November Review & December Risk Events & Themes

Pound Sterling

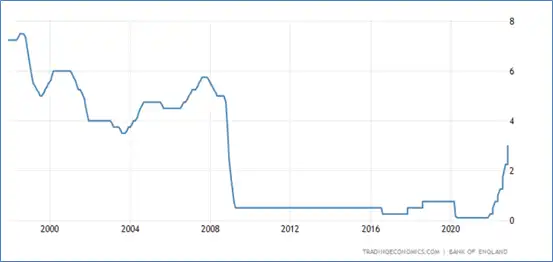

In case you missed it, the Bank of England implemented the largest interest rate rise in over three decades at the start of the month on a 7-2 voting majority. The 75 bps hike pushed base rates to 3%, increasing the cost of borrowing to the highest level since late-2008.

UK bank rate hits 3% as inflation stays put – Source: Trading Economics

UK bank rate hits 3% as inflation stays put – Source: Trading Economics

Policy makers’ hands were forced by 40-year-high inflation causing a deepening cost-of-living crisis, however there is speculation of a lower terminal rate than what has been priced into the markets. BoE head Andrew Bailey said as much during the November 3 Monetary Policy Report press conference.

“We can make no promises about future interest rates,” conceded Bailey, “but based on where we stand today, we think the bank rate will have to go up by less than currently priced into financial markets.”

Elements of the market seemed to pay attention to Bailey’s soft-touch edict. In the following weeks, the average five-year fixed mortgage rate fell below 6% for the first time since that mini-budget that we all want to forget about, and rates could “fall further still” reckons Moneyfacts.

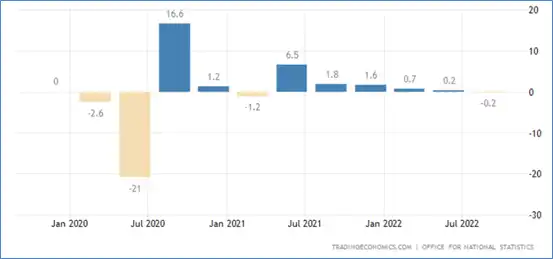

Elsewhere on the economic calendar for the first half of the month, gross domestic product shrank -0.2% in the third quarter, which was actually not as bad as -0.5% expectations, but nevertheless represented the first quarterly contraction since the first quarter of 2021.

UK economy contracts, albeit at a lower rate than expected – Source: Trading Economics

UK economy contracts, albeit at a lower rate than expected – Source: Trading Economics

Cable looked bullish in response to this sort of frontloaded economic policy, rallying over 5% until November 16, one day prior to chancellor Jeremy Hunt’s delayed autumn statement.

However, it may have spoken more to the greenback’s weakness as opposed to the pound’s strength- the US Dollar Index (DYX) fell around 6% during the same period.

Cable (line) shoots up in tandem with DYX dip – Source: tradingview.com

Cable (line) shoots up in tandem with DYX dip – Source: tradingview.com

Sterling’s performance against the euro was more muted during this timeframe too. While the EUR/GBP pair acted quite volatile, euro ended up stronger come the autumn statement, albeit by a conservative 30 pips. By the end of the month, the euro had lost most of this ground, with the pair closing the month at 86.27p.

Once the delayed autumn statement finally dropped, reactions to the high-tax, low-spending budget came in thick, fast and unsurprisingly mixed.

Martin McTague, chair of the Federation of Small Businesses, voiced his concerns on the abundance of stealth taxes: “Today’s budget is high on stealth-creation and low on wealth-creation, piling more pressure on the UK’s 5.5 million small businesses, their employees and customers.”

Basically describing the polar opposite of October’s mini-budget, chief economist George Lagarias at Mazars called it an “emergency budget for emergency times”. With fiscal discipline front and centre, it certainly feels like the headmasters have wrested control from the class clowns.

Was it enough to shore up a modicum of positive investor interest? Yields on ten-year gilts seem to indicate so, given that they dipped below 3% on November 24 for the first time post-mini-budget.

