GBP

The pound enjoyed a positive August against the greenback, with cable rallying around 2% over the course of the month, rebounding from its first monthly loss in six in July, to reclaim the 1.35 handle as summer drew to a close.

Trading conditions did, however, become rather thin towards the tail end of the month, with the market treading water for most of the last two weeks of August. Furthermore, the bulk of that move in cable came by virtue of a broadly weaker USD. In the crosses, participants continue to take a relatively dim view of the quid, with GBPEUR notching a third straight monthly decline in August, its worst such run since mid-2019.

This GBP weakness in the crosses came despite a notable hawkish repricing of BoE policy expectations as the month progressed, with money markets now discounting just 10bp of further easing by year-end, compared to around 22bp (i.e. another Bank Rate cut) at the end of July.

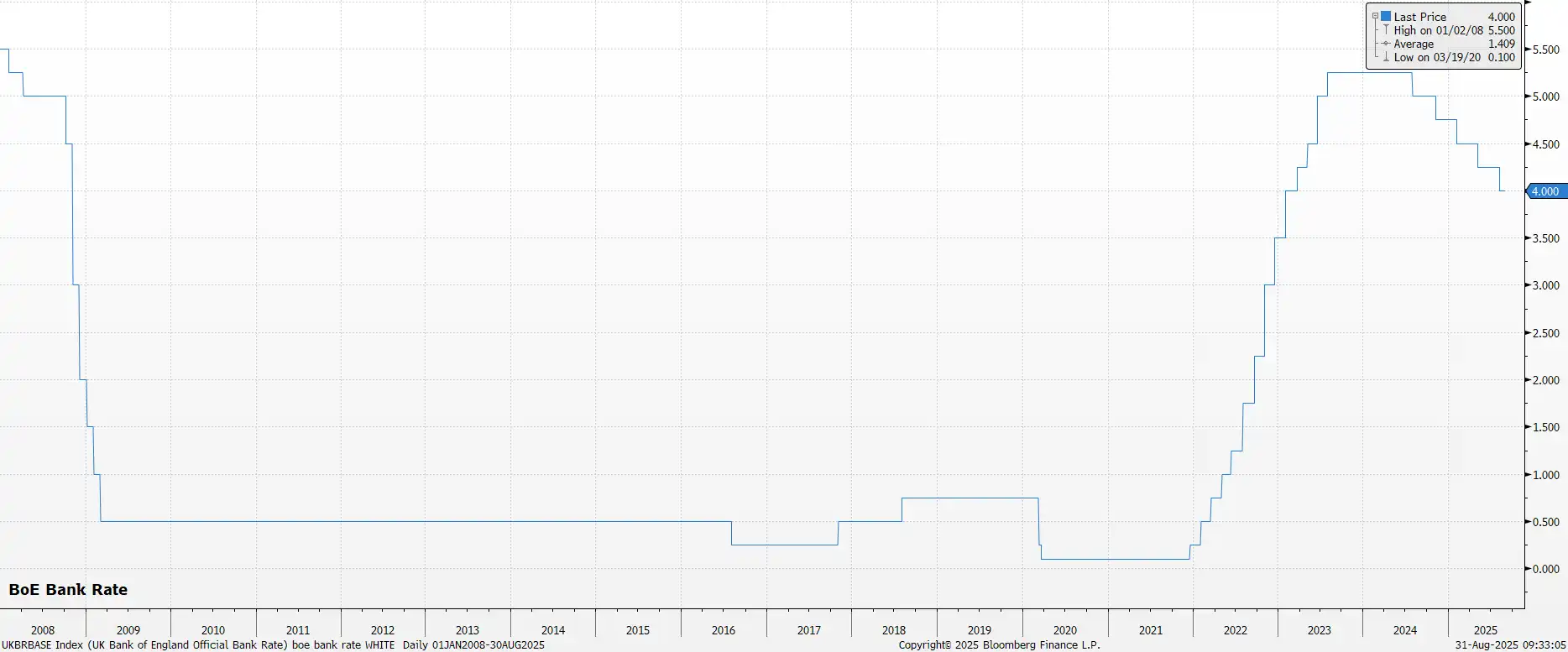

