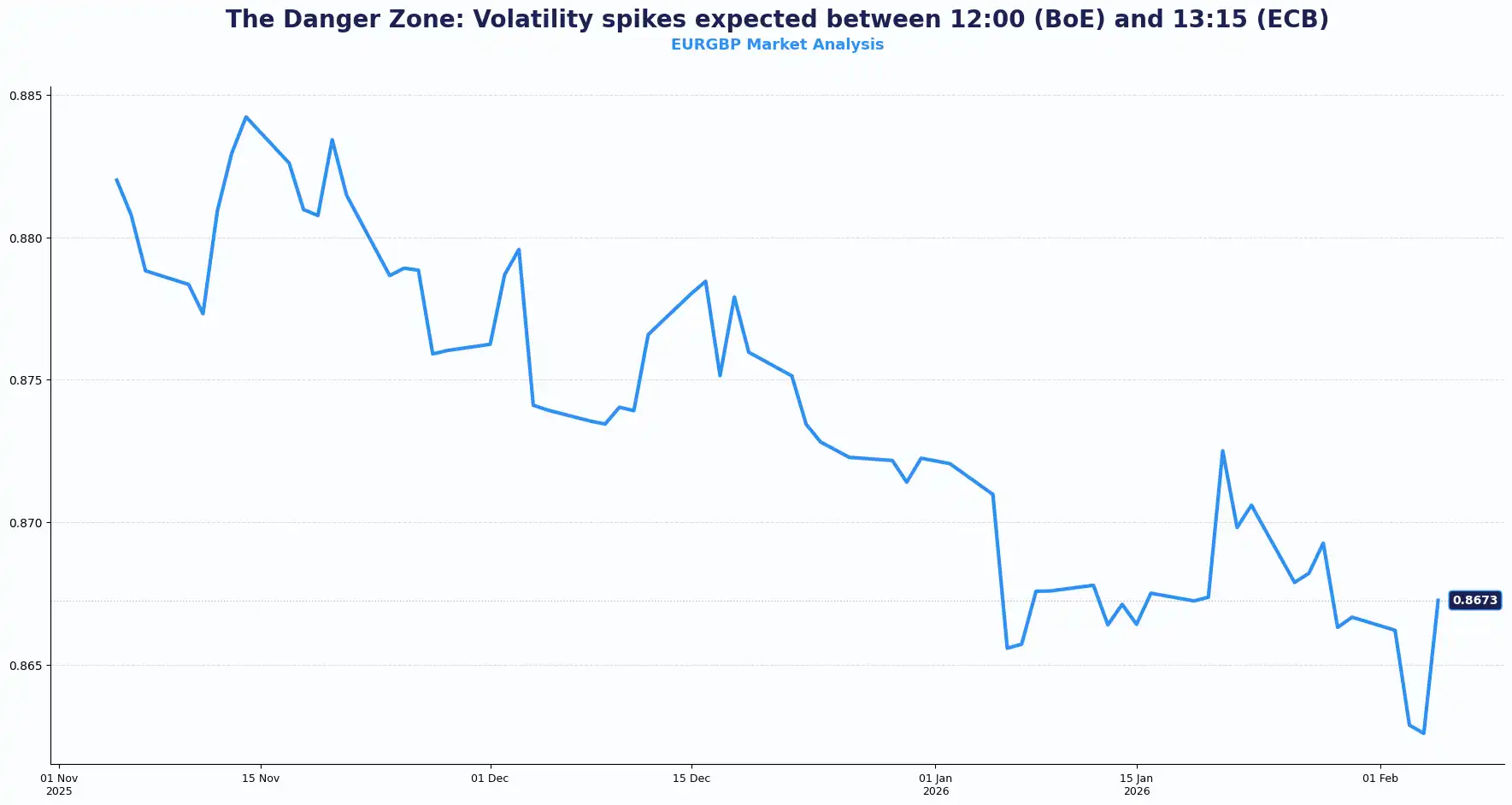

EUR/GBP hovers at 0.8650 ahead of today's central bank double-header. Sterling draws strength from sticky 3.4% inflation, contrasting a 1.7% Eurozone HICP undershoot. Central bank policy divergence stays the key driver for the pair.

