GBP

Sterling looks set to close out July in the red, with sterling notching its first monthly decline since January, having lost over 2% during the month, and with cable set to finish up around the 1.34 mark, close to the 2-month lows hit towards the middle of July

The quid has also fared relatively poorly against the euro, notching a second straight monthly decline, as spot briefly tested the 1.14 handle to the downside, probing almost 2-year lows in the process.

These GBP declines came after a month of rather grim economic releases, which pointed to a rather downbeat ʻstagflationary’ economic backdrop.

On the ʻstag’ side of proceedings, we have not only seen a disappointing retail sales print, which rebounded by less than 1% MoM in June despite a near-3% decline in May, but also a dismal slate of ʻflash’ PMI surveys, which pointed to renewed weakness in the services sector, and a 2-month low on the composite output metric.

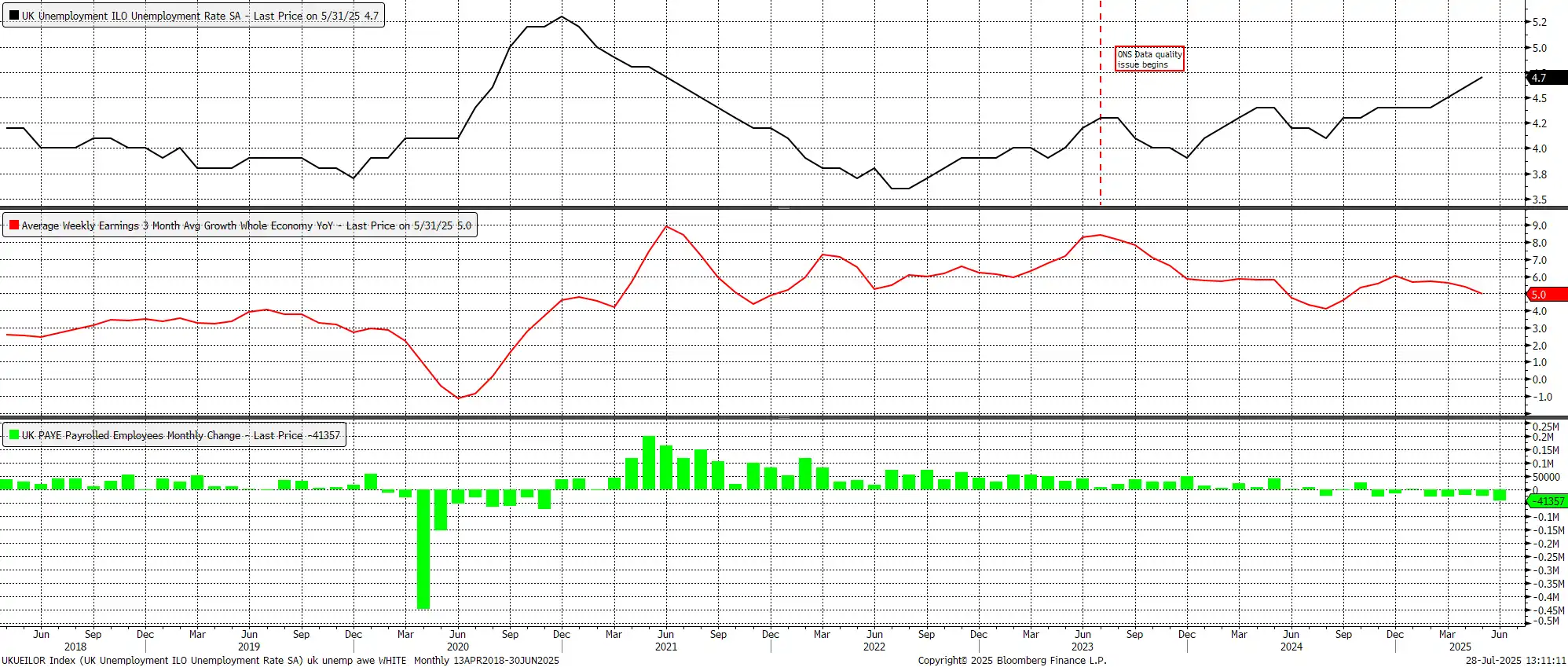

In turn, and as the impact of April’s National Insurance increase continues to be digested, the labour market has continued to weaken at a worryingly rapid pace. Unemployment rose to a 4-year high of 4.7% in the three months to May, while payrolled employment declined for the 8th month running, meaning that jobs have been lost in every single month since last October’s Budget.

