Sterling stabilised against the US Dollar, trading near 1.2623, as market sentiment turned cautious due to US President Trump's tariff agenda. During a joint press conference with French President Emmanuel Macron, Trump commented, "The tariffs are going forward on time, on schedule," fuelling fears of a global trade war. Additionally, disappointing US economic data, including Jobless Claims and the S&P Global Purchasing Managers' Index (PMI), weighed on the greenback. S&P Global's Composite PMI dropped to 50.4 in February, down from 52.7. Conversely, the Manufacturing PMI rose from 51.2 in January to 51.6 in February, exceeding the forecast of 51.5. Meanwhile, the Services PMI declined from 52.9 in January to 49.7 in February, falling short of the anticipated 53.0. The University of Michigan Consumer Sentiment Index decreased to 64.7, below the expected 67.8 and the prior reading. Additionally, 5-year Consumer Inflation Expectations increased to 3.5%, surpassing the consensus of 3.3% and the previous figure.

On the sterling front, the Bank of England's (BoE) gloomy outlook and key policymakers' comments added volatility to the currency. Recent economic data has led to mixed signals, favouring a cautious stance by the markets.

Retail Sales, a vital gauge of consumer spending, increased by 1.7% in January after a revised 0.6% decline in December, adjusted from an initial -0.3%. Economists expected a modest rise of 0.3%. Year-over-year, Retail Sales grew by 1%, above the 0.6% forecast but below the 2.8% increase from the previous year. The S&P Global/CIPS UK Manufacturing PMI fell to 46.4 in February from 48.3 in January, missing the forecast of 48.4. Conversely, the Preliminary UK Services Business Activity Index rose to 51.1 in February, surpassing January's 50.9 and the estimated 50.8.

On the policy front, BoE Monetary Policy Committee (MPC) member Swati Dhingra advocated for a swift monetary expansion cycle due to the weak demand environment in her speech at Birkbeck on Monday. "I know 'gradual' has been interpreted in the media as 25 basis points (bps) per quarter, but cutting interest rates at this pace for the remainder of 2025 would still leave monetary policy in an undesirable restrictive position at the end of the year," Dhingra stated. She also warned that "consumption weakness is not going away," which is why she favours reducing the level of monetary policy restriction.

In today's session, broader market sentiment around the Richmond Manufacturing Index and CBI Realised Sales will drive the GBP/USD exchange rate.

EUR/CAD Rebounds Despite Tariff Concerns

EUR/CAD recovered to near 1.4925, as an escalation in crude oil prices undermined the commodity-linked Loonie. The recent hotter-than-expected CPI report reinforced speculation that the Bank of Canada (BoC) will reduce the policy rate again at its next monetary policy meeting on March 12, adding pressure to the currency. The Consumer Price Index (CPI), which measures the cost of everyday goods and services, increased by 1.9% from December's 1.8%, which aligns with forecasts by analysts. On a month-to-month basis, prices went up by 0.1%, bouncing back from a 0.4% decrease in December. In contrast, the Bank of Canada's Core CPI, which omits fluctuating categories like food and energy, showcased more strength. It rose to 2.1% year-over-year in January 2025, compared to 1.8% the month before, and noted a monthly increase of 0.4%, reversing a 0.3% drop in December.

On the geopolitical front, Trump indicated on Monday that tariffs on imports from Canada and Mexico are still planned for March 4 and that reciprocal tariffs on other nations will proceed as scheduled. However, uncertainty persisted as Canada and Mexico ramped up negotiations to prevent 25% tariffs on exports to the US. They aimed to convince President Trump's administration that their enhanced border security and measures against fentanyl trafficking are adequate, especially as the March 4 deadline approaches.

On the other hand, sluggish growth in the Eurozone, coupled with rising expectations that the European Central Bank (ECB) will introduce further interest rate cuts, undermines the euro. On the economic front, the HCOB Manufacturing PMI in Germany rose to 46.1 in February from 45, exceeding the 45.5 forecast and marking a two-year high. In contrast, the Services PMI fell to 52.2 in February from 52.5 in January, missing expectations and hitting a two-month low. Monday's German IFO data for February came in weaker than expected. The IFO Business Climate, which assesses current conditions and business expectations, registered at 85.2, the same as January and below estimates of 85.8. Conversely, IFO Expectations—which evaluates current conditions and business expectations for the next six months—improved to 85.4, surpassing forecasts of 85.2 and the previous reading of 84.3. Germany's economy fell 0.2% quarter-on-quarter in Q4 2024, matching preliminary estimates after a 0.1% gain previously. This decline was mainly due to net trade, with a 2.2% drop in exports and a 0.5% rise in imports. Annually, the economy also contracted by 0.2% in Q4, aligning with forecasts and marking the sixth consecutive quarter of decline.

