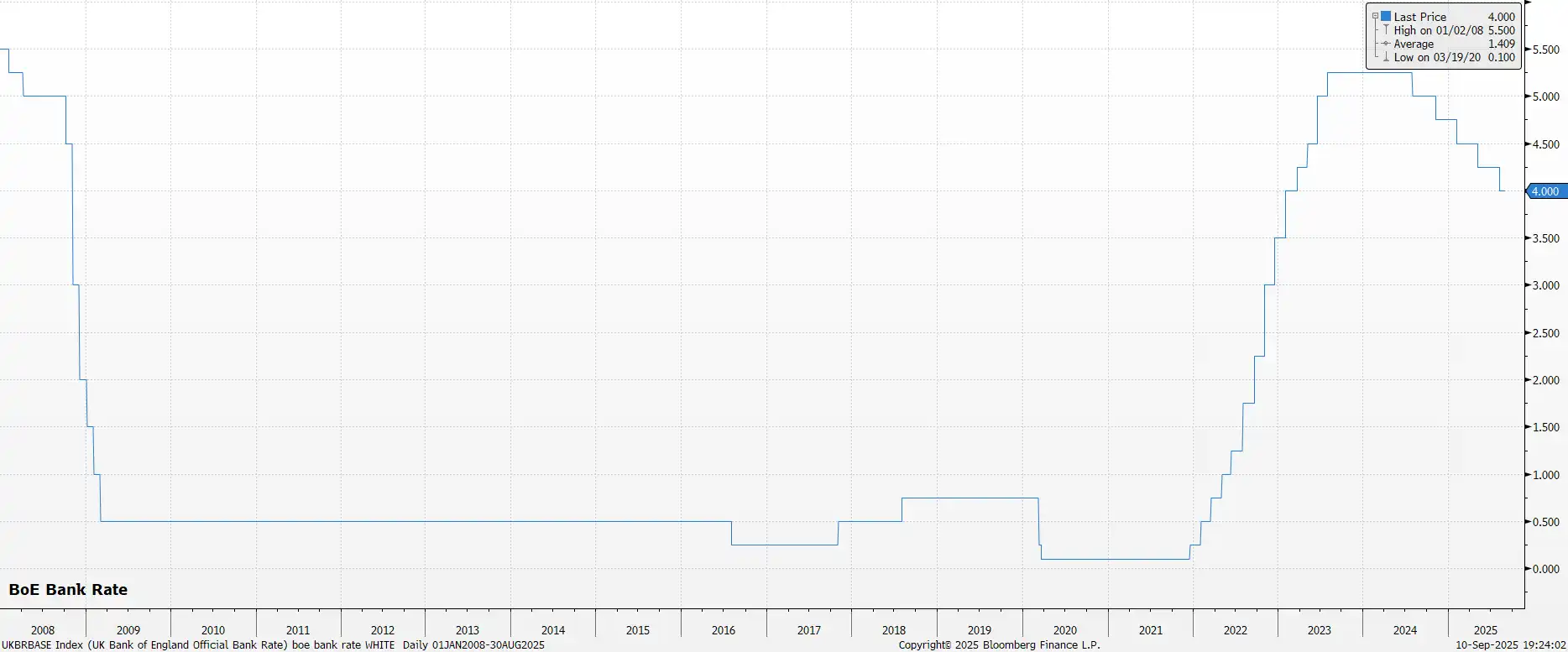

The Bank of England's Monetary Policy Committee, after delivering a rate cut in August, are set to stand pat this time out. However, the Old Lady's decision on the pace of balance sheet run-off over the next year will be closely watched, especially given recent jitters at the long-end of the Gilt curve.

However, the call to stand pat is unlikely to be unanimous. A 7-2 vote in favour of holding Bank Rate steady seems most plausible, with external members Dhingra and Taylor dissenting in favour of a 25bp cut. Dhingra, owing to her typically uber-dovish stance, and Taylor owing to his initial vote for a 50bp reduction last time out, plus recent commentary indicating his preference for 'four to five' cuts this year.

The MPC's policy guidance is likely unchanged from last time out. The statement will probably reiterate that the MPC will take a 'gradual and careful' approach to future rate reductions, while repeating that the pace will remain 'data-dependent'.

