Sterling softens on weak UK labour data. The euro holds steady and the dollar waits on Fed minutes. The yen and the Aussie dollar react to politics and policy signals. Volatility sits high as policy paths diverge across major currencies.

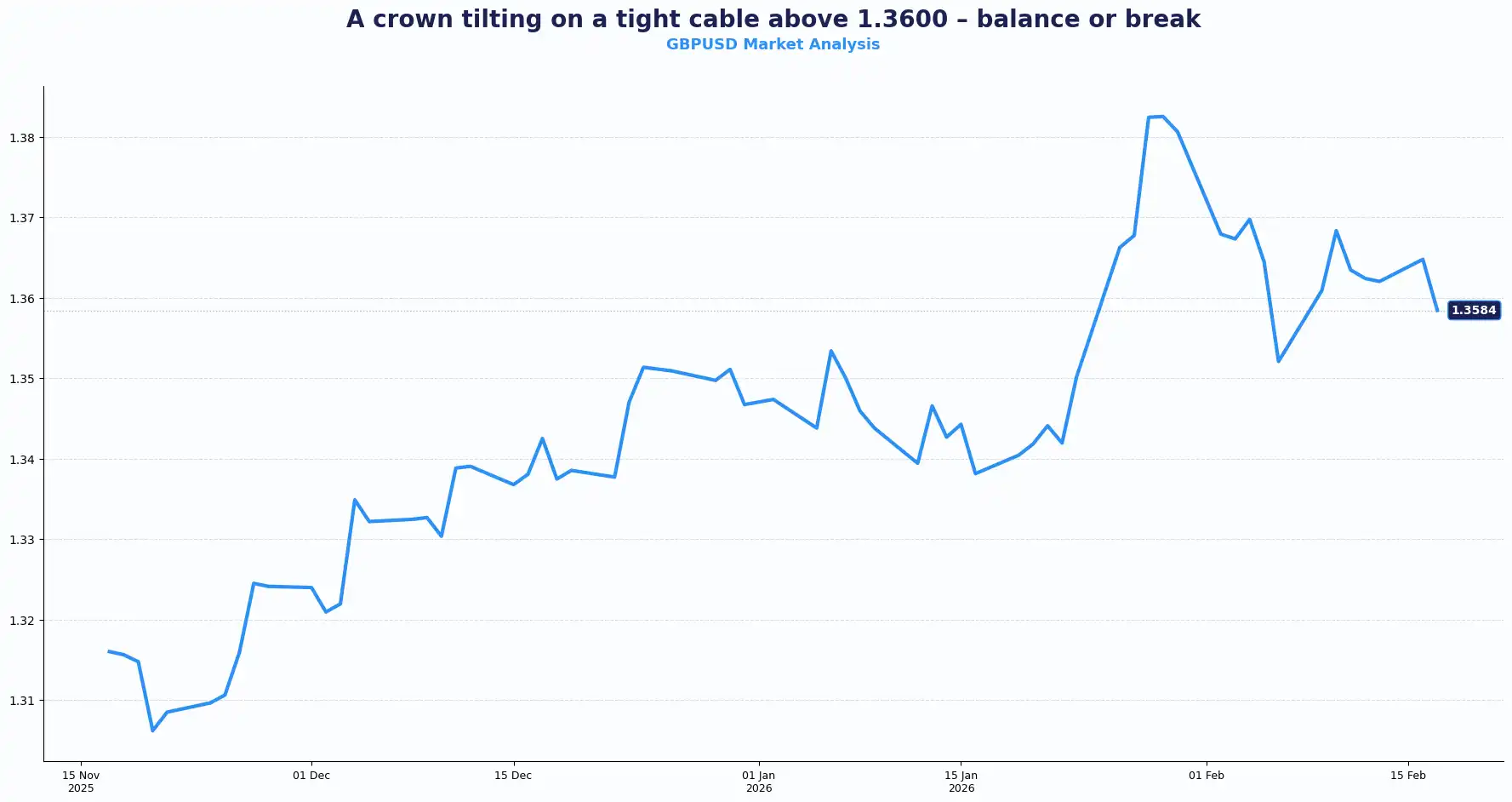

GBP: Sterling Stumbles on a Softening Labour Market

The pound fell on Tuesday after data showed Britain's unemployment rate rose in December while wage growth slowed more than expected, potentially adding to the case for further Bank of England (BoE) rate cuts.

