EUR/GBP hovered near 0.8370 as the weaker economic data from the Eurozone reinforced market expectations of a reduction in interest rates by the European Central Bank (ECB) during the June policy meeting. In a speech on Tuesday, ECB policymaker and head of the French central bank, François Villeroy de Galhau, referred to France's 0.6% inflation rate as a "very encouraging sign of disinflation in action." He adopted a dovish perspective on the interest rate outlook, noting that "policy normalisation in the Euro area is probably not complete." Meanwhile, the ECB Chief Economist, Philip Lane, stated that the central bank is unlikely to lower rates below 1.50%. Lane said, "Rates below 1.5% are clearly accommodative. Going there would only be appropriate in the event of more substantial downside risks to inflation or a more significant slowdown in the economy. I do not see that at the moment."

On the data front, the latest GfK Consumer Confidence Survey from Germany showed a slight improvement, rising from -20.8 to -19.9, although it remains at very low levels. The European Central Bank's recent Consumer Expectations Survey indicated on Wednesday that Eurozone inflation is expected to increase in the coming year by April. Expectations for inflation over the next 12 months grew by 0.2 percentage points to 3.1%, up from 2.9%. Meanwhile, inflation expectations for three years ahead stayed the same at 2.5%, and for five years ahead, they also remained unchanged at 2.1%. In May, France's Harmonised Index of Consumer Prices (HICP) showed a year-on-year increase of 0.6%, down from the 0.9% rise in April, which was below the 0.9% estimates. This represents the lowest reading since December 2020. Concurrently, German Import Prices fell sharply by 1.7% month-on-month, exceeding the anticipated 1.4% decline, marking the largest monthly drop since the pandemic due to an 11.2% decrease in energy prices. Additionally, German Unemployment Change reported an increase of 34,000 in May, significantly higher than the forecast of 12,000, while the unemployment rate held steady at 6.3%, the highest level since 2015, excluding the pandemic peaks. For France, the Preliminary GDP growth quarter-on-quarter stood at 0.1%, in line with expectations, reflecting modest growth supported by inventory buildup despite weak consumer spending and exports. French Consumer Spending showed a month-on-month increase of 0.3% in April, below the expected 0.8%, but this marks the first monthly increase in 2025, indicating a tentative recovery in household demand.

Conversely, the Sterling strengthened against its major counterparts on Thursday, following a slight increase in the International Monetary Fund's (IMF) growth forecast for the United Kingdom's (UK) Gross Domestic Product (GDP) to 1.2% from 1.1% for this year, attributed to positive economic performance in the first quarter. Additionally, a decline in market expectations that the Bank of England (BoE) will further cut interest rates at the June policy meeting has contributed to the British currency's strength. Traders have decreased their dovish bets on the BoE, spurred by a higher-than-anticipated UK Consumer Price Index (CPI) and strong growth in UK Retail Sales for April.

With no new domestic data on tap today, EU-US trade discussions will determine the market sentiment around the EUR/GBP exchange rate.

USD/CHF Muted on the Tariff-Block News

The USD/CHF stabilised near 0.8266, as improved market sentiment following the Court of International Trade's decision on Wednesday to block US President Donald Trump's proposed reciprocal trade tariffs dampened the safe-haven Swiss Franc (CHF). Furthermore, concerns that the Swiss National Bank (SNB) might lower interest rates into negative territory to address inflation risks, combined with persistent US fiscal issues, ongoing global trade uncertainties, and the unresolved geopolitical conflict between Russia and Ukraine, weaken the Swiss Franc. During an event in Basel, SNB Chairman Martin Schlegel expressed cautious concern, indicating that subdued inflation, a robust Swiss Franc, and increasing market volatility are raising risks to price stability. This underscores the central bank's readiness to consider further actions on these matters. He remarked that "even negative inflation figures cannot be ruled out in the coming months" but emphasised that it would not inevitably lead to a policy reaction. "The SNB does not necessarily have to react to this. Our focus is not on the current rate of inflation, but rather on price stability over the medium term," he stated.

On Tuesday, Switzerland's trade surplus amounted to 6.3 billion Swiss Francs in April, as stated in a report released by the Federal Office for Customs and Border Security (FOCBS). On a monthly basis, exports declined by 9.2% in nominal terms to 25.2 billion Swiss Francs, while imports dropped by 15.6% to reach 18.9 billion Swiss Francs. Exports to North America fell by 34.7% compared to the previous month; those to Europe decreased slightly by 0.3%, while exports to Asia rose by 4.4%. Meanwhile, imports from North America dipped by 15.4%, while those from Europe and Asia declined by 20.1% and 2.6%, respectively. Swiss inflation eased to 0.0% in April, touching the lower bound of the SNB's official 0–2% target range and reinforcing expectations of further monetary easing. Markets widely anticipate that the central bank will deliver another interest rate cut at its 19 June policy meeting, which would bring the benchmark rate down to zero.

