GBP

Cable advanced for the fifth straight month in June, with spot gaining almost 2%, and rallying north of the 1.37 mark, to its best levels since late-2021.

This move, though, was driven almost entirely by a significant softening in the greenback. GBP/EUR, and other GBP crosses, didn’t fare nearly as well, with the pound actually notching its third monthly decline in the last four against the common currency, as spot fell to test, and briefly break beneath, the 1.17 mark.

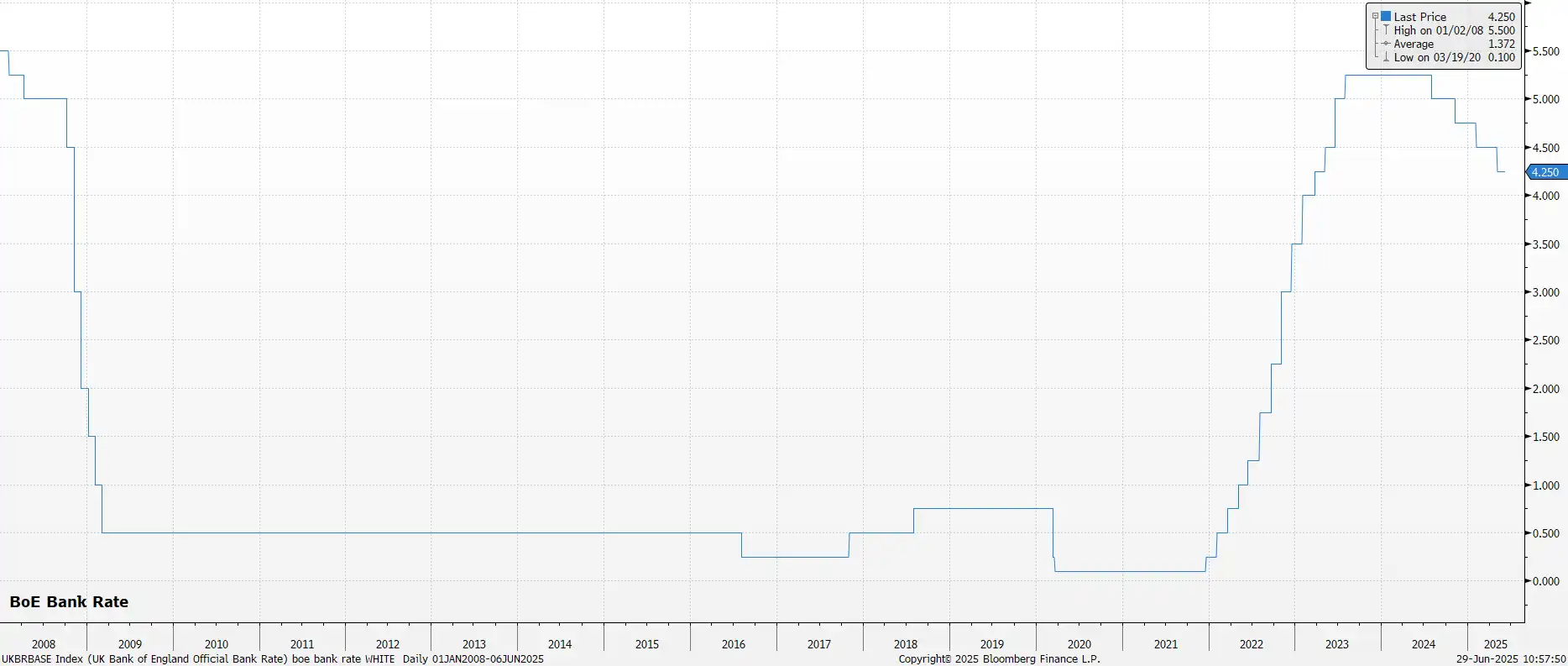

Factors driving that USD weakness are discussed later in this report. As for GBP-specific drivers, considerable attention fell on the June Bank of England decision, where the Monetary Policy Committee, as expected, voted to hold Bank Rate steady at 4.25%.

