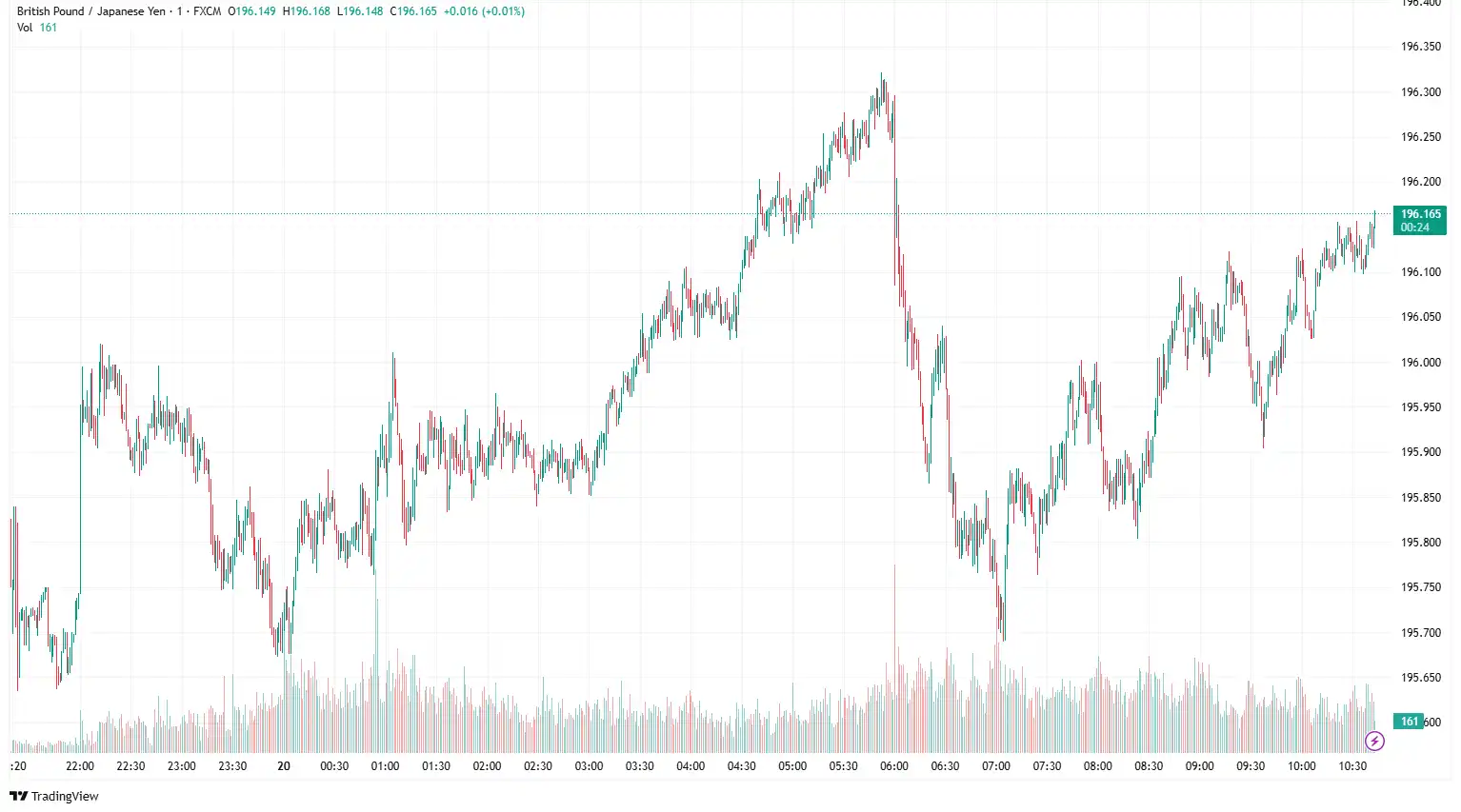

EUR/GBP declined to around 195.88, as weaker-than-expected Retail Sales data and the Bank of England's (BoE) decision to leave interest rates steady dampened the pound. The BoE was anticipated to maintain a "gradual and careful" approach to monetary expansion at the May policy meeting, especially after a 25 bps interest rate cut. Investors expected the BoE to keep borrowing rates steady at 4.25%, with a 7-2 majority. However, three members of the Monetary Policy Committee (MPC) – Swati Dhingra, Dave Ramsden, and Alan Taylor – advocated for an interest rate reduction. They argued that a loosening labour market, weak consumer demand, and wage agreements at sustainable levels prompted their support for further easing of monetary policy. On the data front, retail sales declined 2.7% month-on-month (MoM) in May after climbing 1.3% in April (revised from 1.2%), compared to the markets' expected 0.5% drop. The core retail sales, excluding automotive fuel sales, fell 2.8% MoM against the previously revised growth of 1.4% and the estimated -0.5% figure. Annual retail sales in the UK dropped by 1.3% in May compared to April's 5%, while core retail sales also decreased by 1.3% in the same month versus a previous revision of 5.2%. On Friday, Bank of England Governor Andrew Bailey stated, "You (Ukraine's central bank) have clearly indicated that once security risks diminish and the right macroeconomic conditions are in place, you will revert to conventional inflation targeting." He further remarked, "Ukraine's dedication to returning to a defined inflation-targeting framework after the security risks subside seems both credible and crucial."

