UK jobs disappoint, BoE cut bets deepen as inflation cools; Iran tensions push the dollar higher despite falling yields and Japan's $550bn US pledge steadies the yen.

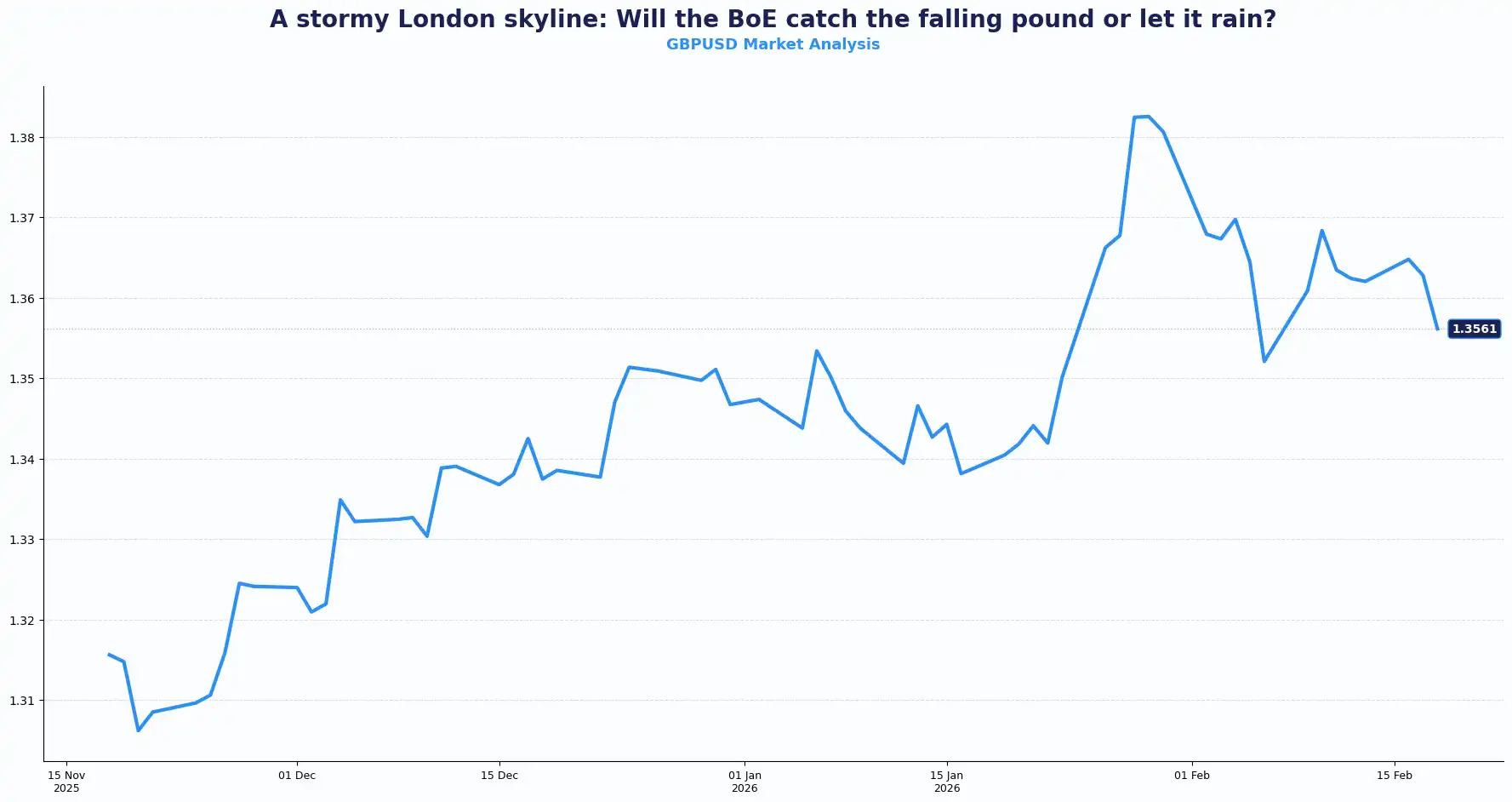

GBP: Pound Under Pressure as Jobs Data Bites

GBP/USD sits at 1.3555; its lowest print since 6 February, after a 0.5% slide in the prior session. Tuesday's UK labour data landed soft: unemployment climbed to a five-year high in December and wage growth cooled. The Bank of England (BoE)'s case for a March rate-cut just got harder to argue against.

