GBP/USD rebounded to around 1.3366, driven by renewed pressure on the US Dollar (USD) after Moody's Investors Service downgraded the US credit rating from Aaa to Aa1. The agency cited escalating debt levels and growing interest payment burdens as key concerns. This downgrade follows similar actions by Fitch Ratings in 2023 and Standard & Poor's in 2011. Moody's now projects that US federal debt will reach roughly 134% of GDP by 2035, up from 98% in 2023. Additionally, the federal deficit is expected to expand to nearly 9% of GDP due to rising debt-servicing costs, increased entitlement spending, and declining tax revenues.

The University of Michigan's Consumer Sentiment Index fell sharply to 50.8 in May from 52.2 in April, marking the lowest level since June 2022 and the fifth consecutive monthly decline. Analysts had forecast a rise to 53.4. The gauge of Current Conditions eased to 57.6 from 59.8, while the Consumer Expectations component decreased from 47.3 to 46.5, indicating growing concern about the economic outlook. Inflation expectations, meanwhile, have moved higher. The one-year forecast rose to 7.3% from 6.5%, while the five-year outlook increased to 4.6% from 4.4%, suggesting consumers are becoming more wary of price pressures. On Friday, Atlanta Federal Reserve President Raphael Bostic said he expects only one rate cut this year due to ongoing uncertainties. He mentioned, "This year, economic growth could be around 1% or 0.5%. Although I anticipate slower growth, I don't foresee a recession. We may need to combat inflationary pressures due to tariffs. The US-China de-escalation slightly alters my perspective."

Sterling gained ground ahead of Monday's European Union (EU)-United Kingdom (UK) trade summit in London. Recent stronger-than-expected UK GDP data has indicated robust economic growth, strengthening expectations that the Bank of England (BoE) may uphold its current interest rate stance should inflation remain persistent or accelerate further, thus further supporting the pound. The UK GDP rose 1.3% year-over-year in Q1 2025, surpassing the expected 1.2% but lower than 1.5% growth in Q4 2024. Monthly UK GDP was 0.2% in March, down from 0.5% in February, exceeding the anticipated 0%. The Index of Services for March recorded a 0.7% three-month-on-three-month change, up from 0.6%. Industrial and Manufacturing Production fell by 0.7% and 0.8%, respectively, in March, both missing market expectations. Preliminary Total Business Investment for January to March surged by 5.9%.

In today's session, speeches by influential FOMC members and the EU-UK trade summit will shape market anticipations around the GBP/USD exchange rate.