The first catalyst for this repricing came from the August MPC decision itself. While the Committee did vote in favour of a 25bp Bank Rate cut, to 4.00%, as expected, the vote was considerably tighter than participants had foreseen. Four MPC members preferred to hold Bank Rate steady at the August meeting, including Chief Economist Pill and Deputy Governor Lombardelli, amid continued concern over the risks of persistent price pressures becoming embedded within the UK economy. Naturally, with almost half of the MPC against further policy easing, the bar to another rate cut is now a significantly higher one.

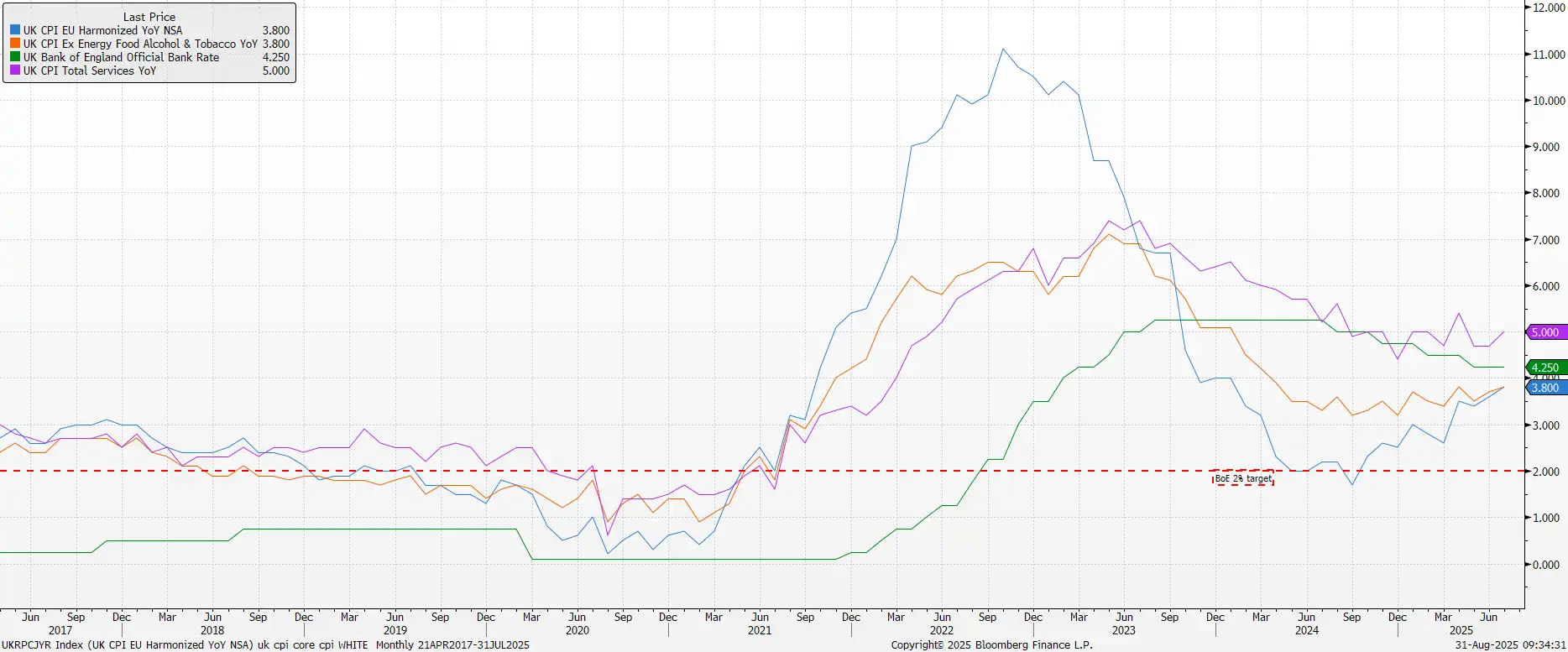

In addition, the latest round of inflation data helped to reinforce those hawkish dissents. Headline CPI rose 3.8% YoY in July, not only above expectations, but also the fastest rate in 18 months. Measures of underlying inflation also pointed to an intensification in price pressures, as core CPI rose 3.8% YoY, and services prices rose 5.0% YoY, both being the fastest pace since April.