In the seven-day period following Hunt’s budget, Cable gained over 2%. For the first time in three months, the pound was buying more than 1.2 US dollars.

Sterling recovered nicely in other cross-currency pairs, particularly the Canadian dollar. Following a dive to 1.516 on November 3, the GBP/CAD pair shot up to 1.622 by the end of the month.

EURO

Hot off the heels of Halloween’s befittingly grim stagflationary economic data – which paired worse-than-expected GDP growth with a bitter-tasting inflation reading – conversation quickly turned to ponder on what the European Central Bank (ECB) had in store next following its 75 bps jumbo hike to 2%.

ECB president Christine Lagarde was blunt in her assessment. “Inflation everywhere is way too high,” Lagarde said at the start of the month. “There is no question in my mind that we just have to fight that inflation,” she added.

The next base rate decision is not due until December 15, but with a terminal rate of 3% baked into the markets – which Italian central bank governor Ignazio Visco called “a possibility” – another jumbo hike is likely, if not a foregone conclusion. Sentiment among Europe’s policymakers is clear: reducing inflation takes precedence over economic growth.

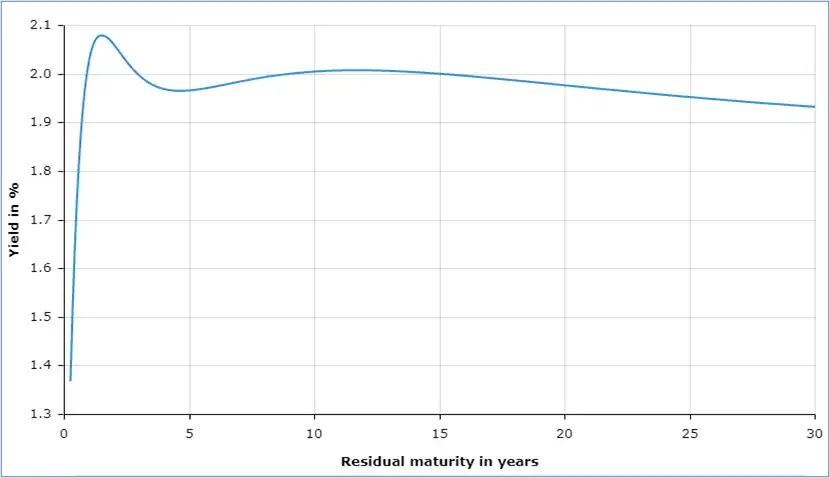

Looking at the euro area yield curve on debt securities, it’s safe to say the market has priced in a recession, given the inverted relationship between short-term and long-term debt.

Higher short-term yields are a strong recession indicator – Source: European Central Bank

Higher short-term yields are a strong recession indicator – Source: European Central Bank

With the Eurozone’s economy stubbornly refusing to cool down, the euro rallied hard against the US dollar during the first half of November. After struggling below parity for so long, the euro finally punched above one dollar on November 7, and has remained above parity since.

Between November 3 and November 15, the EUR/USD pair jumped 7% to a four-month high of 1.048. But as earlier stated, given the US Dollar Index’s shoddy performance, this was as much a story of the greenback’s weakness as it was the euro’s strength.

Performance against the pound was less impressive- the EUR/GBP pair rose 2% in the same timeframe.

While Russian aggression in Ukraine continues to pummel energy prices, European consumer spending keeps falling, as evidenced by retail sales figures released on November 15. Eurozone sales declined for the fourth month in a row, this time by 0.6%- not as bad as the -1.5% forecasted.

Yes, recession is here, the questions to ask going forward are: How deep, and for how long?

US Dollar

There is little doubt that the US dollar, having run red hot for so long, was poised to cool off. That’s precisely what we got in November.