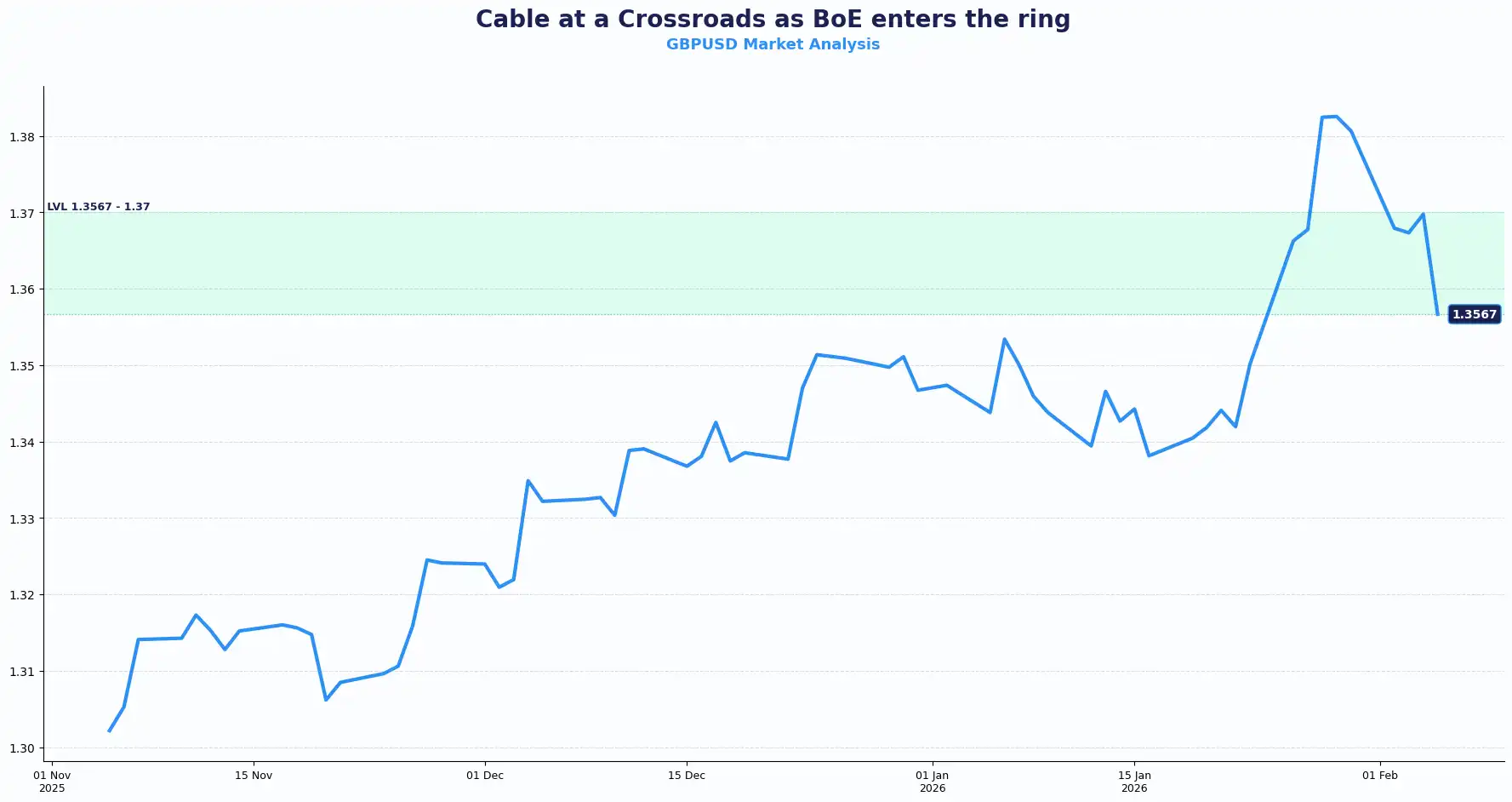

GBP: BoE patience steadies the pound

Sterling trades at $1.3617 as “Super Thursday” begins and traders square positions ahead of the Bank of England (BoE) decision. Policy is a balancing act as December CPI surprised at 3.4%, representing a significant detour from the disinflationary path seen in late 2025. While a minority of the Monetary Policy Committee previously favoured a cut, the recent upside surprise in inflation has likely forced a "hawkish hold”. The BoE is expected to leave rates unchanged at 3.75% today.

