EUR/GBP traded near 0.8437, following the increased risk sentiment after US President Donald Trump threatened to double import tariffs on steel and aluminium, raising them to 50% from 25%. On Saturday, the European Commission (EC) stated that Europe was ready to respond to President Trump's plan to double tariffs on imported steel and aluminium. The euro (EUR) may encounter challenges due to heightened safe-haven demand amid the escalating trade conflict between two of the world's largest economic powers. Moreover, the market anticipates that the European Central Bank (ECB) will further ease monetary policy by cutting interest rates for the eighth consecutive time and that ECB President Christine Lagarde will adopt a neutral stance. On Friday, Fabio Panetta, a member of the European Central Bank (ECB) Executive Board, stated that while there is "reduced room to cut rates further, the macroeconomic outlook remains weak and trade tensions might exacerbate it." He further noted that disinflation has not severely impacted the Eurozone economy and is nearing its end. The results of trade negotiations are unpredictable, yet their effects on the European economy will likely be substantial. Additionally, industries most affected by tariffs are already exhibiting signs of declining confidence, with lower expectations for both orders and employment.

In terms of data, Spain's Manufacturing PMI increased to 50.5 in May, up from 48.1 in April, surpassing the previous forecast of 48.3 and signalling a sector growth return for the first time since January. Meanwhile, Italy's Manufacturing PMI dipped to 49.2 in May from 49.3 in April, slightly below the anticipated 49.5, suggesting a continued contraction but at a reduced rate. France's Final Manufacturing PMI rose to 49.8 in May, up from 48.7 in April and in line with the preliminary estimate of 49.5, indicating increased output and growing business confidence. In Germany, the Final Manufacturing PMI was noted at 48.3 in May, a slight decrease from 48.4 in April and falling short of the expected 48.8, indicating ongoing pressure in the manufacturing sector. The Eurozone's Final Manufacturing PMI remained unchanged at 49.4 in May, consistent with April figures and market expectations, representing the slowest contraction rate since August 2022. On Friday, official data from Destatis revealed that German retail sales unexpectedly fell by 1.1% month-on-month (MoM) in April, following a revised growth of 0.9% (from -0.2%) in March, which was below the forecasted 0.2% growth. Year-on-year, retail sales increased by 2.3% in April compared to 3.3% in March (revised from 2.2%) and against an expected 1.8%.

On the sterling front, market expectations that the Bank of England (BoE) will maintain its easing monetary policy approach in June due to a hotter-than-expected UK Consumer Price Index (CPI) and strong growth in UK Retail Sales for April influence the pound. Moreover, the International Monetary Fund (IMF) has raised its UK GDP growth forecast for 2025 to 1.2% from its prior estimate of 1.1%. The upward revision came as Gross Domestic Product (GDP) data revealed that the economy expanded at a robust pace of 0.7% in the first quarter, following the 0.1% growth recorded in the last quarter of 2024. The UK's Final Manufacturing PMI rose to 46.4 in May, up from 45.4 in April, indicating a marginally slower rate of contraction. Recent comments by BoE Governor Andrew Bailey emphasised a "gradual and careful approach" to interest rate cuts, noting that the economy is "hard to read". He warned about "strengthening inflation in food and other product categories". Regarding employment, Bailey stated that the UK labour market data aligns with our expectations, and the "slowing wage increase trend remains unchanged".

Broader market sentiment regarding the UK's final manufacturing PMI and the Eurozone manufacturing PMI will influence the EUR/GBP exchange rate.

USD/CAD Sinks Amid BoC Rate Speculations

USD/CAD depreciated to near 1.3681 as stronger-than-expected Canadian Gross Domestic Product (GDP) augmented market sentiment that the Bank of Canada (BoC) will maintain the interest rate at Wednesday's policy meeting. On Friday, Statistics Canada announced that Canada's real GDP grew by 0.5% compared to the previous quarter in the first quarter of the year. This figure aligns with the 0.5% growth seen in the last quarter of 2024. Furthermore, the real GDP increased at an annual rate of 2.2% during the first quarter, exceeding analysts' expectations of 1.7% growth. According to the press release, "Total exports rose 1.6% in the first quarter of 2025 after increasing 1.7% in the fourth quarter of 2024." The release also noted, "In the context of looming tariffs from the United States, exports of passenger vehicles (+16.7%) and industrial machinery, equipment and parts (+12.0%) drove the overall increase in exports in the first quarter of 2025."