Moreover, the German federal election results have introduced additional weakness in the euro due to any single party's lack of a clear majority, which threatens to hinder growth in an already fragile economy. Preliminary results indicated that the conservative Christian Democratic Union (CDU), led by chancellor candidate Friedrich Merz, in coalition with its partner, the Christian Social Union (CSU), achieved victory in the election. Investors will closely monitor how the conservative Christian Democrats could establish a coalition government to bolster the struggling economy.

Without significant economic data from the Loonie, the German Final GDP, any development in crude oil prices, and renewed tariff fears will drive the EUR/CAD exchange rate.

GBP/JPY Sinks on Tumbling JGB Yields

GBP/JPY hovers near 188.80, following the abrupt decline in Japanese government bond (JGB) yields and the release of Japan's Services Producer Price Index (PPI). The SPPI figures rose 3.1% YoY in January, up from the previous 3.0% and aligning with the market anticipation, fuelling bets that the Bank of Japan (BoJ) will hike interest rates further. Friday's hotter-than-expected Japan's National Consumer Price Index (CPI) inflation data showed an increase of 4.0% year-on-year (YoY) in January, a growth from the previous 3.6%, as the Japan Statistics Bureau reported. However, US President Trump is attempting to provoke a global trade war with threats of high tariffs on Canada and Mexico, warning that these tariffs are still anticipated to take effect "next month," which could steer market volatility by adding safe-haven flows for the yen.

On the other hand, the Pound remains muted as speeches by key BoE policy members failed to shift market sentiment. BoE Monetary Policy Committee (MPC) member Swati Dhingra advocated for a swift monetary expansion in her speech at Birkbeck on Monday, citing weak demand conditions. "While 'gradual' has been interpreted as 25 basis points (bps) per quarter, continuing this pace for the rest of 2025 would still leave monetary policy overly restrictive by year-end," Dhingra explained. She also emphasised that "consumption weakness is not dissipating," which is why she supports reducing monetary policy restrictions.

Amid a lack of significant UK economic releases, Bank of England (BoE) Chief Economist Huw Pill's speech could provide fresh direction to the policy stance and GBP/JPY exchange rate.

