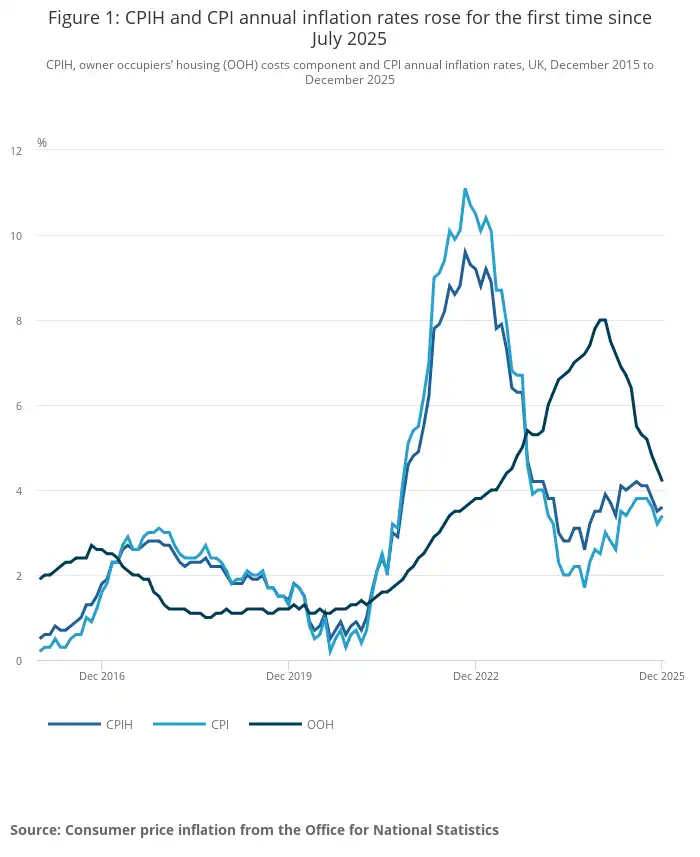

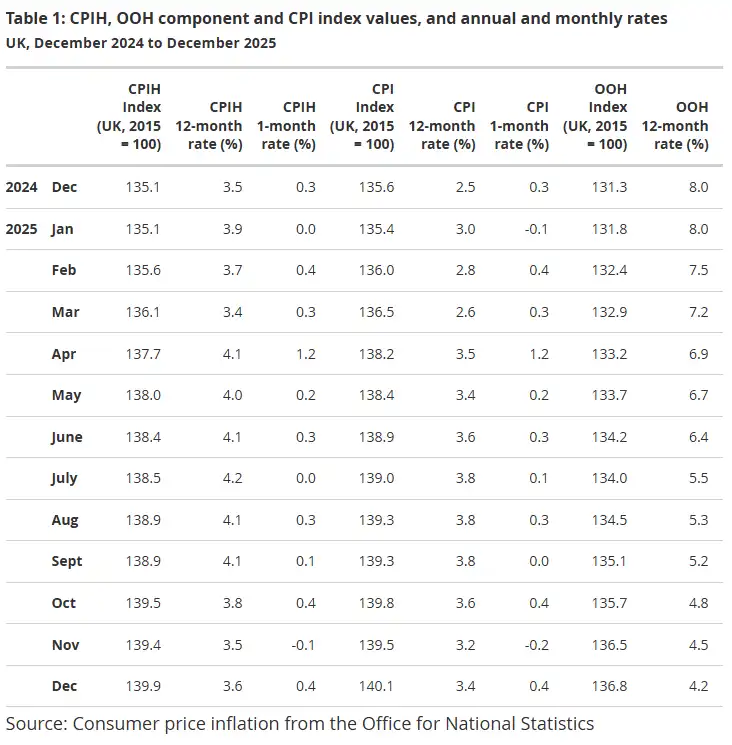

Inflation ticks higher, narrows BoE's room to cut

Inflation beat expectations at 3.4%. This proves domestic price pressure is 'sticky' despite a cooling labour market.

UK core inflation data for December (excluding food and energy) came in at 3.2% YoY, matching expectations but still 120 basis points (bps) well above the Bank of England's (BoE) 2% target.

The higher inflation reading reduces the likelihood of aggressive policy easing. The Monetary Policy Committee cut rates by 25 bps to 3.75% in December, marking the fourth cut in 2025. The narrow 5-4 vote highlighted differing views within the Committee over the pace of easing. The Committee emphasised that any further cuts would be gradual. Markets now anticipate just 42 bps of easing for the whole year. The Bank of England’s next meeting is scheduled for 5 February, with rates expected to remain at 3.75%. The December Decision Maker Panel survey indicated that firms expect slower price growth, though this is unlikely to alter the Committee’s cautious approach.

Sterling Remains Steady as Geopolitical Factors Dominate

GBP/USD traded at 1.3438 during Asian hours on Wednesday, little change from pre-data levels. The pair showed minimal reaction to the inflation data, as geopolitical developments remained the primary focus. Sterling had its largest two-day rally since December on Tuesday, as concerns over a trade war prompted investors to sell dollar assets. Analysts note that the pound is approaching resistance at 1.3500, with support at 1.3350.