Perhaps of more concern, however, is that inflation is yet to show any signs of peaking. While the MPC expect headline CPI to peak at 4.0% YoY in September, policymakers will want to be sure that such a peak has indeed passed before delivering another rate reduction. The September MPC meeting, hence, should see the Bank stand pat on rates, though a decision to drastically reduce, or even end, active Gilt sales is likely to be made.

On a somewhat more positive note, however, tentative signs are beginning to emerge that the recent bout of labour market weakness may well be bottoming out. HMRC payrolls were, essentially, unchanged in July, while unemployment held steady at 4.7% in the three months to June.

This nascent jobs recovery, however, could well be killed stone dead by Chancellor Reeves’s upcoming Budget. While no date for that announcement has yet been set, with mid-November now the earliest that the fiscal statement can be made, speculation of how the Chancellor will plug the fiscal ʻblack hole’ continues, including potential increases in property taxes, or even a ʻwindfall’ tax on bank profits.

That speculation, of course, is only likely to continue, and increase, in the run up to the announcement itself, with the accompanying fiscal uncertainty to act as a stiff headwind to UK Plc for the time being.

EUR

The common currency also benefitted from a broadly weaker USD through August, gaining around 2.5% over the course of the month, in turn notching its seventh monthly gain of eight this year. Once more, however, conditions did become rather more subdued as the month progressed, resulting in the common currency largely treading water around the $1.17 handle.

Fresh fundamental developments were relatively thin on the ground as the month progressed, with the bulk of what market volatility there was coming by virtue of external catalysts, such as Fed Chair Powell’s dovish pivot at the Jackson Hole Symposium (more on that below).