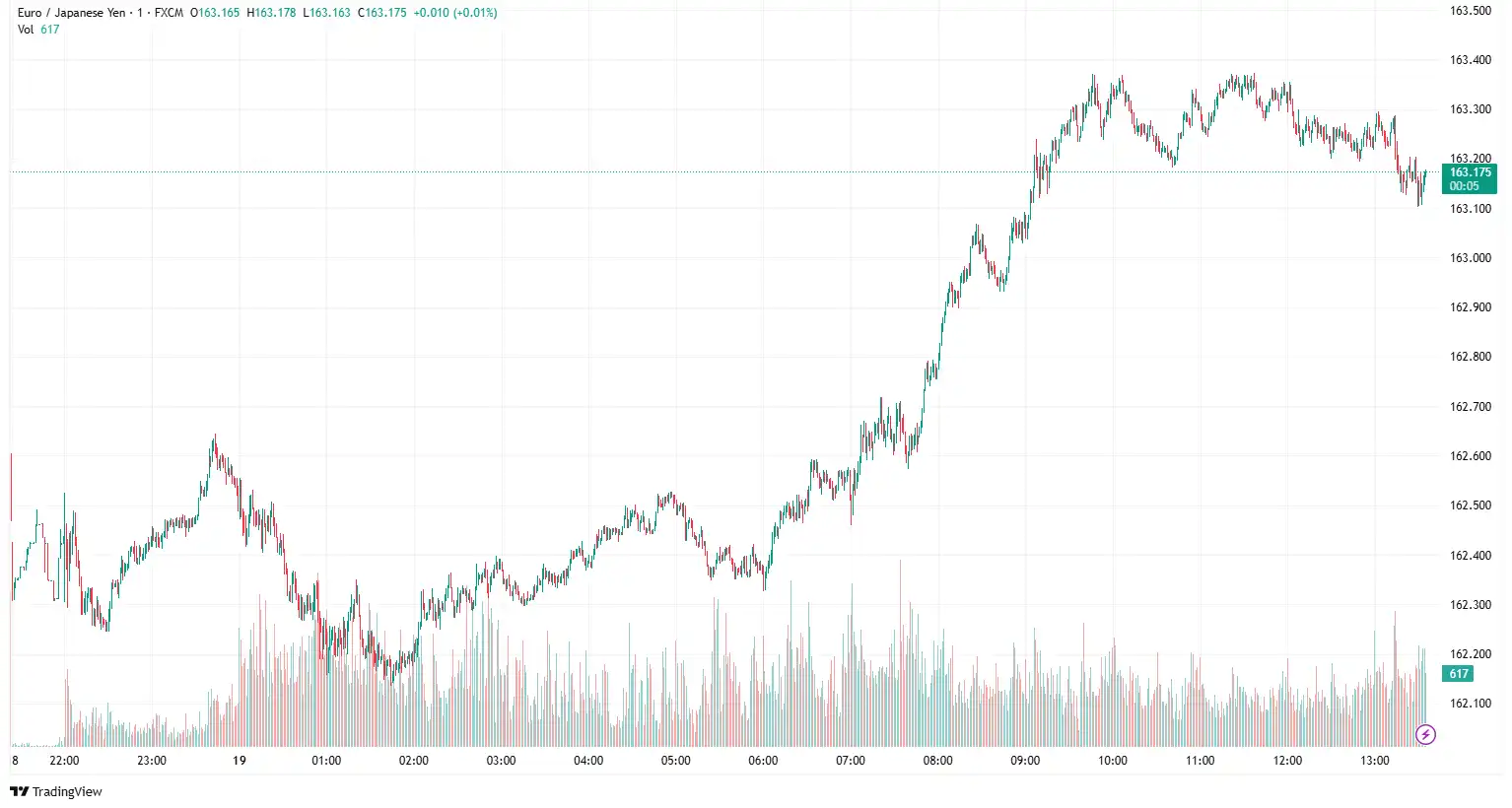

EUR/JPY Gains Following Japanese GDP Data

EUR/JPY climbed to 162.65 as weaker-than-expected Japan's Q1 Gross Domestic Product (GDP) exerted selling pressure on the Japanese Yen (JPY). Japan's economy shrank for the first time in a year and at a faster pace than expected. Japan's Gross Domestic Product (GDP) contracted by 0.2% quarter-on-quarter (QoQ) in the first quarter (Q1) of 2025, following growth of 0.6% in Q4 of 2024, according to a preliminary reading released by Japan's Cabinet Office on Friday. Markets had expected a 0.1% decline. Meanwhile, the country's GDP fell 0.7% year-on-year (YoY) in Q1, compared to 2.2% previously, which was below the market consensus of -0.2%. Japan's Producer Price Index (PPI) rose 0.2% in April, with the yearly rate at 4%, down from 4.2% the previous month.

On Friday, Bank of Japan (BoJ) board member Toyoaki Nakamura commented, "uncertainty over economic outlook heightening, so a cautious monetary policy approach is necessary." He added, "US trade policy, overseas economies, and FX affect Japan's economy and prices, so they must be accounted for in setting monetary policy. However, the medium- to long-term perspective on Japan's fundamentals must also be considered in policy decisions. Downward pressure on Japan's economy is intensifying due to slowing global growth and declining earnings in the mainstay automobile sector." Recent comments from Bank of Japan (BoJ) Deputy Governor Shinichi Uchida, "will keep raising interest rates if the economy and prices improve in line with our forecast." He also highlighted that uncertainty about trade policies in each country remains extremely high. Japan's underlying inflation is expected to re-accelerate following a slowdown in growth. It is important to consider that the recent price increases negatively affect consumption.

On the euro's front, softening market expectations that the European Central Bank (ECB) will implement another rate cut in its upcoming policy meeting weighed on the shared currency. Moreover, increased investors' confidence that Eurozone inflation aligns with the ECB's 2% target and that the region's economic outlook remains weak amid continued global uncertainty could exert further pressure on the euro.

On the data front, the Eurozone's economy expanded by 0.3% in the first quarter of 2025 (Q1), slightly below the preliminary estimate of 0.4%, according to Eurostat's second estimate released on Thursday. As expected, the region's Gross Domestic Product (GDP) grew at an annual rate of 1.2% in Q1, consistent with the initial estimates. Additionally, the Eurozone Employment Change for Q1 was reported at 0.3% quarter-over-quarter (QoQ) and 0.8% year-over-year (YoY). On Saturday, European Central Bank (ECB) President Christine Lagarde remarked in her interview, "It's impressive to note that in a period of uncertainty when we should normally have seen the dollar appreciate significantly, the opposite happened. It's counterintuitive, but justified by the uncertainty and loss of confidence in US policies among certain segments of the financial markets."

Broader market sentiment around the Eurozone's consumer data will drive today's EUR/JPY exchange rate.

NZD/USD Struggles Amid a Modest USD

NZD/USD hovered near 0.5890, as prevailing market sentiment suggests that the Federal Reserve (Fed) will further cut rates amid signs of easing inflation and the likelihood of several quarters of sluggish growth in the US economy, which undermined the greenback. On Friday, Moody's lowered the United States' highest sovereign credit rating by one notch to "Aa1," highlighting worries over the increasing national debt. Last week's release of the Consumer Price Index (CPI) and Producer Price Index (PPI) indicated a potential reduction in inflationary pressures. Furthermore, the disappointing Retail Sales data from the US raised the chances that the economy will face several quarters of slow growth. Moreover, market speculation about the Federal Reserve (Fed) potentially cutting rates in response to easing inflation and the expectation of several quarters of sluggish growth in the US economy will impact the value of the dollar.