Relative softening in UK data drives the current sterling underperformance. This trend grants the BoE significant room to lower rates. The base case now calls for a 25bps cut to 3.50% in March, though some analysts look towards April. The current path still points to rates near 3% by year-end. Lower interest rates trim gilt yields and erode sterling's carry appeal.

UK inflation dropped to 3.0% from 3.4% in Dec, in line with forecasts. A softer print confirms the disinflationary trend, firms up March cut bets and puts further pressure on GBP through the near term. The BoE expects inflation to move toward its 2% target by April, helped by regulated energy pricing and November budget measures.

Volatility around UK data has increased. Periods of elevated uncertainty around central bank timing have historically coincided with wider bid-offer spreads and increased hedging activity among corporate and institutional market participants.

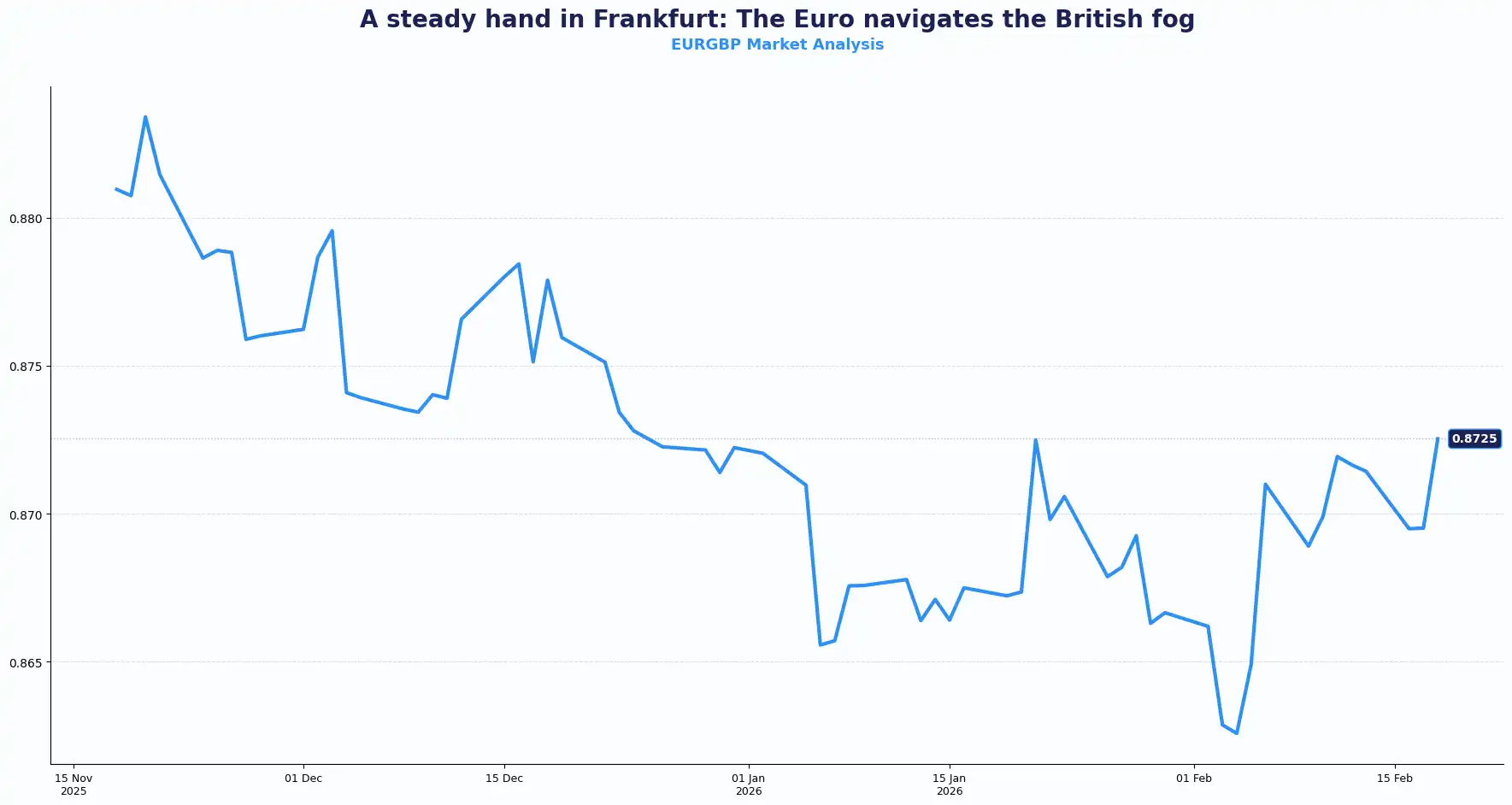

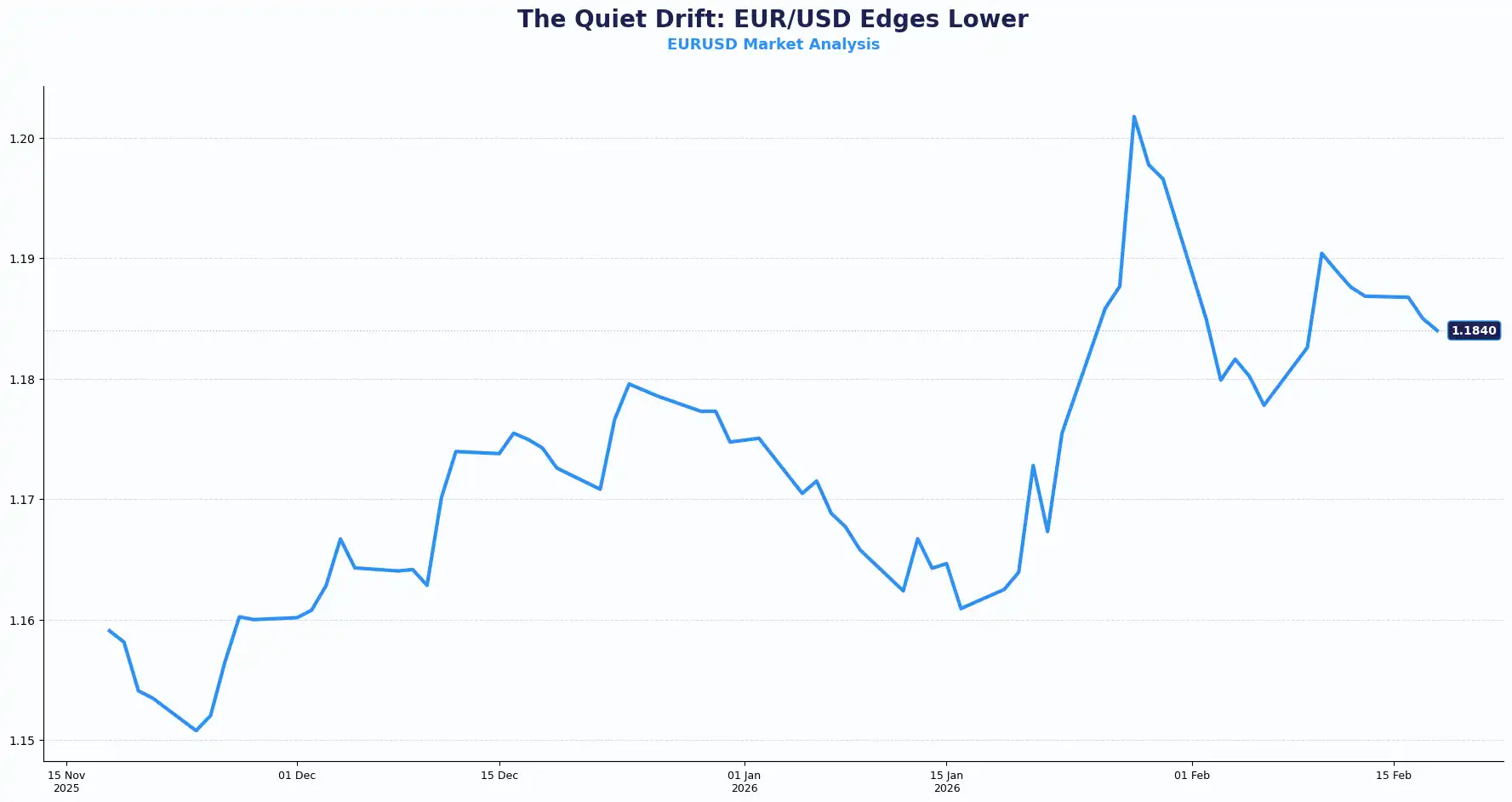

EUR: Cross Flows Cushion the Single Currency

EUR/GBP trades near 0.8735, steady ahead of UK data. EUR/USD sits at 1.0843 and edges lower.

The Eurozone February ZEW Economic Sentiment printed at 39.4, missing the 45.2 forecast and dipping from 40.8. Despite this miss, the soft survey had limited impact on the euro.

Instead, relative policy expectations did the heavy lifting. A more dovish BoE outlook pushed traders to trim sterling exposure, which kept the EUR/GBP pair supported.

