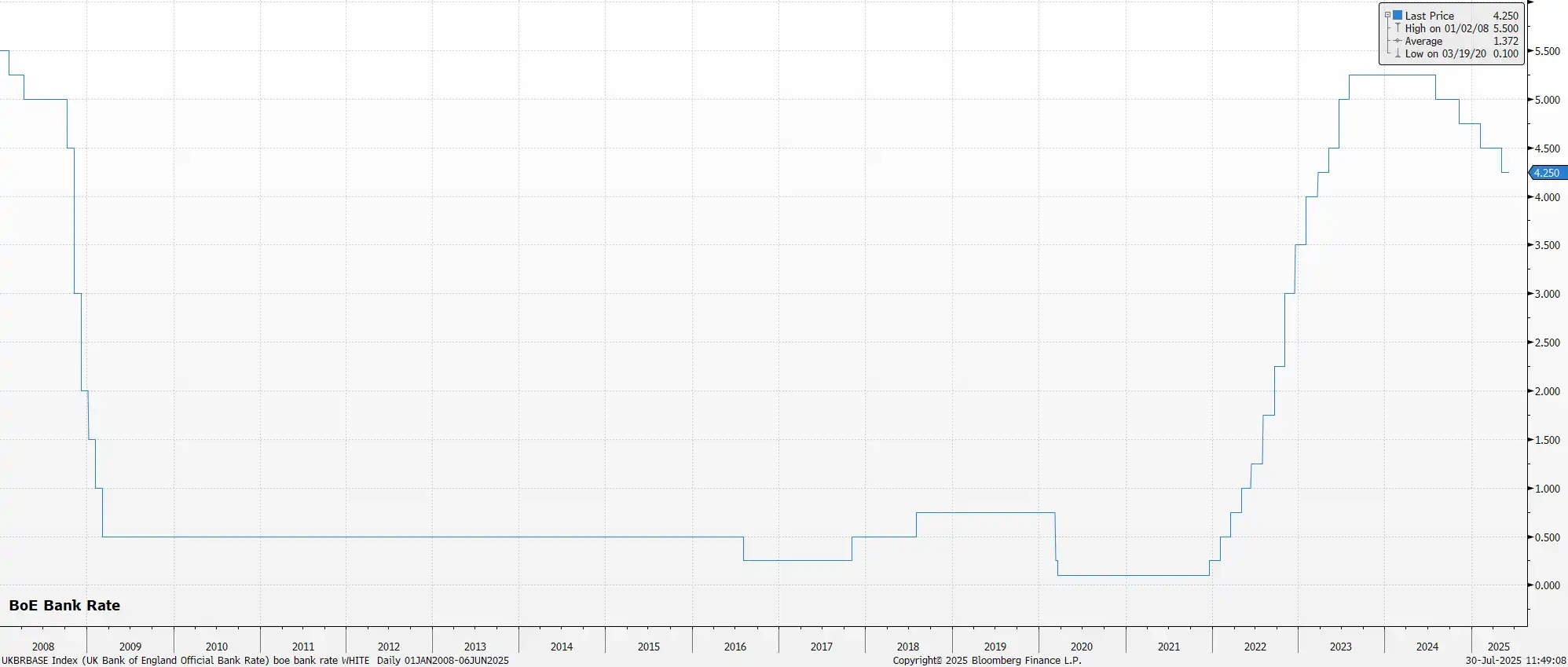

The August MPC meeting should deliver a straightforward 25bp cut, lowering Bank Rate to 4.00% – the third cut this year and fifth in the easing cycle that began twelve months ago. Money markets fully price this move and discount a 90% chance of another cut before year-end.

However, the vote split remains murky. At June's meeting, three policymakers, Deputy Governor Ramsden and external members Dhingra and Taylor, favoured a 25bp reduction despite holding rates steady. The key question is whether any will dissent for a larger 50bp cut this time.

Ramsden seems unlikely to break from the MPC's core bloc, while Taylor's recent comments suggesting five cuts are needed in 2025 make a dovish dissent unlikely. That leaves uber-dove Dhingra as the sole potential dissenter, given her view that 'gradual' cuts would still keep policy restrictive all year. Conversely, external member Mann poses a hawkish risk, having flip-flopped across the hawk-dove spectrum this cycle. Despite recent concerns about inflation being 'well above' the 2% target, predicting Mann's vote has become nearly impossible.

The base case remains an 8-1 vote (25bp cut vs 50bp cut) with Dhingra dissenting, though a 1-7-1 vote (unchanged vs 25bp vs 50bp) represents a hawkish risk.