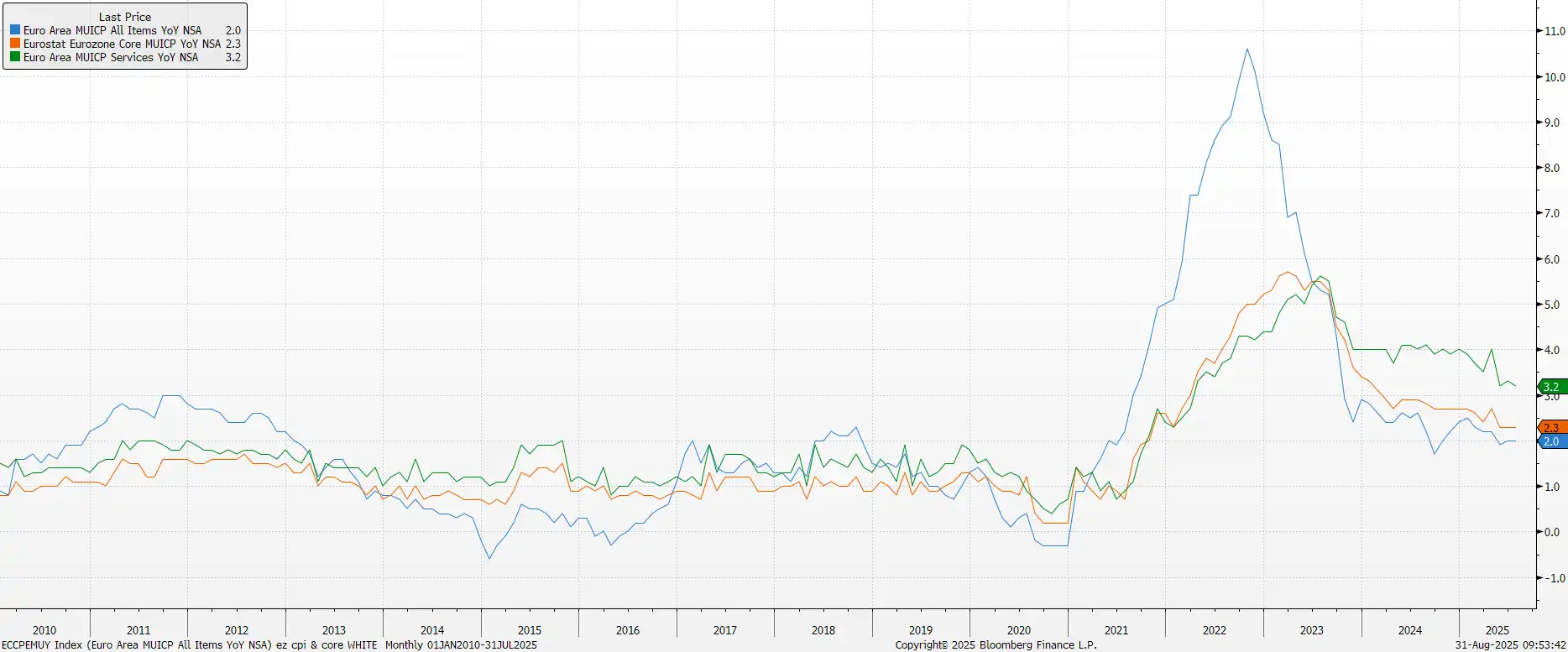

As usual, ECB policymakers observed a long, and mercifully quiet, summer break, offering little by way of fresh policy guidance. The outlook now, however, is a relatively straightforward one, with Lagarde & Co firmly on hold for the foreseeable future, and 2% likely to mark the floor for the deposit rate this cycle – barring, that is, a further round of EUR strength which policymakers feel the need to tamp down on.

That aside, the September ECB decision is likely to see policymakers reiterate their ʻdata-dependent’ and ʻmeeting-by-meeting’ approach to future rate decisions, while offering little-to-no sign that they are inclined to lower rates further. The latest round of economic projections are also likely to offer little by way of surprises, reiterating that a modest inflation undershoot is foreseen next year, before CPI returns to the 2% target in 2027.

Besides the upcoming ECB decision, and simmering geopolitical risk with the Russia-Ukraine war showing no sign of coming to a rapid truce, domestic political fragilities are starting to flare up once again.

French PM Bayrou faces a confidence vote in early-September which, on present form, he seems likely to lose resoundingly. Thus, President Macron, who shan’t resign before the end of his term in a couple of years, faces the choice of either fresh legislative elections, or installing another ʻcentrist’ figure as PM, albeit one who is unlikely to obtain the support of a majority of lawmakers, thus making passing a fresh Budget nigh-on impossible. For the time being, concern on this front is likely to be limited to French assets such as OATs, though a broadening out of said worries posing a headwind to the EUR can’t be ruled out.

USD

As alluded to above, the dollar struggled once more through August, losing around 2% against a basket of peers, and marking the seventh such monthly decline this year. In turn, these declines saw the dollar index (DXY) slide back towards the 97 figure, and the lows seen in mid-July.

Developments surrounding the Fed were the primary driver of these headwinds facing the greenback, though not all in terms of the policy outlook.

