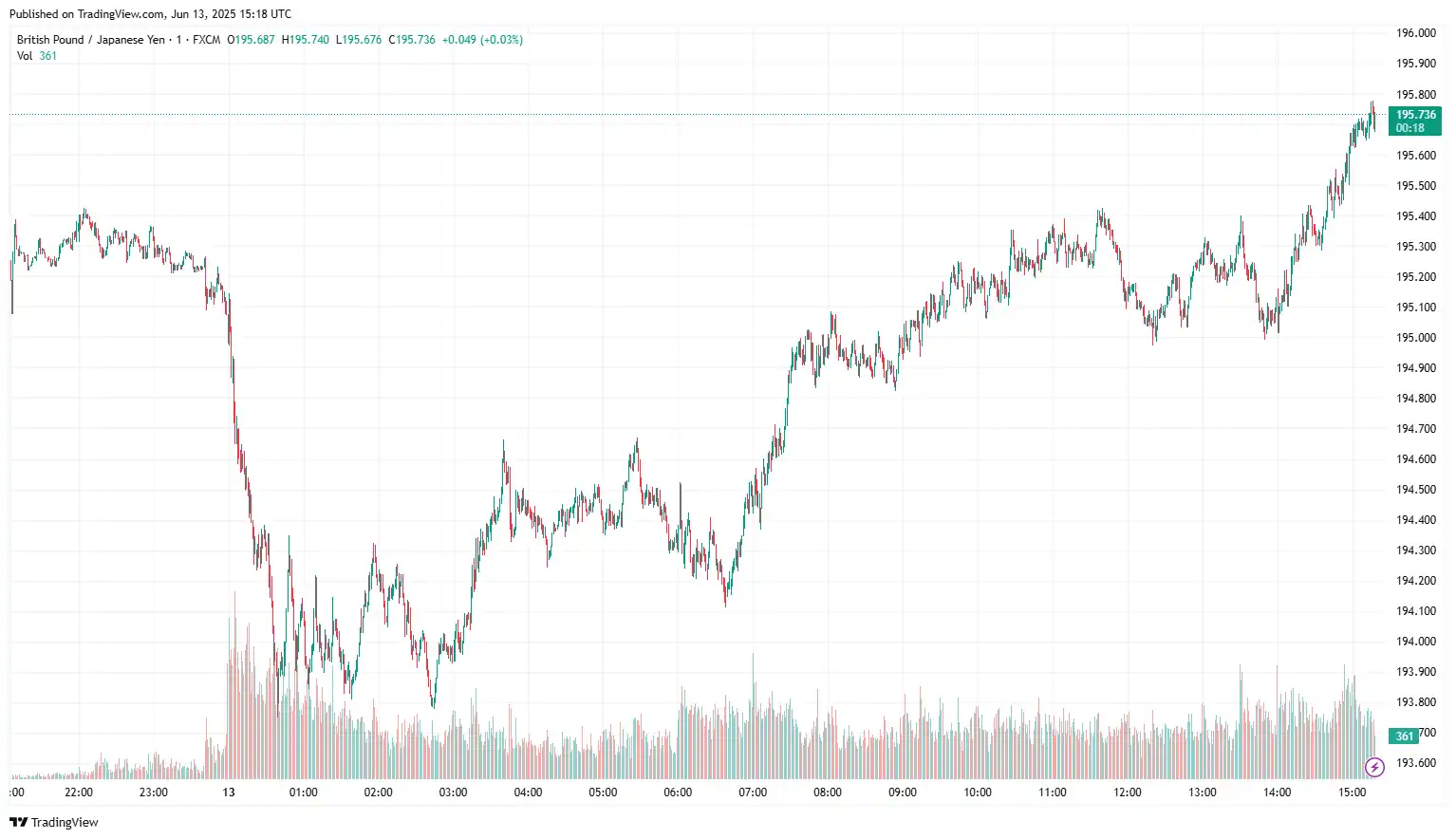

GBP/JPY recovered near 195.00, as a sharp escalation of geopolitical tensions in the Middle East reinforced demand for the safe-haven JPY. Israel initiated a pre-emptive strike on Iran. The Israeli Air Force executed multiple airstrikes across Iran, aiming at nuclear and missile facilities in addition to military command centres. In the wake of the attack, Israeli Minister of Defence Israel Katz announced a special state of emergency in the country, cautioning that an imminent missile and drone assault on Israel and its civilian populace was expected. Moreover, signs of easing in Japan's annual wholesale inflation, combined with optimism regarding a positive outcome from US-China trade talks, undermined the safe-haven JPY. Japan's Corporate Goods Price Index (CGPI), which measures the prices companies charge each other for their goods and services, rose by 3.2% in May compared to a year earlier, falling short of the median market forecast for a 3.5% gain. Japan's industrial production declined by 1.1% month-on-month in April 2025, a more significant decrease than the preliminary estimate of a 0.9% drop, reversing the 0.2% gain in the previous month.

Conversely, the pound stays under pressure as market sentiment turns risk-averse amid escalating geopolitical tensions in the Middle East. Moreover, disappointing UK monthly GDP and manufacturing production data, along with sluggish second-quarter GDP growth and rising unemployment figures, further strengthen market expectations for the Bank of England's policy easing stance. The UK economy contracted in April, with Gross Domestic Product (GDP) falling by 0.3%. This follows a 0.2% increase in March. Market predictions had expected a 0.1% decline, according to the latest data from the Office for National Statistics (ONS) released on Thursday. Moreover, the Index of Services for April indicated a 0.6% rise over the past three months, compared to March's 0.7%. Other UK data revealed that both Industrial and Manufacturing Production decreased by 0.6% and 0.9%, respectively, in April, with both figures failing to meet market forecasts. The Office for National Statistics (ONS) reported that the unemployment rate rose to 4.6% in the three months ending in April, the highest level recorded since July 2021, and employers added fewer jobs during the same period. Cracks appeared in the labour market after employers' contributions to National Insurance (NI) increased from 13.8% to 15% in April.