On the yen's front, upbeat National Consumer Price Index (CPI) numbers indicate that inflationary pressures remain above the Bank of Japan's (BoJ) 2% target in May, reaffirming expectations of interest rate hikes. The Japan Statistics Bureau reported this Friday that the headline National Consumer Price Index (CPI) increased by 3.5% year-on-year in May, compared to the prior reading of 3.6%. Meanwhile, the National core CPI, which excludes volatile fresh food prices, rose from the 3.5% year-on-year rate in April and grew by 3.7% last month, marking the highest level since January 2023. Further details revealed that a core reading, which excludes both fresh food and energy prices and is closely monitored by the Bank of Japan as a gauge of underlying inflation, rose by 3.3% year-on-year in May from 3.0% in the previous month. Stronger CPI figures indicated broadening inflationary pressures in Japan and provided the BoJ with more incentive to hike interest rates in the coming months.

On Friday, Japan's chief trade negotiator, Ryosei Akazawa, stated that Japan will not focus on the approaching date for reciprocal tariffs to revert to higher levels. He mentioned that trade discussions with the US "remained unclear" despite both parties' attempts to finalise a deal. He emphasised, "To prevent any misunderstanding, I want to clarify that I have not indicated that July 9 is the negotiation deadline between Japan and the US. It is also possible that the US may struggle to allocate enough time domestically to make significant progress in the Japan-US negotiations."

Broader market sentiment surrounding the de-escalation of the Iran-Israel conflict and a revival of risk appetite will influence the GBP/JPY exchange rate.