This vote, however, was a more dovish split than expected, with Deputy Governor Ramsden joining external members Dhingra and Taylor in dissenting for a 25bp cut, which is likely to be delivered at the August meeting. Quarterly cuts from the BoE remain the base case for the time being, after the MPC reiterated that a ‘gradual and careful’ approach to rate cuts remains appropriate, in both the June statement, and in subsequent speaking appearances.

This approach, however, is increasingly looking as if it is on borrowed time.

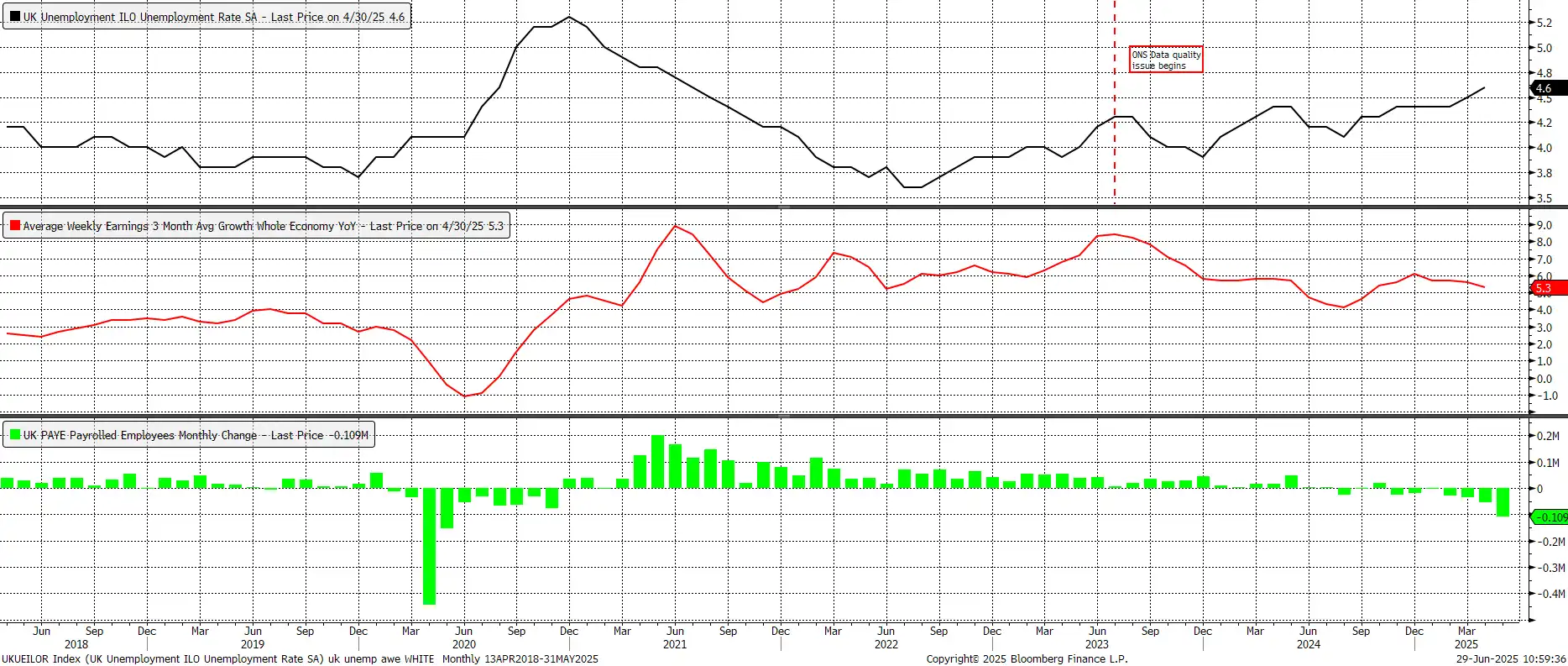

Data released last month pointed to the labour market weakening at a much greater rate than had been anticipated, not only as demand wanes, but also as the full impacts of April’s National Insurance increase begins to be felt. Not only did headline unemployment rise to 4.6% in the three months to April, the more timely indicator of HMRC payrolled employment pointed to 109k jobs being lost in May, the biggest one-month fall in employment since the pandemic.

