GBP/USD slowly declined to near 1.3345 despite rising optimism around the upcoming US-UK trade agreement. Persistent market sentiment that the Bank of England (BoE) will lower the interest rate by 25 bps to 4.25% continues to bolster the pound. However, the recent release of UK economic data offered mixed signals, contributing to a cautious market mood amid persistent economic uncertainty, further influencing the pound. In April, the UK manufacturing sector encountered difficulties, with final PMI data confirming continued contraction. Export orders saw their most significant drop in almost five years, primarily due to increasing costs from US tariffs and rising domestic employer taxes. The S&P Global UK Manufacturing Purchasing Managers' Index (PMI) for April 2025 was finalised at 45.4, an upward revision from the initial estimate of 44.0 and slightly above the March figure of 44.9. The seasonally adjusted S&P Global UK Services PMI Business Activity Index dropped to 49.0 from 52.5 in March, reaching its lowest since January 2023. This decline indicates that business activity has decreased for the first time since October 2023. The headline S&P Global UK Construction Purchasing Managers’ Index, a seasonally adjusted indicator of total industry activity, registered at 46.6 in April, showing a slight increase from 46.4 in March. This marks the fourth consecutive month of decreased construction activity.

On the other hand, the greenback gains from the cautious market sentiment ahead of the Federal Reserve’s (Fed) interest rate decision. The market anticipates the Fed keeping its benchmark rate steady at 4.25–4.50% for the third consecutive meeting in May 2025, reflecting the central bank’s balanced policy stance following cooling inflation with a strong labour market and growing uncertainty surrounding US trade policy. On the global front, US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are scheduled to meet Chinese Vice Premier He Lifeng in Geneva, which may provoke international trade tensions, directing the safe-haven asset flow, and increased demand for the US dollar. The Trade Balance was $-140 billion higher than expected, totalling $-137 billion, and surpassed February’s figure of $-123.2 billion. Imports reached $419 billion, with consumer goods, particularly pharmaceuticals, significantly contributing to the increase. Exports saw a slight rise to $278.5 billion.

Broader market sentiment around both the Bank of England (BoE) and the Federal Reserve’s (Fed) interest rate decision will drive the GBP/USD exchange rate.