On the Kiwi's front, optimism over the US-China trade truce, mixed Chinese macro data, and global risk appetite bolstered the New Zealand Dollar. On Friday, the Reserve Bank of New Zealand's (RBNZ) latest monetary conditions survey revealed that inflation expectations accelerated in the 12-month and two-year time frames for the second quarter of 2025. Two-year inflation expectations, when RBNZ policy action will influence prices, increased to 2.29% in Q2 2025 from 2.06% in Q1. The average one-year inflation expectations in New Zealand rose to 2.41% in Q2, compared to 2.15% in the first quarter. The Business NZ PMI increased to 53.9 in April, compared to the prior reading of 53.2. The BusinessNZ Services Index decreased to 48.5 in April 2025, compared to the prior reading of 48.9, indicating a slight slowdown in the performance of the services sector. The Producer Price Index (PPI) Input increased by 2.9% quarter-on-quarter (QoQ) in Q1 2025, reversing the previous quarter's decline of -0.9%. The PPI Output rose by 2.1% QoQ in Q1 2025, after a slight decline of -0.1% in Q4 2024. China's April retail sales rose 5.1% year-over-year (YoY), compared to 5.5% expected and 5.9% in March, as per the latest data released by the National Bureau of Statistics (NBS) on Monday. Chinese industrial production increased 6.1% YoY in the same period, against the 5.5% forecast and the 7.7% previously reported. Meanwhile, fixed asset investment reached 4% year-to-date (YTD) YoY in April, falling short of the expected 4.2% figure. The March reading was 4.2%.

Mixed market sentiment amid varying economic signals, along with speeches from influential FOMC members, will drive the NZD/USD exchange rate.

USD/JPY Wobbles Amid Reviving Safe-Haven Demand

USD/JPY fluctuated near 144.87, amid growing market expectations that the Bank of Japan (BoJ) will hike interest rates again in 2025, alongside disappointing GDP data, which continue to undermine the Japanese Yen (JPY). Japan's economy contracted for the first time in a year and at a faster pace than expected. Japan's Gross Domestic Product (GDP) shrank by 0.2% quarter-on-quarter (QoQ) in the first quarter (Q1) of 2025, following a growth of 0.6% in Q4 of 2024, as indicated by the preliminary reading released by Japan's Cabinet Office on Friday. Markets had expected a 0.1% decline. Meanwhile, the country's GDP decreased by 0.7% year-on-year (YoY) in Q1 compared to 2.2% previously, falling short of the market consensus of -0.2%. Japan's Producer Price Index (PPI) increased by 0.2% in April, with the yearly rate at 4%, down from 4.2% the previous month.

On Friday, Japan's Economy Minister Ryosei Akazawa announced that the government will persist in advocating for a review of US tariffs and is prepared to take all necessary measures to assist affected businesses financially. He emphasised, "The government will continue to demand a review of US tariffs and take all necessary steps to offer liquidity aid to impacted firms. We must be mindful of downside risks to the economy from US trade policy. Hit by consumption, household sentiment from sustained price rises is also becoming a downside risk to Japan's economy." Addressing tariff concerns, Finance Minister Shunichi Kato noted on Friday his intention to meet with US Treasury Secretary Scott Bessent to discuss foreign exchange issues. Kato further remarked that significant fluctuations in foreign exchange rates adversely affect the Japanese economy. Additionally, the likelihood of the Bank of Japan (BoJ) raising interest rates in 2025 and hopes for a trade agreement with the US bolster the JPY.

On the other hand, current market sentiment shows that the Federal Reserve (Fed) will implement further rate cuts amid easing inflation and expected slow economic growth in the US, weakening the dollar. The agency raised concerns about rising debt levels and increasing interest payment obligations. The University of Michigan's Consumer Sentiment Index dropped to 50.8 from 52.2 in April, the lowest since June 2022, marking five straight months of decline. Analysts had expected it to reach 53.4. The Current Conditions gauge fell to 57.6 from 59.8, and the Consumer Expectations component decreased from 47.3 to 46.5, reflecting growing economic outlook concerns. Inflation expectations have risen, with the one-year forecast climbing to 7.3% from 6.5%, and the five-year outlook up to 4.6% from 4.4%, indicating consumers' caution about price increases.

Last Friday, Atlanta Federal Reserve President Raphael Bostic noted he anticipates only one rate cut this year due to ongoing uncertainties, stating, "This year, economic growth could be around 1% or 0.5%. Although I anticipate slower growth, I don't foresee a recession. We may need to combat inflationary pressures due to tariffs. The US-China de-escalation slightly alters my perspective."

Investors will pay attention to the US-Japan trade deal and upcoming comments from US Federal Reserve (Fed) officials to get fresh impetus for the USD/JPY exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.