Recent UK data has improved the pound’s underlying tone. GDP beat expectations in November, retail sales rebounded in December and services activity accelerated in January, even as firms flagged rising input prices. A reminder that inflation risks linger despite the softening headline.

Rate markets price around 35 basis points of easing this year, while political risk creeps back into the frame. Upcoming by-elections and local polls in May serve as a barometer for government stability. Any sign of political fragmentation could see the "Brexit premium" return to haunt Sterling valuations.

EUR/GBP trades higher near 0.8650, reflecting recalibration rather than outright euro strength.

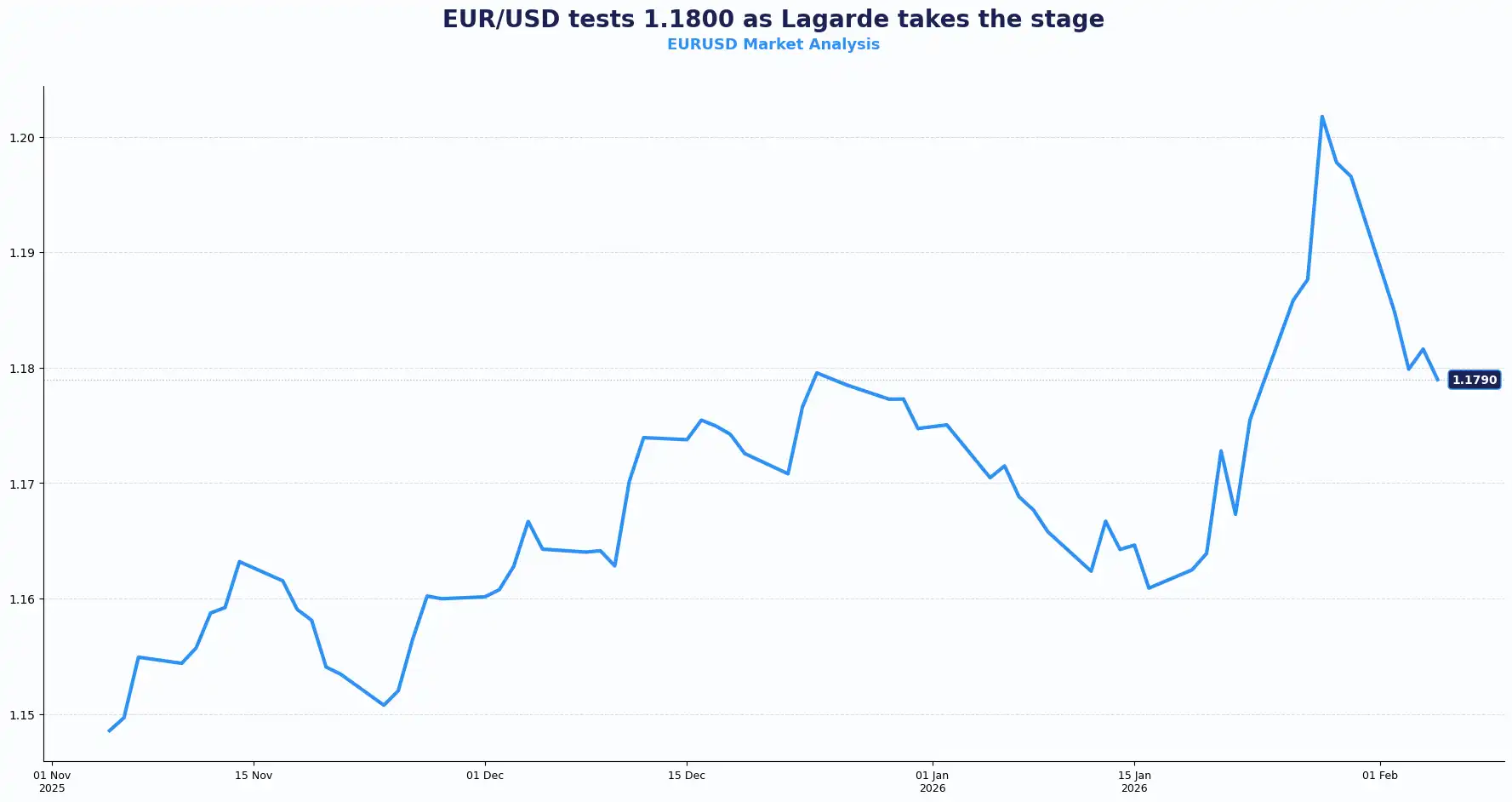

EUR: EUR: Inflation cools ahead of ECB

EUR/USD softened below 1.1800 after failing to sustain January's rally toward 1.2050. The Eurozone HICP cooled to 1.7% in January, matching the European Central Bank (ECB) 's 2% target and reinforcing a dovish backdrop ahead of today's meeting. Investors recalibrate their expectations for the ECB meeting.

Policymakers are widely expected to hold the deposit rate at 2.00%. This would mark the fifth consecutive meeting without a move, yet the narrative is shifting from "how high" to "how long." ECB President Lagarde is likely to address the strong euro’s dampening effect on Eurozone exports, especially as Germany’s 2026 growth forecast stays fragile at 0.9%. In today’s press conference, any Dovish commentary around FX sensitivity could weigh on the euro.

EUR/JPY has pulled back from multi-year highs as traders reposition for a more cautious ECB tone.

EUR/USD is currently testing a major technical inflection point between 1.1750 and 1.1800. Markets signal limited appetite for further 2026 cuts unless economic activity deteriorates further, yet the divergence between a cooling Eurozone and a resilient US economy keeps the path of least resistance tilted to the downside for the pair.

The broader Eurozone context stays hampered by fragile global trade dynamics. While Euro core inflation has shown signs of stabilisation, the reliance on external demand makes the euro particularly sensitive to US trade policy and potential tariff escalations. Warsh's nomination and shifting Fed timelines drive dollar demand.

