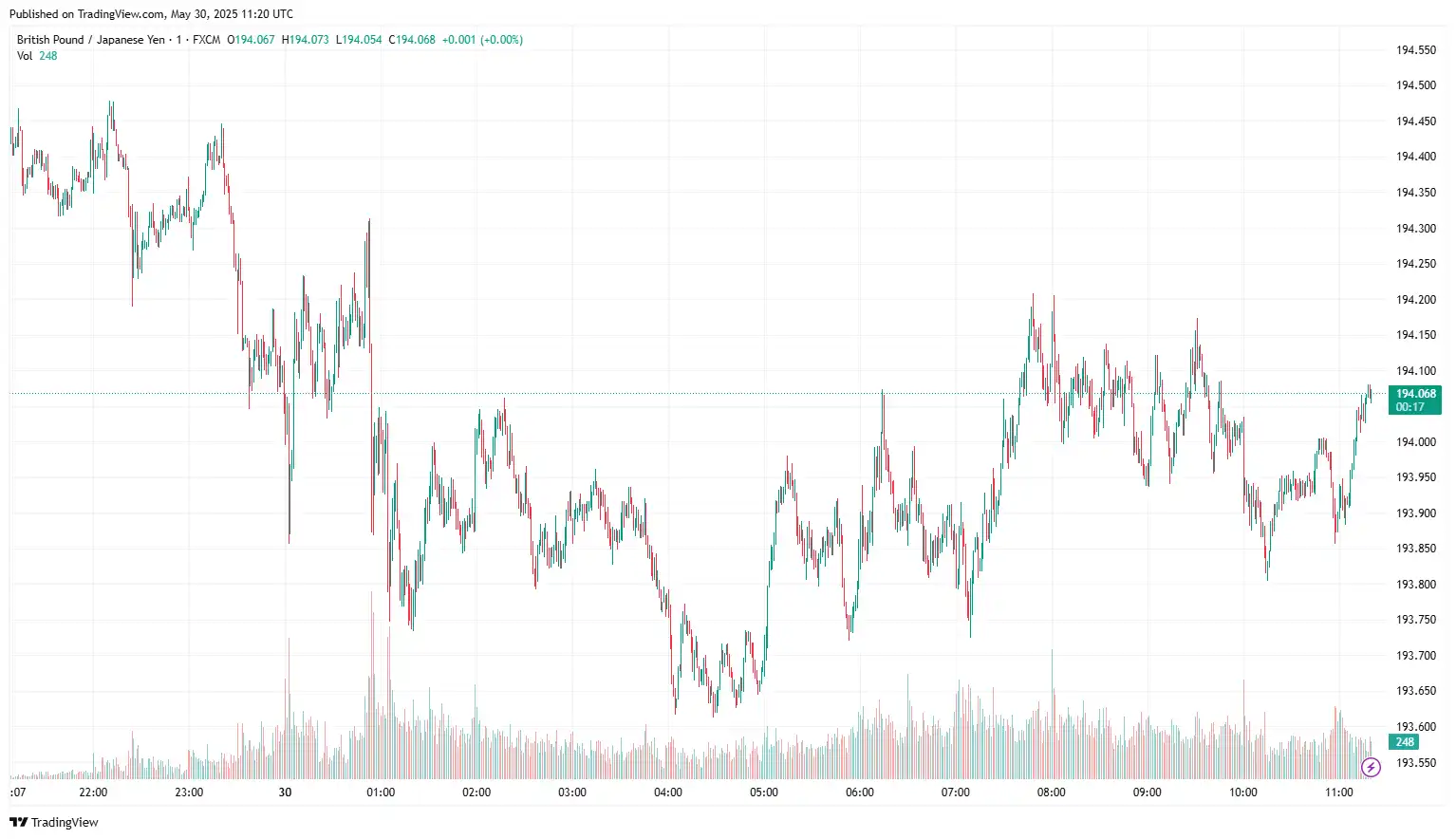

GBP/JPY struggled near 193.94 as the yen remained subdued following the domestic inflation numbers. Friday's Consumer Price Index (CPI) in Tokyo, the nation's capital, increased by 3.4% year-on-year in May, down from 3.5% in the previous month. Meanwhile, a gauge that excludes volatile fresh food rose to over a two-year high. In fact, the Core CPI recorded a 3.6% YoY rise following a 3.4% increase in April, exceeding median market forecasts of a 3.5% gain. Furthermore, a separate index that eliminates the effects of both fresh food and fuel costs rose by 3.3% in May compared to the previous year, after a 3.1% increase in April. The Tokyo CPI has surpassed the Bank of Japan's 2% target for three consecutive years, highlighting persistent food inflation. This will keep the central bank under pressure to raise rates further, although uncertainty over US tariffs may compel the BoJ to maintain a wait-and-see approach. Separate data revealed that Japan's Industrial Production shrank by 0.9% in April, marking a reversal from a 0.2% rise in March. However, the contraction was smaller than anticipated. Additionally, a survey indicated that manufacturers expect output to increase by 9.0% in May but decline by 3.4% in June. Furthermore, Japan's Retail Sales rose more than expected, by 3.3% YoY in April, compared to 3.1% in the previous month. This supports the expectation that substantial wage hikes will bolster private consumption, reinforcing the case for further policy normalisation by the BoJ.

