GBP/JPY softened near 191.18 as the market anticipated a hawkish outlook from the Bank of Japan (BoJ) on its monetary policy. Favoured market sentiment also boosted Japan's 10-year government bond yield, which marked its highest level in over 15 years. Recently, BoJ Governor Kazuo Ueda cautioned that uncertainty surrounding US President Donald Trump's possible tariff policies might impact the global economic forecast, highlighting the need for cautious adjustments in monetary policy. Additionally, BoJ Deputy Governor Shinichi Uchida noted, "Japan's economy is showing moderate recovery, although certain weaknesses remain. The underlying inflation rate is steadily increasing toward the 2% target," emphasising that the Bank of Japan (BoJ) is poised to continue raising interest rates this year.

On Thursday, Atsushi Mimura, Japan's Vice Finance Minister for International Affairs, expressed concerns about increasing global protectionism, particularly regarding tariff measures. He emphasised the importance of adopting a balanced strategy to alleviate the adverse impacts of globalisation while avoiding a complete shift towards protectionist policies. Japan's unemployment rate unexpectedly rose from 2.4% to 2.5% in January, with companies reducing spending on plants and equipment by 0.2% in Q4. The Au Jibun Bank Japan Manufacturing PMI stood at 49.0 in February 2025, slightly above the expected 48.9, following January's 10-month low of 48.7, marking six months of declining output.

Sterling gained ground following comments from Bank of England (BoE) policymakers that struck a more hawkish tone. During his testimony before the Treasury Select Committee on Wednesday, BoE Governor Andrew Bailey remarked, "We anticipate an increase in inflation, but it won't resemble the surges seen a few years back. The chances of experiencing second-round inflation effects due to an economic downturn are slim." BoE policymaker Megan Greene also addressed the Treasury Committee, advocating for a cautious and measured approach to relaxing monetary restrictions. Greene stated, "It's probable that the persistence of inflation will wane naturally," while stressing that monetary policy will likely remain tight for the foreseeable future. BoE Chief Economist Huw Pill also spoke to Parliament lawmakers, asserting, "We must stay alert to new shocks that could impact our return to 2% inflation. The evidence suggests a slower pace of bank rate cuts is necessary."

With no key UK data releases scheduled today, the broader market sentiment will drive the GBP/JPY exchange rate.