Against this backdrop, it is very difficult to argue that there is a significant risk of price pressures becoming embedded within the UK economy. In fact, May’s inflation figures pointed to those pressures subsiding once more, with headline CPI dipping to 3.4% YoY, and services inflation pulling back beneath 5%. It seems safe to say that the peak in price pressures is now in the rear view mirror and that, with another month of data to take into account by then, a pivot to a more rapid pace of policy easing could become appropriate.

This is particularly pertinent considering that risks to the UK economy remain clearly, and firmly, tilted to the downside. The most recent round of PMI surveys are consistent with an overall economic contraction in Q2, while retail sales pointed to an aggressive consumer pullback in May. On top of this, there remains the high probability that the autumn Budget will bring with it another significant fiscal tightening, likely through the form of sizeable tax increases, especially as the Chancellor’s efforts to rein in spending appear to be failing, as shown by the recent forced U-turn on cuts to welfare. Though this backdrop, in isolation, argues for a lower GBP, that may not in fact come to fruition, especially with outflows from the greenback proceeding at such a rapid pace, and appearing unlikely to slow in the near future.

EUR

In a similar manner to the GBP, the common currency also stood to benefit from the broad-based USD weakness which dominated markets as the second quarter came to a close. Consequently, EUR/USD advanced over 3% in June, extending its run of monthly gains to a 6th straight month, with spot rallying to its best levels since late-2021, north of 1.17.

As noted, the majority of this EUR upside has been driven by considerable outflows from the USD, with eurozone-specific catalysts actually having been relatively thin on the ground last month.