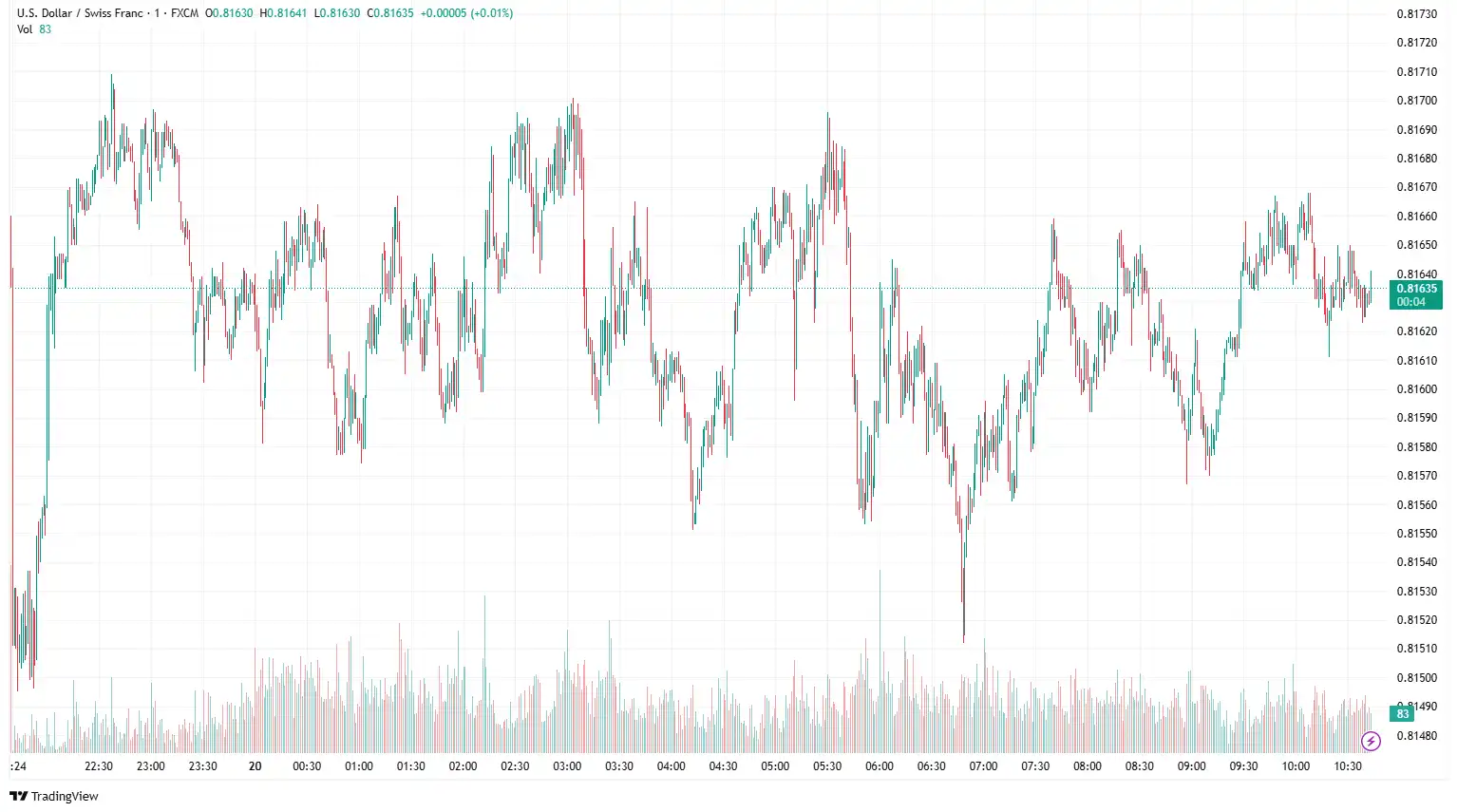

USD/CHF hovers following the SNB's rate cut

The USD/CHF pair falls to 0.8165 due to heightened market anxiety surrounding US actions in the Middle East, which increases demand for the Swiss Franc (CHF), regarded as a safe-haven currency. On Thursday, the Swiss National Bank (SNB) decided to reduce its interest rate by 25 bps from 0.25% to zero during its June meeting. The accompanying policy statement emphasised that the central bank has adjusted its growth and inflation forecasts. The SNB projects inflation for 2025 at 0.2% (down from a previous forecast of 0.4%), inflation for 2026 at 0.5% (previously 0.8%), and inflation for 2027 at 0.7% (also down from 0.8%). It also highlighted that the economic outlook for Switzerland remains uncertain, with international developments posing significant risks, given the highly uncertain global economic scenario. Furthermore, Switzerland's trade surplus decreased to CHF 2.0 billion in May from a downwardly revised CHF 5.4 billion in April. The Swiss trade balance has recorded its smallest surplus since December 2023, as monthly exports fell by 13.6% to CHF 21.0 billion.