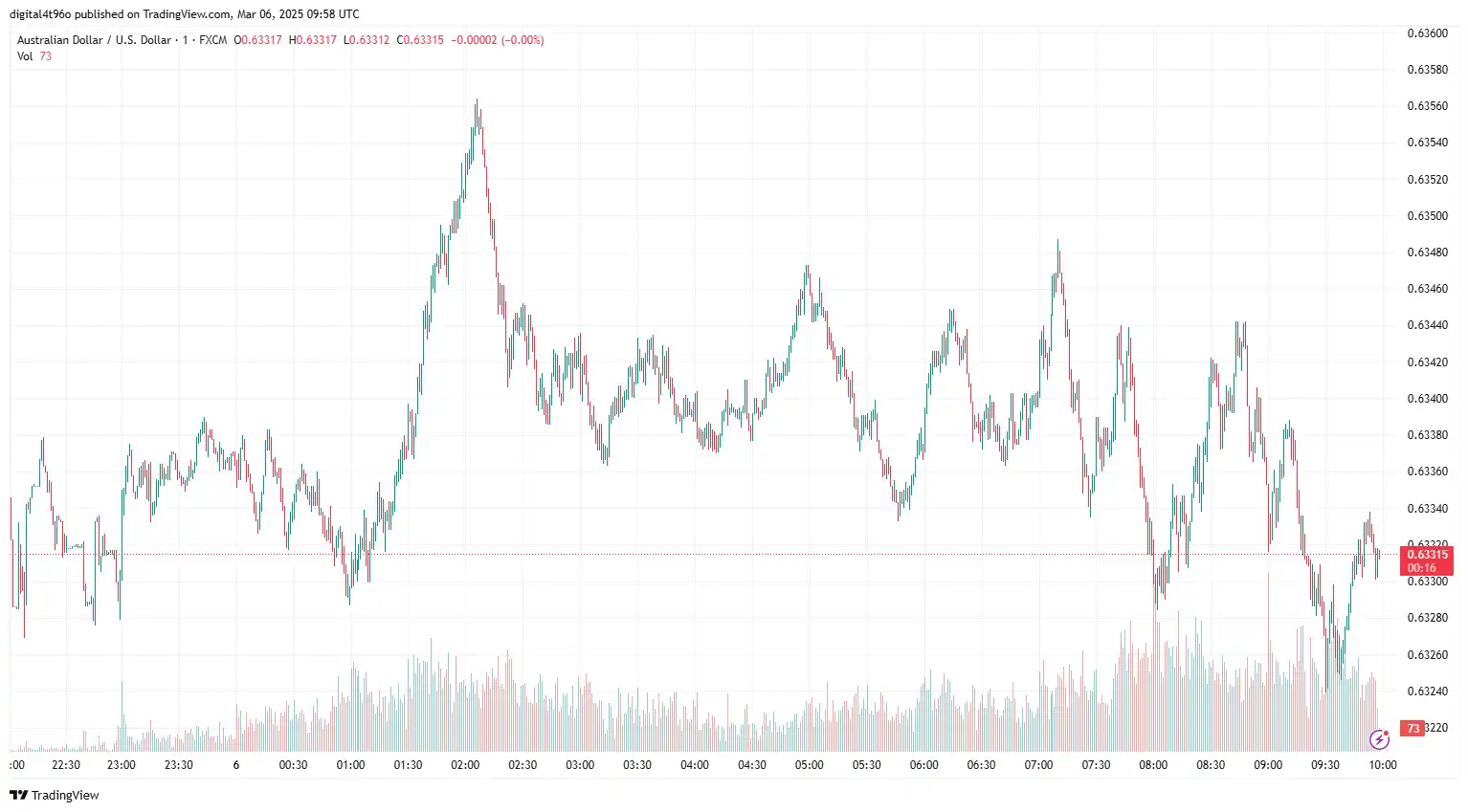

AUD/USD Struggles Following Key Australian Data

AUD/USD hovers near 0.6340 after key Australian economic data release. Australia's trade surplus rose to 5.62 billion in January, exceeding the expected 5.5 billion and improving from the previous figure of 4.92 billion (revised from 5.08 billion). Exports rose by 1.3% month-on-month from the prior month, reaching an 11-month high driven by non-monetary gold. Meanwhile, imports fell by 0.3% month-on-month, following a sharp increase of 5.9% in the previous month. In January, Australia witnessed a 6.3% month-on-month increase in building permits, a substantial rise from the upwardly adjusted 1.7% growth recorded in December. This represents the second straight month of growth and the quickest rate observed since last July. Australia's Gross Domestic Product (GDP) grew by 0.6% quarter-on-quarter in Q4 2024, surpassing the 0.3% growth achieved in Q3 and exceeding market expectations of 0.5%. Annual GDP increased by 1.3% in Q4, up from 0.8% in the previous quarter.

On the geopolitical front, rising global trade tensions may impact the Australian Dollar, especially since China is Australia's top trading partner. On Wednesday, a spokesperson for the Chinese foreign ministry warned that China is ready to fight "any type" of war after striking back against President Donald Trump's mounting trade tariffs, with comments, "If the US truly wants to solve the fentanyl issue, then the right thing to do is to consult with China on the basis of equality, mutual respect and mutual benefit to address each other's concerns. If the US has another agenda in mind and if war is what the US wants, be it a tariff war, a trade war or any other type of war, we're ready to fight till the end." China's Services Purchasing Managers' Index (PMI) unexpectedly increased to 51.4 in February, up from 51.0 in January, surpassing market expectations of 50.8.

On the other hand, the Dollar faced headwinds due to soft ADP Employment data and concerns over slowing US economic momentum. The US ADP Employment Change for February indicated only 77K new jobs, falling well short of the 140K forecast and below January's figure of 186K. Traders are now closely monitoring Friday's US Nonfarm Payrolls (NFP) report, which is expected to show a slight uptick in job growth. Estimates suggest net job additions will rise to 160K in February, up from January's modest 143K.