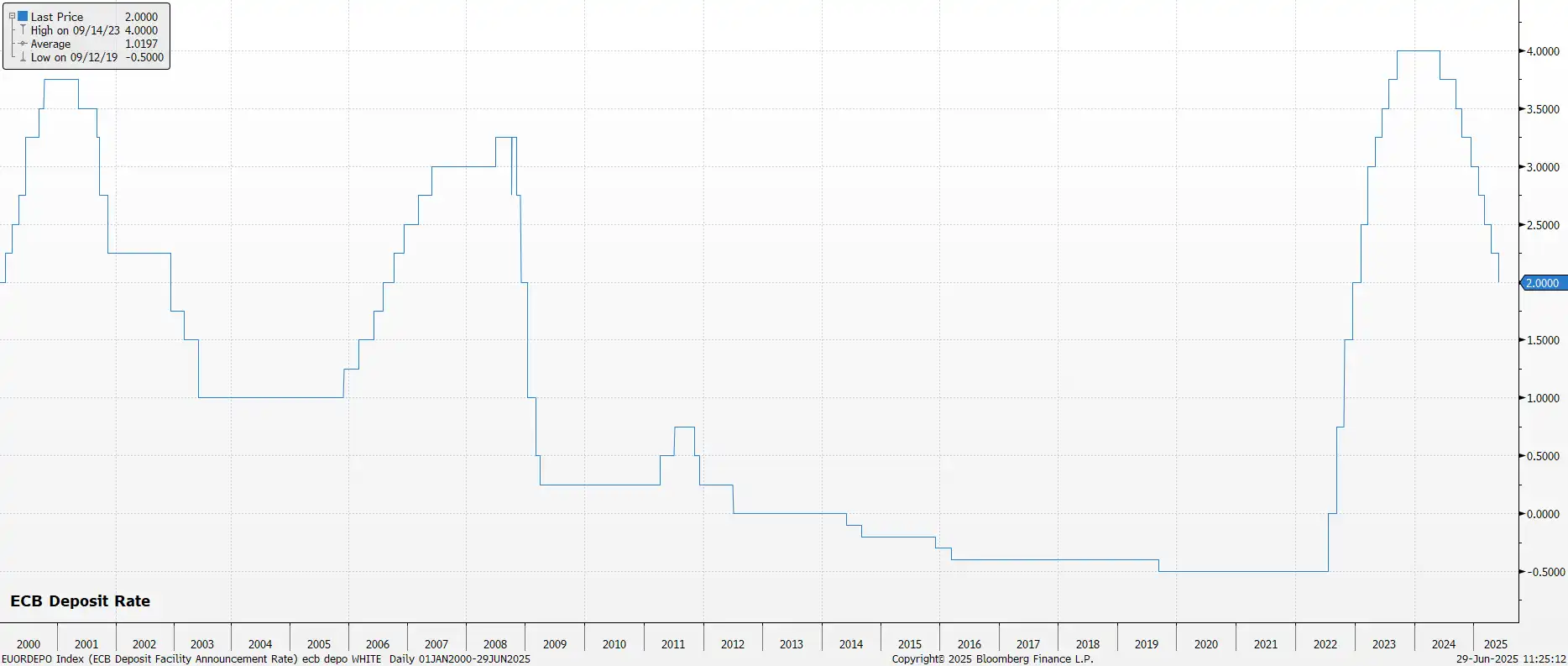

That said, the ECB have clearly indicated that they are probably done and dusted with rate cuts for the time being. While Lagarde & Co did indeed deliver this cycle’s 8th 25bp reduction at the June meeting, lowering the deposit rate to 2.00%, policymakers were at pains to stress that rates are now in a ‘good place’.

This emphasis, despite having downgraded the latest round of inflation projections, which now point to headline CPI undershooting target for the next 18 months or so, is a relatively clear indication that, unless an external factor were to force their hand, the deposit rate has likely now reached its terminal level.

On the subject of inflation, both headline and core CPI are now hovering around the 2% price goal, with the pace of services disinflation also having notably quickened. This further supports not only the idea that peak inflation is now far in the past, but also that the ECB are probably done with rate cuts for now, though risks to that base case do tilt towards a more dovish outturn.

The primary risk facing the eurozone economy, and the EUR, remains a further flare-up in trade tensions, particularly ahead of the 9th July tariff deadline where, at present, the EU would be faced with a 50% tariff on goods exported to the US, if a trade agreement were not signed beforehand. Though recent reports indicate that US-EU talks are making progress, there remain plenty of uncertainties here, even if a ‘worst case’ scenario is likely to be avoided, particularly with the Trump Admin having already shown they have no desire, or ability, to stomach tariffs at such a level that an effective trade embargo results.

This ongoing trade uncertainty means that eurozone-growth risks continue to tilt firmly to the downside, though from here on in any further economic support is likely to have to come from the fiscal side of proceedings. That, mercifully, does appear to be taking place, with greater fiscal largesse from eurozone governments still on the cards, and further helping to attract inflows into the EUR.

USD

The greenback endured yet another torrid month in June, with the dollar index (DXY) notching a sixth straight loss, and falling to more than 3-year lows in the process.

These declines came primarily as a result of the market continuing to lose confidence in the greenback, and seeking to allocate funds elsewhere, mainly amid a continued erosion of the Federal Reserve’s independence in monetary policy decisions.

President Trump has continued his attacks on Fed Chair Powell in recent weeks, not only appearing increasingly desperate for Powell to lower the fed funds rate, perhaps as low as 1%, but also amid reporting that Trump is seeking to announce Powell’s successor as soon as September, effectively creating a ‘shadow’ Chair. At the same time, Governors Bowman and Waller, both Trump picks during his first term, have lurched aggressively to the dovish end of the spectrum, both advocating for a cut as soon as July, despite having been two of the Committee’s more hawkish members over the last couple of years.