On the other hand, a US federal court stopped Trump's "Liberation Day" tariffs from being implemented, which boosted the USD. A federal trade court determined that the emergency law used by the White House does not give Trump the power to unilaterally impose tariffs on nearly every nation. The summary of the Federal Open Market Committee's (FOMC) May meeting revealed that uncertainty about the economic outlook has further increased. Federal Reserve (Fed) officials mentioned that achieving their dual goals of full employment and low inflation has grown more complex due to policy uncertainty. Fed policymakers emphasised the need to keep interest rates steady for a while as shifts in US policy cloud the economic outlook. On Tuesday, the Consumer Confidence Index from the US Conference Board rose to 98.0 in May, up from 85.7 in April. The survey showed better expectations for income, business conditions, and employment, while worries about a recession in the next year diminished. Conversely, the headline figure for US Durable Goods Orders fell by 6.3%, largely due to declining aircraft demand. April's results were slightly better than the expected 7.9% drop in the market but did not hinder the recovery of the US Dollar.

Market participants are now anticipating the US economic docket, which includes the release of the Prelim Q1 GDP print, the usual Weekly Jobless Claims, and Pending Home Sales data for further insights into the USD/CHF exchange rate.

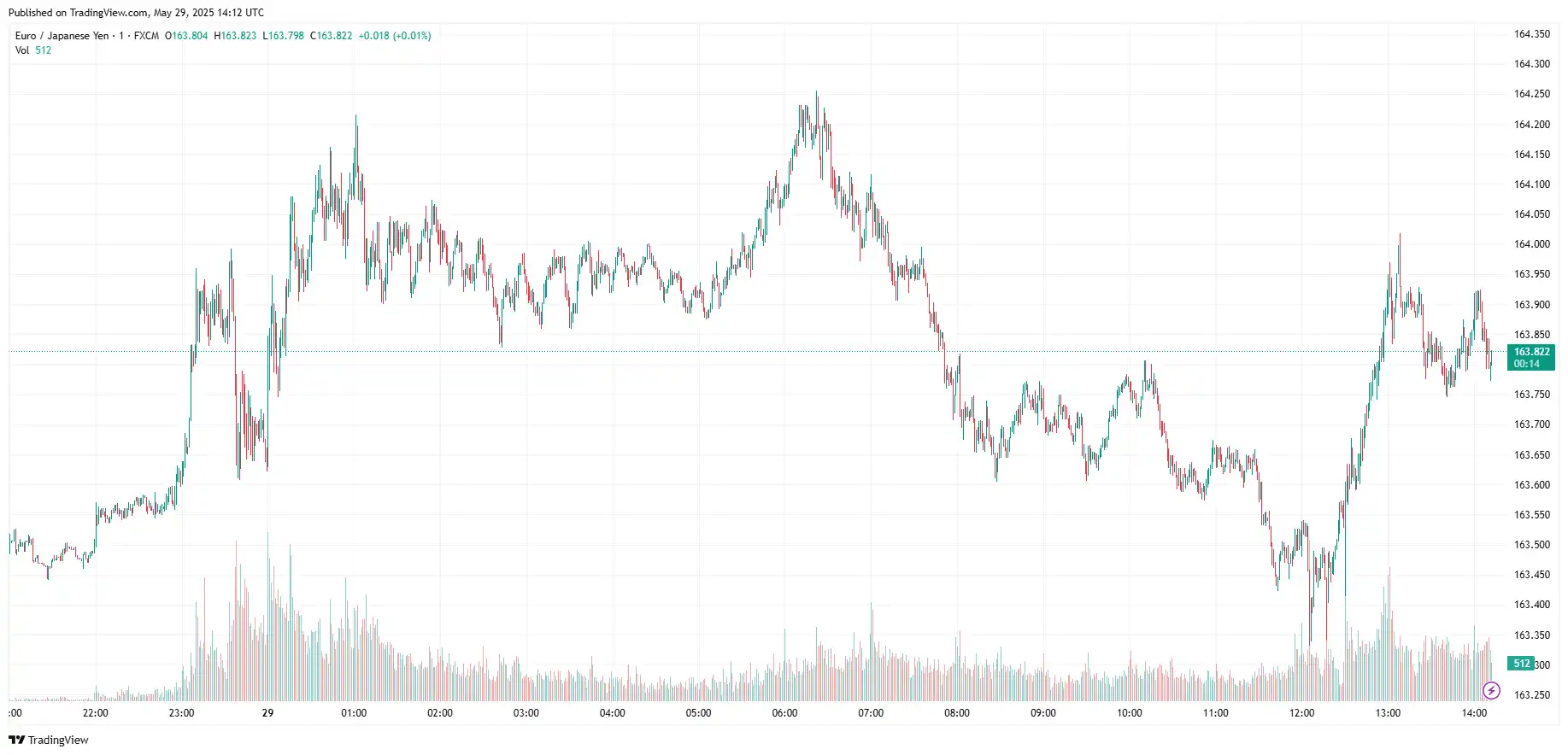

EUR/JPY Appreciates Following Tariff-Block News

EUR/JPY rose to 163.95 as the Japanese Yen weakened due to reduced safe-haven demand after a US federal court prevented President Donald Trump from enforcing "Liberation Day" tariffs. A three-judge panel at the Court of International Trade in Manhattan concluded that Trump does not possess the authority and declared the executive orders issued on 2 April unlawful. The Trump administration imposed higher tariffs on imports from countries with significant trade surpluses, such as China and the European Union, by establishing a 10% baseline tariff on most goods entering the US. Trump seems unlikely to relent, posting on his social media platform Truth Social that he is on a "Mission from God."

