Sterling defends four-year peaks while the Euro hits the 2% inflation target. Policy divergence takes centre stage as traders brace for a high-stakes central bank double-header.

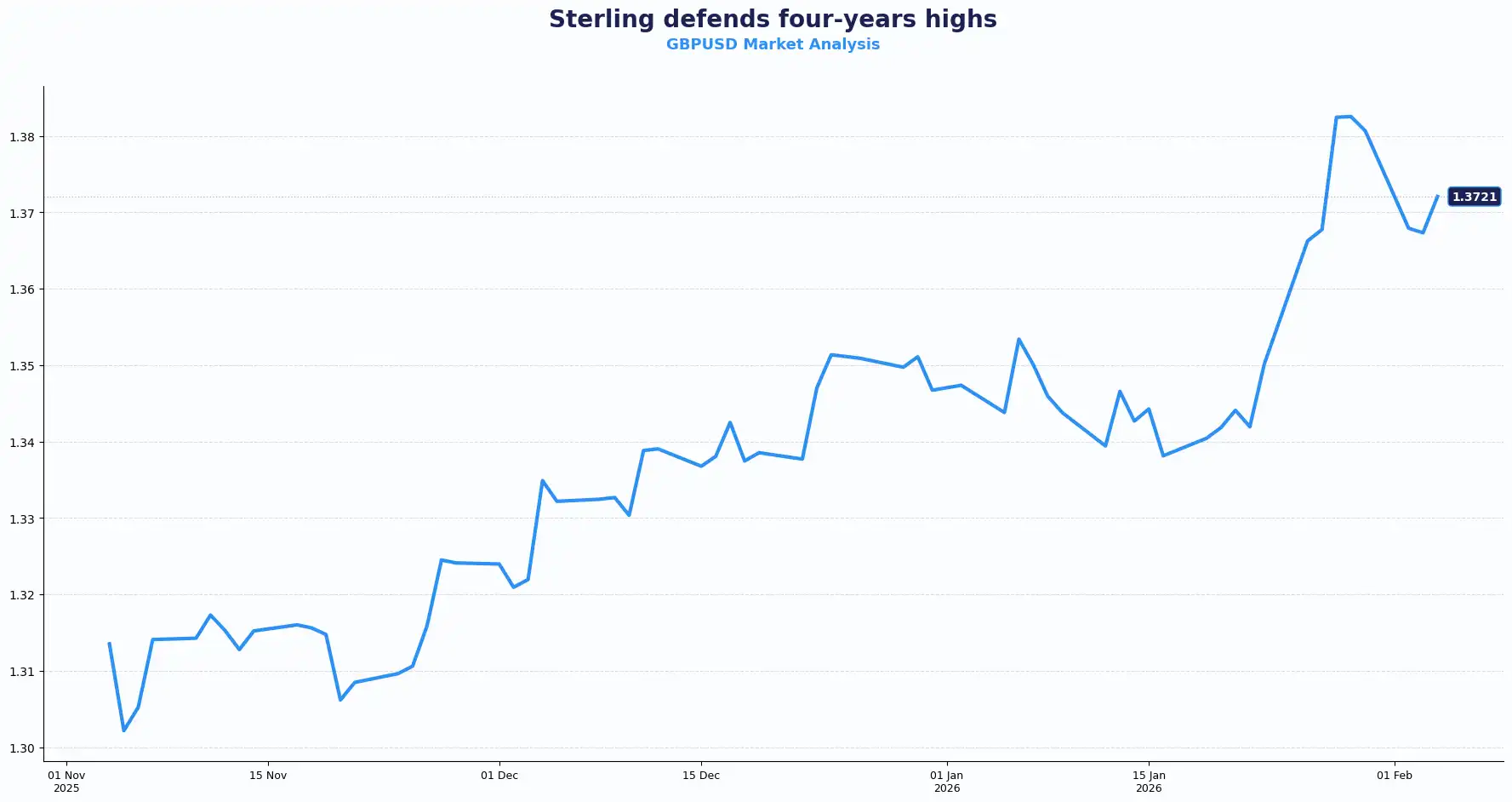

GBP: Sterling tests four-year highs as BoE looms

The British pound trades above 1.3710 while investors anticipate a "hawkish hold" from the Bank of England (BoE) tomorrow. Sterling touched a four-year high of 1.3867 in late January. This rally reflects improved UK economic momentum and pushed-back rate cut expectations.

