Daily Forex Market Report 11-Jan-2023: Indecision amongst USD, GBP traders

Per the World Bank’s latest forecast, the global economy is expected to grow by just 1.7% in 2023, down from the bank’s 3% prediction last June.

But even that number is flattered by China’s predicted growth of over 4%, whereas Western economies could more or less grind to a standstill.

Yet Swissquote analysts warned against taking this as a sign of looser economic policy in the US: “Inflation, though easing, remains more than three times higher than the Fed’s 2% target. This means that the Fed will continue hiking rates even if it means slower economic growth.”

It’s all leading to a general lack of direction in the markets, exasperated by Fed chair Jerome Powell’s silence on the bank’s direction.

Tomorrow’s inflation data will surely be hotly anticipated.

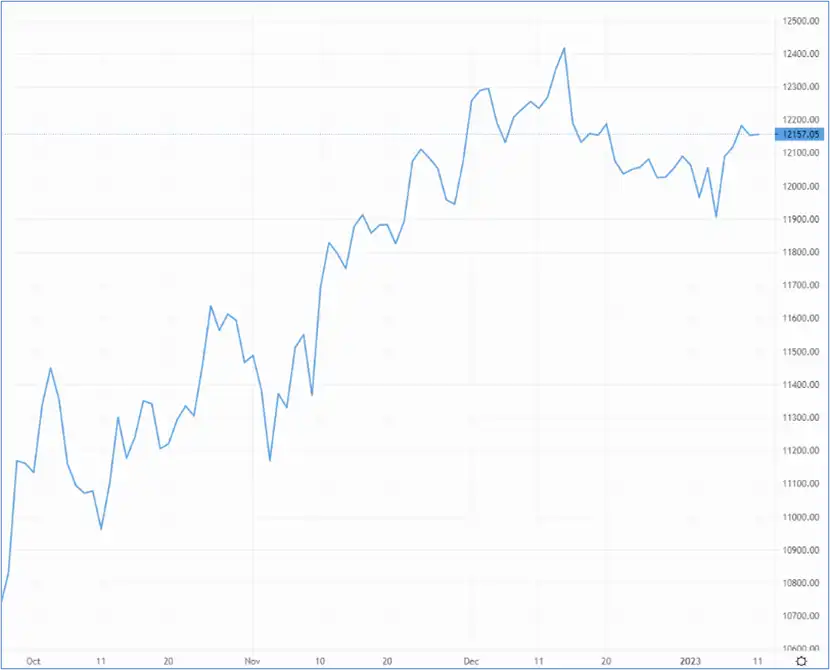

The US Dollar Index (DXY) closed flat at 102.89 on Tuesday following three straight days of meaty losses, though the spinning top candlestick pattern showed clear indecision among traders.

Indecision continued in this morning’s Asia trading window. At the time of writing, DXY was a few basis points lower at 102.77, but there was no clear bearish advantage.

Cable was seen higher following a bearish end to Tuesday’s trading session which saw the pair close 30 pips lower at 1.215 before adding 0.2% to 1.217 this morning.

GBP/USD seen higher, yet investor sentiment is mixed – Source: capital.com

GBP/USD seen higher, yet investor sentiment is mixed – Source: capital.com

The euro maintains a seven-month high against the greenback, with the EUR/USD pair currently changing hands at 1.074.

Benefitting euro bulls, European Central Bank board member Isabel Schnabel made hawkish comments in her Tuesday speech on green policy. “Inflation will not subside by itself”; “To resolve today’s inflation problem, financing conditions will need to become restrictive” and so forth.

EUR/GBP had a strong Tuesday session, closing 30 bps higher at 88.35p, with further upside to 88.38p seen in this morning’s Asia session.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.