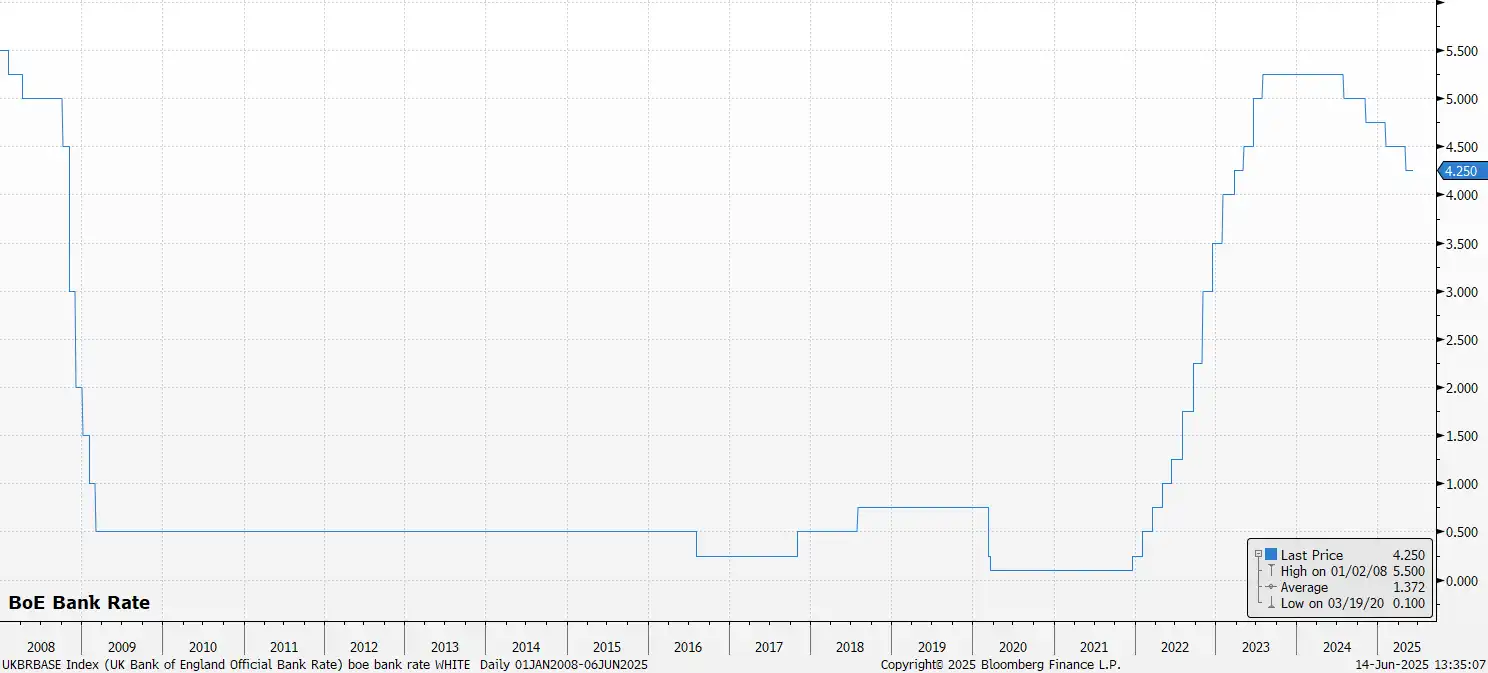

The Bank of England's Monetary Policy Committee is set to hold Bank Rate steady at 4.25% at the June meeting, maintaining the sluggish pace of policy easing that has characterised this cycle.

That said, the June confab will likely again expose the deep divisions among policymakers over the appropriate speed of interest rate cuts. May's meeting saw a three-way split: Mann and Pill favouring steady rates, Dhingra and Taylor dissenting for a larger 50bp reduction, whilst the remaining members, including Governor Bailey, opted for the 25bp cut that was delivered.

This time around, a 7-2 vote in favour of holding steady appears the base case, with external members Dhingra and Taylor likely dissenting for a 25bp cut. However, the recent soft run of economic data raises the potential for another dovish dissenter to emerge, with Deputy Governor Ramsden being a prime candidate. Mann's increasingly erratic voting pattern adds further uncertainty, having flip-flopped from dovish to hawkish stances twice in the first half of the year.

The policy statement will likely be a carbon copy of last month's guidance, reiterating that a "gradual and careful" approach to rate reductions remains appropriate, with policy staying "restrictive for sufficiently long" to combat the risk of persistent price pressures.

