As we all sip Monday coffee and brace ourselves for the week, markets look calm on the surface. They're supposed to. A good chunk of the dealing world is off for Presidents' Day, and parts of Asia are still in holiday mode, and nobody wants to be the one who moved markets on low volume.

Weekend Recap

Friday did the work. January CPI cooled to 2.4% y/y on a 0.2% monthly rise, below the 0.3% the market expected and that was enough to keep mid-year rate cuts alive without igniting them. Sterling is discounted for politics and weak growth. The euro wins by not losing. Japan started the week reminding everyone that normalisation is a plan, not a promise.

USD - Arithmetic, Not Drama

The dollar doesn't need a story. It needs a yield advantage. Right now, that advantage is thinning.

January's CPI miss keeps "first cut by mid-year" as the base case. Fed Fund Futures are currently pricing roughly 62 basis points of easing through year-end. The Fed won't sprint, but the direction is set. DXY is steady around 96.97- not from conviction, but from exhaustion of the current repricing and is waiting for the next reason to move.

One thing worth naming: last week's dollar weakness wasn't a clean "sell dollars on CPI" trade. Yen strength did a significant share of the work. The DXY tells you a story, but not always the whole one.

Today the risk isn't data. It's execution. US markets are closed, several Asian centres are dark, and anyone who needs to move size is doing it in a thinner pool. That means wider spreads, slower interbank flow, and price that can gap on very little. Institutional participants often wait for full US liquidity to return before committing to major positions