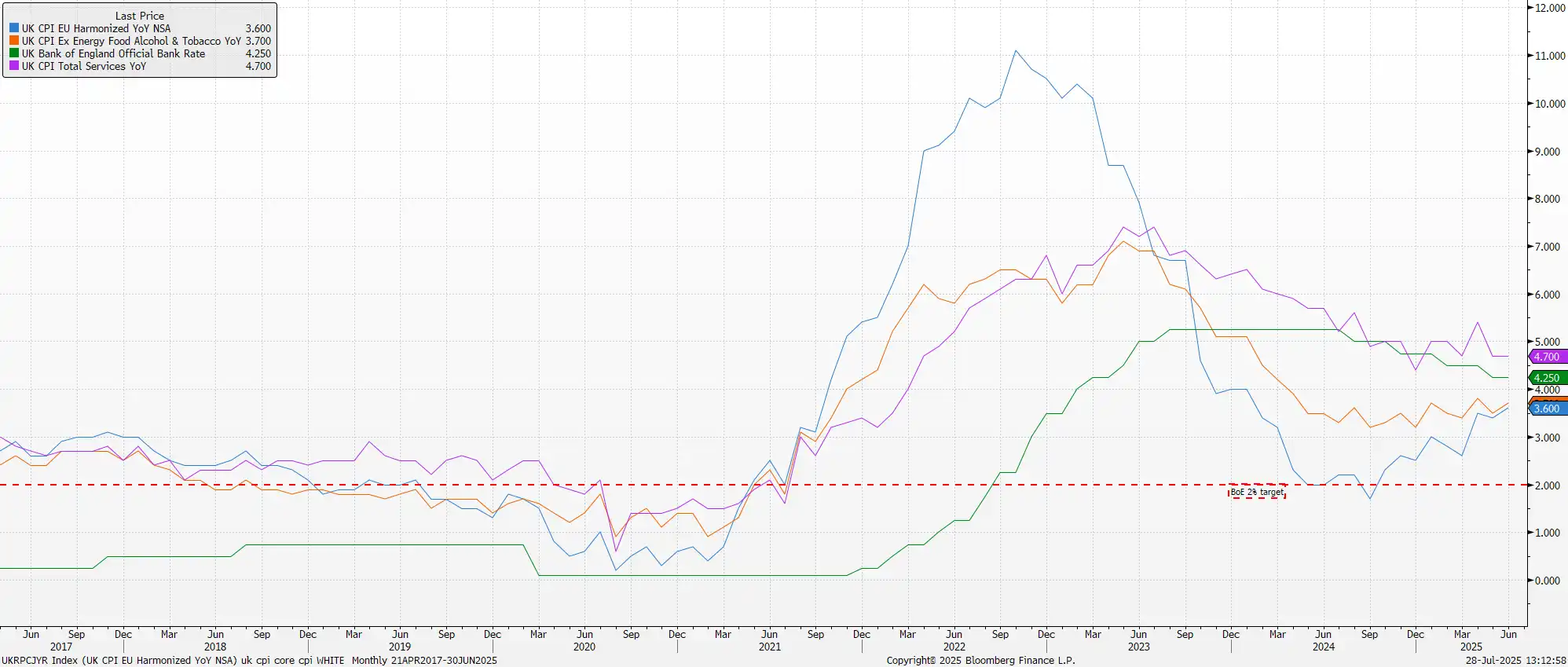

Meanwhile, the inflation outlook remains worrying. Headline CPI surprisingly rose to 3.6% YoY in June, the highest level since the start of 2024, dashing hopes that price pressures may have peaked for the year as a host of index-linked price hikes took effect in April.