Sterling traded mixed before key UK prints. The GBP/USD pair traded at 1.3611, down from 1.3625. The GBP/EUR pair held near 0.8701 in a tight range before the figures were released.

UK labour data points to cooling momentum. Today’s Claimant count rose to 28.6K, above the 22.8K forecast and up from 17.9K. The ILO unemployment rate ticked up to 5.2% from 5.1%, the highest since December 2020. Rising benefit claims signal softer hiring conditions, which tends to weigh on sterling.

The BoE held the Bank Rate at 3.75% earlier this month in a narrow 5-4 split vote. Policymakers signalled cuts could follow if inflation continues to ease. Rate pricing still reflects expectations for roughly two quarter-point cuts this year, keeping pressure on the pound. Domestic data drives that view.

MPC member Catherine Mann flagged last week that successive minimum wage increases have proved "unfortunate" for youth unemployment, and described the UK economy as sluggish. Today's figures back that read without ambiguity.

Wednesday brings the CPI print. Headline inflation is forecast to ease to 3.0% in January, the lowest since March 2025. Core inflation is expected at 3.1%, a four-year low. If CPI figures surprise higher, sterling could find support.

On the political front, PM Starmer steadied after last week's turbulence over Peter Mandelson's Washington appointment, but vulnerability lingers. Sterling feels political noise fast, and any fresh deterioration in Starmer's position is likely to register in the pound.

Sterling trades on domestic data and rate expectations. Volatility around CPI and labour data has coincided with wider intraday ranges in recent months. Participants continue to monitor pricing across GBP pairs as policy expectations evolve.

