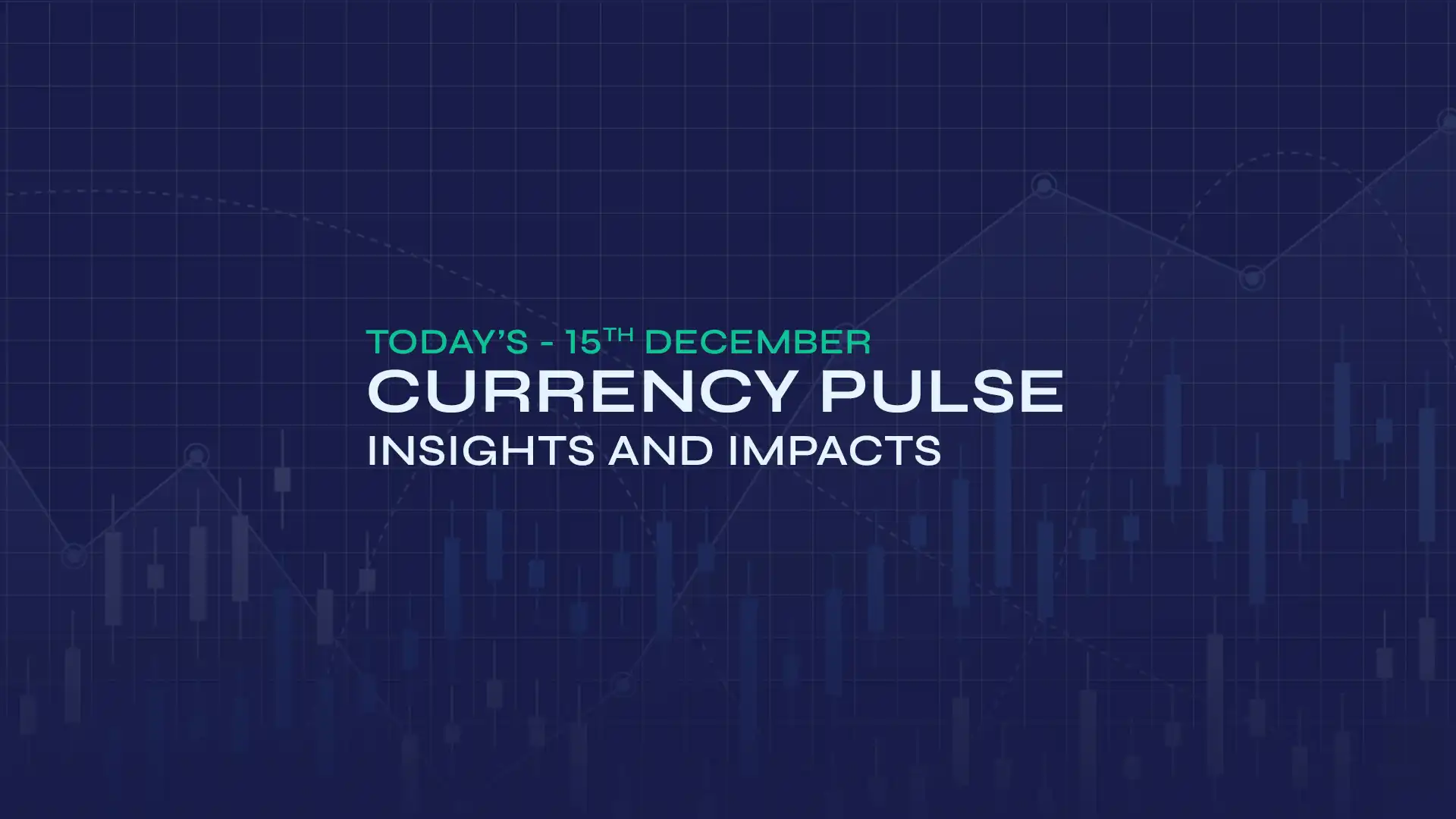

The Japanese Yen (JPY) edged higher against the pound, approaching the 193.35 level, despite Japan's disappointing GDP report. Japan's economy shrank for the first time in a year and at a faster pace than expected. Japan's Gross Domestic Product (GDP) contracted by 0.2% QoQ in the first quarter (Q1) of 2025, following a growth of 0.6% in Q4 of 2024, the preliminary reading released by Japan's Cabinet Office showed on Friday. Markets expected a 0.1% decline. Meanwhile, the country's GDP fell 0.7% YoY in Q1 versus 2.2% prior, below the market consensus of -0.2%. Japan's Producer Price Index (PPI) rose 0.2% in April, with the yearly rate at 4%, down from 4.2% the previous month.