In the upcoming sessions, the Weekly Initial Jobless Claims data and Friday's US Nonfarm Payroll figures will drive the AUD/USD movements.

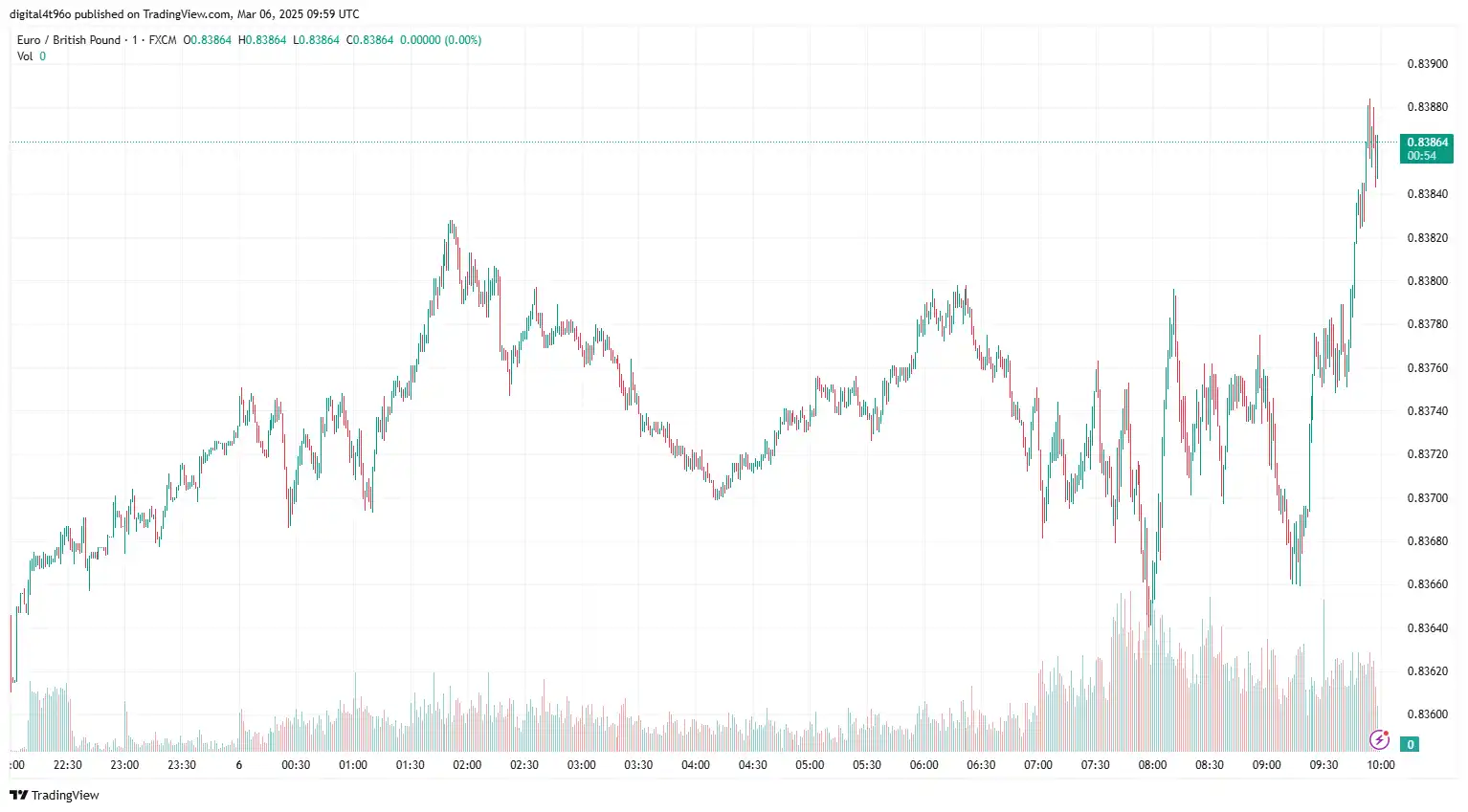

EUR/GBP Stumbles Ahead of ECB Rate Decision

EUR/GBP trades near 0.8368 as investors brace for the European Central Bank (ECB) interest rate decision. The market expects the ECB to implement a quarter-point rate cut on Thursday, reducing the benchmark deposit facility rate from 2.75% to 2.5%, following the Eurozone's weak economic prospects. The Eurozone Services PMI for February 2025 was reported at 50.6, just below the expected 50.7 and down from the prior figure of 50.7, signalling a slight slowdown in the sector. Meanwhile, the unemployment rate in the Eurozone held steady at 6.3% in January 2025, matching December 2024's revised rate of 6.3%. Germany's services sector remained in contraction at 49.1, reflecting an improvement from January's 47.7, highlighting ongoing weakness amid broader economic struggles. France saw its PMI fall below 50 to 49.2, indicating contraction and positioning it as the region's weakest performer, likely due to political uncertainty and decreased consumer spending. In contrast, Italy's services sector continued to grow, with a PMI of 52.4, slightly down from January's 53.4, indicating moderate growth. Spain excelled with a strong PMI of 54.2, propelled by a thriving tourism sector and vigorous service activity. On the global front, today's monetary policy decision will also offer insights into the impending reciprocal tariffs imposed by United States (US) President Donald Trump on the European Union (EU), which could considerably affect the bloc's inflation and economic outlook.

On the other hand, the Sterling strengthened following comments from Bank of England (BoE) policymakers who adopted a more hawkish stance. During his testimony before the Treasury Select Committee on Wednesday, BoE Governor Andrew Bailey stated, "We expect inflation to rise, but not at the same pace as seen in previous years. The likelihood of second-round inflation effects from an economic downturn is low." BoE Chief Economist Huw Pill also addressed Parliament, emphasising, "We must remain vigilant to potential shocks that could affect our return to 2% inflation, and the evidence suggests that a slower pace of bank rate cuts is required." S&P Global UK Construction PMI printed at 44.6 in February, down from 48.1 in January, marking the fastest downturn in construction output since May 2020.

