EUR/GBP wobbles around 0.8525 due to a cautious market mood as investors await the UK Consumer Price Index (CPI) data on Wednesday and the Bank of England's (BoE) monetary policy announcement on Thursday. The BoE is also expected to maintain interest rates at 4.25%, as officials guided a "gradual and cautious" monetary easing approach in May's policy meeting, following a reduction of 25 bps. However, market participants foresee that the BoE may reassess its monetary policy guidance, given recent cracks in the UK labour market. The latest employment data revealed an increase in the unemployment rate and slower job growth as business owners reduced their labour force to offset the impact of rising employers' contributions to social security schemes.

On the euro's front, a hawkish tone from the ECB policymakers, along with the ZEW Survey from Germany and the Eurozone, supports the shared currency. The German ZEW Economic Sentiment Index surged to 47.5 in June, up from 25.2 in May, significantly exceeding the market forecast of 35. Similarly, the Current Situation Index improved to -72, compared to -82 in May, surpassing the estimated -74. In the Eurozone, the ZEW Economic Sentiment Index rose to 35.3 in June from 11.6 in May, while market expectations had been 23.5. European Central Bank (ECB) policymaker Yannis Stournaras stated on Tuesday that "any further rate cuts will depend on data" and added that "the ECB has reached the first point of equilibrium." During a speech on Monday in Frankfurt, ECB policymaker and Bundesbank President Joachim Nagel addressed the audience with "Goal achieved – no reason to give up." He mentioned, "It is not sensible to signal either a pause or rate cut at this time, given the considerable uncertainty. The ECB should remain flexible. Current data and forecasts indicate that our mission has been accomplished. However, we must keep all options open regarding interest rates." Additionally, ECB Vice President Luis de Guindos noted that the EUR/USD exchange rate at 1.15 does not pose significant risks to the inflation target, pointing out that the euro's appreciation is gradual and not excessively volatile. He remarked that "the risk of falling short of the inflation target is minimal, with balanced risks to inflation. Markets clearly understood the message following the decision. The ECB is now very close to the target, and in the medium term, tariffs are likely to constrain both growth and inflation."

Broader market sentiment regarding the German ZEW Economic Sentiment Index, UK Consumer Price Index (CPI) data for May, and the BoE monetary policy announcement will influence the EUR/GBP exchange rate.