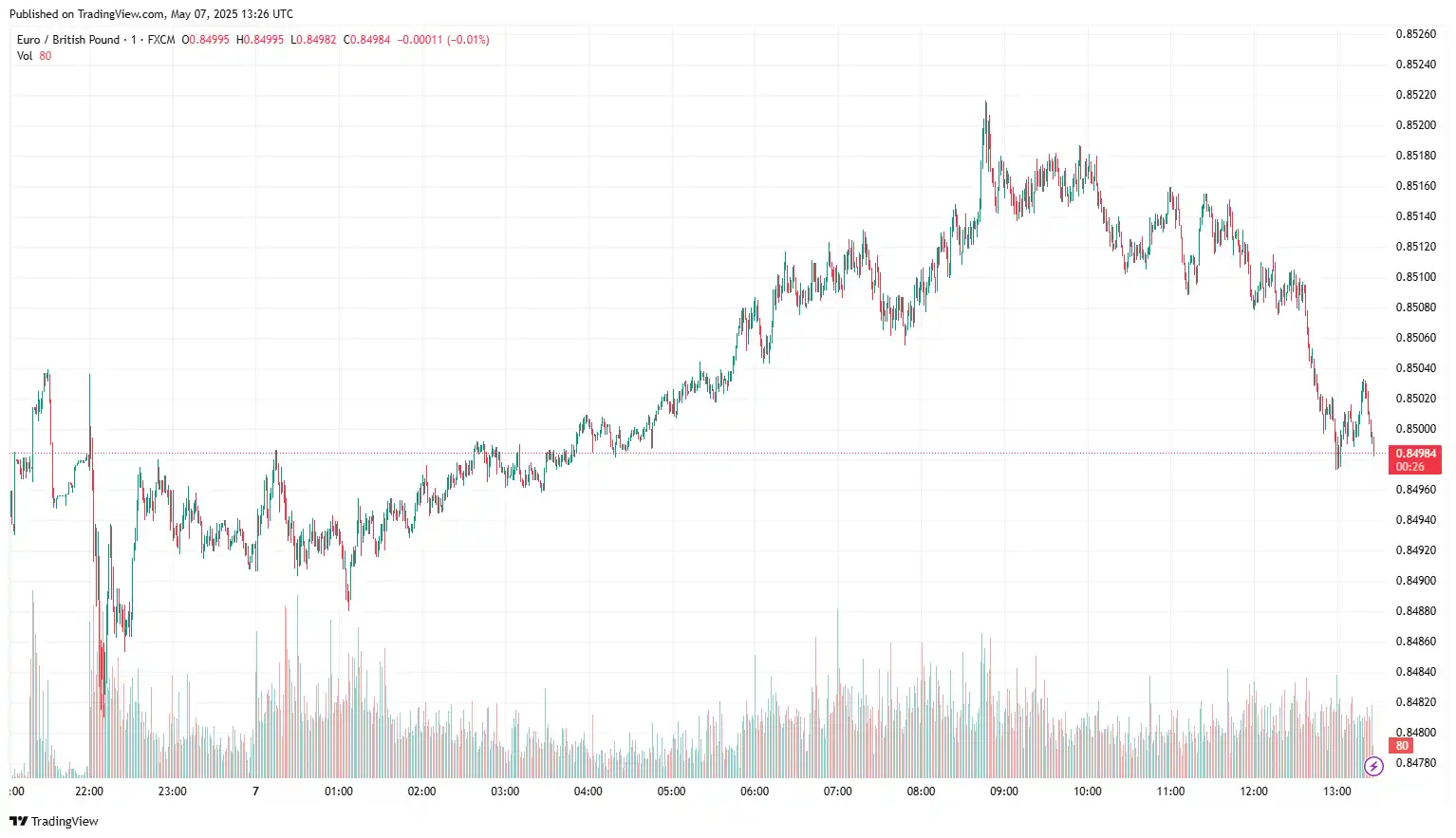

EUR/GBP Gains Ahead of the BoE Interest Rate Decision

EUR/GBP edged higher to 0.8515, driven by rising optimism surrounding the upcoming US-UK trade agreement, alongside persistent market sentiment that the Bank of England (BoE) will lower the interest rate by 25 bps to 4.25%, which continues to bolster the pound. However, the recent release of UK economic data presented mixed signals, contributing to a cautious market mood amidst ongoing economic uncertainty, which further influences the pound. In April, the UK manufacturing sector faced challenges, with final PMI data confirming continued contraction. Export orders experienced their most significant decline in almost five years, primarily due to increasing costs from US tariffs and rising domestic employer taxes. The headline S&P Global UK Construction Purchasing Managers’ Index, a seasonally adjusted indicator of total industry activity, recorded at 46.6 in April, representing a slight increase from 46.4 in March. This marks the fourth consecutive month of declining construction activity.

On the euro’s front, robust Eurozone data and the swearing-in of Conservative leader Friedrich Merz as Germany’s next Chancellor continue to support the euro. Eurozone Retail Sales rose by 1.5% year-over-year in March, following a revised growth of 1.9% in February, as reported by Eurostat on Wednesday. Analysts had projected a 1.6% increase. However, Retail Sales on a monthly basis dipped 0.1% in the same period, a drop from February’s revised +0.2%, and fell short of the forecast of 0%. Meanwhile, Germany's Federal Statistics Office disclosed that Factory Orders surged more than anticipated in March, indicating strengthening in the manufacturing sector. Orders for goods labelled ‘Made in Germany’ increased by 3.6% in March after showing no growth in February, surpassing the estimated rise of 1.3%. Year-over-year, Germany’s Industrial Orders advanced by 3.8% in March, bouncing back from a previous drop of 0.2%. In contrast, the German Final Services PMI edged down to 48.8 in April from 49.0 in March, reflecting slight contraction and economic challenges. Additionally, the seasonally adjusted HCOB Eurozone Composite PMI Output Index decreased from 50.9 in March to 50.4, signalling more modest growth in business activity for the month.

Investors will pay close attention to the BoE’s guidance on monetary policy and the German Trade Balance for further insights on the EUR/GBP exchange rate.