The BoE is likely to wait until May before cutting rates. UK’s inflation rose to 3.4% in December, the highest among G7 nations. This figure provides a floor for sterling as traders price out aggressive near-term cuts. The BoE expects inflation to return to its 2% target by mid-year. Elevated services inflation complicates the rate cut timeline. These delayed expectations support the pound.

Stronger UK GDP in November, rebounding December retail sales and improved January business activity propelled sterling higher. This data streak suggests the UK economy is navigating slowing growth better than expected. The BoE expected to maintain bank rates at 3.75% tomorrow, prioritising price stability over immediate growth concerns.

EUR/GBP last traded at 0.8620 levels, down nearly 1% this year. Diverging central bank rhetoric drives the pair; the BoE focuses on containing the highest inflation in the G7, while the European Central Bank (ECB) faces pressure to address a rapid cooling in the Eurozone economy.

Little major UK data arrives until mid-to-late February when growth, employment, and inflation figures land. Investors scrutinise Thursday's BoE statement for clues on the May meeting. Any shift in forward guidance triggers volatility. The light calendar keeps focus on central bank messaging and cross-currency dynamics.

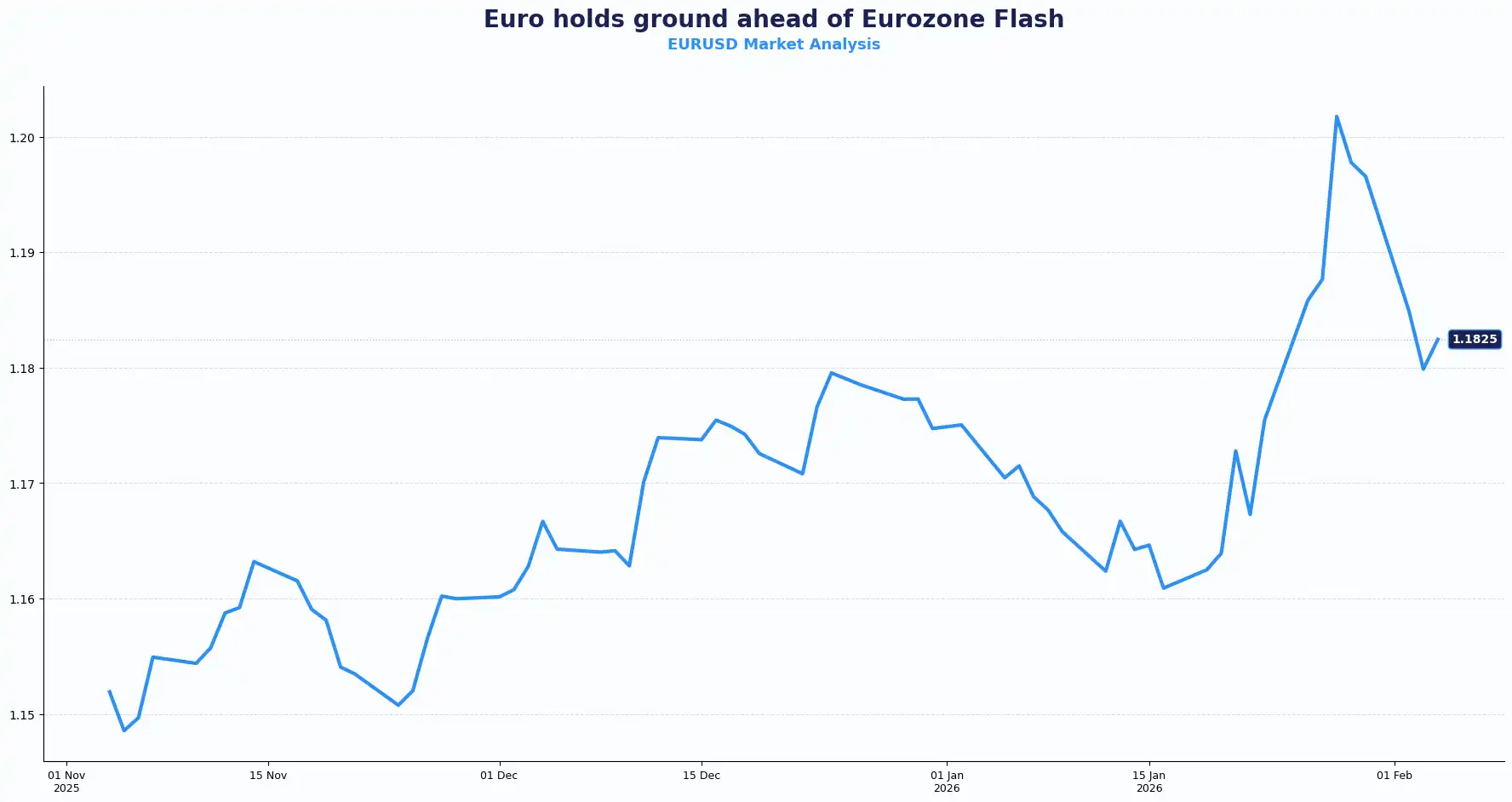

EUR: Euro tests policy patience as inflation undershoots target

The Euro shows a fragile recovery with Eurozone flash inflation and services activity data on tap. EUR/USD picks up to 1.1830 from weekly lows near 1.1775 ahead of the policy decision tomorrow. Eurozone Flash inflation is expected to ease 1.7%, falling below the ECB’s 2% target and complicating President Lagarde’s outlook.

ECB officials face a balancing act; while inflation normalises, the euro’s recent appreciation against the dollar acts as a "disinflationary import." Any signal of concern regarding currency strength could trigger a quick retreat toward the 1.1700 handle.

German inflation rose unexpectedly in January, while French inflation undershot expectations. A large downside miss raises concerns at the ECB. The bank previously flagged risks from rapid euro appreciation. EUR/USD reacts to uncertainty surrounding Trump's trade policies despite pulling back from January highs above 1.2000. That pressure weighs on the dollar and leaves upside risk for the euro.

Both the ECB and BoE hold rates on Thursday. Investors watch ECB guidance on euro strength. Hawkish remarks from President Lagarde could continue to support the euro.

USD: Dollar steadies after Warsh nomination sparks volatility

The US dollar index (DXY) stabilised near 97.33 as the market digests Kevin Warsh’s nomination to lead the Federal Reserve (Fed). Institutional investors view Warsh as a "hawk" less inclined to cut rates aggressively. This provides a floor for US Treasury yields, with the longer end of the curve edging higher as investors price in disciplined balance sheet reduction.