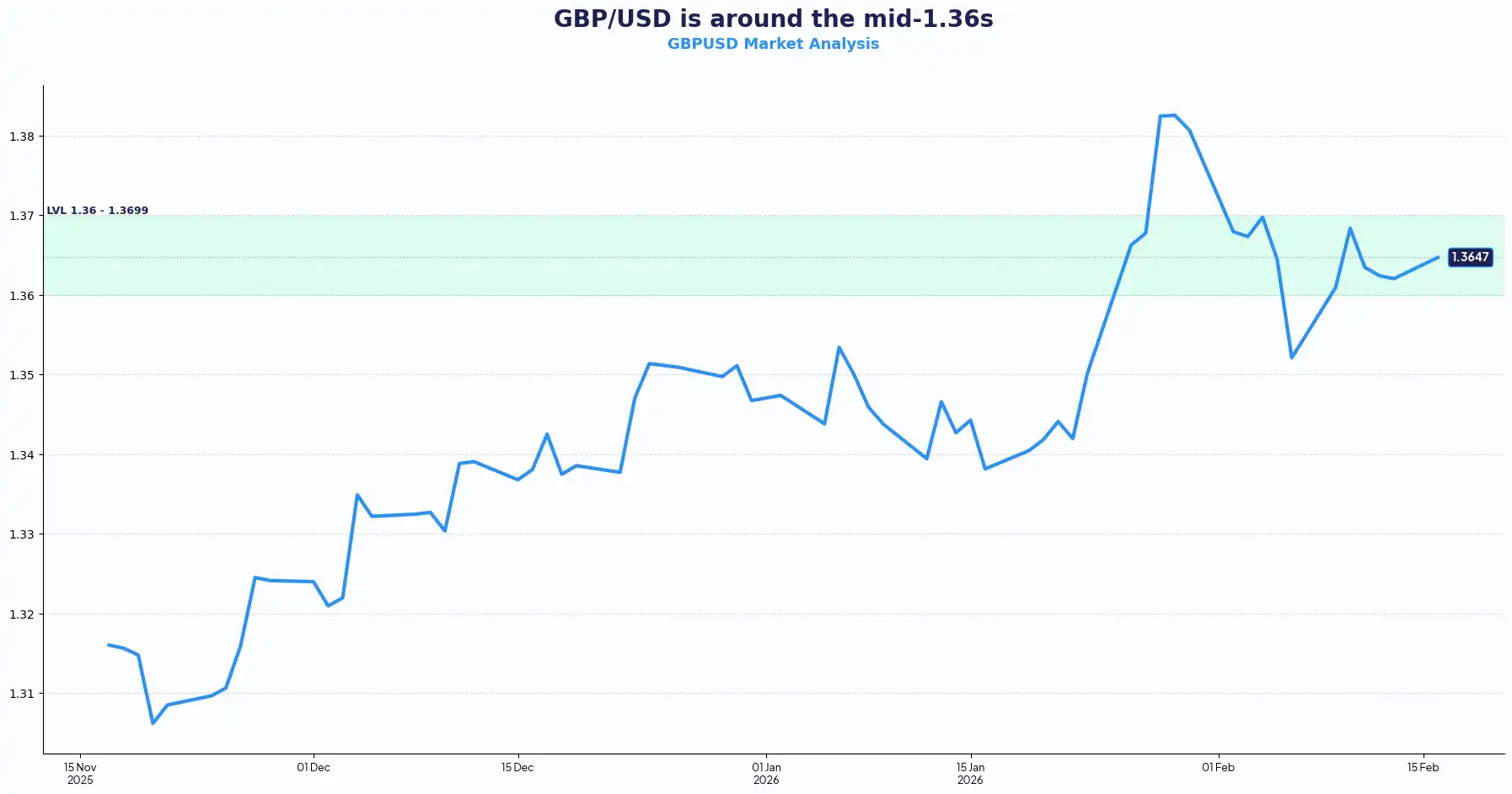

GBP: Quiet Pressure, No Catalyst

Sterling is still looking for reasons to push higher. The problem is the quiver is running light.

The ONS confirmed UK GDP grew 0.1% q/q in Q4 2025, matching Q3 but missing the 0.2% consensus. That's two consecutive quarters of near-stagnation, which is not the backdrop that earns a currency a confidence premium.

The Bank of England held at 3.75% on a 5-4 vote in February. Five members were held. Four wanted to cut. That's not conviction; that's a committee watching the same soft data and disagreeing about how patient to be.

The 1.3600 level is the shelf the market keeps returning to. In thin liquidity, a break there doesn't drift, it gaps - watch for any US data surprise Tuesday to act as the trigger, given sterling’s current sensitivity to rate-path repricing. For those managing sterling requirements, the current consolidation reflects a currency under quiet pressure. The practical response is to stagger execution , smaller tranches rather than one swing , to avoid being caught in a sudden move in a fragile market.

Side note worth filing: MPC member Catherine Mann flagged rising youth unemployment, linked partly to minimum wage increases for younger workers. Not a Monday trigger. But wages and services inflation are still the Bank's pressure points, and this is a reminder they haven't gone away.

