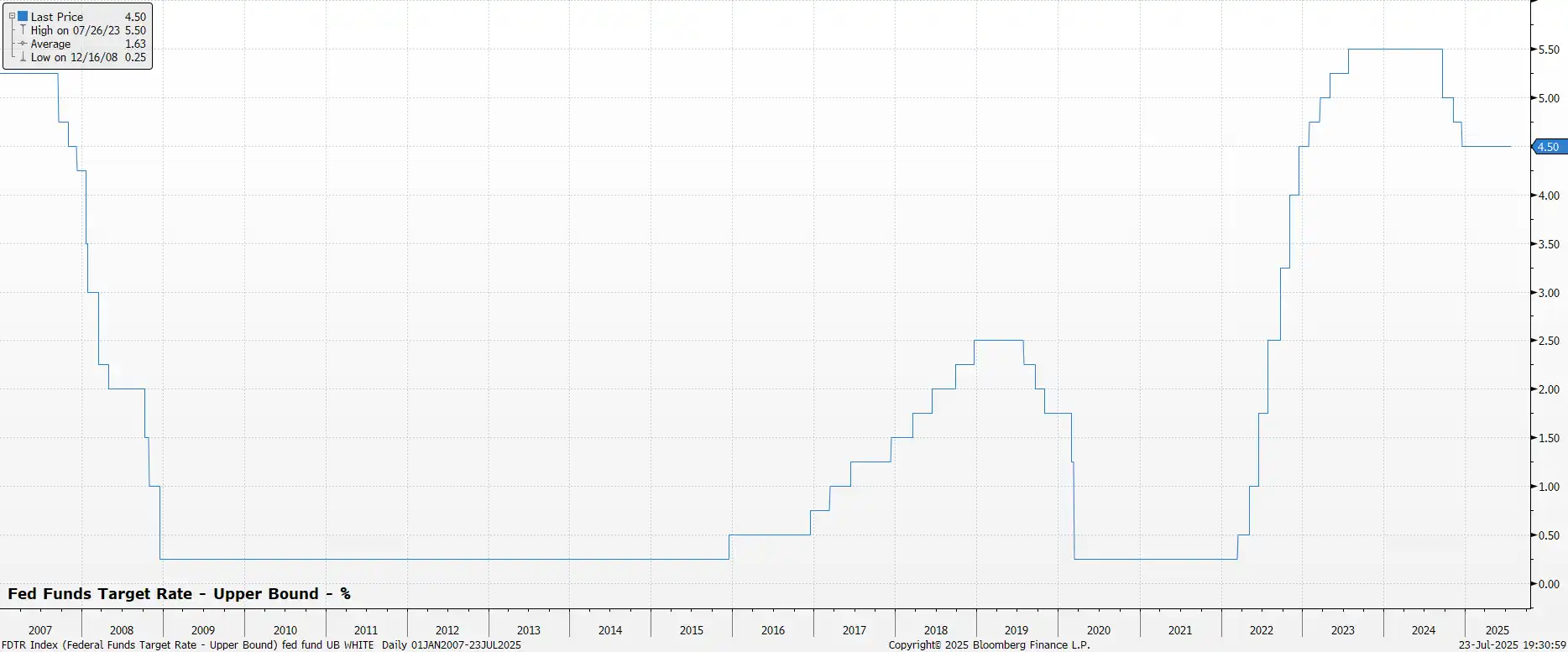

The FOMC will maintain all policy settings at the conclusion of the July meeting, though such a decision is unlikely to be via a unanimous vote, even as the vast majority of policymakers continue to view a 'wait and see' approach as appropriate, given elevated economic uncertainty, and significant risks to each side of the dual mandate.

The target range for the fed funds rate is set to be held steady at 4.25% - 4.50%. Money markets price next-to-no chance of any action this time out, with the next 25bp cut not fully discounted until October, and with around 45bp of easing in the curve by year-end.

That decision, however, is unlikely to be unanimous among FOMC members. While the majority continue to view a patient approach as appropriate, a couple of Governors have marked out a much more dovish position, advocating for more rapid rate reductions.