SNB Chairman Martin Schlegel is addressing the press after the meeting, detailing the rationale behind the 25 basis points (bps) interest rate cut to 0%. SNB Vice Chairman Antoine Martin is also speaking at the press conference, justifying the decision to cut the rate by 25 bps to 0%. He noted, "Conditions relevant to the Swiss financial sector have deteriorated since the last financial stability report. Trade tensions have caused significant increases in financial market volatility. The interest rate environment in Switzerland has begun to impact banks' profitability. The SNB supports the Swiss government's measures for preventing and managing financial crises. Vulnerabilities in the domestic mortgage and residential real estate markets persist. Timely and comprehensive action is crucial for enhancing financial stability in Switzerland." Swiss National Bank (SNB) governing board member Petra Tschudin commented that "Global outlook is subject to high uncertainty. Expect Swiss economic growth to slow and remain subdued for the remainder of 2025. The economic outlook for Switzerland is uncertain; developments abroad are the main risk."

Investors are looking forward to the Philly Fed Manufacturing Index and the Federal Reserve's Monetary Policy Report for new insights. During its June meeting on Wednesday, the US Federal Reserve (Fed) opted to keep the policy rate steady at 4.25%–4.50%. This decision, alongside the Federal Open Market Committee's (FOMC) forecast of 50 basis points in interest rate cuts by the end of 2025, strengthened the US dollar. In a post-meeting press conference, Fed Chair Jerome Powell indicated that inflation remains slightly above target and could rise in the future, citing the impact of tariffs from US President Donald Trump. Powell supported the current policy trajectory, which is advantageous for the central bank. He warned that continued policy uncertainty might lead the Fed to maintain its current rate, with any cuts contingent upon further improvements in labour and inflation data. The Federal Reserve maintained its projections for two interest rate cuts by year-end; however, economic growth expectations for 2025 were downgraded to 1.4% from the previous 1.7%, and inflation expectations were revised upward to 3% from the prior 2.7%. This context of subdued growth and elevated inflation presents a dilemma for the central bank.

In the upcoming sessions, speculation surrounding direct US involvement in the Israel-Iran conflict, along with the release of the Philly Fed Manufacturing Index and the Fed's Monetary Policy Report, will likely influence the USD/CHF in the forthcoming sessions.