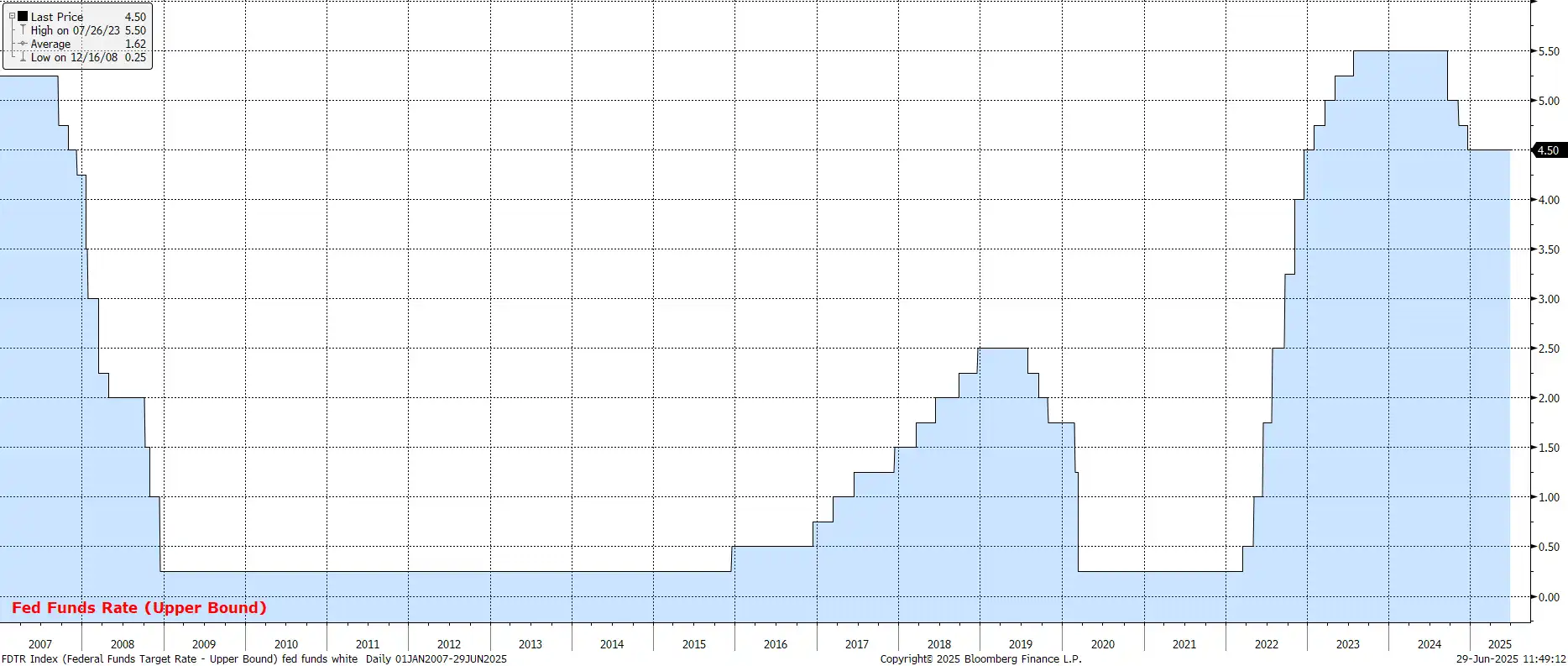

In the short-term, though, barring those two members, the FOMC continue to take a ‘wait and see’ approach to monetary policy decisions. The Committee, unanimously, voted to maintain the target range for the fed funds rate at 4.25% - 4.50% at the conclusion of the June meeting, while also nudging higher near-term inflation expectations, and lower short-term growth projections.

Naturally, those two projections have come as a result of continued uncertainty on the trade front, with the impact of those tariffs already imposed continuing to be felt, and further tariffs still likely to be announced, such as those on chips and pharma imports.