On Friday, Bank of Japan (BoJ) Governor Kazuo Ueda stated that the BoJ's financial condition will not influence its short-term interest rate decision, which will prioritise achieving the price target. He emphasised that the Bank of Japan's financial standing will not affect this decision and acknowledged the ongoing aggressive pricing and wage-setting behaviours among firms. Additionally, the Board's revision of inflation forecasts reflects the pressures of global economic slowdown due to trade policy uncertainty, the diminishing pace of cost-push inflation, and the recent significant drops in crude oil prices.

On the other hand, sterling traded without a clear direction amid a lack of key economic data. However, fading market expectations that the Bank of England (BoE) would reduce interest rates again at the June policy meeting stabilised the pound. On Thursday evening, Andrew Bailey, Governor of the Bank of England (BoE), emphasised that the key influences on the BoE's main reference rate are primarily rooted in the economic requirements of the United Kingdom (UK) rather than external factors like the tariff policies of the Trump administration.

Sterling ends the week with UK data still missing from the calendar; therefore, in today's session, the broader market sentiment regarding the Japanese economic data will influence the GBP/JPY exchange rate.

AUD/USD Sinks Ahead of US PCE Inflation Data

AUD/USD lost ground near 0.6420 following the release of disappointing economic data from Australia. On Friday, the Australian Bureau of Statistics (ABS) reported that Australia's Retail Sales, which gauge consumer spending, decreased by 0.1% month-on-month in April, following a rise of 0.3% in March. This reading was below the market expectation of 0.3%. Additionally, the monthly Building Permits dropped by 5.7%, in contrast to the anticipated increase of 3.1%. On Wednesday, the Australian Bureau of Statistics (ABS) reported that the monthly Consumer Price Index (CPI) remained steady at 2.4% for the year ending in April, compared to a 2.4% increase recorded in March, slightly above the market forecast of 2.3% growth. Furthermore, the market anticipates that the Reserve Bank of Australia (RBA) will reduce interest rates in upcoming policy meetings, which could exert further pressure on the AUD. During the recent policy meeting, the central bank highlighted its success in mitigating inflationary pressures while cautioning that US-China trade barriers present downside risks to economic growth. Governor Michele Bullock stated that the RBA is prepared to take additional action if the economic outlook sharply deteriorates, raising the prospect of future rate cuts.

On the greenback's front, marketers are awaiting the US Personal Consumption Expenditure Price Index (PCE) inflation figures, setting a cautious market mood around the dollar. April's PCE inflation index is anticipated to decrease to 2.5% YoY from 2.6%, while the MoM figure is predicted to rise back to 0.1% from March's unchanged print of 0.0%. The preliminary annualised Gross Domestic Product decreased by 0.2% in the first quarter, which is slightly better than the anticipated drop of 0.3%. Personal Consumption Expenditures (PCE) grew at a steady rate of 3.6% quarter-over-quarter in Q1, aligning with expectations. At the same time, Core PCE rose by 3.4% QoQ, slightly below the expected 3.5% increase. The US weekly jobless claims report, released on Thursday, fell short of expectations, negatively impacting the US Dollar. The number of Americans submitting new applications for jobless benefits for the week ending May 24 climbed to 240K, up from the prior week's 226K (revised from 227K), according to the US Department of Labour (DOL) report on Thursday. This number exceeded the market consensus of 230K. Additionally, Continuing Jobless Claims rose by 26K, bringing the total to 1.919M for the week ending May 17.

Apart from the US April Personal Consumption Expenditures (PCE) Price Index report, investors will also monitor the Michigan Consumer Sentiment and the Chicago Purchasing Managers Index (PMI) for fresh impetus on the AUD/USD exchange rate.

EUR/GBP Subdued Following German Retail Sales Data

EUR/GBP edged lower to 0.8412, as easing trade tensions between the United States (US) and the European Union (EU), along with mixed German retail sales data, injected volatility into the euro. President Trump has postponed the tariff deadline for imports from the EU from June 1 to July 9. In response, Brussels has also agreed to expedite trade discussions with the United States to prevent a transatlantic trade conflict. On Friday, official data released by Destatis indicated that retail sales in Germany unexpectedly declined by 1.1% month-on-month (MoM) in April, following the revised growth of 0.9% (from -0.2%) reported in March, short of the forecasted 0.2% growth. On an annual basis, retail sales rose by 2.3% in April compared to March's 3.3% (revised from 2.2%) and the expected 1.8%. In April, Spain's Consumer Price Index (CPI) rose 2.2% compared to the previous year, a decrease from the 2.3% seen in March. Monthly, the CPI increased by 0.6%, showing a notable rise from the 0.1% climb in March. Core inflation, excluding unprocessed food and energy, remained at 2.4%, indicating persistent inflationary pressure within the economy.