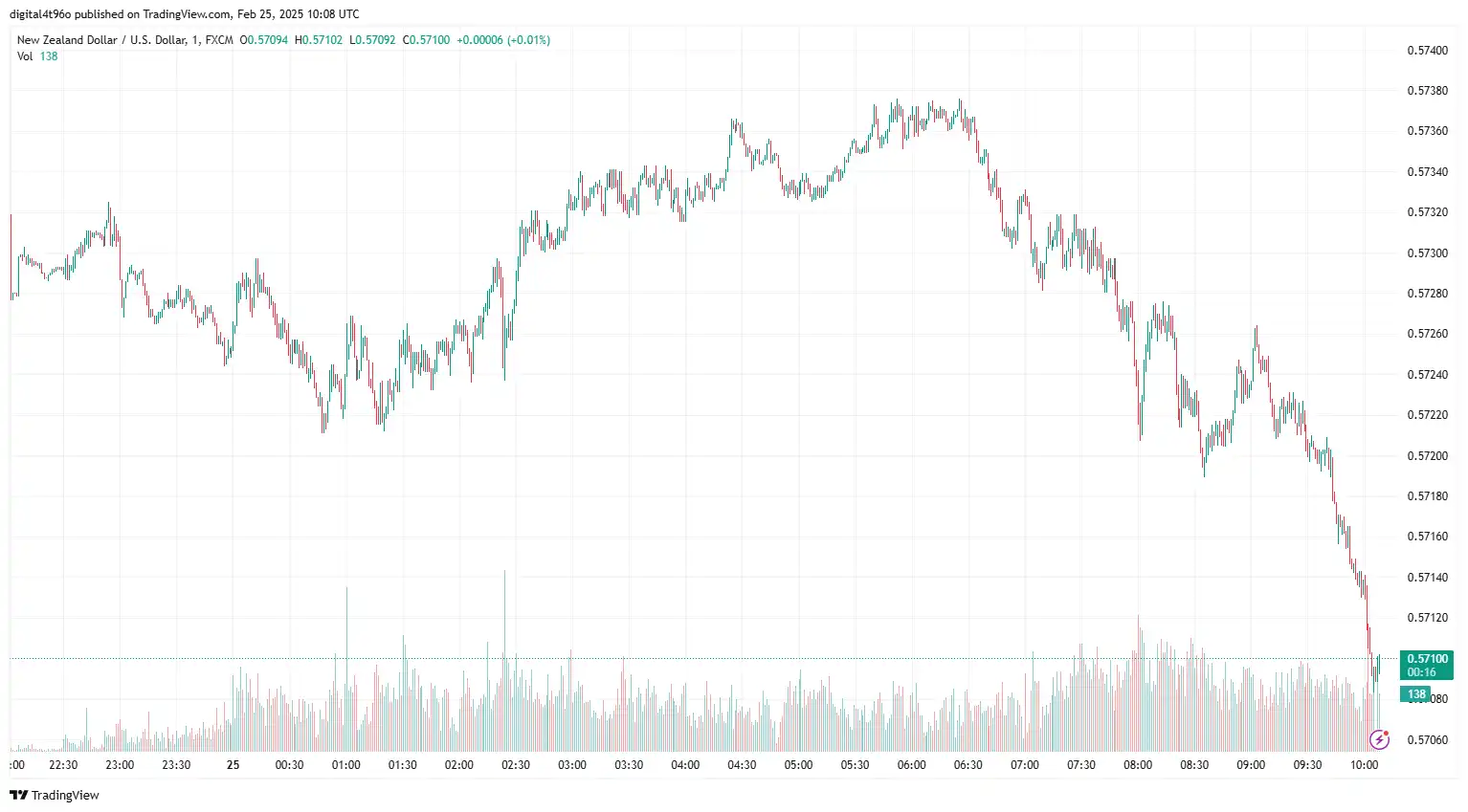

NZD/USD Declined as Risk Appetite Fades

NZD/USD is trading at approximately 0.5748, following the Chinese government's announcement of its 2025 annual policy statement, which emphasises rural reforms aimed at revitalising the agricultural sector and boosting food security amidst US tariffs, economic slowdowns, and climate change. On Tuesday, the People's Bank of China (PBOC) injected CNY300 billion through the one-year Medium-term Lending Facility (MLF), keeping the interest rate steady at 2%. Furthermore, the bank provided CNY318.5 billion via seven-day reverse repos, maintaining the previous rate of 1.50%.

Although China's stimulus plans benefit the Kiwi, domestic Trade Balance data and the Reserve Bank of New Zealand's (RBNZ) position may challenge the currency. In January 2025, New Zealand experienced a trade deficit of NZD 486 million, contrasting with a revised surplus of NZD 94 million from December. Goods exports fell to NZD 6.19 billion from NZD 6.67 billion, while imports rose to NZD 6.8 billion from NZD 6.62 billion. Furthermore, the Reserve Bank of New Zealand (RBNZ) recently captured attention by reducing the Official Cash Rate (OCR) by 50 basis points, moving from 4.25% to 3.75%.

Additionally, the monetary policy meeting minutes suggested potential further policy easing. In a subsequent press conference, RBNZ Governor Adrian Orr mentioned that the expected trajectory of the OCR includes an additional decrease of 50 basis points by mid-year, likely in July, occurring in two increments of 25 basis points each. New Zealand saw retail sales grow by 0.9% in the December 2024 quarter, compared to a revised growth of 0.0% in the September 2024 quarter. Core retail sales increased by 1.4% in December 2024, while a revised 0.8% decline was noted for September 2024. Retail sales reached NZD 25.9 billion, up from NZD 25.7 billion, with ten sectors reporting increased sales volumes.

The US dollar faces headwinds from disappointing economic data; however, concerns over US President Donald Trump's tariff plans could support the greenback. Investors will pay attention to the US Durable Goods Orders and the January Personal Consumption Expenditures Price Index (PCE) for fresh insights into the NZD/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.