Moreover, a continuous rise in crude oil prices lent support to the commodity-linked CAD. West Texas Intermediate (WTI) oil prices have risen to nearly £62.00 per barrel at the time of writing. The oil producer group OPEC+, comprising the Organisation of the Petroleum Exporting Countries and its allies, has decided to increase output by 411,000 barrels per day (bpd) in July, marking the third consecutive month with this level of output. This move has relieved markets, which were expecting a larger increase, settling the cautious tone around the loonie.

On the other hand, renewed concerns over rising inflation amid slowing economic growth continue to weigh on the USD. Moreover, renewed trade tensions between the United States (US) and China, following President Donald Trump's indication via a post on Truth Social media that Beijing has violated the trade agreement, stating, "The bad news is that China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH the US," are influencing the currency. Annual inflation in the United States (US), as indicated by the change in the Personal Consumption Expenditures (PCE) Price Index, declined to 2.1% in April from 2.3% in March, as reported by the US Bureau of Economic Analysis on Friday. This figure fell short of the market expectation of 2.2%. The core PCE Price Index, which excludes the volatile prices of food and energy, rose by 2.5% during the same period, down from the 2.7% increase reported in March and aligned with analysts' estimates. Both the PCE Price Index and the core PCE Price Index increased by 0.1% monthly. Additional details in the report indicated that Personal Income and Personal Spending grew by 0.8% and 0.2%, respectively, on a monthly basis in April.

In today's session, the Manufacturing PMI figures from both the USA and Canada, along with Fed Chair Powell's speech, will influence the USD/CAD exchange rate.