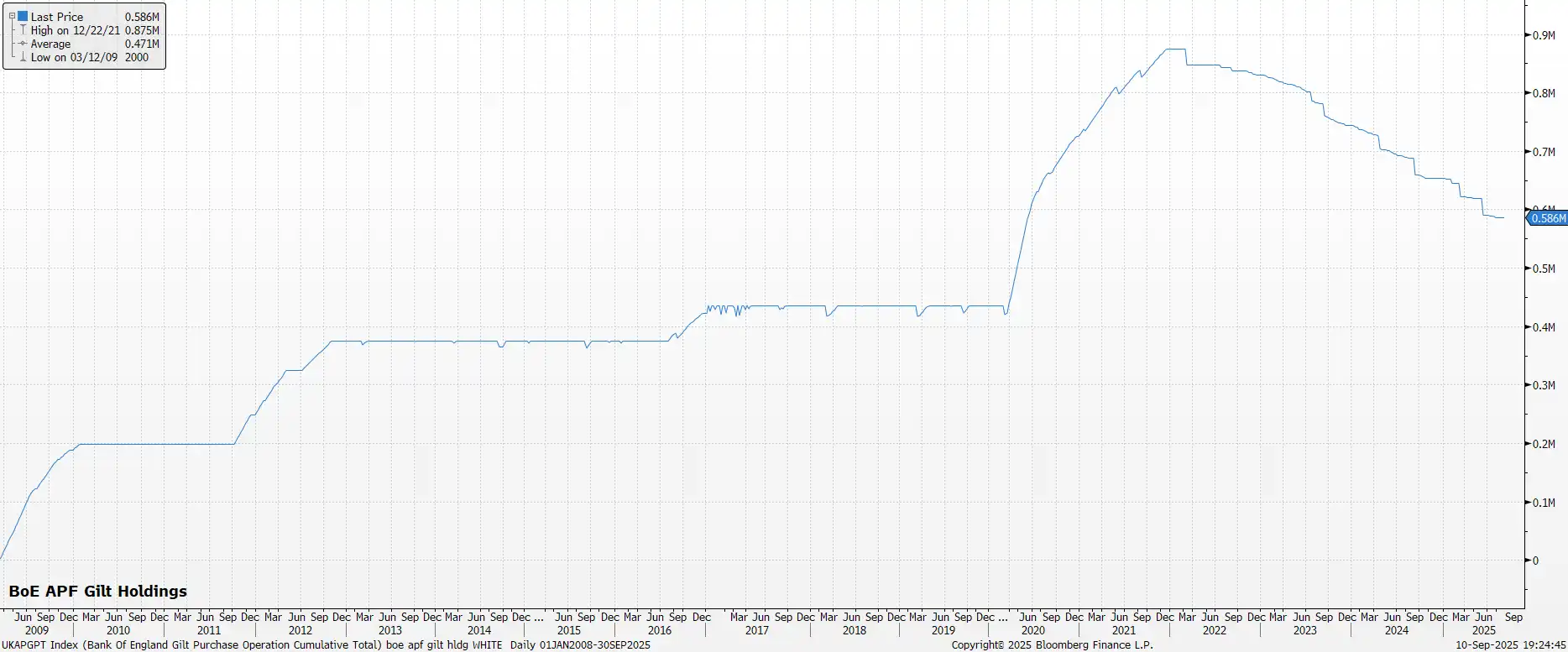

With the rate decision relatively predictable, the main intrigue surrounds the annual balance sheet review. For three years, the MPC has been reducing Asset Purchase Facility holdings by £100bln per annum, split between passive run-off of maturing securities and active Gilt sales.

While active sales have proceeded smoothly in terms of market reception, the Bank's research shows they add up to a 25bp premium onto 10-year Gilt yields, and likely higher than that further out the curve. These sales also crystallise losses, requiring HM Treasury indemnification, while also prompting a steeper Gilt curve compared to DM peers.

Given this, and QT's tightening impact offsetting easing from Bank Rate reductions, the MPC are likely to trim the overall QT envelope. Maturing Gilts would passively reduce holdings by around £50bln over twelve months, with active sales the key question. Anything above the current £13bln seems implausible, likely leaving overall reduction around £60bln. Ending active sales would ensure market stability, though tilting sales towards shorter maturities seems more plausible.

With no new forecasts due, there's no post-meeting press conference scheduled. Governor Bailey may make media remarks echoing recent comments that rates remain on a 'downward path', but the MPC shouldn't cut too quickly or too much.

Besides balance sheet developments, September offers little fresh information on Bank Rate outlook. By retaining 'gradual and careful' guidance, the MPC maintains an easing bias and preference for predictable, quarterly cuts. The next 25bp cut remains likely at November's meeting, though September's CPI report due 22nd October may threaten this if headline inflation rises above the projected 4% peak.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.