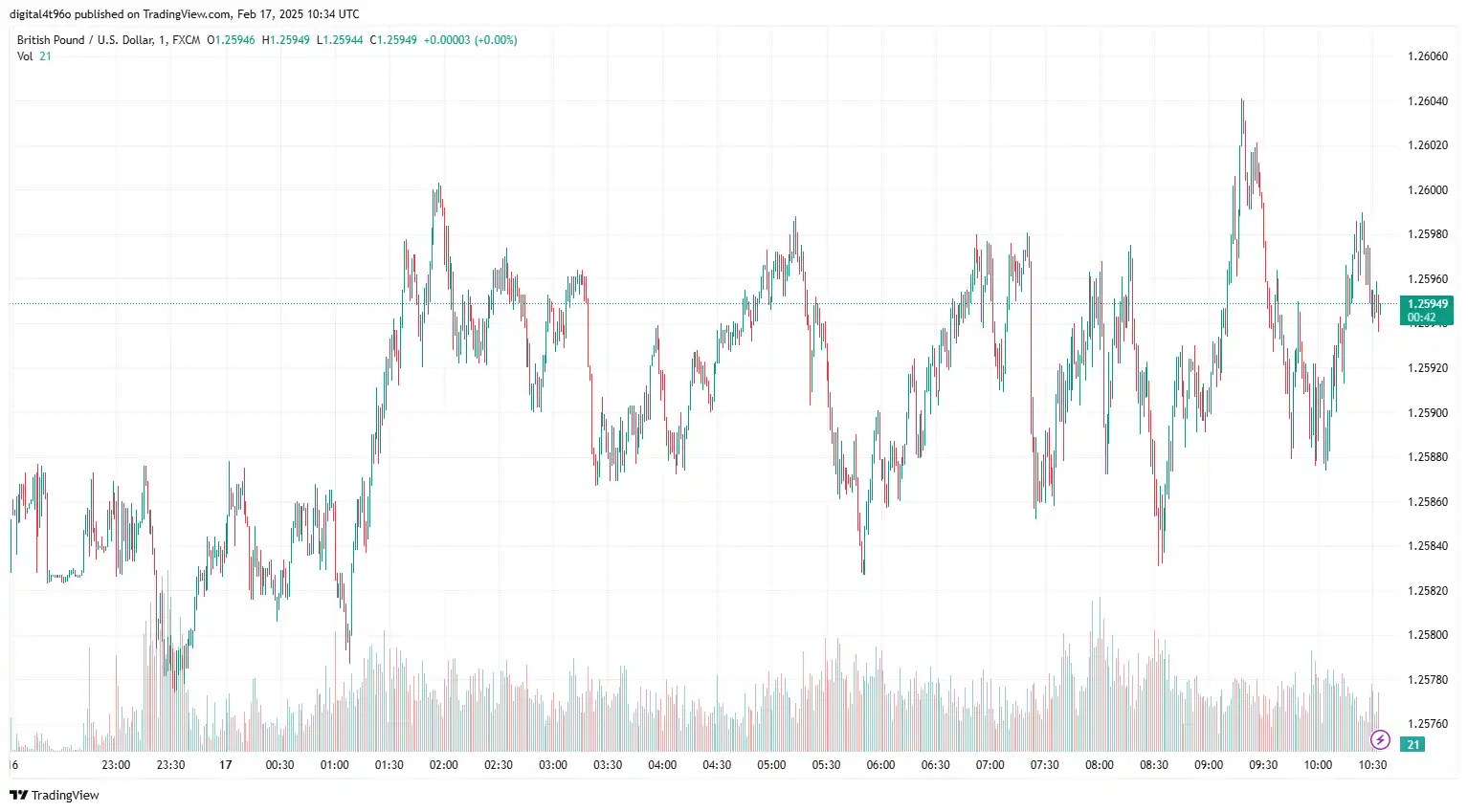

GBP/USD recovered to near 1.2596, as weaker US Retail Sales data caused fluctuations in the US dollar. Retail Sales fell 0.9% in January after a revised 0.7% increase in December, missing the expected 0.1% decline. On a year-over-year basis, Retail Sales increased by 4.2%. Industrial production rose by 0.5% MoM in January, slightly below December's 1% but above the expected 0.3%. January Import/Export data showed the Export Price Index increased to 1.3%, surpassing the 0.3% forecast. Conversely, the Import Price Index recorded 0.3%, falling short of the expected 0.4%, but was revised up from December's 0.2%. US core PPI inflation rose to 3.6% YoY in January, exceeding the anticipated 3.3% but slightly below the revised 3.7%.

Wednesday's US CPI increased by 3.0% YoY in January, surpassing expectations of 2.9%. Core CPI, excluding food and energy, rose to 3.3% from 3.2%, exceeding the forecast of 3.1%. On a monthly basis, headline inflation jumped to 0.5% in January from 0.4% in December, while core CPI increased to 0.4% from 0.2%. Rising market expectations that the Federal Reserve (Fed) will maintain its hawkish stance and keep interest rates unchanged could further support the greenback.

The UK economy expanded by 1.4% YoY in Q4 2024, exceeding market expectations of 1.1% and accelerating from the revised 1.0% in the previous quarter. This marks the strongest GDP growth since Q4 2022. Yearly, the British economy grew by 0.9%, up from 0.4% in 2023, driven by a 1.3% rise in the services sector. Upcoming labour market data and inflation figures are expected to influence market expectations regarding the Bank of England's (BoE) monetary policy stance.

