Daily Forex Market Report 9-Jan-2023: US Dollar at 7 month lows, GBP and EUR traders at a stalemate

US employment data continue to be an influence on the forex market. The US Dollar Index (DXY) began testing seven-month lows following last week’s strong payroll figures, and the bearish trend looks to continue this week.

Having shed another 0.2% in this morning’s Asia trading window, DXY is now trading well below the 20-day moving average at 103.20.

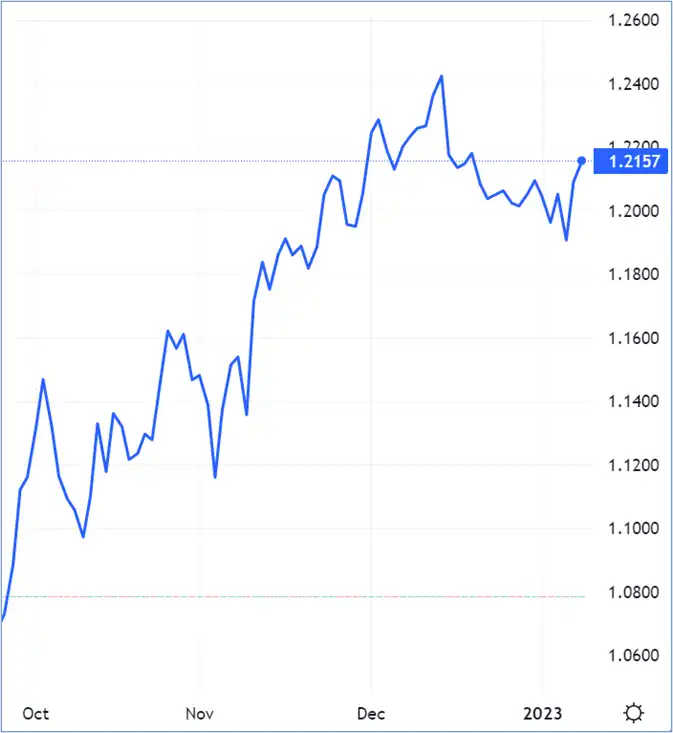

Sterling reached a new January high of 1.215 against the greenback, although Cable has been inching downwards on the one-hour chart.

Pound makes strong gains on US dollar – Source: dailyfx.com

Pound makes strong gains on US dollar – Source: dailyfx.com

After soaring over 120 pips against the dollar on Friday, the euro has continued to make gains, although the pace has slowed somewhat.

EUR/USD closed 20 pips higher on Sunday, and has added another 15 pips to 1.067 this morning.

Euro area unemployment figures for the month of November are due later today, with forecasts predicting the record low of 6.5% achieved in October to be matched.

Hitting these forecasts will be another boon to the euro hawks.

Traders on the EUR/GBP pair seem locked in a stalemate given the spinning top candlestick pattern forming on the daily chart. The pair closed flat at 87.97p on Sunday and is currently changing hands at 87.90p at the time of writing.

While today is pretty quiet on the economic calendar front, tomorrow’s UK retail sales monitor should give an insight into the state of consumer spending.

The British Retail Consortium isn’t particularly optimistic about sales growth in 2023, with a growth rate of 2.3% expected for the first half of 2023 due to the persistent cost-of-living crisis.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

Employment data also failed to impress, while the goods trade balance widened its deficit more than expected.

As such, Federal Reserve chair signalled a slower pace of interest rate hikes in the months to come.

"It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” said Powell, though he did note that the terminal rate could be "somewhat higher" than the 4.6% indicated by in the September projections.

EUR/GBP closed the Wednesday session at .863, around 12 basis points below the intraday high, though the euro has the slight upper hand this morning having added a few pips.

Yesterday’s EU headline inflation data came in at a flat 10% against a 10.3% forecast, though that figure is still unacceptable high given the 2% target, so excessive rate hikes are likely to stay on the agenda in the coming months.

Combined with Powell’s dovish overtures, EUR/USD jumped a full percentage point to 1.042 yesterday, and continued to rally another 0.33% to 1.045 in today’s Asia window.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.