Underlying inflation metrics also ticked higher, with core CPI rising to 3.7% YoY, and services CPI ticking to 4.7% YoY, both moving in the wrong direction, and both pointing to increased risks of persistent price pressures becoming embedded within the economy.

With all of this in mind, the Bank of England are highly unlikely to be able to embark on any form of dovish pivot at the August meeting, even if a 25bp Bank Rate cut remains the most likely outcome. That cut, however, will continue to be accompanied by guidance that a ʻgradual and careful’ approach is required when it comes to further policy easing.

It remains the case that the MPC would, in an ideal world, be seeking to ease policy more forcefully in order to prop up the ailing employment backdrop. While some policymakers may dissent in favour of a larger cut at the August meeting, the core of the Committee will likely still view a ʻslow and steady’ approach as appropriate.

Ordinarily, of course, a relatively more hawkish policy outlook would likely provide support to the currency in question. That, though, seems relatively unlikely in the GBP’s case right now, with a ʻtighter for longer’ policy stance likely to only worsen the ongoing activity slump, especially with risks continuing to tilt clearly and obviously to the downside, most notably as the prospect of further, significant, tax hikes this autumn looms large, not least after another record-wide deficit in the month of June.

EUR

The euro lost ground in July, dipping around 1% against the greenback, and pulling back under the 1.17 mark, in what will go down as the common currency’s first monthly loss of the year so far.

Interestingly, these losses came despite what, on the face of it, were a couple of developments that should’ve proved a positive for the currency.