In the upcoming sessions, aside from the latest FOMC meeting minutes, US housing data, and S&P Flash PMIs, the UK economic docket, including BoE Governor Bailey's speech, jobs data, the latest inflation report, and Retail Sales data, will significantly influence the GBP/USD exchange rate.

EUR/GBP Plummets on Dovish Market Sentiment Surrounding the ECB

EUR/GBP weakened to 0.8319 as key European Central Bank (ECB) officials signalled that the central bank may lower its Deposit Facility rate three more times this year. Recent comments from ECB policymaker Boris Vujčić reinforced market expectations of further policy easing, while signs of potential trade conflicts between Europe and the US added pressure to the euro. US President Donald Trump unveiled a plan to impose reciprocal tariffs on countries that levy duties on US imports.

Eurostat's second estimate showed the Eurozone's economy grew by 0.1% in Q4 2024, exceeding the initial reading of 0%. The Eurozone's GDP increased by 0.9% YoY, matching the initial estimate and market expectations. Additionally, Eurozone Employment Change for Q4 showed a 0.1% QoQ increase and a 0.6% rise YoY. Reports suggest that a ceasefire in Ukraine could potentially support the euro if gas supplies are resumed. US President Donald Trump and Russian President Vladimir Putin are reportedly negotiating to end the conflict, with US officials scheduled to meet Russian counterparts in Saudi Arabia for talks.

On the Pound front, the UK economy grew by 1.4% YoY in Q4 2024, surpassing expectations of 1.1%, marking the fastest growth since Q4 2022. Yearly GDP expanded by 0.9%, up from 0.4% in 2023, driven by a 1.3% rise in the services sector. Investors are focusing on UK labour market data to assess the potential impact of Chancellor Rachel Reeves's National Insurance hike. The ILO Unemployment Rate is expected to rise to 4.5% from 4.4% in December. Weak employment conditions and elevated inflation expectations could impact market sentiment around the BoE's policy stance.

In the upcoming session, UK Retail Sales data for January and the Consumer Price Index (CPI) for both regions will drive the EUR/GBP exchange rate.

NZD/USD Buoyed Following Postponement of Trump's Reciprocal Tariffs

NZD/USD edged higher near 0.5735 as disappointing US Retail Sales data weighed on the US dollar. Retail sales dropped 0.9% in January, following a revised 0.7% growth in December, missing the expected 0.1% decline. However, year-over-year, retail sales increased by 4.2%. Trump's decision to delay the implementation of reciprocal tariffs and speculation that the Federal Reserve (Fed) may cut interest rates later this year boosted market sentiment, supporting the US dollar.

The recent price index reflected a rise, reinforcing expectations that the Federal Reserve (Fed) may hold the current interest rate until the second half of the year. The US Consumer Price Index (CPI) rose by 3.0% YoY in January, surpassing expectations of 2.9%. Core CPI, excluding food and energy, increased to 3.3% from 3.2%, above the forecast of 3.1%. Monthly, headline inflation jumped to 0.5% in January from 0.4% in December, and core CPI rose to 0.4% from 0.2%. Core PPI inflation in the US reached 3.6% YoY in January, exceeding the expected 3.3% but slightly below the revised 3.7%.

The likelihood that the Reserve Bank of New Zealand (RBNZ) will lower interest rates by 50 basis points to 3.75% in Wednesday's meeting continues to weigh on the Kiwi. In January, the Business NZ Performance of Services Index (PSI) rose to 50.4, up from a revised 48.1 in December, signalling a modest recovery in the services sector after ten months of decline. The Business NZ Manufacturing Index increased to 51.4 from the prior 46.2.

With US markets closed for Presidents' Day, NZD/USD will be influenced by broader market sentiment regarding geopolitical developments today.

USD/CAD Struggles Ahead of Canadian CPI Data

USD/CAD hovered near 1.4189 as a decline in crude oil prices due to hopes for a peace deal between Russia and Ukraine weighed on the commodity-linked Loonie. A potential end to sanctions against Russia could alleviate global supply disruptions. However, market sentiment that the Bank of Canada (BoC) will maintain the same interest rate may limit the Canadian Dollar's downside. Wednesday's BoC Meeting Minutes highlighted concerns over trade tariffs from the United States, a key risk to future policy guidance. Despite concerns over renewed inflation driven by retaliatory tariffs between the US and Canada, the BoC is considering a pre-emptive rate cut to support economic activity.

On the greenback front, weaker-than-expected US Retail Sales and Trump's proposal for reciprocal tariffs contributed to the downside of the currency.

Retail sales fell 0.9% in January, following a revised 0.7% growth in December, missing the expected 0.1% decline. However, year-over-year, retail sales rose by 4.2%. US CPI increased by 3.0% YoY in January, surpassing the 2.9% forecast. Core CPI rose to 3.3%, above the expected 3.1%. Monthly, headline inflation jumped to 0.5%, while core CPI rose to 0.4%. Core PPI inflation reached 3.6%, exceeding expectations of 3.3%. Recently, Federal Reserve (Fed) Chair Jerome Powell suggested that Fed officials adopt a cautious approach to further interest rate decisions, saying, "We can maintain policy restraint for longer if the economy remains strong and inflation does not move toward 2%," creating market volatility.

In the upcoming sessions, the Consumer Price Index (CPI) numbers for both regions, along with crude oil price dynamics and any significant developments in Trump's policies, will drive the USD/CAD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.