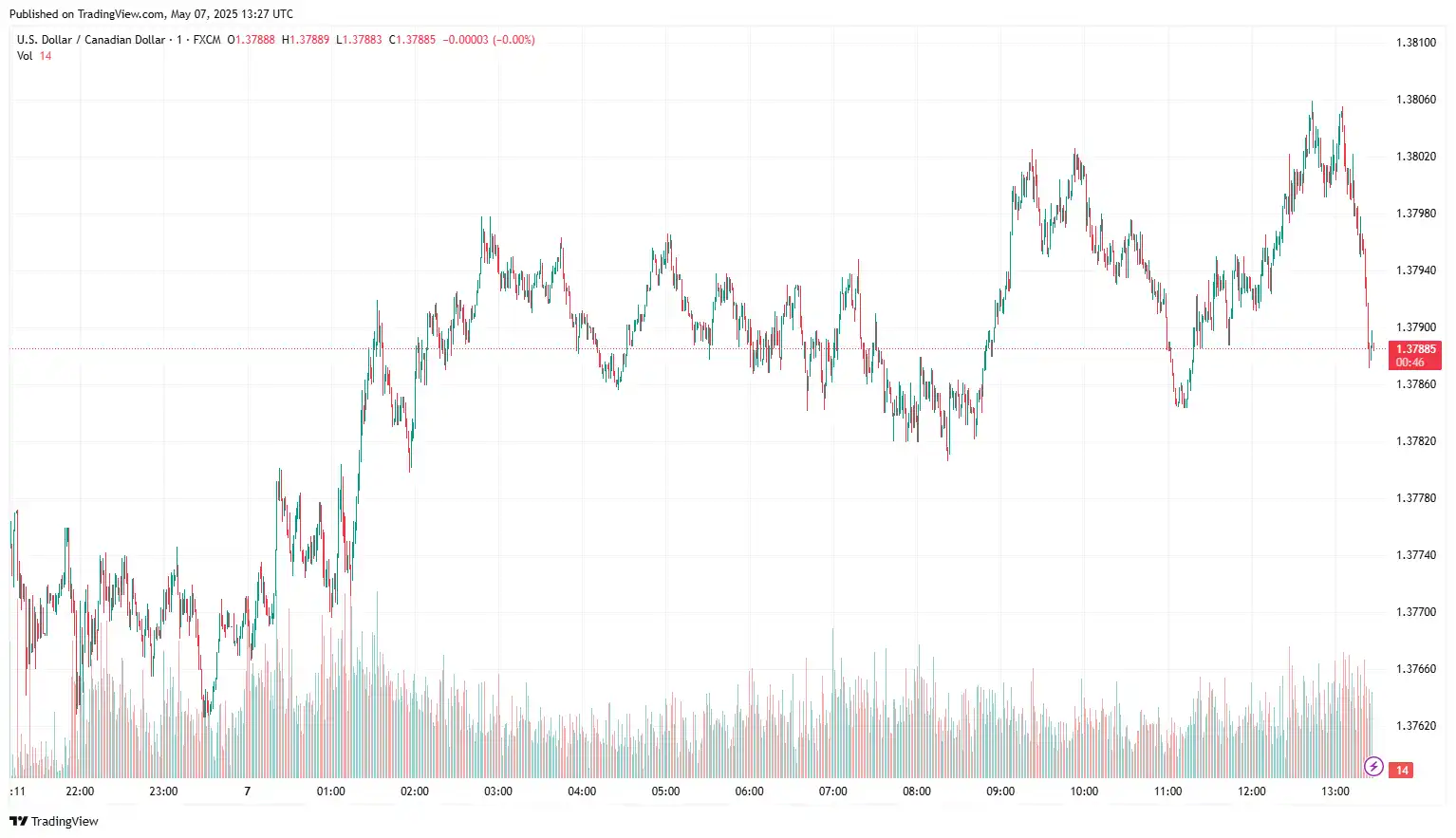

USD/CAD Struggles Ahead of Fed Decision

USD/CAD hovered near 1.3786, as investors maintained their cautious market sentiment ahead of the Fed interest rate decision. Although the market expects the Fed to maintain a stable interest rate after the positive US jobs report and stronger-than-expected US ISM Services PMI figures, comments from Fed Chair Jerome Powell at the post-meeting press conference may influence the greenback's value. US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are set to meet with Chinese Vice Premier He Lifeng in Geneva this weekend. This meeting marks the first significant dialogue since the escalation of US-imposed tariffs heightened global trade tensions. China's Ministry of Commerce confirmed its participation after reviewing US proposals, considering national interests, global sentiment, and input from domestic industries.