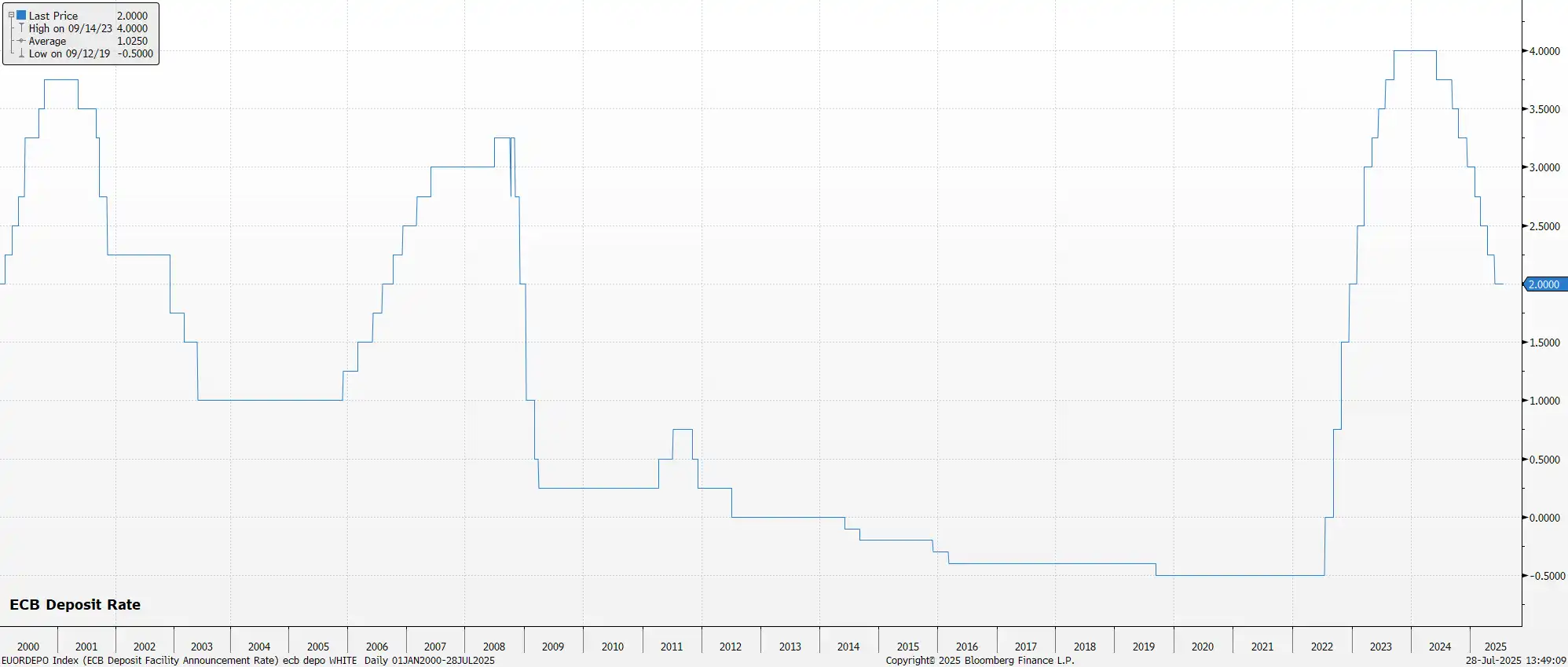

Firstly, the ECB held the deposit rate steady, at 2.00%, at the July confab and, although sticking to the ʻdata-dependent’ and ʻmeeting-by-meeting’ approach with which participants are now familiar, strongly hinted at the easing cycle now being at an end. Once more, President Lagarde stressed that policy is in a ʻgood place’, essentially confirming that policymakers see little-to-no need to embark on further rate reductions, even if current projections point towards a sustained undershoot of the 2% inflation target over the next 18 months or so.

Secondly, right at the end of the month, came news of a US-EU trade deal having been reached.

As part of the deal, the EU will open its markets to imports from the US and, in return, the US will levy a 15% tariff on imports from the bloc, including autos. Various other commitments were included too, such as the EU making $750bln in US energy purchases, and committing to orders for a significant amount of US military equipment.

While, on the face of it, a 15% tariff remains a sizeable levy, it is probably one that should be relatively straightforward for EU exporters to deal with, while also being quite clearly more advantageous than the 30%, or even 50%, tariffs that President Trump had previously threatened to impose.

As noted, though, despite this good news, the common currency has failed to gain significant ground. This raises the prospect that the EUR has already priced in most, if not all, of the ʻgood’ news that we’ve seen over the last month or so, which in turn raises the question of what other catalysts could provide a boost to the currency in the immediate-term.

Confirmation that the ECB easing cycle is over is an obvious one, though policymakers will likely attempt to retain as much flexibility on that front as possible for the time being, given the incredibly volatile nature of US trade policy. One could, hence, argue that geopolitical events, namely the ongoing war in Ukraine, coming to a peaceful resolution may be the next potential catalyst to provide a leg higher in the EUR, even if a move towards the $1.20 mark could prove somewhat problematic for the ECB from an inflationary perspective.

USD

The dollar enjoyed a solid July, rallying around 1.4% against a basket of peers, notching a first monthly gain of 2025 so far, though the dollar index (DXY) has failed to break above its 50-day moving average, which we’ve remained below since mid-February.

The greenback’s advance appeared to be more of a mechanically-driven rebound than anything else, especially with fundamental drivers on net tilting in a bearish direction. Still, the market appears to have finally wised-up to President Trump’s plans on the trade front, with the early-July letters outlining potential new tariff rates being greeted with little by way of significant reaction, and being interpreted as little more than a negotiating ploy.

A ploy which, incidentally, appears to have worked, with the US having now agreed deals with the EU, Japan, and others, while having also agreed an extension to the present trade truce with China. Perhaps, at the margin, this progress on trade is giving participants some degree of confidence to re-open USD longs, which had been closed out amid the ʻpeak uncertainty’ seen in Q2.