On Thursday, Japanese Finance Minister Katsunobu Kato stated that he agreed with US Treasury Secretary Scott Bessent that the market should determine the exchange rate. He also emphasised that there was no discussion of an exchange rate target with Bessent. The Group of Seven (G7) finance ministers noted positive developments in tariff negotiations. Japan's Chief Trade Negotiator and Economy Minister, Ryosei Akazawa, expressed his intention to meet with US Treasury Secretary Scott Bessent to hold ministerial talks. He underscored the need for the US to reconsider its tariff measures and stated that discussions on trade expansion and economic security cooperation will continue. He acknowledged the US court's decision to block Trump tariffs and indicated that they would examine the details and potential effects on Japan.

On the Euro front, easing trade tension between the United States and the European Union (EU) contributed to the downside of the shared currency. On the data front, the German GfK Consumer Confidence Survey showed a small increase to -19.9 from -20.8 previously, although it remains at very low levels. The latest monthly Consumer Expectations Survey by the European Central Bank, released on Wednesday, indicated that Eurozone inflation is expected to rise over the next year in April. Expectations for inflation over the next 12 months increased by 0.2 percentage points, moving from 2.9% to 3.1%. Meanwhile, inflation expectations for the next three years stayed steady at 2.5%, and for the next five years, they remained unchanged at 2.1%. On Wednesday, Klaas Knot, a member of the European Central Bank (ECB) Governing Council and head of the Dutch central bank, De Nederlandsche Bank (DNB), stated that the current economic outlook for European inflation is dismal, posing a challenge for the central bank to take decisive action. Knot also noted that the medium-term inflation outlook is more uncertain, which could lead to significant problems.

In the absence of key Eurozone figures, broader market sentiment around the EU-US trade discussions and hawkish BoJ expectations will drive the EUR/JPY exchange rate.

NZD/USD Buoyed Despite Weak Confidence Data

NZD/USD edged higher near 0.5967, as renewed trade tensions between the United States (US) and China weighed on the China-proxy Kiwi. US President Donald Trump's administration has suspended certain sales of essential US technologies to China, including those related to jet engines, semiconductors, and specific chemicals. This action is in response to China's recent restrictions on exports of critical minerals to the US, a decision by Beijing that threatens to cripple supply chains for US companies. The Chinese Commerce Ministry stated on Thursday, "China and the US have used multilateral and bilateral occasions to maintain communications at various levels," adding that it is focused on the abuse of US export controls in the semiconductor sector.

On the domestic front, the Reserve Bank of New Zealand (RBNZ) decided to lower its Official Cash Rate (OCR) by 25 basis points, bringing it down from 3.5% to 3.25% during the May policy meeting. The minutes from this meeting revealed that inflation is currently within the target range. In May, New Zealand's ANZ Business Confidence Index experienced a significant decline, decreasing from 49.3 to 36.6. Similarly, the Own Activity Outlook, which reflects businesses' expectations for their performance, fell to 34.8 from 47.7. The committee is strategically positioned to respond to both domestic and global developments, ensuring price stability in the medium term. Forecasts suggest the OCR will drop to 3.12% by September 2025 and further to 2.87% by June 2026, indicating a higher possibility of additional rate cuts. At the post-meeting press conference, Christian Hawkesby, RBNZ's acting Governor, answered queries from the press. He emphasised that inflation is still within the set target range and described the decision to keep current rates as a positive sign. He also acknowledged that interest rates have been significantly lowered to align with a neutral zone. Meanwhile, RBNZ Chief Economist Paul Conway voiced his somewhat greater pessimism regarding the country's medium-term productivity outlook. Furthermore, RBNZ Assistant Governor Karen Silk envisioned a slight rise in house prices stemming from the rate cuts. Silk also mentioned that New Zealand house prices are currently within the upper limits of our sustainable housing price range.

Conversely, a US federal court blocked Trump's "Liberation Day" tariffs from taking effect, which supported the USD. A federal trade court ruled that an emergency law invoked by the White House does not grant Trump unilateral authority to impose tariffs on nearly every country. The summary of the May meeting of the Federal Open Market Committee (FOMC) indicated that uncertainty regarding the economic outlook has increased further. Federal Reserve (Fed) officials stated that achieving its dual objectives of full employment and low inflation has become more complicated due to policy uncertainty. Fed policymakers underscored the necessity of keeping interest rates on hold for some time as policy shifts in the US obscure the economic outlook.

Investors will monitor today's US economic docket, featuring the release of the Prelim Q1 GDP print, the usual Weekly Initial Jobless Claims, and Pending Home Sales data, for further insights on the NZD/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.