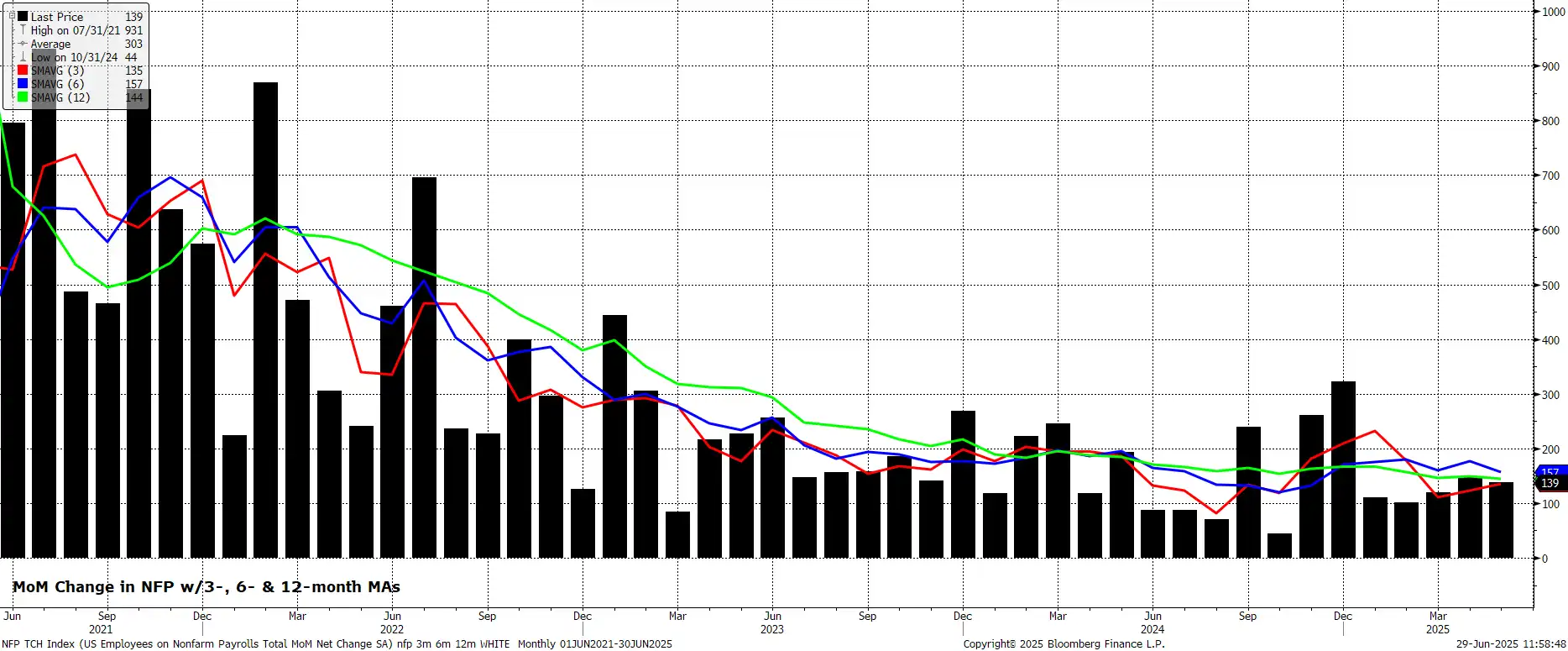

Despite all of this uncertainty, the underlying economy continues to demonstrate a remarkable degree of resilience, with consumer spending solid, underlying growth strong, and the labour market also continuing to perform well, with job gains still in excess of the breakeven pace required for growth in employment to keep pace with growth in the size of the labour force. It is, then, logical to conclude that recent USD weakness is being driven almost entirely by concerns over the credibility of US institutions going forwards, as opposed to economic jitters.

Looking forward, bearing in mind that there seems little-to-no chance of President Trump changing his stance towards the FOMC any time soon, the path of least resistance seems to point towards a further slow but steady depreciation in the value of the greenback.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.