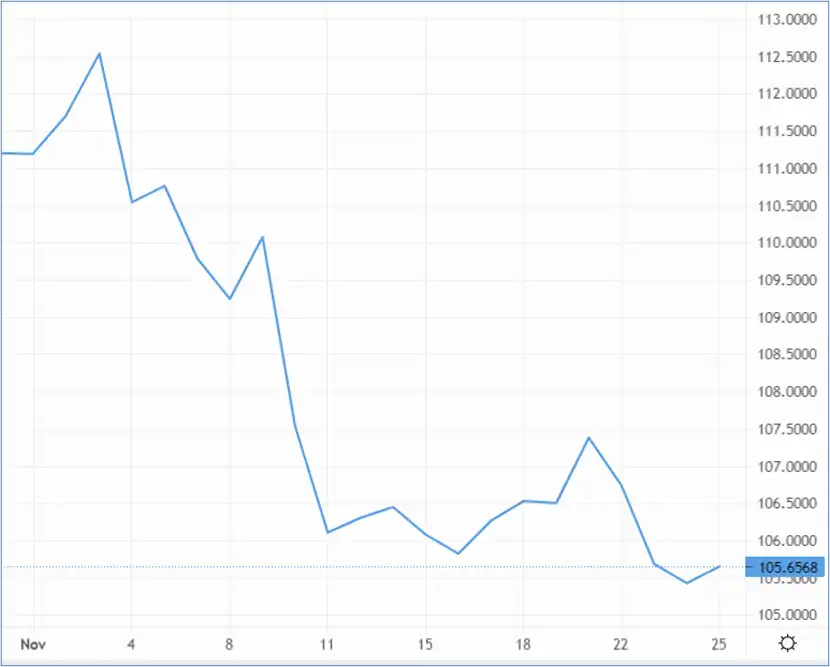

After briefly hitting the month’s highest point of 112.8 on November 3 following the Federal Reserve’s fourth straight 75 bps base rate hike, the US Dollar Index (DXY) spent the subsequent two weeks declining in value. Come the 15th, DXY had dipped by more than 5% to a November low of 106.7.

The US Dollar Index (DXY) compares the dollar’s strength to a basket of six major currencies – Source: capital.com

The US Dollar Index (DXY) compares the dollar’s strength to a basket of six major currencies – Source: capital.com

Fed’s outlook was far from dovish, but chair Jerome Powell did suggest that the pace of rate hikes will have to slow down (even if comments from FOMC members James Bullard and John Williams suggested otherwise).

Plus, the greenback was contending with uber-hawkish policies coming out of the UK and Eurozone that helped prop their respective currencies up.

Inflation data released on November 10, while still far above the 2% target, came in 0.4% lower than expected at 7.7%, with the core inflation rate falling from 6.6% to 6.3%. It gave vindication to speculation of looser monetary policy down the line.

Retail sales surged as a consequence of easing inflation, gaining 1.3% month on month against a forecast of 0.9%.

Throughout the month, the dollar fell over 6% in the GBP/USD pair, and over 5% in the EUR/USD pair.

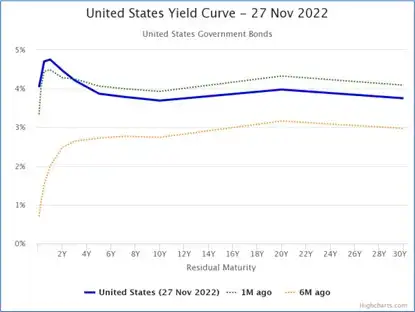

US markets have priced in a recession with an inverted yield curve – Source: worldgovernmentbonds.com

US markets have priced in a recession with an inverted yield curve – Source: worldgovernmentbonds.com

In summary, the US economy seems to be teetering on the edge of a recession, after burning red hot for far too long. In attestation, the inverted yield curve on US government bonds suggests the market has priced in a pending recession.

TOP BANK FORECASTS

DECEMBER RISK EVENTS AND KEY THEMES

UNITED KINGDOM

Recession:

Figures could point to the beginning of the country’s longest recession since records began, with the Bank of England expecting the economy to contract 0.75% in the second half of 2022 and continue to fall in 2023 and first half of 2024, as high inflation and interest rates weigh sharply on households and businesses.

