UK retail sales blow past forecast, giving sterling a floor. The euro navigates ECB uncertainty and the dollar logs its best week since October. PCE and Global PMI data now hold the key to whether current FX volatility persists into next week.

GBP: Sterling Steadies as Retail Sales Deliver a Surprise

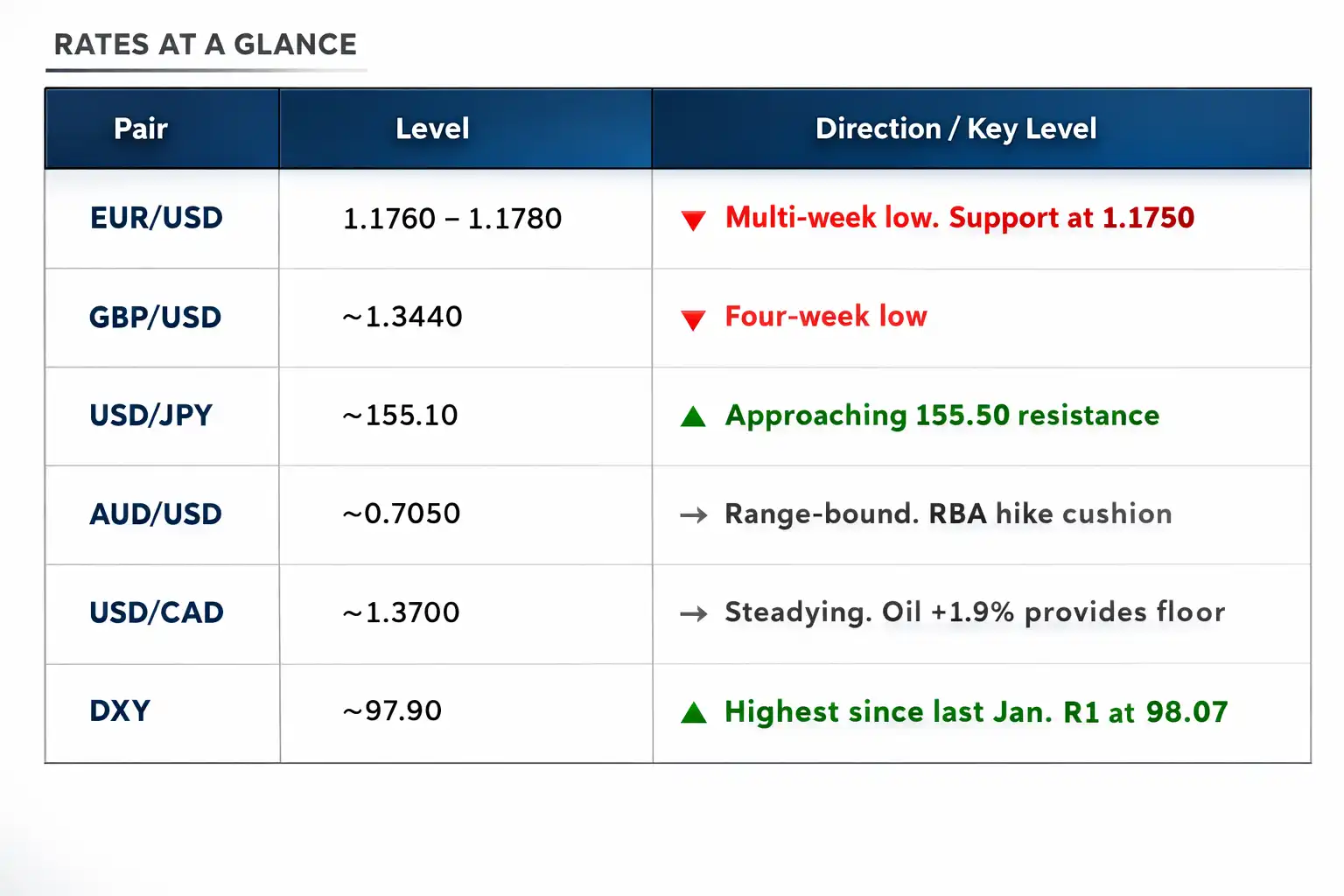

Sterling fell 0.17% to $1.3440 in early Friday trade. It faced a weekly drop of nearly 1.5% as the dollar pared its gains ahead of the UK ONS data.

UK Retail Sales for January came in at 1.8% MoM, nine times (!) the 0.2% forecast and well above the prior 0.4%. The YoY reading hit 4.5% above the 2.8% consensus and the 2.5% prior. Ex-Fuel figures told the same story: 2.0% MoM against a 0.2% forecast, and 5.5% YoY against 3.6% expected.

These are not marginal beats. The UK consumer came in swinging

For sterling, the data provides an immediate floor. GBP/USD had been tracking towards its worst week in over a month; a print this strong gives the pound a concrete reason to recover ground. The consumer resilience narrative is now harder to dismiss.