Japan's Economy Minister Ryosei Akazawa stated on Friday that the government will continue to demand a review of US tariffs and take all necessary steps to provide liquidity aid to affected firms. He added, "The government will continue to demand a review of US tariffs, and take all necessary steps to offer liquidity aid to impacted firms. We must be mindful of downside risks to the economy from the US trade policy. Hit by consumption, household sentiment from sustained price rises is also becoming a downside risk to Japan's economy." Regarding concerns about the tariffs, Japan's Finance Minister Shunichi Kato mentioned on Friday that he would seek to meet US Treasury Secretary Scott Bessent to discuss foreign exchange. Kato further stated that excessive FX moves harm the Japanese economy. Additionally, expectations that the Bank of Japan (BoJ) will raise interest rates in 2025, along with hopes for a trade deal with the US, further support the JPY.

Sterling edged higher against its major peers as the recent Gross Domestic Product (GDP) data showed that the economy expanded at a faster-than-expected pace. The UK economy expanded by 0.7% quarter-on-quarter in the three months to March 2025, following a 0.1% increase in the final quarter of 2024, surpassing the estimated 0.6% rise during the reported period. The UK GDP rose 1.3% year-over-year in Q1 2025, compared to an expected 1.2% and a 1.5% growth in Q4 2024. Monthly UK GDP stood at 0.2% in March, down from 0.5% growth in February, exceeding the anticipated 0% reading. Meanwhile, the Index of Services for March recorded a 0.7% three-month-on-three-month change against a prior figure of 0.6%. Additional data from the UK indicated that Industrial Production and Manufacturing Production decreased by 0.7% and 0.8%, respectively, in March, both falling short of market expectations. The preliminary Total Business Investment for the January to March quarter surged by 5.9%. Furthermore, preliminary quarterly Total Business Investment surged by 5.9% in the January to March quarter.

In today's session, improved market sentiment following the growth numbers and renewed optimism over a potential US-Iran nuclear deal will drive the GBP/JPY exchange rate.