In today's session, the European Central Bank's (ECB) interest rate decision will drive the EUR/GBP exchange rate.

EUR/USD Rebounds Ahead of ECB's Policy Meeting

EUR/USD recovered near 1.0782 as the market cautiously monitors the influence of Germany's debt restructuring on the Eurozone's inflation outlook. Germany's likely next Chancellor, Friedrich Merz, and the Social Democratic Party (SDP) agreed to establish a €500 billion infrastructure fund and extend the borrowing limit on Tuesday. Investors anticipate that such reforms could boost inflation and stimulate economic growth in the German economy, the engine of the Eurozone. On the economic front, the mixed performance of the economic indicators continues to bolster the expectations that the ECB will reduce the interest rate by 25 bps. The Eurozone Harmonized Index of Consumer Prices (HICP) rose by 2.4% year-on-year (YoY) in February, following an increase of 2.5% in January. The market forecast for the reported period was a 2.3% rise. Meanwhile, the core HICP grew by 2.6% YoY in February, compared to a 2.7% rise in January, aligning with market expectations of 2.6%. The Eurozone Services PMI for February 2025 was recorded at 50.6, slightly below the forecast of 50.7 and down from the previous reading of 50.7, indicating a slight slowdown in the sector. The Eurozone's unemployment rate remained steady at 6.3% in January 2025, unchanged from the revised figure of 6.3% in December 2024. The Eurozone Producer Price Index (PPI) increased by 0.8% month-on-month, up from 0.5%, exceeding the forecasted 0.3%.

Conversely, the Dollar encountered challenges from weak ADP Employment data and worries about slowing economic momentum in the US. The February ADP Employment Change revealed only 77K new jobs, far below the expected 140K and January's figure of 186K. Traders are paying close attention to the upcoming US Nonfarm Payrolls (NFP) report on Friday, which is anticipated to reflect a slight increase in job growth. Projections indicate that net job additions may rise to 160K in February, compared to January's 143K.

Investors will pay close attention to Christine Lagarde's speech for fresh cues on the monetary policy, the inflation outlook, and the consequences of potential tariffs from the United States (US).

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.