USD: Dollar firms after Warsh boost

The dollar index (DXY) trades firm near 97.70 following Kevin Warsh's nomination as Fed chair. Warsh advocates for lower rates but faces a divided FOMC.

Fed officials reinforce caution without committing to a definitive pivot. Governor Lisa Cook flagged stalled inflation progress, while Richmond Fed President Barkin highlighted productivity gains but stressed uncertainty around their durability.

ADP's private payrolls increased only by 22,000 jobs in January, missing the forecast. While a lackluster reading typically caps USD gains and provides a tailwind for GBP/USD, the data carries extra weight this month as the official Non-Farm Payrolls report was delayed by the government shutdown. All eyes now shift to the rescheduled NFP release on Wednesday, February 11, which will confirm if this private-sector slowdown is a trend or an anomaly.

Safe-haven demand continues to support the greenback amid simmering global trade tensions. Traders are ignoring the abysmal ADP print, viewing it as distorted by the shutdown.

USD/JPY trades at 157.11 amid political uncertainty in Tokyo, weighing heavily on the yen. The pair developed a 2.3% bullish streak this week, driven by comments from Japanese leadership in favour of fiscal expansion and prolonged stimulus. Intervention risks from the Japanese Ministry of Finance continue to act as a persistent shadow over the market.

AUD/USD has softened to 0.6540, giving back gains after an initial RBA-driven surge earlier in the week. The Australian central bank raised rates to 3.85%, but the "mighty dollar" has overshadowed the hawkish move.

Safe-haven demand continues to support the greenback amid simmering global trade tensions. The dollar's dominance is currently less about US strength and more about the comparative weakness of its G10 peers.

Markets look ahead:

-

THURSDAY, FEB 5: Bank of England rate decision (Exp: 3.75% Hold)

-

THURSDAY, FEB 5: ECB rate decision and press conference (Exp: 2.00% Hold)

-

SUNDAY, FEB 8: Japan General Election – Significant yen volatility expected

-

WEDNESDAY, FEB 11: US CPI inflation report – Key for Fed rate path

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.