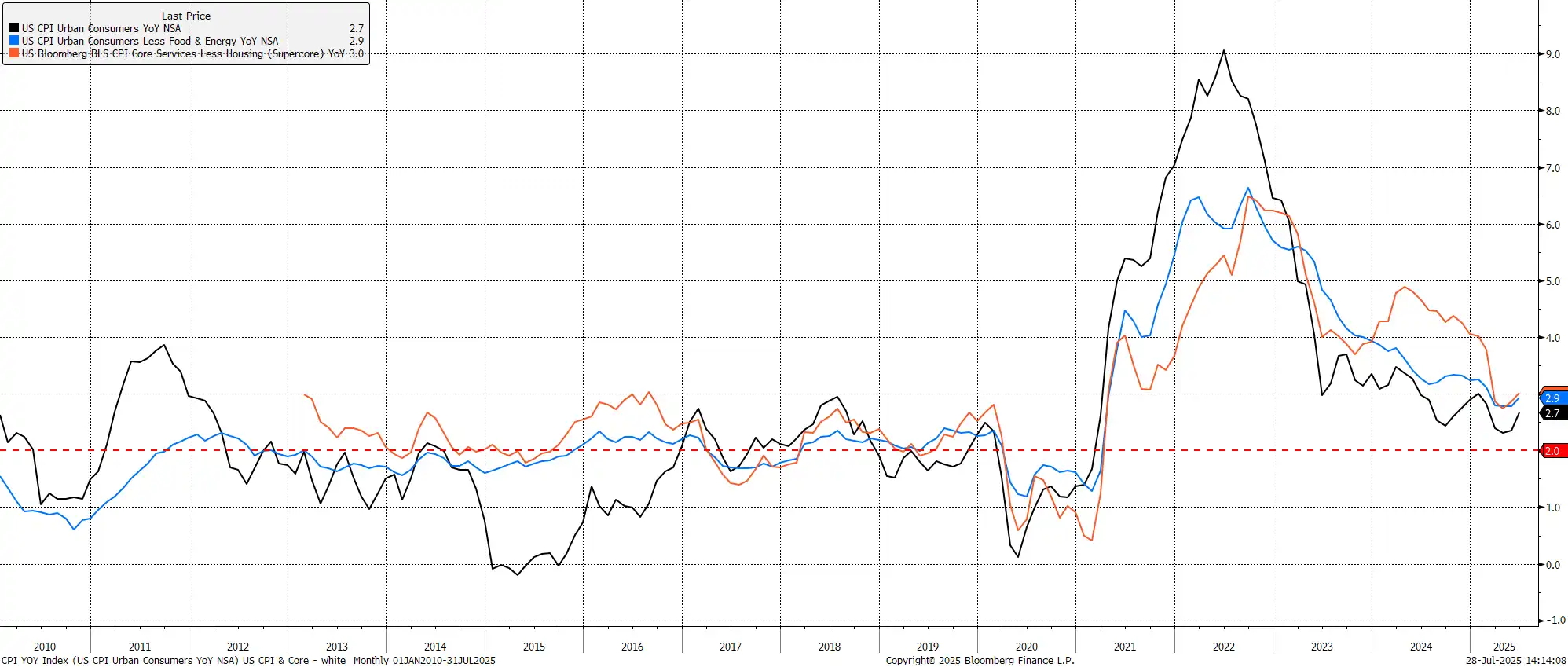

That said, the degree of economic uncertainty remains elevated, ensuring that the FOMC will continue to stick resolutely to their ʻwait and see’ policy stance for the time being. Such a stance remains warranted, particularly amid the risk that inflation expectations may become un-anchored, and with tariff-induced price pressures starting to emerge, as both headline and core CPI rose to their highest levels since February last month, and as core goods prices rose at their fastest rate in almost two years.

