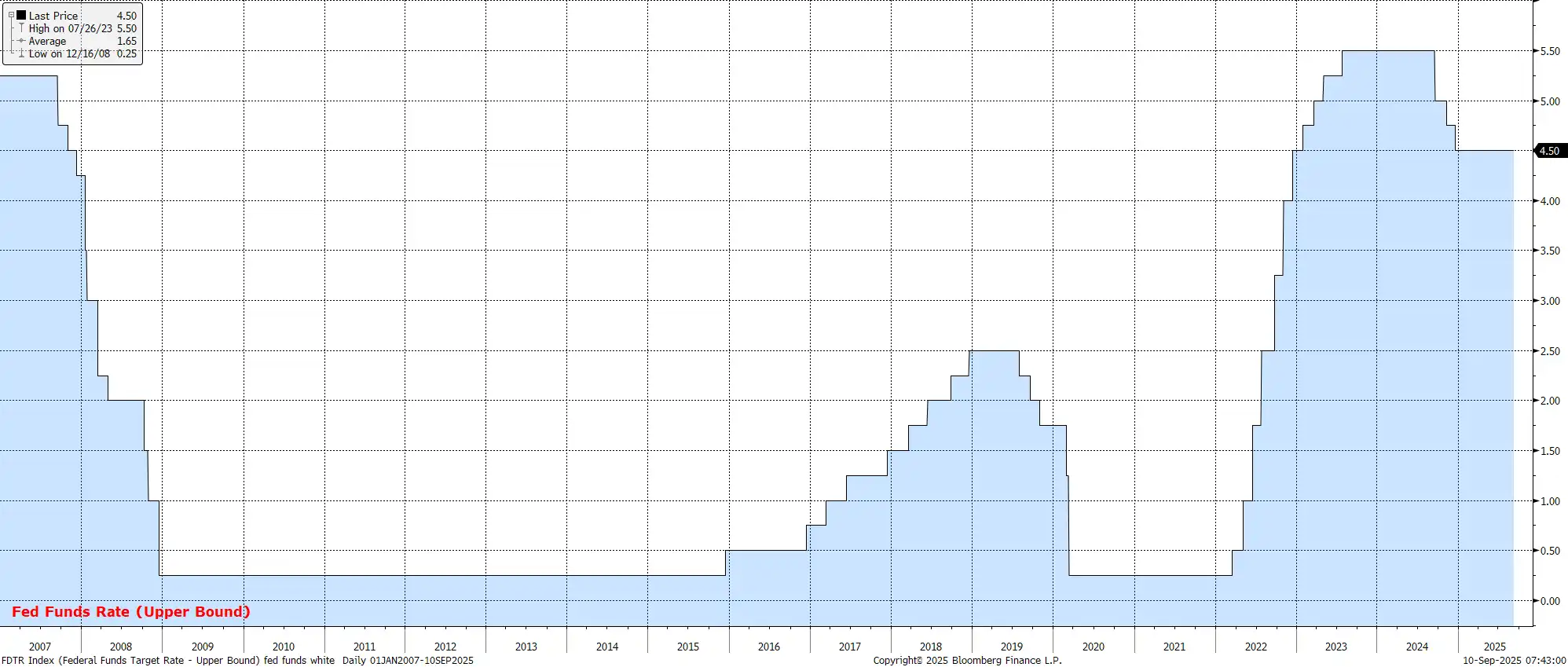

The FOMC are set to deliver a 25bp cut at the conclusion of the September meeting, restarting the journey back to neutral which paused at the end of last year, as policymakers seek to support a stalling labour market, despite tariff-induced inflation risks. Further easing beyond September is on the cards, with another cut most likely to be delivered in December.

Such a cut would see the target range for the fed funds rate stand at 4.00% - 4.25%, while also marking the Committee’s first rate reduction since last December. Money markets, per the USD OIS curve, fully discount a move at the September meeting, while also seeing around 68bp of easing in total by year-end.

That decision, though, seems unlikely to be unanimous among Committee members. Assuming he is confirmed in time, CEA Chair Miran is likely to dissent in favour of a larger move, probably 50bp, given his previously espoused dovish views and potential political interference from the Oval Office. Governors Waller and Bowman, who dissented in favour of a 25bp cut in July, are also potential candidates to plump for a larger rate move.