Policy divergence is doing the work here. The eurozone data calendar shows preliminary PMI figures for the eurozone, Germany and France coming on Friday. Stronger data could lend near-term support to the EUR/USD pair. Progress in US-Iran negotiations, which eased geopolitical tension, provided additional support to risk-sensitive currencies, including the euro.

Cross-currency positioning tends to shift ahead of PMI releases when policy outlooks diverge significantly between two central banks. While the ZEW data disappointed, the euro's resilience highlights a transition of weakness from the Continent to the UK. Market Participants often use these periods of divergence to balance their European currency weights.

USD: Dollar Firms on Iran Risk, Defies Its Own Fundamentals

The dollar index (DXY) sits at 97.11 after a two-day advance, and Tuesday's price action is worth sitting with. All the technical conditions for dollar weakness were in place: the Fed cut expectations to their highest since late last year, Treasury yields falling and mixed risk tone. The dollar strengthened anyway.

Geopolitical tensions in the Middle East and volatility in US equities drove a "risk-off" rotation into the Greenback. Reports of a 'general agreement' in nuclear negotiations between the US and Iran briefly cooled the rally, yet the dollar maintains its strength. Peace talks between Ukraine and Russia mediated by the US, also keep the market on edge. Investors are returning to the classic "safe haven" play: buying US dollars and Treasuries while offloading equities.

Fed communication added another layer. Governor Barr signalled rates on hold "for some time." Chicago Fed President Goolsbee left the door open to several cuts in 2026 if inflation cooperates. That split is already creating volatility in rate forwards, even as spot looks contained.

We see a technical contradiction where the dollar strengthens even as the market prices in the most Fed cuts since last year. This anomaly stems from geopolitical anxiety. With the FOMC minutes due today and GDP data on Friday, the dollar stays the primary sanctuary for capital.

Periods of geopolitical uncertainty often coincide with increased dollar demand and shifting hedging patterns among globally exposed firms.

Antipodean Pairs Slip as Risk Appetite Fades

AUD/USD holds below 0.6100. NZD/USD trades near 0.5997. Both reflect the broader risk-off tone rather than domestic catalysts.

The Reserve Bank of New Zealand (RBNZ) held its rate to 2.25% earlier today. The decision nonetheless draws attention as a new chapter begins for the RBNZ's leadership with Anna Breman’s debut as central bank chief.

Yen Steady as Japan Backs $550bn in US Projects

USD/JPY trades at 153.12. The yen found support after the Trump administration confirmed the first tranche of Japan-financed US investment: three projects valued at $36bn, part of Tokyo's broader $550bn commitment to reduce tariff pressure.