Investors will closely monitor the Bank of England (BoE) and Bank of Japan's (BoJ) monetary policy announcements in the upcoming week for more insights on the GBP/JPY exchange rate.

EUR/USD Struggles Following Disappointing US Data

EUR/USD hovered near 1.1535 as softer-than-expected consumer and producer inflation data provoked market expectations of further rate cuts by the Federal Reserve in upcoming policy meetings. Thursday's US Producer Price Index (PPI) rose by 0.1% month-on-month in May, compared to a decline of 0.2% (revised from -0.5%), as reported by the Bureau of Labour Statistics. This figure was softer than the expectation of a 0.2% increase. Meanwhile, the core PPI, excluding food and energy, increased by 0.1% month-on-month in May, compared to -0.2% previously (revised from -0.4%), falling below the consensus of 0.3%. The preliminary June Consumer Sentiment Index is anticipated to be 53.5, rising from 52.2 in May, while inflation expectations for the 1-year and 5-year horizons were previously noted at 6.6% and 4.2%, respectively.

Additionally, rising tensions in the Middle East increased demand for safe havens, benefiting the US dollar. Israeli military officials reported that Israel struck numerous locations in Iran, citing the Iranian nuclear programme as a significant threat to their nation. Israeli Minister of Defence Israel Katz warned of potential missile and drone assaults in response to Israel's pre-emptive actions against Iran, and he announced a special state of emergency in the area, according to reports. White House Secretary of State Marco Rubio stated, "Tonight, Israel took unilateral action against Iran. We are not involved in strikes against Iran, and our top priority is protecting American forces in the region." He added, "President Trump and the Administration have taken all necessary steps to protect our forces and remain in close contact with our regional partners. Let me be clear: Iran should not target US interests or personnel."