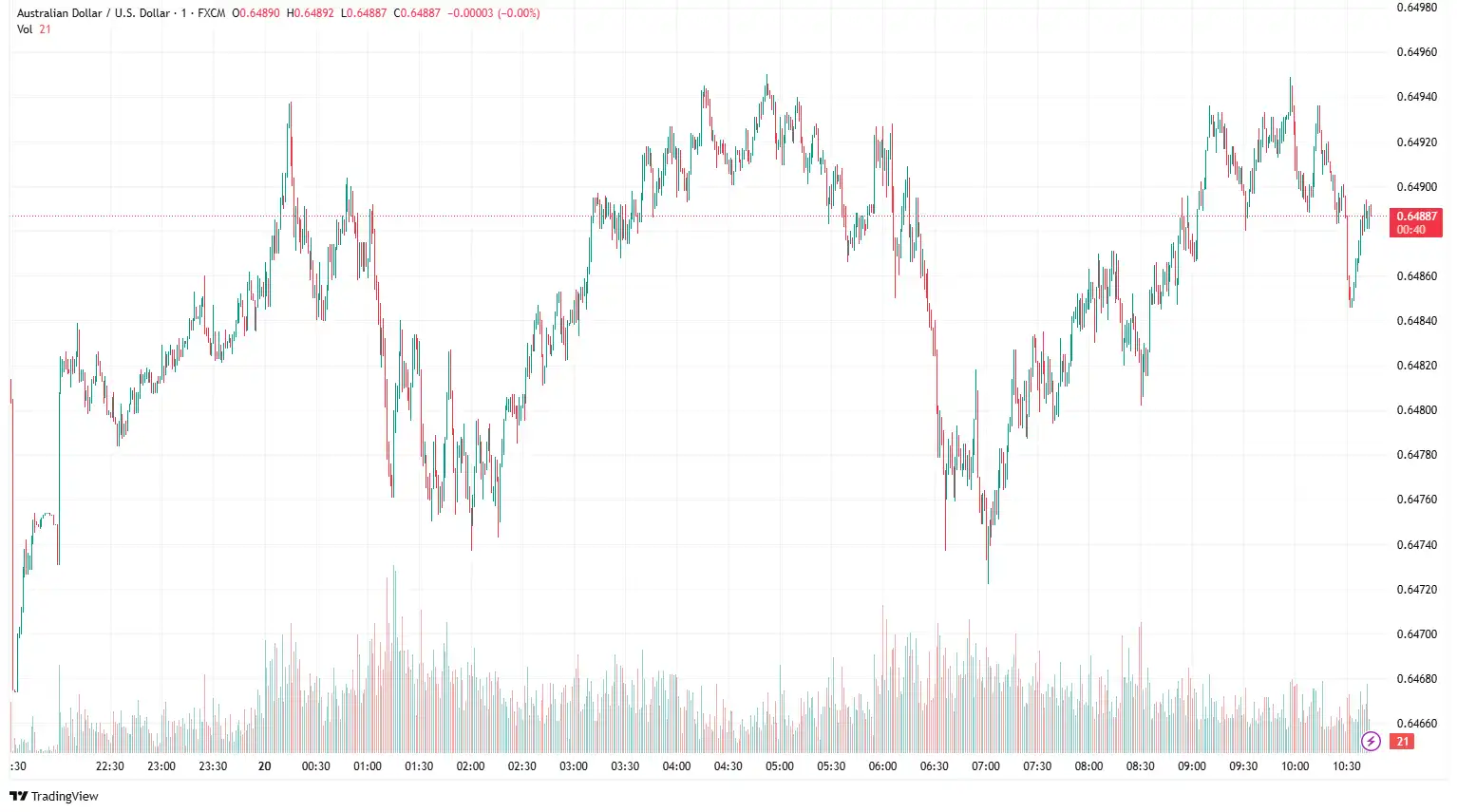

AUD/USD wobbles ahead of Fed Monetary Policy Report

AUD/USD struggled near 0.6487 following the People's Bank of China's announcement to leave the Loan Prime Rates unchanged. The People's Bank of China (PBOC), China's central bank, announced it would leave its Loan Prime Rates (LPRs) unchanged on Friday. The one-year and five-year LPRs were at 3.00% and 3.50%, respectively. China Retail Sales rose 6.4% year-over-year in May, surpassing the 5.0% expected and April's 5.1% increase. Meanwhile, Industrial Production increased 5.8% YoY but came in below the 5.9% forecast and 6.1% prior. On the domestic front, Australia's unemployment rate stabilised at 4.1% in May, unchanged from April, according to official data released by the Australian Bureau of Statistics (ABS) on Thursday. This figure aligned with the market consensus. Furthermore, Australian employment change recorded a decline of -2.5K in May, down from 87.6K in April (revised from 89K), compared to the consensus forecast of 25K. The participation rate in Australia fell to 67.0% in May, compared to 67.1% in April. Meanwhile, full-time employment rose by 38.7K in the same period, up from 58.6K in the previous reading (revised from 59.5K). Part-time employment decreased by 41.2K in May, compared to 29K previously (revised from 29.5K). Furthermore, disappointing employment figures from Australia indicated signs of weakness in the labour market and supported the argument for the next interest rate cut by the Reserve Bank of Australia (RBA) in July.

On the greenback front, during its June meeting on Wednesday, the US Federal Reserve (Fed) opted to keep the policy rate between 4.25% and 4.50%. This decision, along with the Federal Open Market Committee's (FOMC) forecast of 50 basis points of interest rate cuts by the end of 2025, strengthened the US dollar. In the post-meeting press conference, Fed Chair Jerome Powell remarked that inflation remains slightly above target and could increase in the future, referencing the impacts of US President Donald Trump's tariffs. Powell supported the current policy stance, which places the central bank in a favourable position. He warned that ongoing policy uncertainty will maintain the Fed's rate-hold approach and that rate cuts will be contingent on further improvements in labour and inflation metrics.