Shifting political dynamics and the resolution of the partial US government shutdown cap the dollar's upside. While the shutdown's end boosts risk appetite, it has caused delays for critical employment data release. This leaves the Fed flying partially blind. Strategists expect elevated volatility ahead of Warsh's confirmation. Richmond Fed President Barkin said rate cuts helped the labour market as the Fed tackles “the final stage of inflation”. Productivity gains reduced costs, though durability stays uncertain. The Fed balances growth support against inflation risks.

Policy uncertainty drives dollar flows. The Warsh nomination signals a less dovish Fed policy ahead. For now, the dollar appears to be consolidating.

USD/JPY stays in focus, eyeing the 156.45 resistance level. A stronger mandate for Prime Minister Takaichi in the upcoming election could signal further yen weakness if her fiscal plans heighten debt concerns.

Yen bears retain control amid political uncertainty

USD/JPY eyes the mid-156.00 area ahead of Japan's lower house election. Fiscal expansion fears drive yen weakness despite positive economic data. Takaichi's earlier comments favouring a weaker yen triggered a sell-off. Intervention risks and the BoJ's hawkish tilt limit further downside for the yen. Expectations for Fed easing could cap USD/JPY upside.

AUD/USD traded at 0.7028 after a 1% jump as the RBA raised rates. Investors price in further tightening this year as Australian inflation stays high. The RBA diverges from other central banks currently in cutting mode.

Oil prices rose after US-Iran tensions escalated, bringing supply risks back to focus. Precious metals stabilised after recent volatility. Gold hovers near key support as dollar strength offsets safe-haven demand.

Week ahead: Central banks and US data dominate

Thursday brings the ECB and Bank of England rate decisions. Traders watch for guidance on euro strength and UK rate cut timing. Flash Eurozone inflation and PPI data arrive ahead of the ECB meeting that would provide final inputs for policymakers.

US ISM services PMI and ADP payrolls are likely to test American economic resilience. The services sector stays critical to US growth health. Delayed employment data from the government shutdown has created uncertainty around labour market trends. Volatility stays elevated but may ease as the market stabilises around Warsh's nomination. Central bank decisions could reset expectations across major currency pairs. Thursday holds all eyes for central bank policy guidance and tone.

Markets look ahead:

Wednesday: US ISM Services PMI, Eurozone Composite and Services PMI, Eurozone PPI, US ADP Employment Change

Thursday: BoE Rate Decision, ECB Rate Decision

Friday: US Non-Farm Payrolls (Delayed)

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.