For the Bank of England (BoE), the picture gets more complicated. BoE policymaker Catherine Mann described this week's UK inflation data as "good numbers" but noted underlying progress fell short of what the Bank had hoped to see.

Retail sales at this level signal that consumer demand is holding firm, keeping domestic price pressure alive. That is not the backdrop that makes early rate cuts straightforward to justify. The BoE's already cautious stance now has another reason to stay patient. Fewer cuts, sooner than expected, would be constructive for sterling over the medium term. However, one strong retail print alone is unlikely to shift the broader policy path without support from wages and services inflation.

Data surprises like this often coincide with short bursts of FX volatility, particularly in GBP pairs. Many corporate and institutional participants typically review currency risk exposure during periods when UK data diverges from expectations.

UK Flash PMI readings follow later this morning. UK Composite PMI is forecast at 53.4 (prior: 53.7). Manufacturing expected to hold at 51.8. Services expected to ease to 53.6 (prior: 54.0). Every forecast sits above 50, signalling that the UK private sector is expanding. A dip below 50 in any category would cut against today's retail sales momentum and quickly revive cut expectations.

PMI Watch: Two Scenarios for Sterling

Scenario A: PMI beats forecast: If UK Composite PMI prints above prior 53.7, activity across the private sector accelerates. GBP/USD is likely to recover to 1.3480. The case for near-term BoE cuts weakens slightly, and sterling finds a bid.

Scenario B: PMI misses forecast: UK Composite PMI comes in below both the forecast and the prior. GBP/USD is expected to test support near 1.3400 and rate cut expectations for the second half of 2026 firm up, adding fresh weight to sterling's short-term outlook.