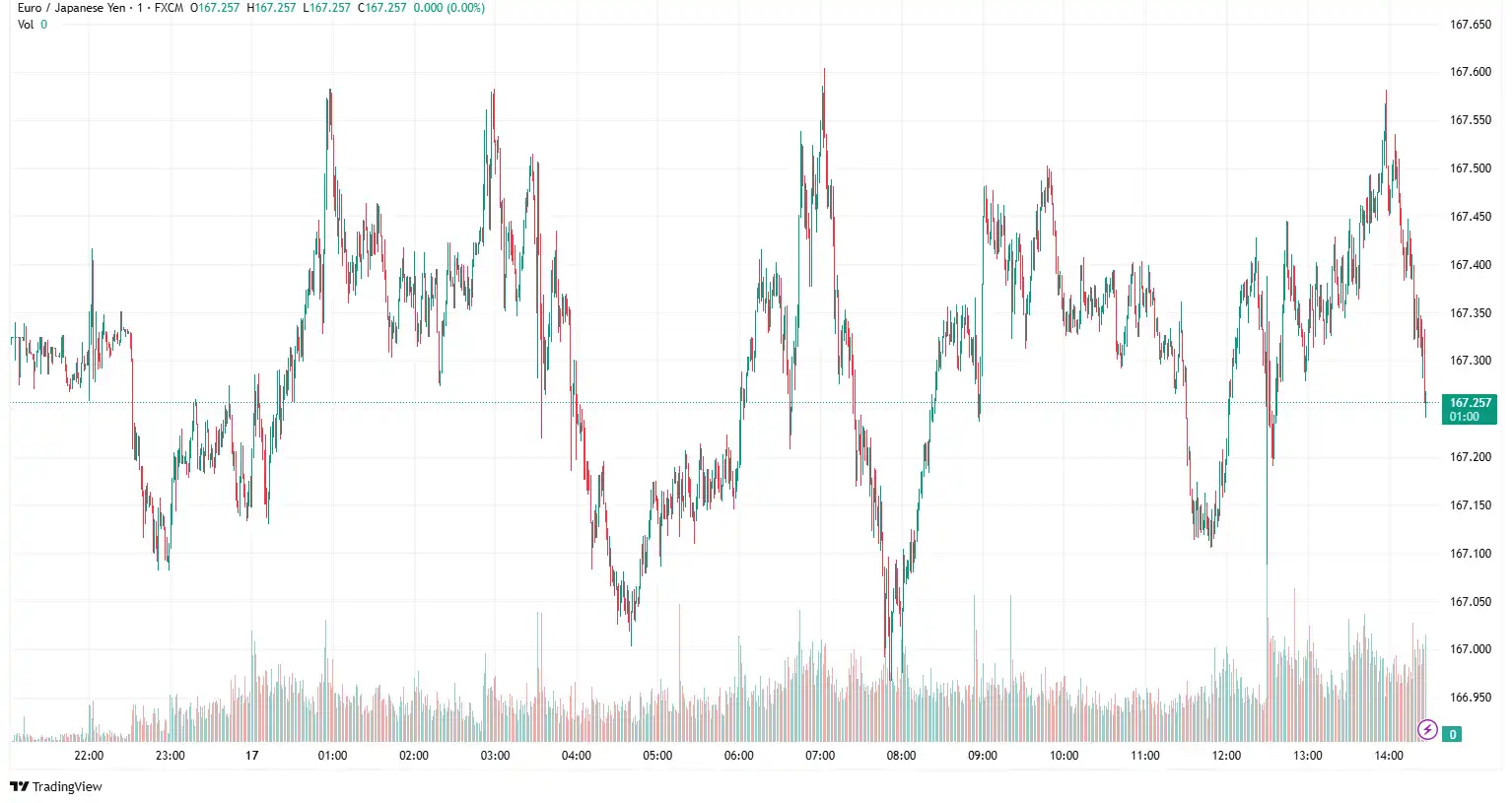

EUR/JPY Buoyed After BoJ Interest Rate Decision

EUR/JPY edged higher near 167.19, following the Bank of Japan's (BoJ) decision to keep its short-term interest rate target unchanged in the range of 0.4%–0.5% in June. The BoJ continued its rate-hiking cycle pause into the third consecutive month in June, maintaining the policy rate at the highest level in 17 years. Furthermore, the BoJ will reduce its monthly outright JGB purchases to approximately ¥2 trillion from January to March 2027. The amount will be reduced by approximately ¥400 billion each calendar quarter until January–March 2026 and then by around ¥200 billion each calendar quarter from April–June 2026. At the press conference following the meeting, Bank of Japan (BoJ) Governor Kazuo explained the central bank's decision to maintain the interest rate at 0.5% for the third consecutive meeting, with comments, "Will respond nimbly in case of rapid rise in long-term interest rates such as by increasing bond buying, conducting fixed-rate bond purchase operations, using fund-supply operations against pooled collateral." Regarding the Japanese economy, he added, "Japan's economy is recovering moderately, although some weak moves are seen. Japan's economic growth is likely to moderate as trade policies lead to a slowdown in the overseas economy and a decline in corporate profits. Expect the Japanese economic growth rate to rise thereafter as overseas economies return to a moderate growth path." He also cautioned that developments in trade policies and how the overseas economy and prices react to them are extremely uncertain. Attention must be paid to the impact of trade policies on financial and FX markets, Japan's economy, and prices.

In recent geopolitical developments, US President Donald Trump and Japanese Prime Minister Shigeru Ishiba were unable to finalise a trade agreement during the Group of Seven summit, according to reports. Ishiba is urging Trump to remove the 25% tariffs on Japanese vehicles and the 24% reciprocal duties on other Japanese imports, which are currently suspended until 9 July. "There are still some points on which the two sides are not on the same page, so we have not yet reached an agreement on the trade package," Ishiba stated on Monday. "We have been exploring the possibility of a deal right up to the wire. However, there are still points where our views remain divided," he highlighted, calling Japan's auto sector a "major national interest."

On the euro's front, the ZEW Survey from Germany and the Eurozone, coupled with a hawkish tone from ECB policymakers and rising expectations that the ECB will pause its easing cycle, continue to underpin the shared currency. Recently, ECB Vice President Luis de Guindos remarked that the EUR/USD exchange rate at 1.15 does not significantly challenge the inflation target, emphasising that the euro is appreciating gradually and that volatility remains moderate. He noted, "The risk of undershooting the inflation target is minimal, and the risks to inflation are balanced. Markets clearly understood the message following the decision. The ECB is now very close to the target. In the medium term, tariffs will likely dampen both growth and inflation."

In today's session, the German ZEW Economic Sentiment, Bank of Japan (BoJ) interest rate decision, and improved market risk appetite will influence the EUR/JPY exchange rate.