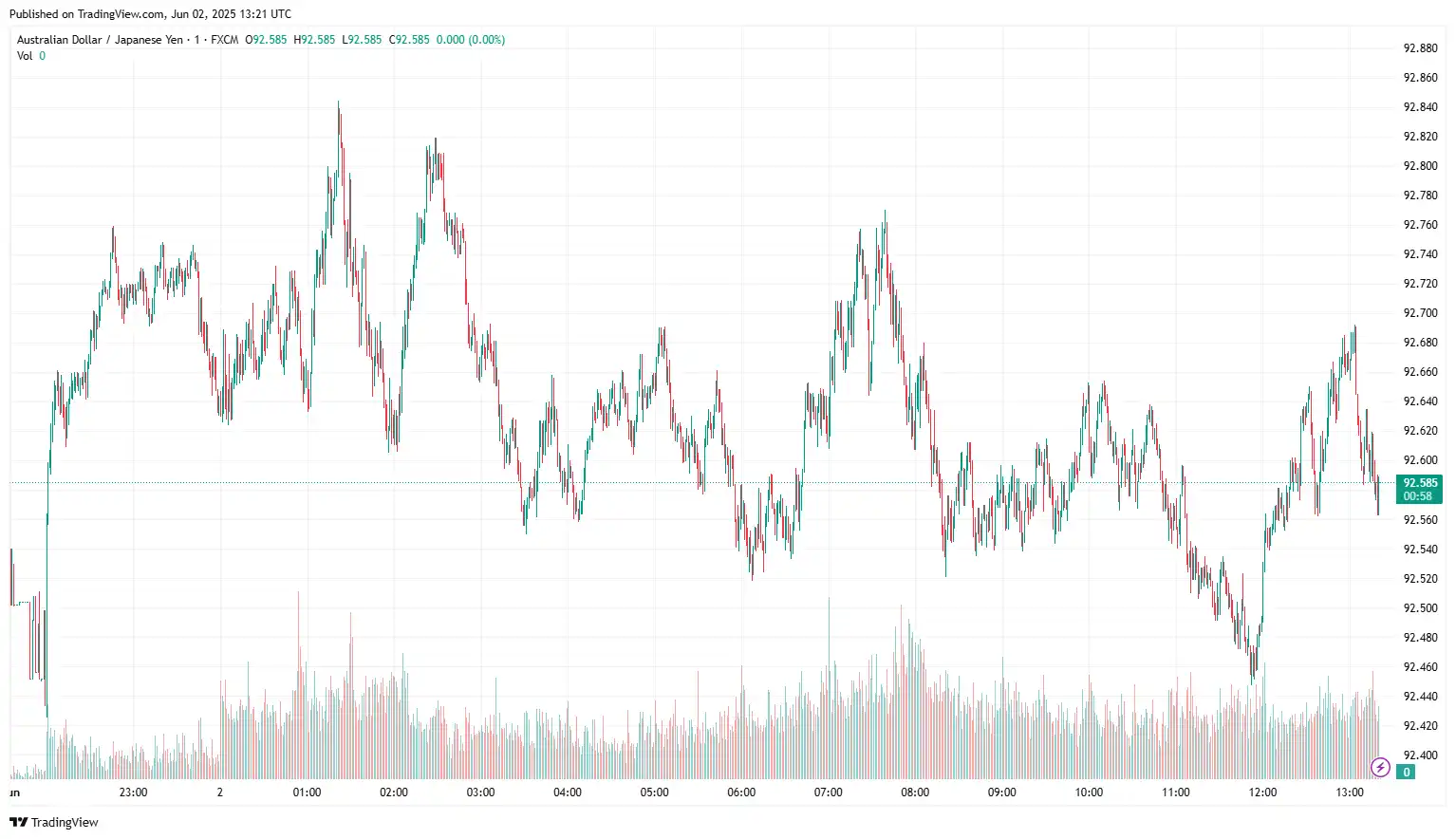

AUD/JPY Struggles Amid Growing US-China Trade Tensions

AUD/JPY hovered near 92.63 as renewed geopolitical tensions, particularly trade disputes between the United States (US) and China, continue to undermine the AUD. US President Donald Trump threatened to double import tariffs on steel and aluminium, increasing them from 25% to 50%. Additionally, mixed data from the Chinese Manufacturing Purchasing Managers' Index (PMI) released on Saturday affected trade dynamics, causing fluctuations in the Australian dollar. The National Bureau of Statistics (NBS) reported that China's Manufacturing PMI increased to 49.5 in May, up from April's 49.0. In contrast, the Non-Manufacturing PMI decreased to 50.3 from 50.4, which was below the anticipated 50.6 reading.

On the domestic front, ANZ Job Advertisements fell by 1.2% in May, following a revised decrease of 0.3% in April. This marks the second consecutive month of decline in Australian job ads. Additionally, the S&P Global Manufacturing Purchasing Managers' Index (PMI) dipped to 51.0 in May from 51.7 the previous month, also reflecting a decline for the second month in a row and reaching the lowest level since February. On Friday, the Australian Bureau of Statistics (ABS) reported a 0.1% month-on-month decrease in Australia's Retail Sales for April, following a 0.3% increase in March. This result fell short of the market expectation of a 0.3% rise. Moreover, monthly Building Permits fell by 5.7%, contrasting with forecasts for a 3.1% increase. Furthermore, the market anticipates that the Reserve Bank of Australia (RBA) will lower interest rates in upcoming policy meetings, which could increase pressure on the Australian dollar (AUD). In its recent policy meeting, the central bank emphasised its achievements in controlling inflationary pressures while cautioning that US-China trade barriers pose downside risks to economic growth. Governor Michele Bullock noted that the RBA is prepared to take further action should the economic outlook deteriorate significantly, raising the possibility of future rate cuts.

On the yen's front, growing acceptance that the Bank of Japan (BoJ) will continue to raise interest rates and market anticipation that Japan will strike a trade deal with the US continue to boost the Japanese Yen (JPY). The au Jibun Bank Japan Manufacturing PMI was revised higher to 49.4 in May 2025, up from 49.0 in the preliminary estimate and an increase from 48.7 in the previous month, marking the eleventh consecutive month of contraction. Japan's Prime Minister Shigeru Ishiba stated on Monday that Japan reaffirmed its commitment to reducing tariffs. Japan's Economy Minister Ryosei Akazawa is set to depart Japan on Thursday to engage in discussions with his counterparts, including US Treasury Secretary Scott Bessent, as reported by an unnamed government official. Tokyo's Core Consumer Price Index (CPI), a key inflation indicator, rose by 3.4% year-on-year in May, down from 3.5% the previous month. Meanwhile, the CPI excluding fresh food increased by 3.6%, the highest level in two years. The data revealed that the rise was driven by significantly higher food prices, including a staggering 93% increase in rice costs. Retail sales also surpassed expectations, climbing by 3.3% year-on-year in April, indicating that consumer demand remains robust despite rising prices. Industrial production contracted by 0.9% month-on-month in April, a smaller decline than the 1.4% contraction anticipated, further supporting evidence that Japan's economy is faring better than expected.