Conversely, there's potential for votes in favour of holding rates steady. Potential candidates for hawkish dissent include St Louis Fed President Musalem and Kansas City Fed President Schmid, both of whom have noted the current 'modestly restrictive' stance is appropriate.

The accompanying policy statement is likely to preserve optionality regarding the future policy path. Guidance will probably remain unchanged from July, emphasising the data-dependent nature of future policy 'adjustments'.

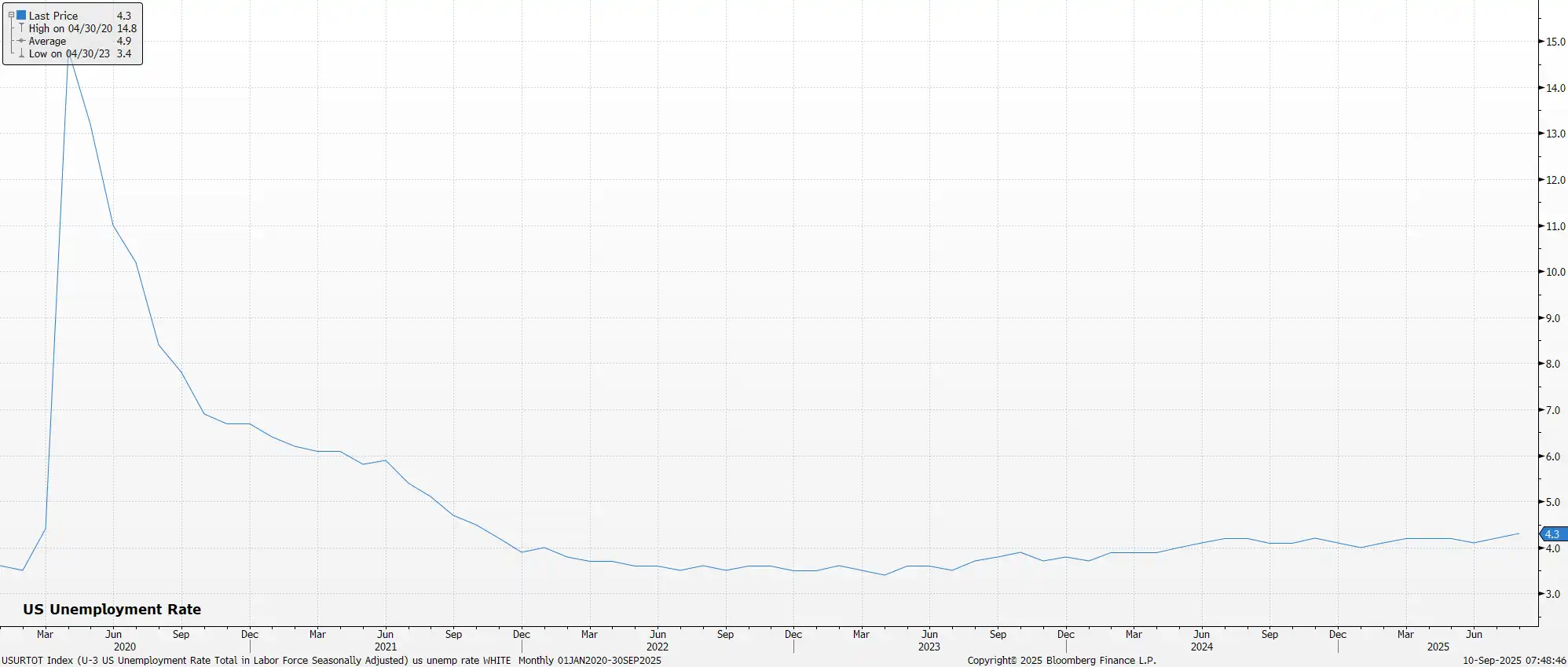

It is the stalling labour market, coupled with Chair Powell's dovish pivot at Jackson Hole, that have spurred expectations of cuts as payrolls growth falls to about half the breakeven pace, and unemployment stands at a cycle high 4.3%.