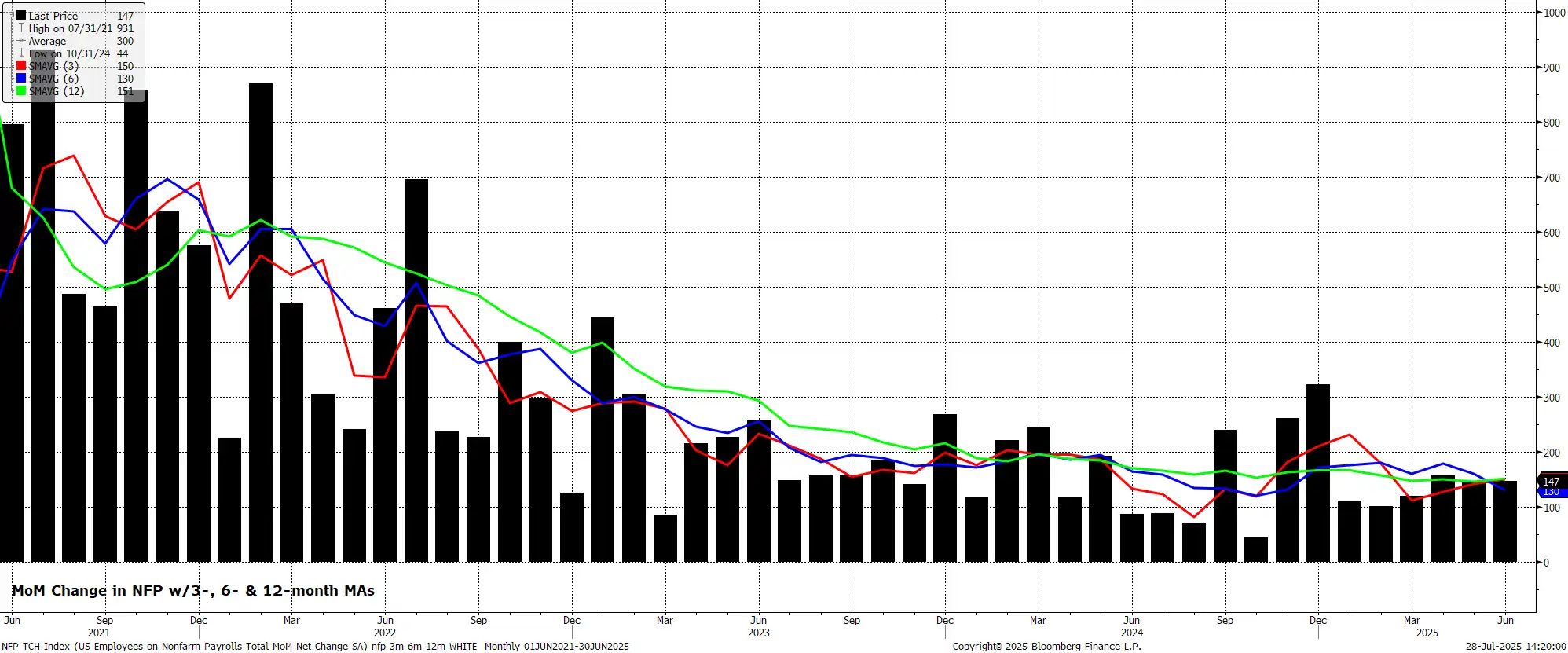

While GDP figures remain significantly skewed by the impacts of tariff front-running in the first quarter, other metrics point to the economy remaining solid, with retail sales growth solid, business investment picking up, and consumer confidence relatively upbeat. All of this, by and large, stems from the solid nature of the labour market, with unemployment having fallen to 4.1% in June, and with the 3-month average of job gains currently running at around double the breakeven pace.

All this seems relatively rosy, though risks clearly remain.

Chiefly, the trade situation remains highly fluid and uncertain, despite country-by-country trade deals being struck, with the Admin’s attention increasingly turning towards the issue of sectoral tariffs, which are likely to be much harder to negotiate away. Furthermore, the longer that tariffs remain in place, and uncertainty persists, the greater the chance that said uncertainty begins to pose a more significant headwind to the economy at large.

Secondly, there are President Trump’s continued attacks on the Federal Reserve, and the ongoing erosion of monetary policy independence. Said attacks, including Trump’s ongoing assertions that the target range for the fed funds rate should be as much as 3% below its current level, seem unlikely to stop any time soon, and are also likely to continue to spur USD outflows, as reserve allocators continue to shift away from the greenback.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.