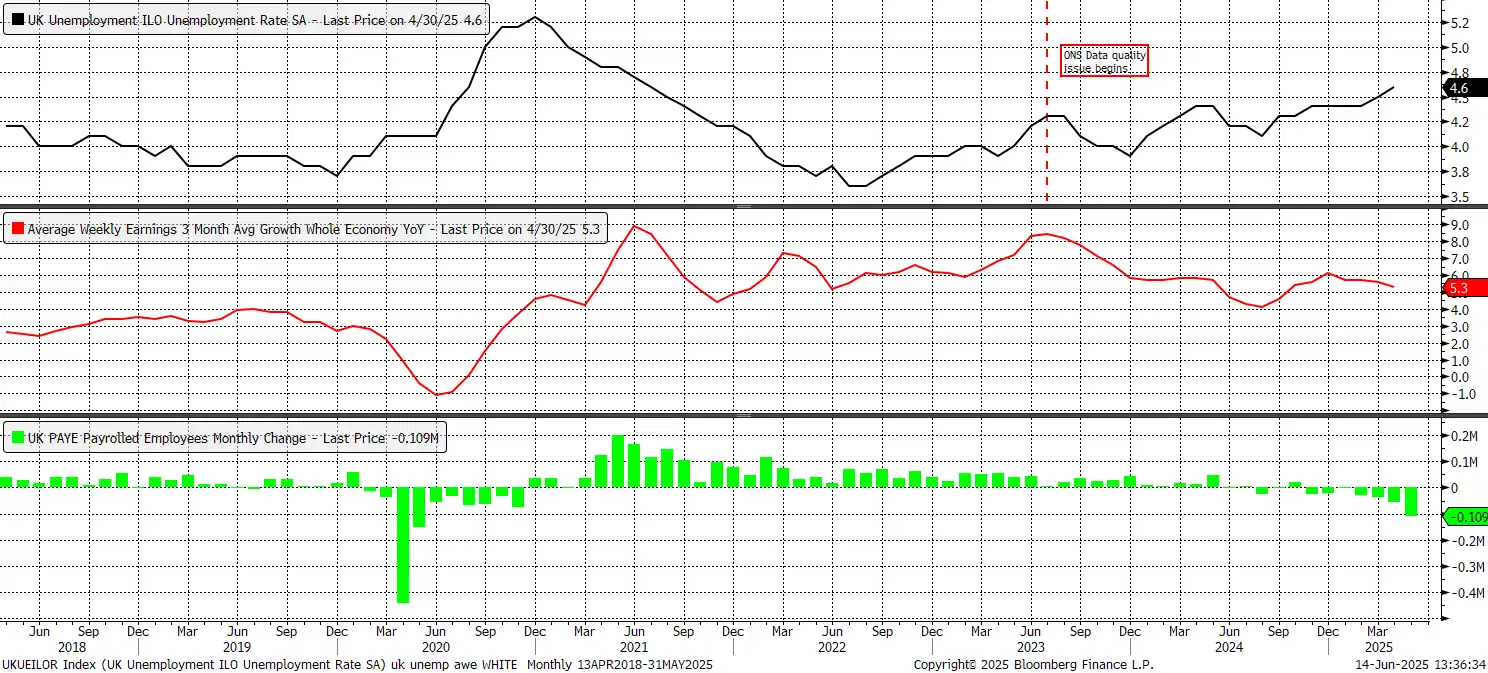

Yet this cautious stance appears increasingly at odds with deteriorating economic conditions. The labour market shows worrying weakness, with unemployment rising to a four-year high of 4.6% and HMRC payrolls data indicating 276,000 job losses since the October Budget. This rapidly opening slack should alleviate concerns over embedded price pressures.

While headline CPI rose to 3.5% in April, this increase appears unsustainable given the softening labour market's constraint on firms' pricing power. The growth outlook also appears dour, with April GDP contracting 0.3% MoM and PMI surveys indicating downside risks persist, particularly with the spectre of further tax hikes in the autumn Budget continuing to loom large.

Against this gloomy backdrop, the MPC's resolute commitment to "gradual and careful" policy removal increasingly resembles policymakers burying their heads in the sand. With rates likely held steady in June, the next 25bp cut is pencilled in for August alongside updated forecasts. However, given the deteriorating economic picture, the potential for faster easing towards the tail end of the year, or even cuts in bigger clips, remains elevated.

The Old Lady's slow and steady approach will be maintained in June, but is on borrowed time thereafter.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.