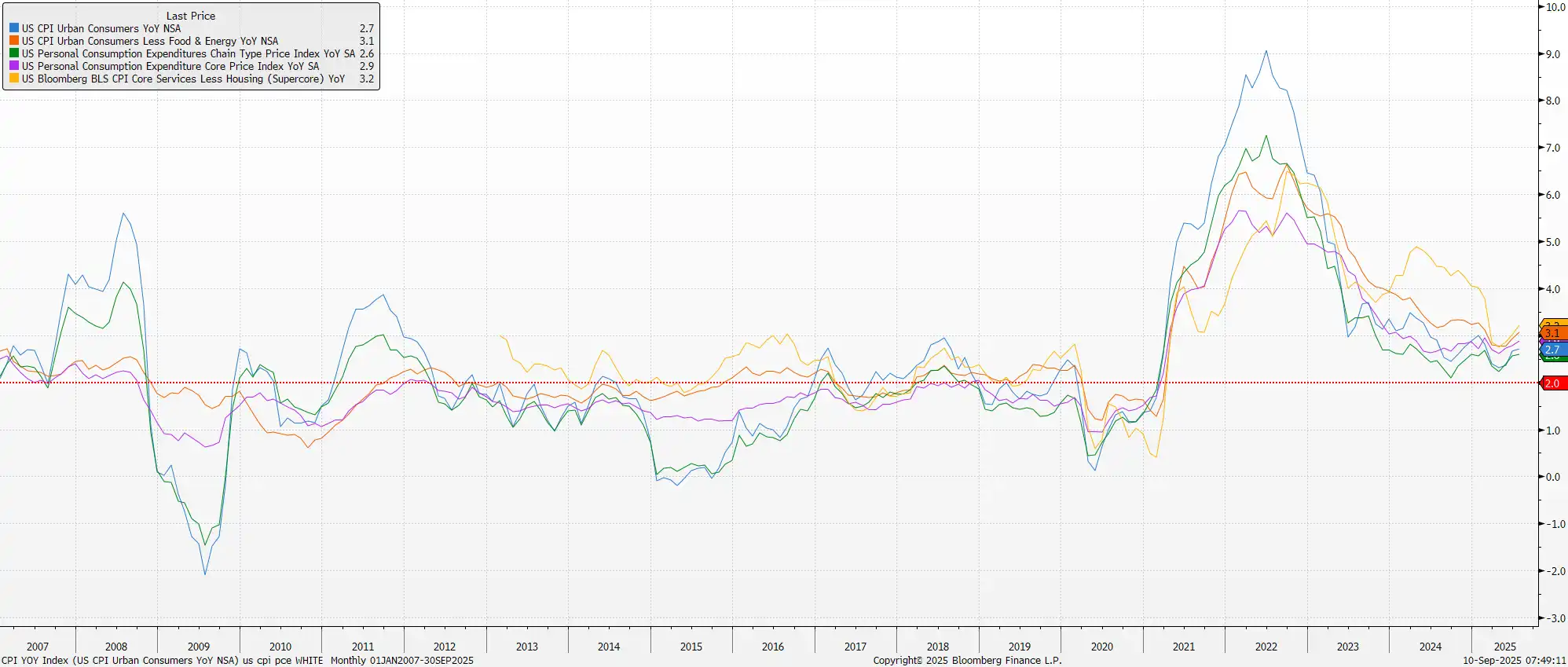

The updated SEP is likely to reiterate expectations for both headline and core PCE to end the year around 3%, though next year's projection may be nudged higher to reflect delayed tariff-induced price pressures. Powell & Co are viewing these as a 'one-time shift in the price level', ensuring longer-run projections point to a return to the 2% inflation target.

At his post-meeting press conference, Powell will likely reiterate that tariffs will prompt a 'one-off shift in the price level', while noting increased downside labour market risks. He'll emphasise the FOMC will 'proceed carefully' given conflicting dual mandate risks.

Taking a step back, the September meeting marks an important moment as the FOMC resume easing, with focus shifting towards employment amid belief that tariff-induced price hikes don't pose medium-term price stability risks. My base case is one further 25bp cut this year, most likely in December, though risks tilt dovish if the labour market weakens more rapidly.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.