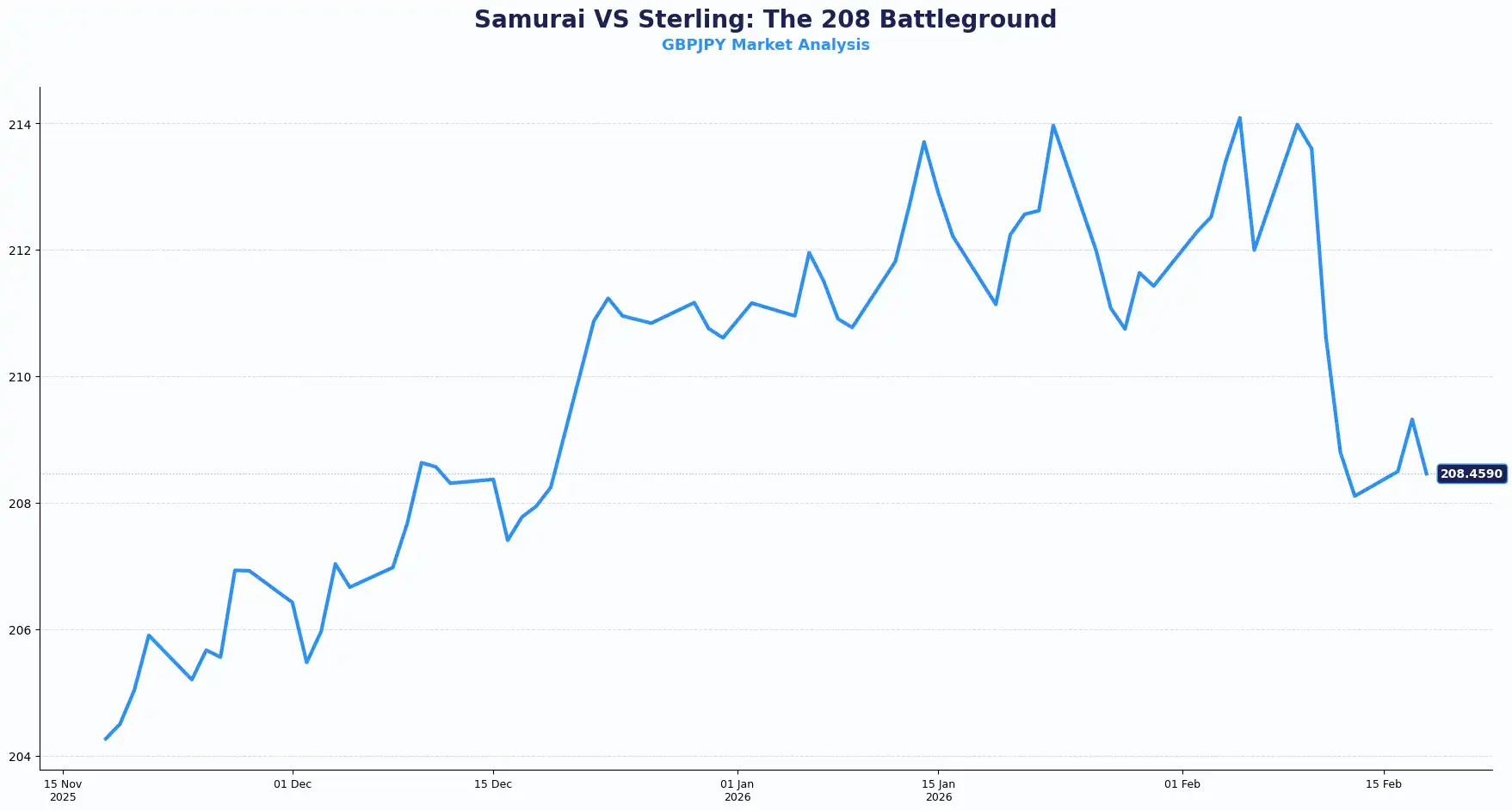

Diverging BoJ-BoE policy expectations shape GBP/JPY, which reclaimed 208.00. The IMF flagged fiscal risks from a potential consumption tax cut in Japan. Speculation that Prime Minister Takaichi may push back on further BoJ rate hikes adds complexity to the yen's direction. Japan's National CPI will further frame the near-term trajectory.

Participants with exposure to JPY crosses have historically reassessed hedging structures ahead of dual CPI releases from two diverging central bank regimes. Yen crosses continue to reflect widening global policy gaps and shifting fiscal narratives.

FX Playbook

Wed, 18 Feb:

US - FOMC MInutes (Jan)

Fri, 20 Feb:

US Q4 GDP

Japan National CPI

Eurozone & Germany Flash PMIs

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.