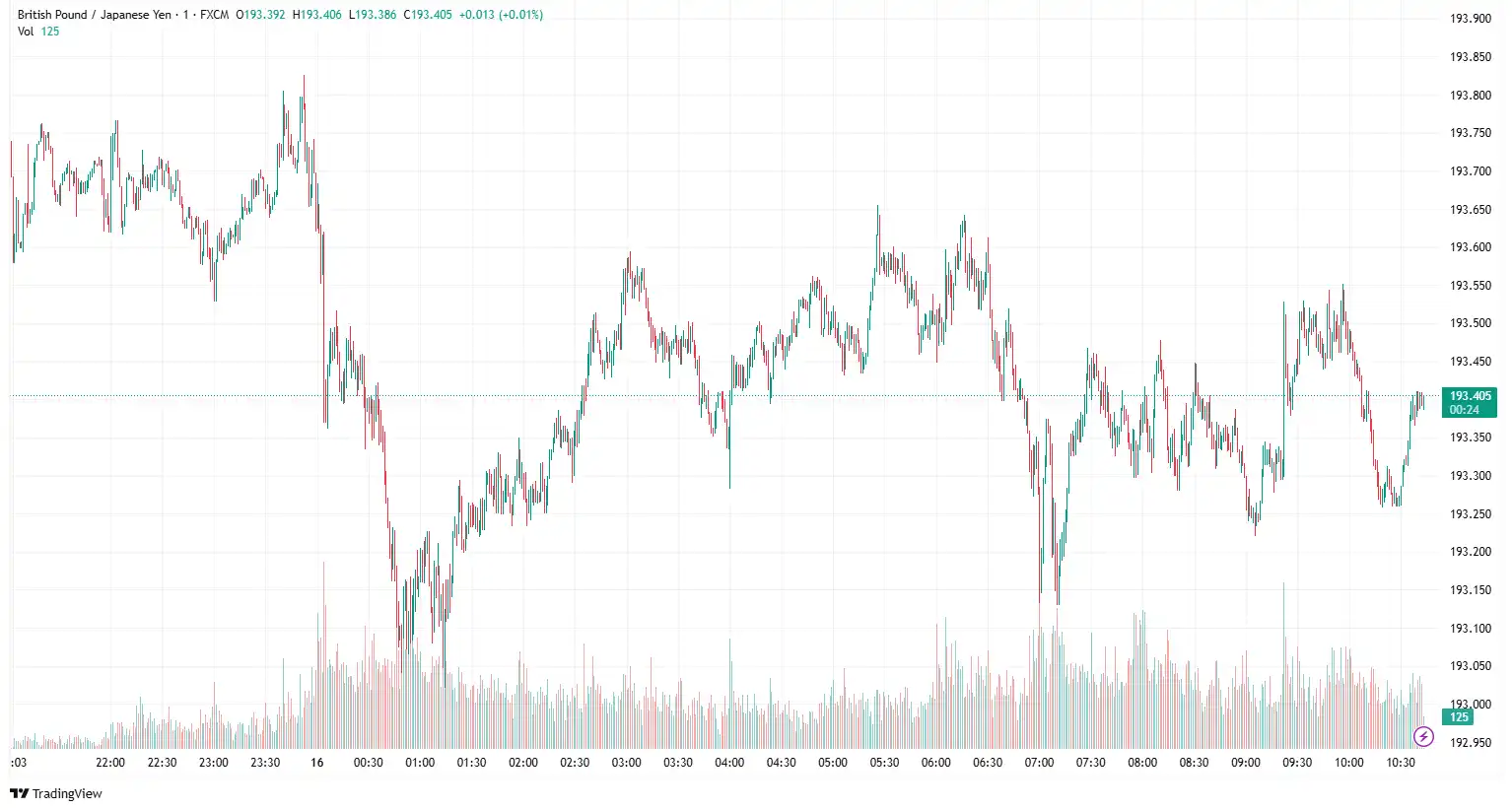

NZD/USD Rebounds Following Q2 RBNZ Inflation Expectations Release

NZD/USD edged higher near 0.5908, as the release of the Reserve Bank of New Zealand (RBNZ) Inflation Expectations for Q2 2025 bolstered the New Zealand Dollar (NZD). On Friday, the Reserve Bank of New Zealand's (RBNZ) latest monetary conditions survey revealed that inflation expectations accelerated in the 12-month and two-year time frames for the second quarter of 2025. Two-year inflation expectations, when RBNZ policy action will influence prices, increased to 2.29% in Q2 2025 from 2.06% in Q1. The average one-year inflation expectations in New Zealand rose to 2.41% in Q2, compared to 2.15% in the first quarter. The Business NZ PMI increased to 53.9 in April, compared to the prior reading of 53.2.

Moreover, market optimism over the potential US-Iran nuclear deal and easing global trade tensions could further support the risk-sensitive New Zealand Dollar (NZD). A preliminary agreement has been established between the US and China, wherein the US will reduce tariffs on Chinese goods from 145% to 30%. In turn, China will decrease tariffs on US imports from 125% to 10%. New Zealand's economic narrative remains soft, following Minister Nicola Willis' announcement of a NZ$190 million social investment fund, aimed at improving long-term outcomes for vulnerable groups. "It's about government investing earlier, smarter, and with a much more transparent measurement of the impact interventions are having," Willis commented.

On the other hand, softer-than-expected inflation and retail sales data undermined the greenback; however, comments from Federal Reserve Chair Jerome Powell supported the US dollar. In April, the US Producer Price Index (PPI) increased by 2.4% year-over-year, a decrease from March's 2.7% rise and lower than the expected 2.5%. The Core PPI, excluding food and energy, rose 3.1% annually, down from 4%. Monthly, the headline PPI decreased by 0.5%, and the Core PPI fell by 0.4%. Retail sales slightly increased by 0.1% in April, following a revised growth of 1.7% in the prior month.

On Thursday, Federal Reserve (Fed) Chairman Jerome Powell mentioned that officials believe the strategic language regarding employment shortfalls and average inflation should be re-evaluated. He also stated, "The Fed is undertaking a two-day review of revisions to its framework adopted in 2020. The framework needs to be robust in many circumstances, including a world where supply shocks may be more frequent and persistent."

In today's session, the University of Michigan's (UoM) Consumer Sentiment Index and the Reserve Bank of New Zealand's (RBNZ) Inflation Expectations for Q2 2025 will influence market sentiment regarding the NZD/USD exchange rate.

EUR/GBP Rallies on Strong Euro Performance

EUR/GBP approached 0.8420, driven by a stronger euro, despite the dovish outlook from European Central Bank (ECB) officials, who indicated the potential for additional interest rate cuts due to diminishing inflationary pressures. On Friday, ECB policymaker Francois Villeroy de Galhau remarked, "We are not currently in a currency war but rather a trade war situation," emphasising that protectionism and uncertainty are impacting US economic confidence. Similarly, fellow ECB member Martins Kazaks reinforced this cautious perspective, stating that a "meeting-by-meeting approach is right" in light of the ongoing uncertainties regarding global trade policies. On Thursday, German Finance Minister Lars Klingbeil spoke to parliament, stating, "We must respond to the US tariffs with unity and determination." He further remarked, "We anticipate the negotiations... will result in a favourable outcome, but I want to stress that we are prepared to take action if necessary." Recently, European Central Bank (ECB) policymaker and Bundesbank President Joachim Nagel noted that the interest rate decision for June will depend on upcoming data. He pointed out that the precise impact of tariffs on inflation and the overall economy remains uncertain and indicated that new staff projections will be published next month. Nagel stressed the importance of central banks adjusting to manage uncertainty.