Falling house prices:

Sellers will likely witness house prices reduce by 5% in 2023 as the housing market weakens due to higher mortgage rates, with sales volumes set to drop by 300,000 to one million, according to data supplied by property website Zoopla. With current house price inflation the lowest in a year, and average selling prices 3% below asking prices, landlords could be facing a tighter budget this Christmas.

Retail slump:

Christmas is undoubtedly the biggest time of the year for retailers, but high streets could be in for a disappointing festive season. With the cost of living crisis still causing pain for Britons, and the prospect of a daunting winter of soaring energy costs, shoppers will be cutting down on discretionary spending wherever possible.

EURO ZONE

Recession:

Data provided by Morgan Stanley expects the euro area economy to contract 0.2% in 2023 due to the ongoing energy crisis and tightening monetary policy. The big talking point over the coming weeks will be, how bad will it get? With the energy crisis triggered by Russian aggression in Ukraine darkening the horizon, and the International Monetary Fund predicts the eurozone economy to expand by only 0.5%, with Germany and Italy expected to contract.

Interest rates:

On Monday, ECB president Christine Lagarde said: “How much further we need to go, and how fast we need to get there, will be based on our updated outlook, the persistence of the shocks, the reaction of wages and inflation expectations, and on our assessment of the transmission of our policy stance.” Basically, there is little clarity in the ECB’s forward policy on interest rates until the December 15 announcement.

USA

Goodbye inflation, hello recession:

With inflation starting to cool (despite being historically very high), market spectators are beginning to weight up what the pending recession will look like. Given the inverted yield curve on US government bonds, there is little doubt that the market full expects the US economy to pivot. At the very least, there is evidence of a manufacturing recession on the horizon, given that durable goods orders rose 0.4% in the latest reading, below the consensus of 0.6%.

Monetary policy indecision:

Investors will be clambouring for some clarity on the Federal Reserve’s forward policy. Despite Powell’s consistently hawkish rhetoric,a majority of Fed officials judged that a slowing in the pace of the fed funds rate increase would likely soon be appropriate. Per the committee minutes released on November 24: "A number of participants observed that, as monetary policy approached a stance that was sufficiently restrictive to achieve the Committee's goals, it would become appropriate to slow the pace of increase in the target range for the federal funds rate. In addition, a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate."

KEY DATES IN DECEMBER

United Kingdom

- December 6: CIPS Construction PMI

- December 7: Halifax House Price Index YoY (7.1% exp)

- December 12: GDP YoY (1.6% exp); Construction Output; Balance of Trade

- December 13: Unemployment Rate ( 3.7% exp)

- December 14: Inflation Rate YoY (11.3% exp); Retail Price Index YoY

- December 15: BoE Interest Rate Decision (50 bps to 3.5% exp)

- December 16: Retail Sales YoY

- December 21: Public Sector Net Borrowing

- December 22: GDP Growth Rate YoY Final (2.4% exp); Business Investment

- December 30: Nationwide Housing Prices YoY

EUROZONE

- December 1: ECB General Council Meeting; unemployment rate (6.9% exp)

- December 5: Retail Sales YoY (-0.2% exp)

- December 6: S&P Global Construction PMI

- December 7: GDP Growth Rate YoY (2.1% exp)

- December 15: ECB Interest Rate Decision (50 bps to 2.5% exp)

- December 16: Balance of Trade; Inflation Rate YoY

- December 19: Construction Output YoY; Wage Growth (4.1% exp)

UNITED STATES

- December 1: S&P Global US Manufacturing PMI

- December 2: Unemployment rate (3.7% exp); S&P Global Services PMI

- December 6: Balance of trade (-US$73bn exp)

- December 8: Michigan Consumer Sentiment

- December 13: Inflation rate YoY (7.6% exp)

- December 14: Fed Interest Rate Decision (50 bps to 4.5% exp)

- December 15: Retail Sales YoY

- December 21: MBA 30-Year Mortgage Rate

- December 22: GDP Growth Rate QoQ Final

- December 23: Michigan Consumer Sentiment Final

- December 27: House Price Index YoY

- December 28: MBA 30-Year Mortgage Rate

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services include but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.