On the data front, US Initial Jobless Claims rose by 245,000 for the week ending June 14, matching market expectations. Continuing Claims, used to soften the rate of change in the weekly print, fell 6,000 to a seasonally adjusted 1.945 million during the week ending June 7. Meanwhile, the housing sector showed signs of cooling. May Housing Starts fell to 1.256 million units, marking a 9.8% MoM drop from April's 1.392 million. Building Permits also edged lower, down 2% on the month to an annual rate of 1.393 million from 1.422 million previously. Market sentiment improved somewhat on Friday after Trump alleviated concerns of an impending attack on Iran, and news reports indicate that US and Iranian officials are maintaining various channels of direct and indirect negotiations. Additionally, it is reported that Iranian diplomats will meet with Eurozone officials to discuss nuclear talks on Friday, which opens up the possibility of a peace agreement.

Without any Australian economic data, ongoing trade uncertainties coupled with increasing geopolitical tensions in the Middle East will influence the AUD/USD exchange rate.

EUR/GBP struggles following downbeat UK Retail Sales data

EUR/GBP traded near 0.8541 after the weaker-than-expected UK economic data weighed on the sterling. Data released by the Office for National Statistics (ONS) on Friday indicated that UK Retail Sales fell by 2.7% month-on-month (MoM) in May, compared to a rise of 1.3% previously (revised from 1.2%). This figure was below the market consensus, which anticipated a decline of 0.5%. On an annual basis, Retail Sales decreased by 1.3% in May, in contrast to a rise of 5.0% previously, which was worse than the forecasted increase of 1.7%. The core Retail Sales, stripping the automotive fuel sales, fell 2.8% MoM, as against the previous revised growth of 1.4% and the estimated -0.5% print. On Wednesday, the Office for National Statistics in the United Kingdom published reports showing that the headline CPI rose by 3.4% year-on-year in May, a slight decrease from 3.5% in April. This figure met market expectations. The Core CPI, which excludes the fluctuating prices of food and energy, increased by 3.5% year-on-year in May, down from 3.8% previously, and was below the anticipated rate of 3.6%. Additionally, the UK's monthly CPI inflation dropped to 0.2% in May, down from 1.2% in April, despite market predictions of a 0.2% increase. Moreover, the Bank of England's (BoE) decision to keep the interest rate steady at 4.25%, aligning with market expectations, exerted selling pressure on the pound. The Bank of England's minutes indicated a rising agreement among Monetary Policy Committee (MPC) members to lower rates in the upcoming August meeting. Governor Andrew Bailey emphasised the bank's cautious approach, stating that "Interest rates remain on a gradual downward path" despite the fact that "The world is highly unpredictable."

On the Euro front, market expectations suggest that the ECB will cut its Deposit Facility Rate by 25 basis points (bps) at the July monetary policy meeting amid ongoing geopolitical unrest that has negatively impacted the shared currency. Statements from European Central Bank (ECB) officials, however, may alleviate some of this decline. ECB Governing Council member Mario Centeno voiced significant concerns on Wednesday about the European economy's growth outlook, asserting that achieving 2% inflation is unattainable without economic growth. "We need a stronger economy to be compatible with 2% inflation; that's my main position," he underscored. Furthermore, ECB executive board member Fabio Panetta noted on Friday that "the ECB is not pre-committing to a defined course on monetary policy," citing macroeconomic risks arising from mixed signals in US trade policy and the recent Iran-Israel conflict.

On Thursday, ECB President Christine Lagarde remarked that "greater regional trade can offset global losses." Additionally, her colleague Olli Rehn cautioned that "the Eurozone risks stagflation shock if the Mideast crisis extends." On the data side, the final CPI figures reveal that monthly inflation remained stable in May, with the annual CPI falling to 1.9% from 2.2% in April. Excluding food and energy, the core CPI was steady month-over-month after a 1% rise in April, while the year-on-year rate declined to 2.3% from 2.7%. Nonetheless, these statistics had little effect on the Euro. The preliminary Consumer Confidence Index released by the European Commission is anticipated to have improved to -14.5 in June from -15.2 in the prior month, still reflecting levels consistent with modest economic growth.

In the upcoming session, the Economic Bulletin and preliminary reading of Consumer Confidence from the Eurozone, along with the UK retail sales number, will shape the market sentiment around the EUR/GBP exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.