. Additionally, concerns about the potential economic impact of the existing 25% US tariffs on Japanese vehicles, along with 24% reciprocal duties on other imports, are putting downward pressure on the JPY. Friday's data showed Japan's core inflation had exceeded the central bank's 2% target for over three years, reaching a more than two-year high in May, which leaves room for further rate hikes by the BoJ; however, this has not generated any momentum in the yen.

General market sentiment is improving amid rising hopes for a US-Japan trade agreement as Japan's Economy Minister Ryosei Akazawa prepares for his seventh visit to the United States. Meanwhile, any significant escalation in the Iran–Israel conflict is expected to influence the AUD/JPY exchange rate, given its sensitivity to global risk sentiment.

EUR/USD Subdued as US Dollar's Safe-Haven Appeal Diminishes

EUR/USD traded near 1.1594, as improved investors' risk appetite following the announcement of the Israel–Iran ceasefire supports the euro. The Eurozone manufacturing sector remained in contraction, while the services sector edged towards expansion in June, according to data from the HCOB's latest Purchasing Managers' Index (PMI) survey, published on Monday. The Eurozone Manufacturing PMI stayed unchanged at 49.4 in June, falling short of market expectations of 49.8. The bloc's Services PMI rose to 50 in June from 49.7 in May. The data aligned with the estimated 50 and reached a two-month high. The HCOB Eurozone PMI Composite remained at 50.2 in June. The market consensus was 50.5. The flash PMI for France's dominant services sector in June stood at 48.7, down from the previous and forecasted 48.9. The flash manufacturing PMI for June was 47.8, down from 49.8 in May and below the forecasted 50.0. The flash composite PMI, which combines both services and manufacturing sectors, stood at 48.5, down from 49.3 in May and also below the forecast of 49.3.

Monday's preliminary business activity data suggested that the contraction in Germany's manufacturing and services sectors lessened in June. The HCOB Manufacturing PMI for Germany's largest economy rose to 49 this month, up from May's 48.3, matching the predicted 49, reaching a 34-month high. Conversely, the Services PMI increased to 49.4 in June from 47.1 in May, exceeding the market forecast of 47.5 and marking a three-month high. The HCOB Preliminary German Composite Output Index increased to 50.4 in June from 48.5 in May, surpassing the expected 49 and reaching its highest level in three months. The headline German IFO Business Climate Index rose to 88.4 in June from 87.5 in May. The data was slightly above the market forecast of 88.3. Meanwhile, the Current Economic Assessment Index improved to 86.2 in June from 86.1 in May but fell short of the expected 86.5. The IFO Expectations Index, reflecting firms' projections for the next six months, increased to 90.7 in June from 88.9 in May, surpassing the expected 90.

On the greenback front, news of a ceasefire between Israel and Iran, along with the dovish outlook from Federal Reserve (Fed) officials on monetary policy, put downward pressure on the USD. On Monday, Fed Governor Michelle Bowman expressed openness to lowering interest rates at the July meeting. She cited downside risks to employment and believed trade policies are likely to have only minimal effects on inflation. "It is time to consider adjusting the policy rate," Bowman stated, adding, "We should put more emphasis on potential downward risks to the job market." Last week, Fed Governor Christopher Waller also supported rate cuts in July, citing concerns about the labour market. "The Fed should not wait for the job market to deteriorate before lowering rates," Waller noted. On the data front, the preliminary S&P Global PMIs beat expectations. The Manufacturing PMI remained steady at 52 in June, against expectations of a slowdown to 51, while the Services PMI eased slightly to 53.1 from 53.7, still outperforming the 52.9 forecast.

The Fed Chair Jerome Powell's testimony to Congress and European Central Bank (ECB) President Christine Lagarde's speech will shape the market sentiment around the EUR/GBP exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.