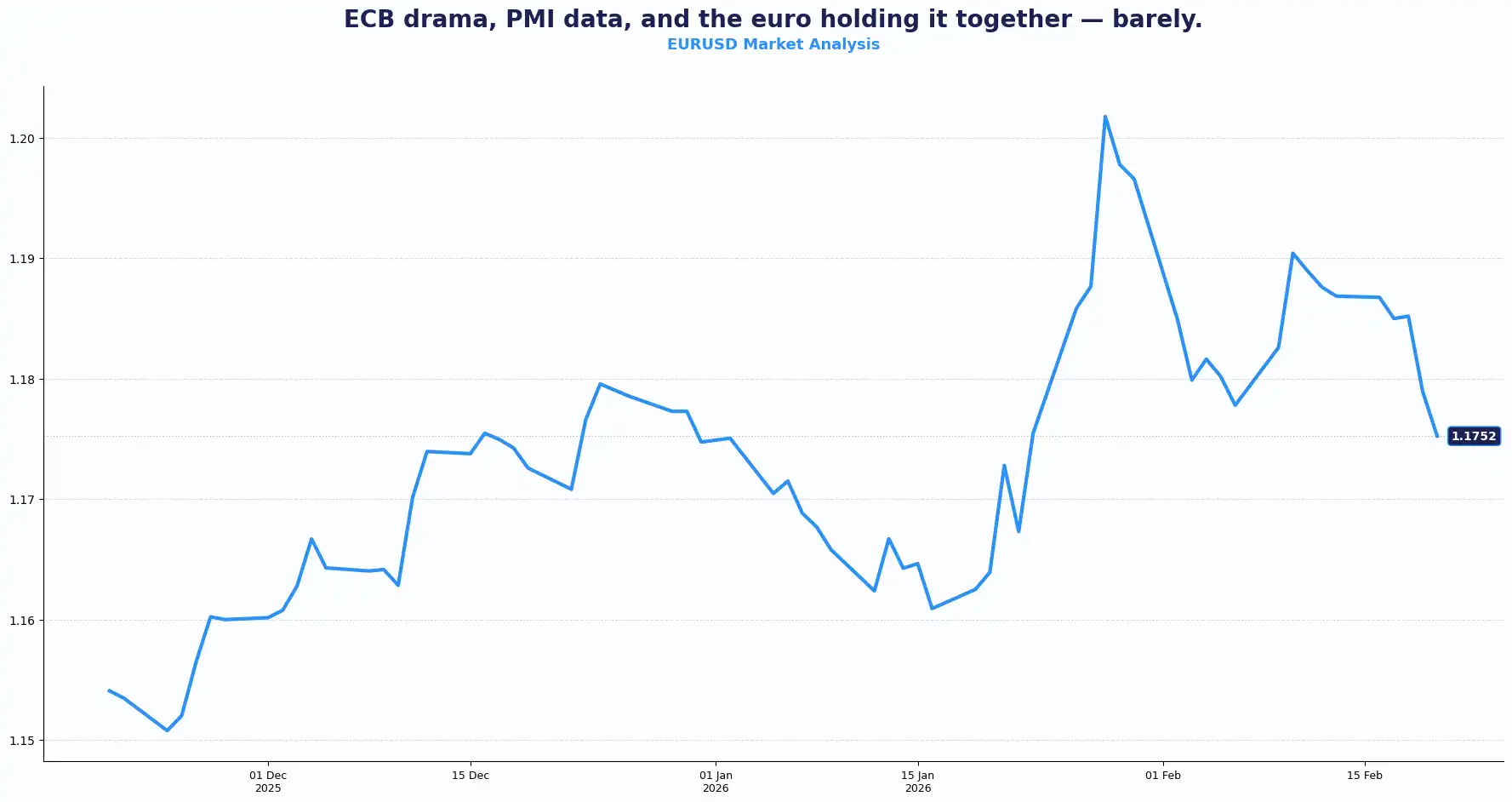

EUR: Euro Drifts as ECB Leadership Clouds Gather

EUR/USD traded at 1.1755 during the early Asian session, on track for a weekly loss of nearly 0.8%, the second consecutive daily decline and the sharpest single-day drop since 30 January. ECB leadership speculation weighed on the euro alongside the broader move into the dollar.

ECB President Christine Lagarde informed colleagues she was focused on her role and would tell them first if that changed. The message was taken as "not yet." Uncertainty persisted regardless, and the euro felt it.

Eurozone flash PMI data lands today. Composite PMI is expected at 51.5 (prior: 51.3). Manufacturing PMI is forecast at 50.0 (prior: 49.5) with hopes for a potential return to the expansion threshold after a period of contraction. Services PMI is pencilled in at 52.0 (prior: 51.6). The eurozone economy is nudging toward broader expansion, making today’s print particularly sensitive for EUR sentiment. A sustained move in manufacturing above 50 would be the headline beat.

Germany’s upcoming producer prices feed into the inflation pipeline. Firmer readings could complicate the European Central Bank (ECB) easing path.

EUR pairs continue to react sharply to policy signals and data surprises. Heightened sensitivity often leads to wider intraday swings across major euro crosses.

EUR/GBP traded flat at 0.8742, at the time of press. Cross traders are watching PMI differentials for further direction.

USD: The Dollar Dominates the Global Stage

The dollar index (DXY) sat near 97.89 on Friday, consolidating Thursday's one-month peak and on track for a weekly gain of over 1%, its strongest performance since late January.

Three forces drove the move. Fed minutes released Wednesday showed several policymakers open to rate hikes if inflation proved persistent. Jobless claims dropped 23,000 to an adjusted 206,000 well below the 225,000 estimate and underlining labour market strength. Geopolitical tensions added a safe-haven bid: President Trump set Iran a 10-to-15-day deadline over its nuclear programme, drawing retaliatory threats from Tehran and lifting oil prices.

The trade deficit widened to $70.3 billion against a $55.5 billion estimate, a theoretical headwind but the labour and Fed narrative drowned it out.

Today's session carries the headline prints. US GDP Q4 (annualised) is forecast at 3.0% (prior: 4.4%). A slowdown from the prior quarter, but still on a solid footing. The GDP Price Index for Q4 was previously at 3.7% (elevated) and a clear signal that the inflation fight is not closed.

PCE data, the Fed’s preferred inflation measure, also prints today. Consensus sits at 0.3% MoM (prior: 0.2%), with the annual rate holding at 2.8%. A hotter print supports rate-hold expectations and the dollar, while a softer print would reopen the debate over rate-cuts.

US flash PMIs also land today. Manufacturing is expected at 52.6 (prior: 52.4). Services PMI is forecast at 53.0 (prior: 52.7). Both forecasts above 50 signal that the US private sector is expected to expand.

Investors are pricing in roughly two Fed cuts this year. The probability of a June cut sits at approximately 58%, down from 62% a week ago, per CME FedWatch. The debate within the Fed is straightforward: cut proactively to support employment, or hold to finish the inflation job. Today's PCE figures add another data point to that argument.

The dollar continues to respond quickly to inflation and labour signals. Periods surrounding PCE releases often see elevated FX positioning adjustments.

Yen, Kiwi, and Aussie Navigate a Stronger Dollar

The USD/JPY pair sat at 155.08, reversing modest earlier session gains. Japan's core CPI for January came in at 2.0% YoY, the slowest pace in two years. Cooling inflation reduces urgency for the Bank of Japan (BoJ) to resume its tightening cycle, particularly given subdued Q4 activity. Wage growth and underlying price dynamics will determine whether a June BoJ hike stays on the table.

The AUD/USD pair traded at 0.7055, as the Aussie dollar slipped to near a two-week low. The Aussie held support from hawkish domestic rate expectations but could not resist a broadly stronger dollar ahead of the US data session.

The NZD/USD pair traded at 0.5967. The kiwi closed out a losing week after the Reserve Bank of New Zealand (RBNZ) delivered a dovish rate outlook. A run of cuts over the past year caught rate-hike bettors badly on the wrong side.

Rates At A Glance

Market Look Ahead;

Fri 20 Feb :

Global PMI

US Core PCE Price Index & Q4 GDP

Mon, 23 Feb

Eurozone - German IFO Business Climate (Feb)

Tue, 24 Feb

US Consumer Confidence (CB)

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.