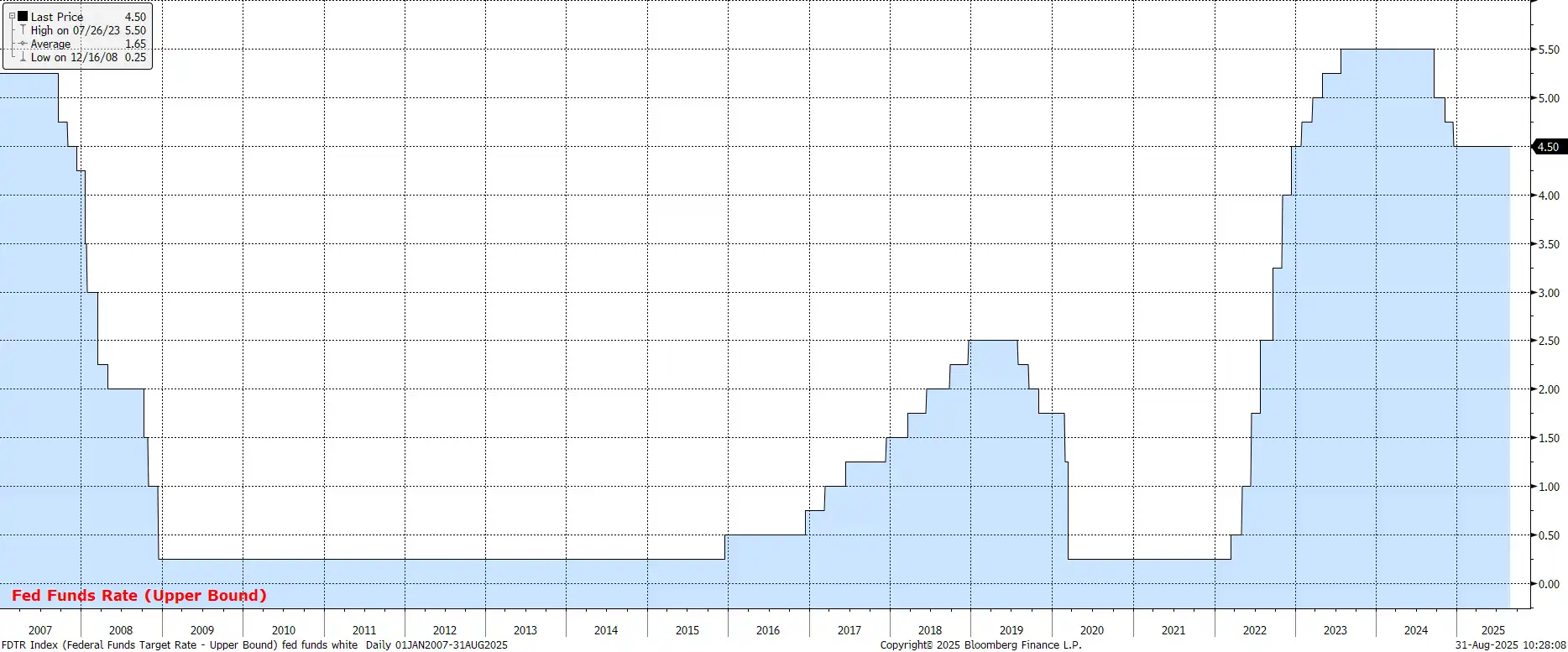

That near-term outlook, though, has tilted in a decidedly more dovish direction since Chair Powell’s remarks at Jackson Hole, where the Fed Chair noted that tariffs are likely to prove a ʻone-time’ shift in the price level, and that the shifting balance of risks facing the labour market suggests that the FOMC may need to ʻadjust’ their policy stance. In plain English, this is Powell clearly and heavily leaning into the idea of a September rate cut, with a 25bp cut at the next FOMC meeting now near-certain.

The only question now is whether such a cut is likely to be framed as a ʻone & done’ move, essentially the FOMC taking out insurance against further labour market weakness, before reverting to the ʻwait and see’ stance with which we’ve become familiar, or whether such a cut is likely to be framed as a resumption of the journey back to neutral that paused at the start of the year.