In the upcoming sessions, the quarterly Australian GDP figures, the RBA's Monetary Policy Meeting Minutes, and a speech by the Reserve Bank of Australia's Assistant Governor, Sarah Hunter, will influence the AUD/JPY exchange rate.

EUR/USD Gains on Softer USD Following Tariff Threats

The EUR/USD appreciated to near 1.1419 as growing trade tensions, stemming from Donald Trump's fresh tariff threats and a looming economic slowdown, exerted selling pressure on the US dollar. US President Donald Trump noted on Friday that he intends to increase import tariffs on steel and aluminium, which may heighten pressure on global steel producers and escalate the trade war. "We are going to be imposing a 25% increase. We're going to bring it from 25% to 50% — the tariffs on steel into the United States," US Treasury Secretary Scott Bessent said on Sunday, adding that US President Donald Trump and Chinese President Xi Jinping are likely to speak soon to resolve trade issues, including a dispute over critical minerals, according to reports. In April, annual inflation in the US, measured by the PCE Price Index, fell to 2.1% from 2.3% in March, coming in below the expected 2.2%. Core PCE inflation, which excludes food and energy, declined to 2.5% from 2.7%, matching forecasts. Monthly, both overall and core PCE rose 0.1%.

Additionally, Personal Income increased by 0.8%, while Personal Spending rose by 0.2% in April. The preliminary data for May from the University of Michigan, released on Friday, indicated a slight improvement in consumer sentiment and expectations, presenting a somewhat mixed yet slightly more optimistic perspective on US household outlooks. The Consumer Sentiment Index increased to 52.2 from 50.8, signalling a modest recovery in overall confidence. At the same time, the Consumer Expectations Index climbed to 47.9 from 46.5, suggesting that although consumers are still cautious about the future, their expectations have seen a minor improvement. Earlier on Monday, Federal Reserve (Fed) Governor Christopher Waller expressed optimism regarding the potential for interest rate cuts in the coming months despite the heightened inflationary pressures resulting from tariffs. His remarks have intensified downward pressure on the US dollar.

On the euro front, market speculation regarding the European Central Bank (ECB) potentially reducing interest rates for the eighth consecutive time continues to influence the shared currency. In terms of data, Spain's Manufacturing PMI rose to 50.5 in May, up from 48.1 in April, exceeding the previous forecast of 48.3 and signalling a return to growth in the sector for the first time since January. Italy's Manufacturing PMI slipped slightly to 49.2 in May from 49.3 in April, marginally missing the expected 49.5, indicating continued contraction but at a slower pace. France's Final Manufacturing PMI improved to 49.8 in May, up from 48.7 in April and aligning with the preliminary estimate of 49.5, reflecting rising output and increased business confidence. Germany's Final Manufacturing PMI was recorded at 48.3 in May, marginally down from 48.4 in April and below the anticipated 48.8, signalling renewed pressure in the manufacturing sector. The Eurozone Final Manufacturing PMI held steady at 49.4 in May, matching both the April figure and market expectations, marking the weakest pace of contraction since August 2022. On Friday, official data released by Destatis indicated that retail sales in Germany unexpectedly declined by 1.1% month-on-month (MoM) in April, following the revised growth of 0.9% (from -0.2%) reported in March, falling short of the forecasted 0.2% growth. On an annual basis, retail sales rose by 2.3% in April compared to March's 3.3% (revised from 2.2%) and the expected 1.8%.

Today's ISM Manufacturing PMI and Eurozone Manufacturing PMI will be key drivers of the EUR/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.