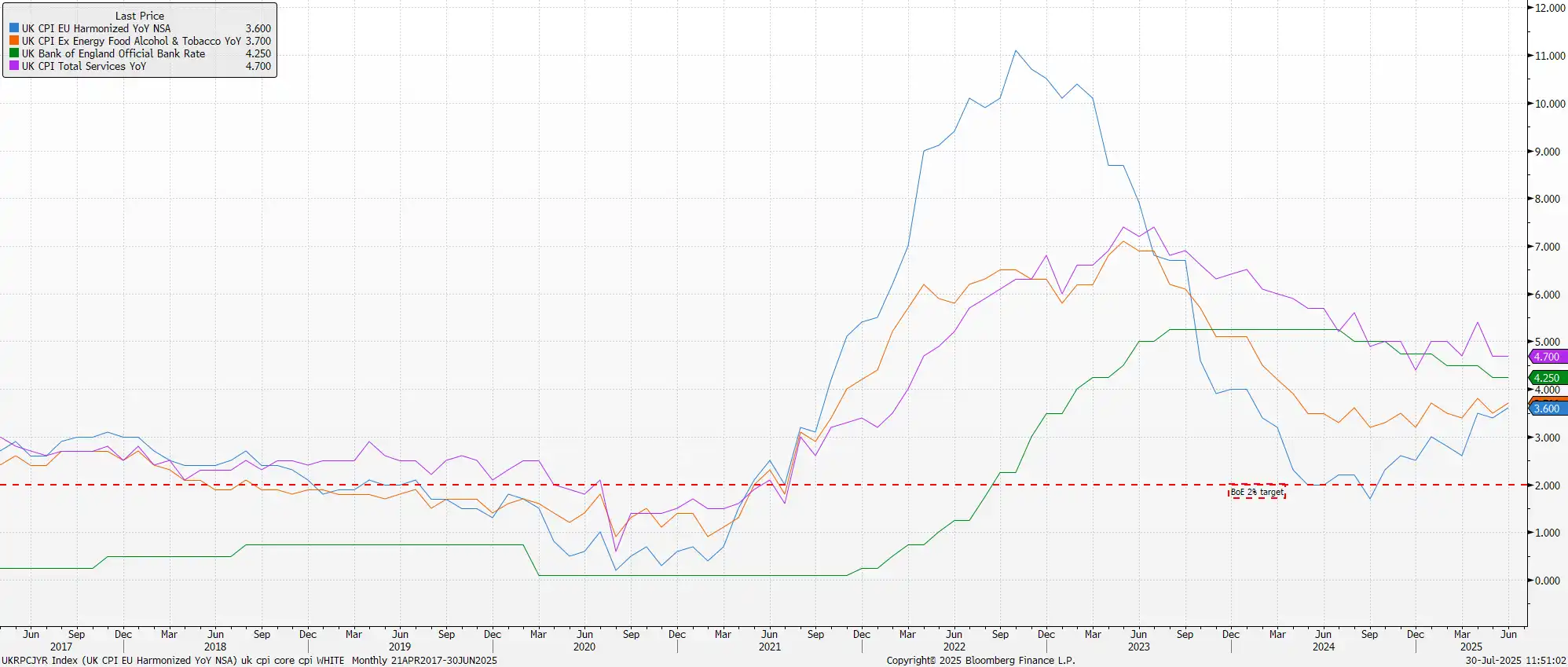

The policy statement should be more straightforward, being a 'carbon copy' of June's guidance, and emphasising a 'gradual and careful' approach to rate reductions, with policy needing to remain 'restrictive for sufficiently long'. This represents a shift from a month or so ago, when a dovish pivot seemed likely, though June's concerning inflation figures, where headline CPI rose to 3.6% YoY, its highest in eighteen months, has reduced those chances considerably.

Updated forecasts will reflect this inflation uptick, with the Bank's 3.5% Q3 peak already exceeded. However, the BoE will likely maintain its early-2027 return to 2% target, viewing current pressures as temporary.

Other forecast revisions also lean pessimistic. Unemployment projections need updating after hitting a four-year high of 4.7%, though the peak likely won't exceed 5%. Growth forecasts of 1.0% this year and 1.3% next seem fanciful given April-May contractions and weak PMI indicators.

Despite the somewhat more pessimistic projections, Governor Bailey’s tone is unlikely to change significantly at the post-meeting press conference. Bailey will likely stick to a ʻdata-dependent’ approach, stressing that although the path of rates remains lower, such a path will still need to be travelled in a ʻgradual and careful’ manner.

Although labour market slack continues to emerge at a worrying rate, policymakers cannot yet pivot to supporting growth while inflation remains stubbornly above target. The 'Old Lady's' 'gradual and careful' guidance appears set to continue, with just one more 25bp cut likely this year, probably in November.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.