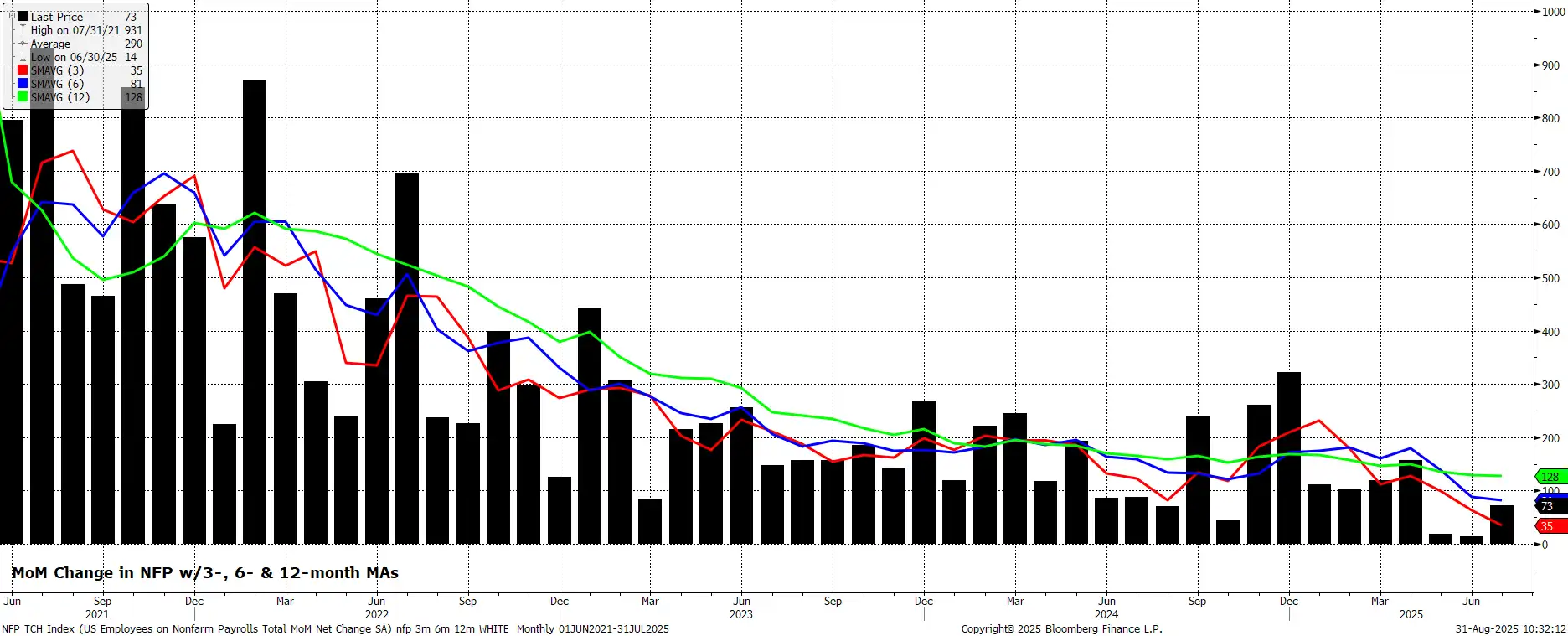

August’s labour market report is likely to be what settles that debate, especially after July’s surprisingly soft figures were the trigger for the Fed’s dovish pivot in the first place. In any case, while the 3-month average of jobs growth currently runs at a meagre 35k, the breakeven payrolls pace may now be as low as 50k, given the tighter immigration enforcement seen under the Trump Administration. It will be labour market, not inflationary, developments that frame the FOMC’s path from here, with Powell & Co having now planted their flag in the ʻtransitory’ price pressures camp once more, despite headline CPI having run north of the 2% target for 53 months in a row.

That said, it is not only the dovish near-term policy outlook posing headwinds to the greenback, but also President Trump’s continued efforts to erode monetary policy independence. Governor Kugler’s surprise early-August resignation opened up a spot on the Board for Trump to fill, with CEA Chair Steve Miran, a clearly politically motivated choice, nominated to take that spot, and likely to be in place by the time of the September FOMC meeting.

Meanwhile, Trump is also in the midst of efforts to fire Governor Cook, over allegations of mortgage fraud. While that case is likely to be embroiled in a prolonged legal battle, Trump’s efforts have not only further shaken confidence in the greenback as a stable reserve currency, but also again speak to the lengths that Trump will go to in order to ensure the Fed Board is packed with policymakers who favour much lower interest rates. That criteria, incidentally, is also likely to be top of the list in the hunt for the next Fed Chair, the identity of whom may become clearer after Labor Day. Either way, capital outflows from the USD are only likely to accelerate as these attacks on the Fed as an institution continue.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.