On the euro's front, the hawkish tone from ECB policymakers, along with a mixed Eurozone economic docket, continues to underpin the shared currency. The European Central Bank's Vice President, Luis de Guindos, indicated that while the bloc's economy has shown resilience, it still faces various risks, such as tariffs, that could hinder growth. He further remarked, "The use of the US dollar in international funding, payment and trade transactions, or as a reserve currency, will not be challenged in the short term. But the role of the euro can gradually expand, especially if we deliver on 'more Europe.' The euro area economy has proved fairly resilient to date, supported by a strong labour market. Recent developments may well have a dampening impact on growth in the euro area." On Thursday, ECB member Isabel Schnabel observed that the Eurozone's growth outlook is "broadly stable", with inflation stabilising at the 2% target before stating that the view is that the bank's monetary cycle is coming to an end. On the data front, the final German CPI figures released on Friday indicated that inflation remains close to the ECB's 2% target. French inflation was confirmed at a modest 0.6%, while Spanish price growth was slightly adjusted upward to 2%. The seasonally adjusted Italian Trade Balance data for April 2025 showed a decline in exports (-2.8%) compared to March 2025 and a slight increase in imports (+0.3%). Exports fell by -7.0% for non-EU countries, while they rose by +1.5% for EU countries. Imports increased by +1.6% for non-EU nations and dropped by -0.7% for EU countries.

Broader market sentiment surrounding the preliminary reading of the US Michigan Consumer Sentiment report, as well as heightened geopolitical tensions in the Middle East, will influence the EUR/USD exchange rate.

USD/JPY Gains Amid Hopes of US-Japan Trade Talks

USD/JPY climbed to 143.78, as underlying geopolitical sentiment, along with upcoming talks between the United States and Japan, influenced the Japanese yen. As the top foreign holder of US Treasuries, Japan has criticised President Trump's tariff policies, which impose 50% duties on steel and aluminium imports, as well as 25% tariffs on automobiles and auto parts. These high tariffs on critical Japanese exports, such as steel, aluminium, and car parts, are exerting pressure on the Japanese economy and contributing to increasing inflation. With both countries gearing up for the Group of Seven (G7) meeting in Canada, discussions are anticipated to pursue a potential trade agreement. Japan's chief trade negotiator, Ryosei Akazawa, commented on Friday that "generally speaking if we reach a deal, it should secure special treatment for Japan and exclude it from rules that apply to most countries," in response to US President Donald Trump's remarks about potentially increasing tariffs on imported cars to stimulate US production. On his journey to Washington for his sixth round of trade negotiations with US officials, Akazawa emphasised, "We are in bilateral negotiations with the US." During a meeting in Tokyo on Thursday, Japanese leaders, including Ishiba, addressed the situation with the US. He remarked, "If there's progress before I meet the president, that's in and of itself good." He added, "What's important is to achieve an agreement that's beneficial to both Japan and the US. We won't compromise Japan's interests by prioritising a quick deal."

On the greenback's front, higher-than-expected jobless claims and slower-than-anticipated price pressures at the factory gate have raised hopes that the Federal Reserve (Fed) will reduce interest rates in September. Applications for unemployment insurance in the US rose to 248K for the week ending 31 May, as reported by the US Department of Labour (DOL) on Thursday. This figure exceeded initial estimates and matched the previous week's revised number. The report indicated a seasonally adjusted insured unemployment rate of 1.3%, with the four-week moving average increasing by 5K to 240.250K from the revised average of the prior week. In addition, Continuing Jobless Claims grew by 54K, totalling 1.956M for the week that ended on 24 May. Thursday's data also showed that the US PPI increased by 0.1% monthly in May, falling short of the market consensus of a 0.2% rise, and matched the expected year-on-year growth of 2.6%. The core PPI recorded another monthly increase of 0.1%, significantly below the forecasted 0.3%, with a year-on-year rate of 3%. The market consensus had predicted a 3.1% reading, compared to April's 3.2%. US Consumer Prices in May showed a modest 0.1% increase from the previous month and a 2.4% rise from the same month last year, both below market expectations of 0.2% and 2.5%, respectively. US President Donald Trump stated on Friday that Iran cannot possess a nuclear bomb while reiterating his hopes for a peaceful resolution to the tensions. US officials indicated that they still intend to hold talks between US and Iranian envoys on Sunday.

While investors will observe the preliminary release of the Michigan US Consumer Sentiment Index and inflation expectations, the main focus will be glued to developments surrounding Trump's trade policies and conflicts in the Middle East for further insights on the USD/JPY exchange rate.