On the data front, the Eurozone's economy expanded by 0.3% in the first quarter of 2025 (Q1), slightly below the preliminary estimate of 0.4%, according to Eurostat's second estimate released on Thursday. The region's Gross Domestic Product (GDP) grew at an annual rate of 1.2% in Q1, consistent with the initial estimates, as expected. Additionally, the Eurozone Employment Change for Q1 was reported at 0.3% quarter-over-quarter (QoQ) and 0.8% year-over-year (YoY). In Germany, wholesale prices rose by 0.8% YoY in April 2025, down from a 1.3% increase in March and a 1.6% rise in February. Month-over-month, prices decreased by 0.1% from March to April. Meanwhile, France's final Consumer Price Index (CPI) saw a 0.6% month-over-month (m/m) increase, following a 0.2% rise in March. The first estimates of the euro area balance revealed a €36.8 billion surplus in trade in goods with the rest of the world in March 2025, compared to +€22.8 billion in March 2024. Euro area exports of goods to the rest of the world in March 2025 amounted to €279.8 billion, reflecting a 13.6% increase compared to March 2024. Imports from the rest of the world reached €243.0 billion, marking a rise of 8.8% compared to March 2024.

Sterling rose against major peers as GDP data revealed a faster-than-expected economic expansion. The UK economy grew by 0.7% quarter-on-quarter in the three months to March 2025, compared to a 0.1% increase in Q4 2024, exceeding the estimated 0.6%. Year-over-year, UK GDP increased by 1.3% in Q1 2025, surpassing an expected 1.2% and a prior 1.5% in Q4 2024. Monthly UK GDP was 0.2% in March, down from 0.5% growth in February but exceeding the anticipated 0%. The Index of Services for March showed a 0.7% change from the previous three months, up from 0.6%. However, in March, Industrial Production and Manufacturing Production fell by 0.7% and 0.8%, respectively, missing market expectations. Preliminary Total Business Investment surged by 5.9% for the January to March quarter.

Amid a lack of British economic data, investors will pay attention to the European Central Bank (ECB) policymaker Piero Cipollone and Chief Economist Philip Lane's addresses for fresh insights on the EUR/GBP exchange rate.

USD/CHF Subdued on Upbeat Swiss GDP

USD/CHF lost momentum near 0.8333, as ongoing economic uncertainties boosted demand for the safe-haven asset, strengthening the Swiss Franc (CHF). However, the Swiss National Bank's (SNB) dovish stance could limit the currency's upside. Switzerland's economy grew by 0.7% in the first quarter, up from a revised 0.5% in Q4 2024, marking the strongest growth since early 2023. Yet, inflationary pressures remain low. In April, Producer and Import Prices decreased by 0.5% year-on-year, worsening from a 0.1% decline in March and indicating ongoing deflationary trends. Monthly, prices increased by just 0.1%, which is slightly below the market expectations of a 0.2% rise. Recently, SNB Chairman Martin Schlegel emphasised the central bank's willingness to intervene in the currency market and possibly lower interest rates, even to negative levels, if inflation consistently remains below target. The Swiss government is actively seeking a trade agreement with the United States to prevent punitive tariffs. Finance Minister Karin Keller-Sutter characterised last week's meeting in Geneva with US Treasury Secretary Scott Bessent as "constructive," expressing optimism that Switzerland might emulate the UK by obtaining a bilateral deal with the Trump administration.

On the greenback's front, mixed US macro data has reinforced dovish Fed expectations, weighing on the currency. In April, the Producer Price Index (PPI) decreased by 0.5% compared to the previous month, contrary to a 0.2% rise prediction. Year-over-year, PPI declined by 2.4%, slightly less than the anticipated 2.5% decrease and down from March's 2.7%. The Core PPI also fell by 0.4% monthly, while the annual rate decreased to 3.1%, marking the lowest point since August 2024. Meanwhile, Retail Sales saw a small increase of 0.1%, surpassing expectations for no change and demonstrating robust consumer demand. During his remarks on Thursday, Powell recognised that the Fed's policy framework might need to be adjusted due to increasingly frequent supply shocks. He stated, "The framework needs to be robust to many circumstances, including a world where supply shocks may be more frequent and persistent," as reported by Reuters. Furthermore, he noted that while structural changes might be necessary, the central bank's commitment to maintaining stable inflation expectations remains consistent. These comments, combined with disappointing consumer data, encouraged a slight increase in the US Dollar as traders re-evaluated the short-term growth outlook.

Broader market sentiment around the US economic data and SNB Chairman Martin Schlegel's speech will influence the USD/CHF exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.