AUD/USD Gains Ahead of US Retail Sales Numbers

AUD/USD gained ground near 0.6541, as improved risk sentiment amid easing geopolitical tensions supports the Australian Dollar (AUD). Optimism surged after Iran reportedly asked numerous countries, including Oman, Qatar, and Saudi Arabia, to urge US President Donald Trump to use his influence on Israel for an immediate ceasefire, according to reports. Furthermore, risk sentiment improved as Canadian Prime Minister Mark Carney agreed with Trump that their two nations should aim to conclude a deal on tariffs within 30 days. Additionally, China's retail sales in May increased by 6.4% year-over-year (YoY), surpassing the expected 5.0% and April's 5.1%, according to the latest data released on Monday. Industrial production in China rose 5.8% YoY during the same timeframe, slightly below the forecast of 5.9% and down from the previous 6.1%. Meanwhile, fixed asset investment registered a year-to-date (YTD) YoY increase of 3.7% in May, missing the anticipated 3.9%. The April figure was 4.0%. During the press conference, the National Bureau of Statistics (NBS) highlighted that the domestic economy was likely stable during the first half (H1) of 2025. However, China may encounter difficulties in maintaining steady growth from the second quarter onwards due to various uncertainties in trade policies, which will significantly influence the China-proxy Aussie.

On the other hand, persistent trade-related uncertainties and geopolitical risks stemming from the worsening Iran-Israel conflict might continue to act as a tailwind for the safe-haven greenback. However, the market sentiment around the two-day FOMC policy meeting, along with Fed Chair Jerome Powell's comments during the post-meeting press conference, could bolster the US dollar. The NY Fed Manufacturing Index fell to a reading of -16 in June, contrary to expectations of a moderate improvement to -5.5 from -9.2 in May. US Retail Sales data are anticipated to show a significant contraction of 0.7% in May, following a 0.1% growth in April, which provides further evidence of the negative impact of the tariff turmoil on the US economy. Globally, Trump's hasty exit from the G7 summit has raised concerns that the US might become involved in the Israel-Iran conflict. The news has diminished investors' appetite for risk and provided some support for the US Dollar due to increased demand for safe assets. Israel and Iran continued exchanging missiles prior to this. Iran vowed to launch its largest missile attack in history against Israel, while Israeli Prime Minister Benjamin Netanyahu threatened to kill Iran's Supreme Leader, Ali Khamenei. Meanwhile, Trump's call for Tehran citizens to leave the city has fuelled concerns of a serious escalation of the conflict.

During the upcoming sessions, traders are keeping a close eye on this week's labour data from Australia, particularly the Employment Change and Unemployment Rate, for indications regarding the Reserve Bank of Australia's (RBA) policy direction. Furthermore, the Federal Reserve's (Fed) interest rate decision will significantly impact the AUD/USD exchange rate.

USD/JPY Hovers as BoJ Holds Rates Steady

USD/JPY struggled near 144.60, following the Bank of Japan's (BoJ) policy announcement and Bank of Japan (BoJ) Governor Kazuo Ueda's speech at the post-meeting press conference. The Bank of Japan, as expected, chose to keep the policy rate steady after the June policy meeting this Tuesday. The BoJ plans to lower its monthly outright JGB purchases to approximately ¥2 trillion from January to March 2027. This will involve a reduction of about ¥400 billion each calendar quarter until January–March 2026, followed by a decrease of around ¥200 billion per quarter from April–June 2026. During the post-meeting press conference, BoJ Governor Kazuo Ueda explained that the bond tapering decision is primarily aimed at preventing excessive volatility from adversely affecting the economy rather than being driven by fiscal concerns. Ueda noted that any further rate hikes will depend on the probability of the central bank meeting its outlook. On Tuesday, Japanese Finance Minister Katsunobu Kato mentioned that he currently has no set plans for further discussions with US Treasury Secretary Bessent. His remark followed reports indicating that US President Donald Trump and Japanese Prime Minister Shigeru Ishiba did not come to a trade agreement during the Group of Seven summit. Ishiba is advocating for Trump to remove the 25% tariffs on Japanese vehicles and the 24% reciprocal tariffs on other Japanese imports, which are currently scheduled to be postponed until 9 July. "There are still some points on which the two sides are not on the same page, so we have not yet reached an agreement on the trade package," Ishiba commented on Monday.

On the greenback front, upcoming monetary policy announcements by the Federal Reserve (Fed), Fed Chair Jerome Powell's press conference and heightened Israel-Iran tensions continue to influence the US dollar. President Trump's unplanned exit from the G-7 conference in Canada implied the potential of the US involvement in ongoing tensions in the Middle East. Trump posted in a social media post, "What a shame, and a waste of human life. Simply stated, IRAN CANNOT HAVE A NUCLEAR WEAPON. I said it over and over again! Everyone should immediately evacuate Tehran. Iran should have signed the 'deal' I told them to sign."

In the upcoming sessions, the Federal Reserve's (Fed) interest rate decisions, US retail sales figures, and Japanese trade balance figures could influence the USD/JPY exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.