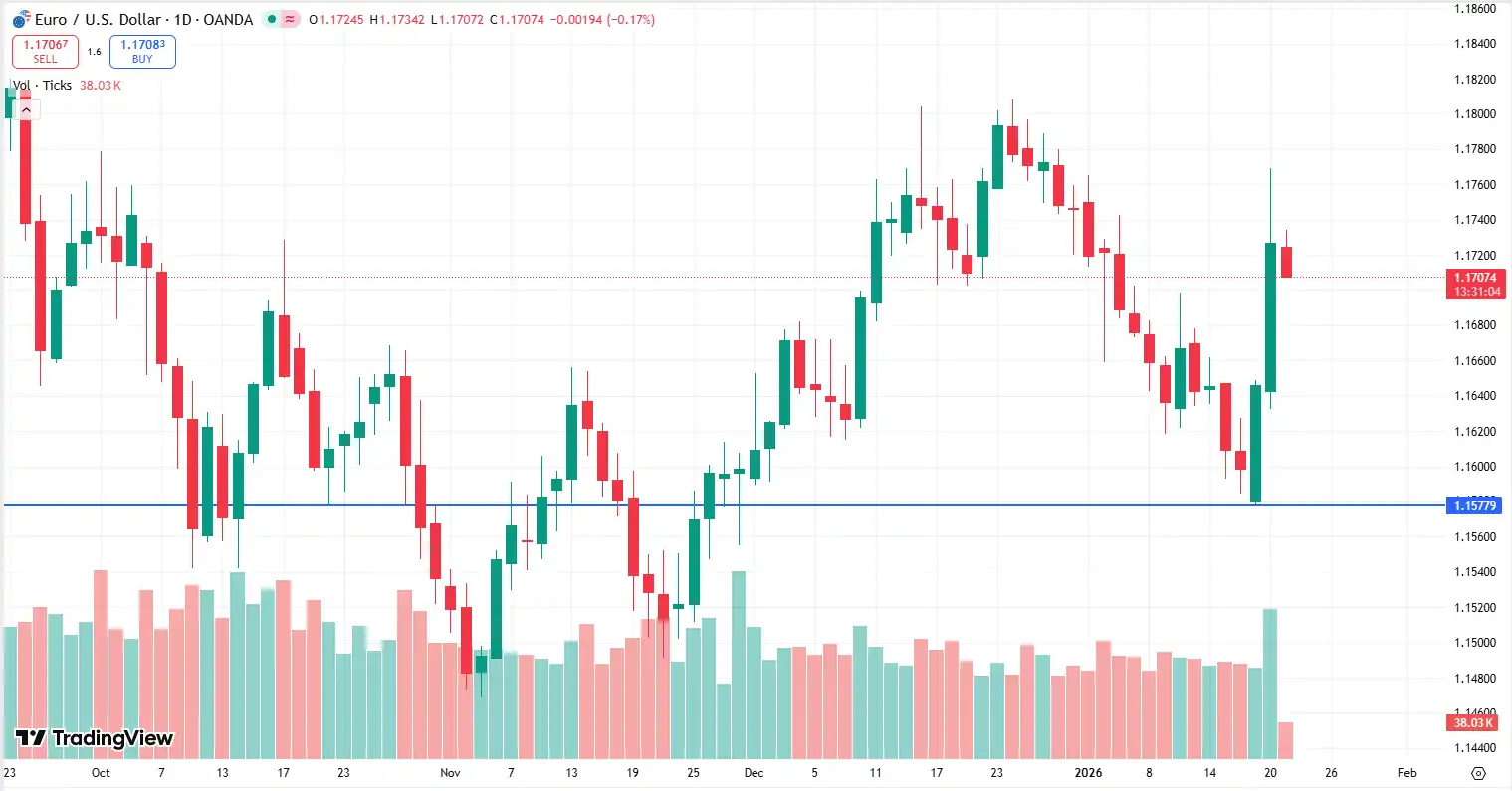

The Dollar Declines Amid Tariff Tensions with Europe

European officials rejected Trump's tariff threats over Greenland, with European Commission President Ursula von der Leyen stating the approach is "completely wrong" for resolving alliance differences. EUR/USD is testing 1.1730. Investors are dumping US Dollar assets in favor of European havens and gold as Trump’s Greenland tariff threats escalate. The "sell America" trade has lifted both sterling and the euro, despite Europe's own economic headwinds and policy uncertainty. US Treasury yields rose overnight, raising concerns that the tariff agenda could increase inflation and restrict the Federal Reserve's (Fed) ability to cut rates further this year.

EUR/GBP Remains Range-Bound Ahead of Lagarde’s Speech

EUR/GBP weakens to around 0.8720 in Wednesday’s early European session . The pair has traded within a narrow range of 0.8680 to 0.8750 over the past week, as markets await direction from both the Bank of England and the European Central Bank (ECB).

The divergence in central bank policy continues to weigh on the euro. The ECB cut rates by 25 basis points in December and signalled further easing ahead, citing weak growth and cooling inflation across the eurozone. ECB President Christine Lagarde is scheduled to speak today at the World Economic Forum in Davos. Markets will closely monitor her remarks for insights on the pace of future rate cuts and the ECB’s view on euro weakness against sterling and the dollar. A dovish tone from Lagarde could move EUR/GBP toward the lower end of its range, while any resistance to aggressive easing expectations may offer temporary support for the euro.

Looking Ahead

Markets will parse ECB President Lagarde’s remarks for signals on policy trajectory, while US API crude oil data, also due, may influence energy-linked currencies. The Bank of England convenes 5 February, and the Bank of Japan (BoJ) announces its decision Friday. Persistent US-Europe trade tensions remain a key driver for currency markets, with central bank guidance and geopolitical headlines expected to steer volatility across major pairs in the days ahead.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.