On the data front, the US Commerce Department revealed that the Balance of Trade was $-140 billion higher than expected, totalling $-137 billion, and exceeded February’s $-123.2 billion figure. Imports amounted to $419 billion, with consumer goods, especially pharmaceuticals, contributing significantly to the increase. Exports experienced a slight uptick to $278.5 billion. In April, the US services sector saw a boost in economic activity, with the ISM Services PMI increasing to 51.6 from March's 50.8 and exceeding analysts' forecasts of 50.6. The survey also revealed that the Prices Paid Index, an important measure of inflation, rose to 65.1 from 60.9, while the Employment Index improved to 49.0 from 46.2, suggesting better labour market conditions in the service industry.

On the other hand, the Canadian Dollar (CAD) found ground following the joint press conference between Canadian Prime Minister Mark Carney and United States (US) President Donald Trump. Carney subsequently conducted a solo briefing, emphasising the constructive tone of the initial US-Canada trade discussions. "The talks were constructive," Carney stated. "President Trump and I reached an agreement to continue discussions in the upcoming weeks, culminating in a follow-up meeting at the G7. Although no decisions regarding tariffs were made today, both parties are dedicated to progressing. On the data front, seasonally adjusted Ivey PMI for April fell sharply below expectations, dropping to 48.0 against a forecast of 51.2, signalling deteriorating business sentiment.

Investors will pay attention to the Federal Reserve’s (Fed) monetary policy decision and Fed Chair Jerome Powell’s press conference for fresh impetus to the USD/CAD exchange rate.

NZD/USD Weakened Amid Improved Risk Appetite

NZD/USD fluctuated near 0.6002 amid intensified risk aversion as global investors responded to elevated geopolitical uncertainty, including tensions in the Middle East, renewed trade frictions, and shifting global central bank dynamics that continue to influence market mood. US President Donald Trump held a joint press conference with Canadian Prime Minister Mark Carney, de- emphasising the need to renegotiate USMCA while instead focusing on broader trade priorities. Trump’s comments regarding China’s economic struggles, along with his administration’s active negotiations with 17 trading partners, contributed to market unease. China’s Ministry of Commerce announced that, after a thorough assessment of US proposals and consideration of global expectations, national interests, and industry input, Beijing has decided to participate in the forthcoming negotiations. On Wednesday, the head of the China Securities Regulatory Commission (CSRC) stated that “US tariff policy has brought great pressure to China's capital markets.” The US Commerce Department announced that the Balance of Trade was $-140 billion higher than anticipated, reaching a total of $-137 billion, surpassing February’s $-123.2 billion figure. Imports accounted for $419 billion, with consumer goods, particularly pharmaceuticals, playing a significant role in this increase. Exports saw a modest rise to $278.5 billion.

On the other hand, improved market sentiment following the declaration of US-China trade talks in Switzerland, coupled with better-than-expected labour market statistics from New Zealand, supports the New Zealand Dollar (NZD). Employment rose by 0.1% from the previous quarter, meeting forecasts and showing a slight rebound from the prior quarter's 0.1% drop. The unemployment rate held steady at 5.1%, in line with the last quarter and below the expected 5.3%. Wage inflation decreased to 0.4% quarter-on-quarter, down from 0.6% previously, indicating a reduction in wage pressures. The recent RBNZ Financial Stability Report pointed out heightened risks to financial stability stemming from global economic fluctuations and tariffs imposed by the U.S. Nevertheless, the RBNZ emphasised that New Zealand's financial institutions are adequately capitalised and equipped to bolster the economy.

The Federal Reserve (Fed) interest rate decision and Fed Chair Jerome Powell's remarks at the post-meeting press conference will influence the NZD/USD pair in today's session.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.