European Central Bank (ECB) Executive Board Member Fabio Panetta said on Friday that there is "reduced room to cut rates further, but the macro outlook remains weak and trade tensions could worsen it." He also added that disinflation has not taken a high toll on the Eurozone economy and is now nearing completion. The outcome of trade negotiations is uncertain, but the impact on the European economy is bound to be significant. Also, sectors most exposed to tariffs are already showing signs of falling confidence, with weaker expectations regarding orders and employment. On Wednesday, Klaas Knot, who serves on the European Central Bank (ECB) Governing Council and leads the Dutch central bank, De Nederlandsche Bank (DNB), expressed that the current economic outlook for inflation in Europe is grim, making it difficult for the central bank to act decisively. Knot further indicated that the medium-term inflation outlook remains uncertain, which could lead to considerable challenges. Meanwhile, on Tuesday, ECB policymaker François Villeroy de Galhau noted that "policy normalisation in the Euro area is probably not complete."

Conversely, the pound fluctuated without a clear trend due to the absence of significant economic data. However, diminishing market expectations that the Bank of England (BoE) might cut interest rates again during the June policy meeting helped stabilise the currency. Traders have reduced their dovish bets on the BoE after the UK Consumer Price Index (CPI) came in hotter than anticipated, and retail sales data for April showed strong growth. On Friday, Bank of England (BoE) policymaker Alan Taylor stated, "I thought we needed to be on a lower [monetary] policy path," and added, "I'm noticing increasing risks associated with the downside scenario due to global developments. A trade war will negatively impact growth. The rise in inflation isn't primarily due to demand and supply pressures; for the most part, it is resulting from one-time tax and administered price changes."

In today's session, Germany's Retail Sales data and Consumer Price Index (CPI) data will be key drivers for the EUR/GBP exchange rate.

USD/JPY Gains Amid Modest USD Uptick Ahead of US PCE Data

USD/JPY advanced near 144.13 as today's upbeat Japanese macro data reaffirmed bets that the Bank of Japan (BoJ) will continue raising interest rates, which remains a key factor underpinning the JPY. Friday's Consumer Price Index (CPI) in Tokyo, the nation's capital, rose by 3.4% year-on-year in May, a slight decrease from 3.5% the previous month. Meanwhile, a measure that excludes volatile fresh food climbed to its highest level in over two years. In fact, the Core CPI recorded a 3.6% year-on-year increase following a 3.4% rise in April, surpassing the median market forecast of a 3.5% gain. Additionally, a separate index that excludes both fresh food and fuel costs rose by 3.3% in May compared to the previous year, after a 3.1% increase in April. The Tokyo CPI has now exceeded the Bank of Japan's 2% target for three consecutive years, underscoring persistent food inflation. This continues to exert pressure on the central bank to raise interest rates further, though uncertainty surrounding US tariffs may prompt the BoJ to adopt a wait-and-see approach. Separate data showed that Japan's industrial production fell by 0.9% in April, reversing a 0.2% increase in March. However, the decline was smaller than expected. Moreover, a survey revealed that manufacturers anticipate a 9.0% rise in output in May, followed by a 3.4% decrease in June. In addition, Japan's retail sales rose more than expected, increasing by 3.3% year-on-year in April, compared to 3.1% the previous month. This supports the view that significant wage increases will strengthen private consumption, further reinforcing the case for policy normalisation by the BoJ.

On Friday, Kazuo Ueda, Governor of the Bank of Japan (BoJ), asserted that the bank's financial position will not sway its decisions on short-term interest rates, which will focus on meeting the price target. He stressed that the BoJ's financial health would not impact this choice and recognised the persistently strong pricing and wage-setting practices among businesses. Moreover, the Board's updated inflation forecasts take into account the pressures stemming from the global economic slowdown caused by trade policy uncertainties, the slowing rate of cost-push inflation, and the recent significant declines in crude oil prices.

On the USD front, the greenback struggles following the US Court of Appeals ruling allowing US President Donald Trump's tariffs to take effect and downbeat data. The Bureau of Economic Analysis (BEA) at the Commerce Department estimates that the advanced GDP Growth Rate has contracted by 0.2% for the January–March period. This marks a significant decrease from the previous quarter's 2.4% growth. The GDP Price Index (deflator) has remained robust, increasing at an annualised rate of 3.7%, compared to a 2.4% rise earlier. According to the US Department of Labour (DOL), new unemployment insurance applications rose to 240K for the week ending May 24, exceeding initial predictions and the revised figure of 226K (down from 227K) from the prior week. The report also indicated a seasonally adjusted insured unemployment rate of 1.3%, while the four-week moving average decreased by 250 to 230.750K from the revised average of the previous week. Additionally, Continuing Jobless Claims increased by 26K, totalling 1.919M for the week ending May 17. The core PCE Price Index, which excludes the more volatile food and energy prices, is expected to experience a monthly increase of 0.1% in April, following no change in March. Over the past year, core PCE inflation is anticipated to decline slightly to 2.5% from 2.6%. In contrast, annual headline PCE inflation is predicted to fall to 2.2% from 2.3% during this period.

The US Personal Consumption Expenditure (PCE) Price Index will shape market expectations about the Fed's rate-cut path, fluctuating the USD/JPY exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.