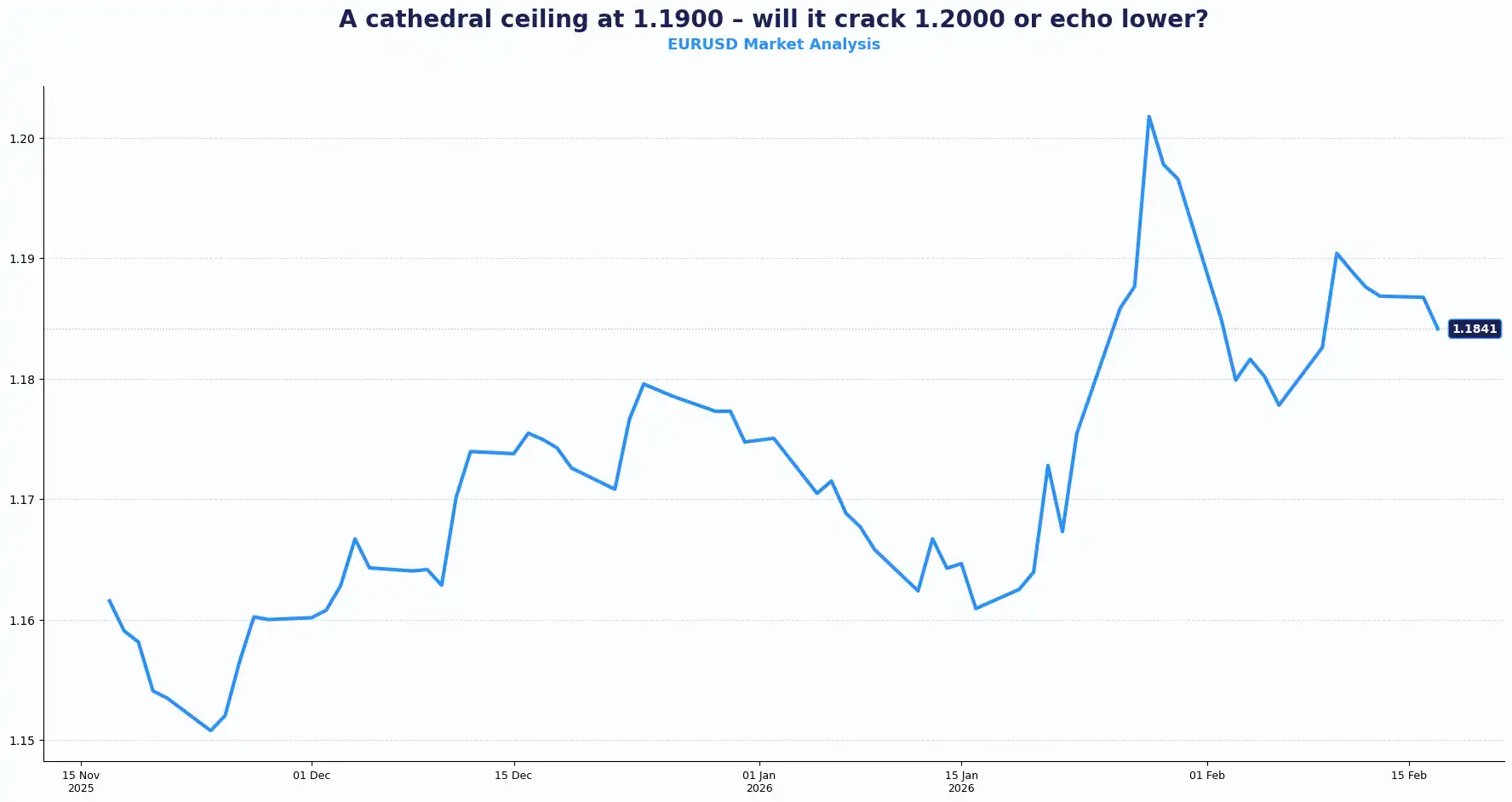

EUR: Euro Gains Capped by Greenback Strength

The EUR/USD pair trades at 1.1843, though the recent rally lost momentum near 1.1900. While German inflation harmonised at 2.1% YoY exactly as the market anticipated; the single currency finds itself a passenger to the US dollar’s broader movements.

Germany's HICP came in line with forecasts and unchanged from the prior reading. That result supports the ECB’s wait-and-see stance.

The European Central Bank (ECB) is expected to keep the deposit rate unchanged through much of 2026. Inflation still tracks toward the 2% objective, and wage indicators show early signs of stabilisation, though services inflation stays under watch. Current pricing implies only around 11 basis points of easing by year-end. Traders expect the ECB to leave rates unchanged at its 19 March meeting.

For the EUR/USD pair, the US narrative dominates. The pair’s earlier rebound stalled as the dollar firmed on US data and positioning. The 1.2000 level stands out as a psychological marker if bullish momentum rebuilds.

Policy divergence shapes the GBP/EUR pair. If the BoE cuts ahead of the ECB, yield spreads shift in favour of the single currency. That dynamic caps sterling rallies against the euro.

Euro pairs respond more to external drivers than domestic data at present. Rate differentials and US developments steer direction. Cross-border exposures tied to EUR flows warrant close monitoring as policy paths diverge.

USD: The Dollar Holds Its Ground Before the Fed Minutes

The dollar index (DXY) edged up to 97.12. Trading ran thin with Asian sessions reduced by Lunar New Year holidays and the US observing President's Day on Monday. That gave this week's data schedule extra weight before it even began.

Friday's US CPI came in below expectations. Consumer prices rose less than forecast in January, giving the Fed breathing room to ease without urgency. Traders are pricing approximately 59 basis points of cuts for the rest of 2026. June looks like the first live meeting for a cut, with a minority of traders also factoring in a follow-up in July.

FOMC minutes from January's meeting will be published this Wednesday. Advance GDP figures follow later in the week. Together they sharpen the picture on the pace and timing of Fed easing. The US exceptionalism narrative has been the defining driver of the dollar through 2026, and until something fractures that story, the dollar holds its position.

Liquidity thins this week due to US and Asian holidays. That backdrop can amplify moves around data releases.

The Yen Finds Its Footing and the Aussie Sits Tight

The USD/JPY pair is trading at 152.90, pulling back from Monday's session high of 153.32. Japan's Q4 GDP figures showed near-flat growth, stirring expectations of further government stimulus.

The yen jumped close to 3% last week, its biggest weekly gain in about 15 months, following PM Sanae Takaichi's LDP landslide election win. The currency sits about 4% weaker against the dollar since Takaichi, widely seen as fiscally accommodative, took office last year.

The BOJ reviews rates in next March, with traders assigning around 20% probability to a hike. Most expect the bank to hold until July. Political dust is settling and the yen is growing more sensitive to incoming data.

The AUD/USD pair is trading at 0.7060. RBA minutes published Tuesday showed policymakers saw no urgency to adjust rates. The bank noted that failing to act earlier would have risked entrenching high inflation, but the current tone is one of patience. Thin Lunar New Year liquidity is amplifying small moves in AUD.

US-Iran talks in Geneva are adding a secondary layer of noise, with oil prices nudging higher after President Trump indicated indirect involvement in negotiations over Tehran's nuclear programme.

FX Playbook

Market look ahead:

- Wednesday 18 February – UK CPI (January inflation)

- Wednesday 18 February – FOMC minutes (January meeting)

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.