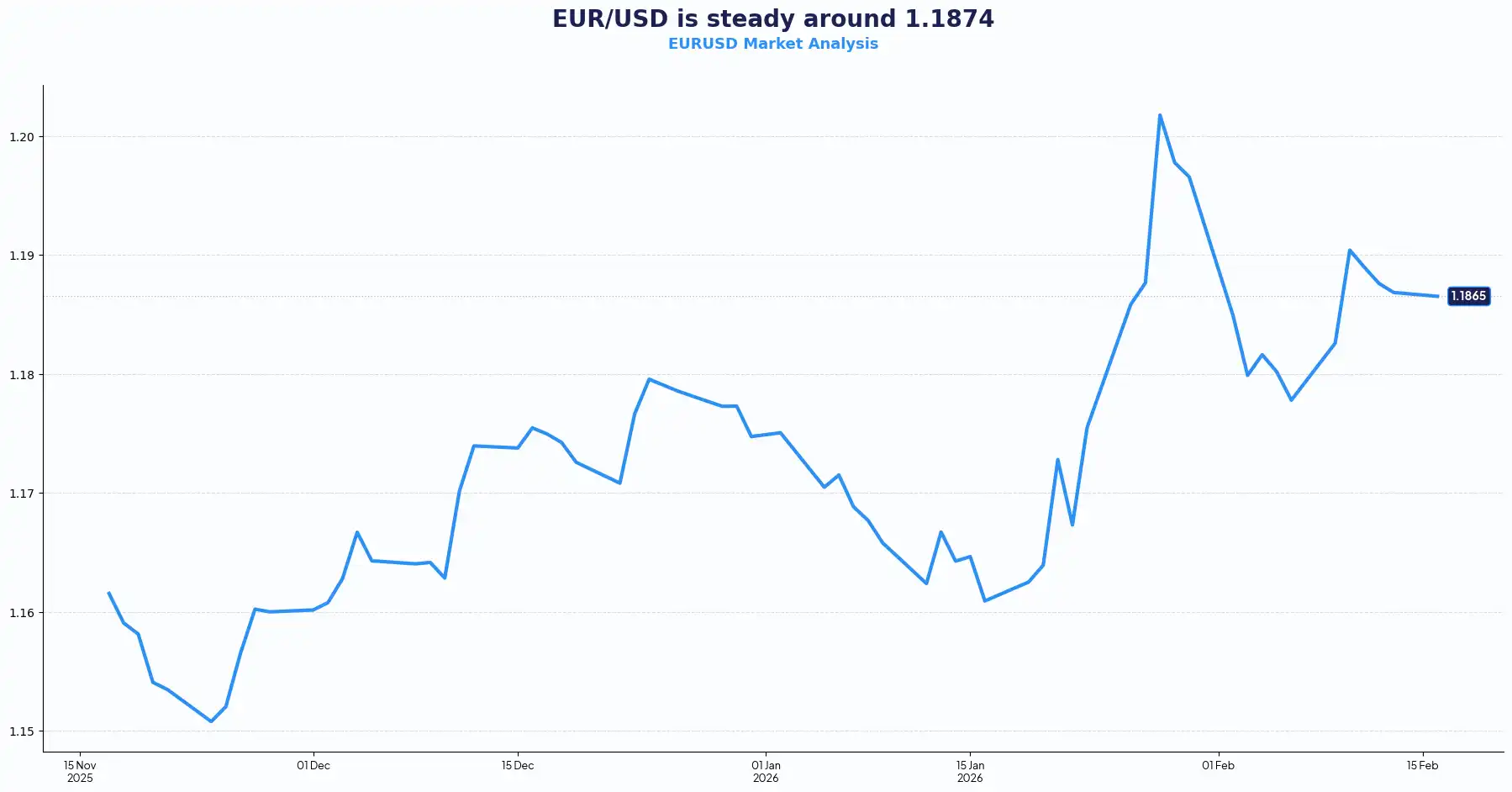

EUR: The Least Problematic Option Wins

The euro isn't exciting. It doesn't need to be.

When the US rate narrative dominates and Europe delivers no fresh shock, the euro trades like a range. That's fine. In a world of uncertainty, boring is a premium.

The weekend's real story: ECB President Lagarde used the Munich Security Conference to announce a significant upgrade to the Eurosystem repo facility for central banks (EUREP). From Q3 2026, a broad set of central banks get standing access, up to €50 billion each, against high-quality euro collateral. The intent is explicit: prevent stress from becoming fire sales of euro assets.

That's backstop architecture. Backstops don't generate returns. They reduce the cost of holding. And reducing the cost of holding is how you slowly, quietly build a reserve currency case. This is a long game, not a scalp.

Near term, EUR/GBP is the cleaner expression, with the pair biased toward the 0.8750-0.8800 range while sterling underperforms. EUR/USD continues to consolidate below the 1.1900 resistance; a break above on renewed dollar weakness reopens the path toward the 1.2082 multi-year high. If sterling is discounted and the euro is playing institutional anchor, flows don't need a catalyst. They just need a direction.

JPY: Normalisation Is a Plan, Not a Promise

Japan wanted a clean growth story. It didn't get one.

Q4 GDP: 0.1% q/q, 0.2% annualised. The consensus was 1.6%. Consumption barely moved. Capex at 0.2% against a 0.8% forecast. Net external demand: nothing. That's not a stumble, that's a structural question about whether domestic demand can carry the normalisation narrative.

The BOJ raised rates to 0.75% in December. Markets now assign only around 20% probability to a March hike. USD/JPY sits near 153.15, profit-taking in thin liquidity, not a directional signal.

When full US liquidity returns Tuesday watch whether USD/JPY reconnects to the Treasury tape - a move back above 154.00 on any UST yield uptick would signal carry positioning is rebuilding while a break below 152.00 would reopen the 150.00 structural support debate.

Next catalysts: Fed minutes Wednesday, U.S. Q4 GDP Thursday, Core PCE Friday.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.