Daily Forex Report 25-Oct-2022: GBP falls but signs of stability emerge

The Euro enjoys an upside against USD though parity not a given

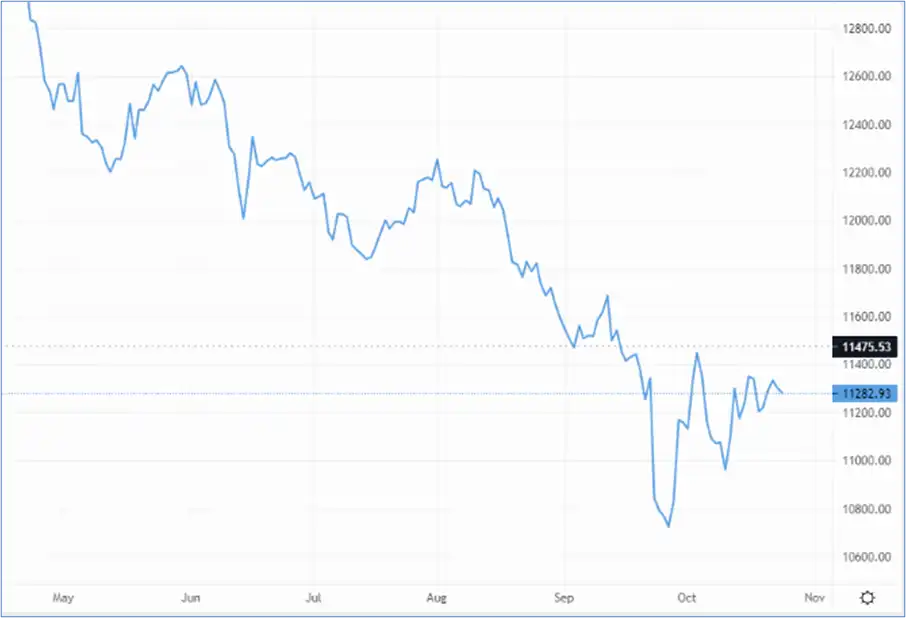

There is a glimmer of hope on the horizon that the UK markets might stabilise themselves now that Rishi Sunak has taken the mantle as the next UK Prime Minister.

Following his ascension, 10-year gilt yields fell sharply to 3.74%, though the pound also fell in tandem, albeit only slightly.

Gilts’ wild ride: Volatility rarely seen on the bond market – Source: Financial Times

Gilts’ wild ride: Volatility rarely seen on the bond market – Source: Financial Times

The GBP/USD pair is changing hands at US$1.128 after having 25 pips knocked off it in this morning’s Asia trading session, while EUR/GBP remains more or less flat at 87.5p.

Rishi Sunak faces a steep hill: GBP against USD – Source: capital.com

Rishi Sunak faces a steep hill: GBP against USD – Source: capital.com

The EUR/USD pair is changing hands at US$0.987, and the moving averages point to some potential further upside, though the latest economic data shows contracting economic activity across the continent.

Parity between the euro and US dollar is likely to face still bearish resistance.

The Japanese yen edged higher against the US dollar, with USD/JPY falling below 150, though the pair remains at a precarious 148.8.

The Japanese government refuses to comment, but a suspected US$36bn intervention was likely responsible for the yen’s incremental recovery… but there’s doubt as to whether it’s enough to resuscitate the struggling yen to any significant degree.

The Australian dollar is currently buying US$0.63.

Understanding your FX risk and exposure is paramount to your bottom line. Contact Currency Solutions today and find out how we can help you with:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

Click here for find out more.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.