EUR/GBP Wobbles on BoE Rate Cut Bets

EUR/GBP edged lower to 0.8506 as a downbeat UK monthly Gross Domestic Product (GDP) report, rising unemployment figures, and industrial production contributed to rising market expectations of interest rate reductions from the Bank of England (BoE). As reported by the UK Office for National Statistics (ONS), the UK's Gross Domestic Product (GDP) decreased by 0.3% from March's 0.2% in April, which was steeper than the expected drop of 0.1%. Additionally, factory data showed a sharper decline than anticipated in April. Industrial and Manufacturing Production saw month-on-month contractions of 0.6% and 0.9%, respectively. On Tuesday, the UK Office for National Statistics revealed that the ILO Unemployment Rate rose to 4.6% for the three months ending in April, up from 4.5% previously, aligning with market expectations. The report indicated an increase of 33.1K in unemployment benefit claims in May, reversing a revised decrease of 21.2K in April that was below the expected 9.5K. Employment Change in April recorded 89K, a decline from 112K in March. Simultaneously, Average Earnings in the UK, excluding bonuses, grew by 5.2% year-on-year (YoY) in April, down from a previously revised 5.5%; the market had anticipated a figure of 5.4%. Furthermore, Average Earnings, including bonuses, increased by 5.3% during the same period, following a revised rise of 5.6% for the quarter ending in March, which also fell short of the 5.5% estimate.

Moreover, risk-averse market sentiment amid escalating geopolitical tensions in the Middle East further dampened the pound. Israel has declared war on Iran following strikes on numerous targets in the northeastern region of Tehran, including nuclear facilities and military bases. Israeli Prime Minister Benjamin Netanyahu has clarified that their military has launched "Operation Rising Lion" to prevent Iran from developing nuclear warheads, stating that the operation aims to "roll back the Iranian threat to Israel's very survival." US President Donald Trump also remarked earlier in the day that Iran "cannot have a nuclear bomb," partly supporting Israel's attack.

On the euro's front, the hawkish tone from the ECB policymakers, coupled with a mixed Eurozone economic outlook, continues to support the shared currency. The final German CPI figures released on Friday indicated that inflation remains close to the ECB's 2% target. French inflation was confirmed at a modest 0.6%, while Spanish price growth was slightly revised upward to 2%. The seasonally adjusted Italian Trade Balance data for April 2025 showed a decline in exports (-2.8%) compared to March 2025, alongside a slight increase in imports (+0.3%). Exports fell by -7.0% for non-EU countries, whereas they rose by +1.5% for EU nations. Imports saw an increase of +1.6% for non-EU nations but dropped by -0.7% for EU countries. In April 2025, compared with March 2025, seasonally adjusted industrial production decreased by 2.4% in the euro area and by 1.8% in the EU, according to first estimates from Eurostat, the statistical office of the European Union. In March 2025, industrial production increased by 2.4% in the euro area and by 1.9% in the EU. Year-on-year, industrial production grew by 0.8% in the euro area and by 0.6% in the EU. The first estimates of the euro area balance indicated a €9.9 billion surplus in trade in goods with the rest of the world in April 2025, compared with +€13.6 billion in April 2024. The euro area's exports of goods to the rest of the world in April 2025 totalled €243.0 billion, a decrease of 1.4% compared with April 2024 (€246.5 billion). Imports from the rest of the world stood at €233.1 billion, an increase of 0.1% compared with April 2024 (€232.9 billion).

Moreover, European Central Bank officials continue to endorse ECB President Christine Lagarde's hawkish stance, influencing the euro's movement. European Central Bank (ECB) Governing Council member Gediminas Šimkus stated on Thursday, "The ECB has arrived at the neutral level of rates." He also mentioned that rates might need to decrease further, as there is a heightened risk of inflation falling below projections. It is important to pause on rates; however, I do not dismiss the possibility of another rate cut in 2025. ECB policymaker François Villeroy de Galhau also commented on Thursday that there is no definitive stance on upcoming rate decisions. He emphasised that the ECB's favourable circumstances do not imply that policy is unchanging. Although he does not anticipate deflation, the ECB is equipped with tools to respond to changing conditions, especially since the chaos of the Trump administration impacts global growth.

In today's session, escalating geopolitical tensions in the Middle East, along with European Central Bank (ECB) policymakers Frank Elderson and José Luis Escrivá's speeches, will influence the EUR/GBP exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.