Daily Forex Market Report 27-Jan-2023: US Dollar sees some upside against GBP and EURO, but analysts unsure over Fed direction

Most of the attention is in the equities market today, at least for US investors encouraged by Thursday's surprisingly strong 2.9% gross domestic product growth for the final quarter of 2022, beating forecasts by 0.3 percentage points.

Healthcare services, housing and utilities, and personal care services led the growth, while spending on automobiles and parts proved a tailwind.

Core personal consumption expenditures (a measure of the spending on goods and services) fell from 4.3% to 3.2% in the last quarter, which according to Bloomberg analysts “will probably offer more evidence supporting a slower pace of Fed hikes”.

Analysts added that “the core inflation gauge probably slid to 4.4% last month, and falling energy prices and discounts to clear excess inventory may stay disinflationary through the first half”.

Yet, as ING pointed out, “the Federal Open Market Committee appears to have more room to surprise on the hawkish side compared to the European Central Bank”, and the forex markets seem to be in agreement (as does the bond market, given the overnight yield hike on 10-year treasury bonds).

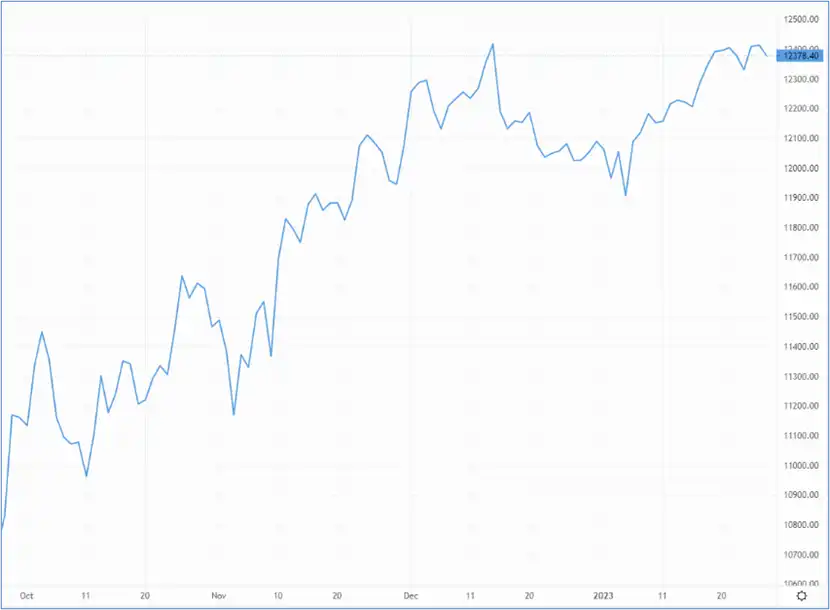

While GBP/USD closed slightly higher yesterday, the pair dipped 40 pips to 1.237 in this morning’s Asia trading window.

Cable pulls back from mid-December highs – Source: capital.com

Cable pulls back from mid-December highs – Source: capital.com

EUR/USD closed 0.25% lower and shed another 0.17% to 1.087 this morning, while the greenback also saw gains against the Japanese yen and Swiss franc, and the rest of the G10 bucket for that matter.

For some perspective, the US Dollar Index (DXY) is still down 2.7% year to date, and the trendline certainly points in the same direction, so the prospect of some short-term upside should take this into consideration.

Without any major catalysts on the UK and Eurozone economic calendars, investors should expect too much action on the EUR/GBP pair. For the moment, the pair is changing hands at 87.86p after closing 0.3% lower on Thursday.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.