The most vocal has been Governor Waller, appointed by President Trump in 2020. Waller has framed his argument for a 25bp cut at the July meeting around the labour market, citing its 'frozen' nature whereby hiring has slowed, albeit without layoffs accelerating. The problem with this argument is that this labour market inertia has almost nothing to do with the cost of credit, and almost everything to do with significant trade policy uncertainty clouding the outlook.

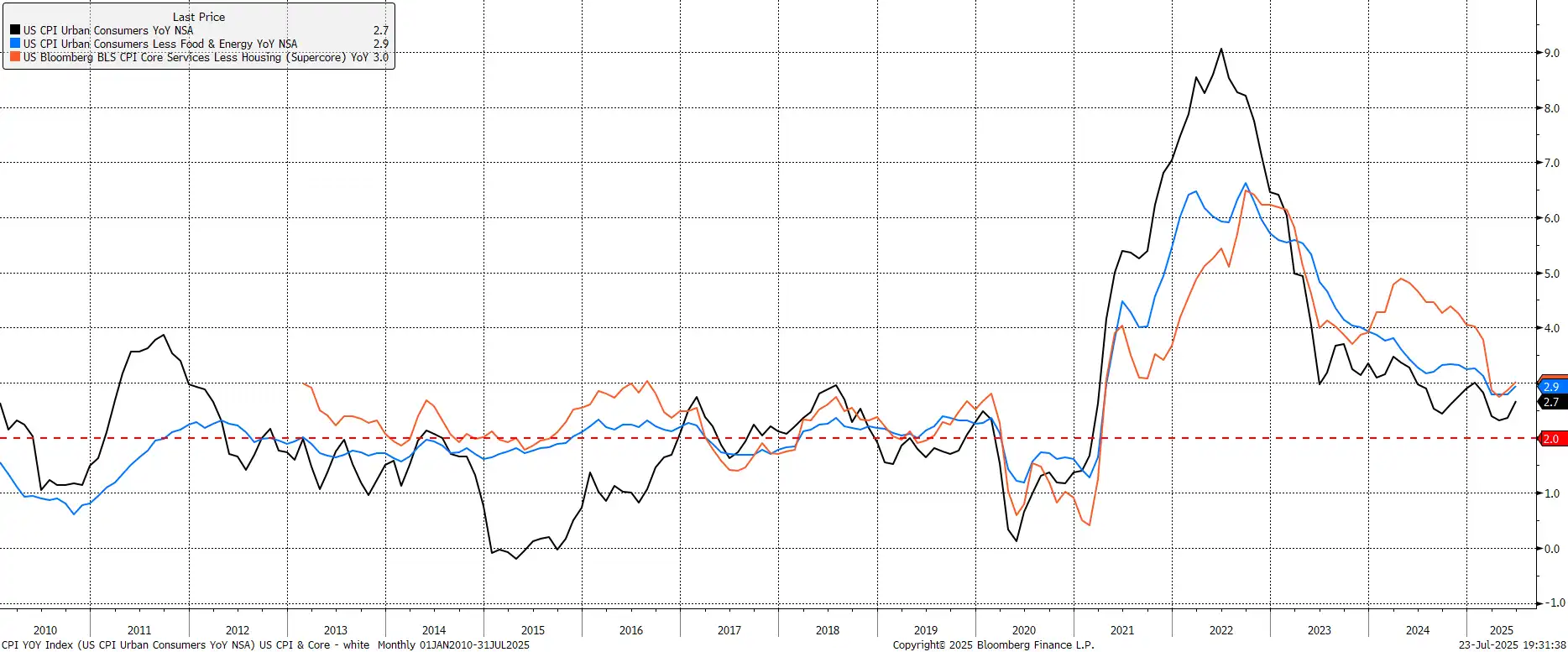

Waller is set to dissent in favour of a 25bp cut, and may well be joined by fellow Trump appointee Governor Bowman. The latter has made her dovish case more cautiously, noting that a July cut would be appropriate 'if inflation remains subdued' – which it hasn't.

Recent data supports both the FOMC's statement comments and their 'wait and see' policy approach. Headline CPI rose to 2.7% YoY in June, while core prices rose 2.9% YoY. Of more concern, core goods prices rose 0.7% YoY, the fastest pace in almost 2 years, signalling that tariff costs are being passed onto consumers.

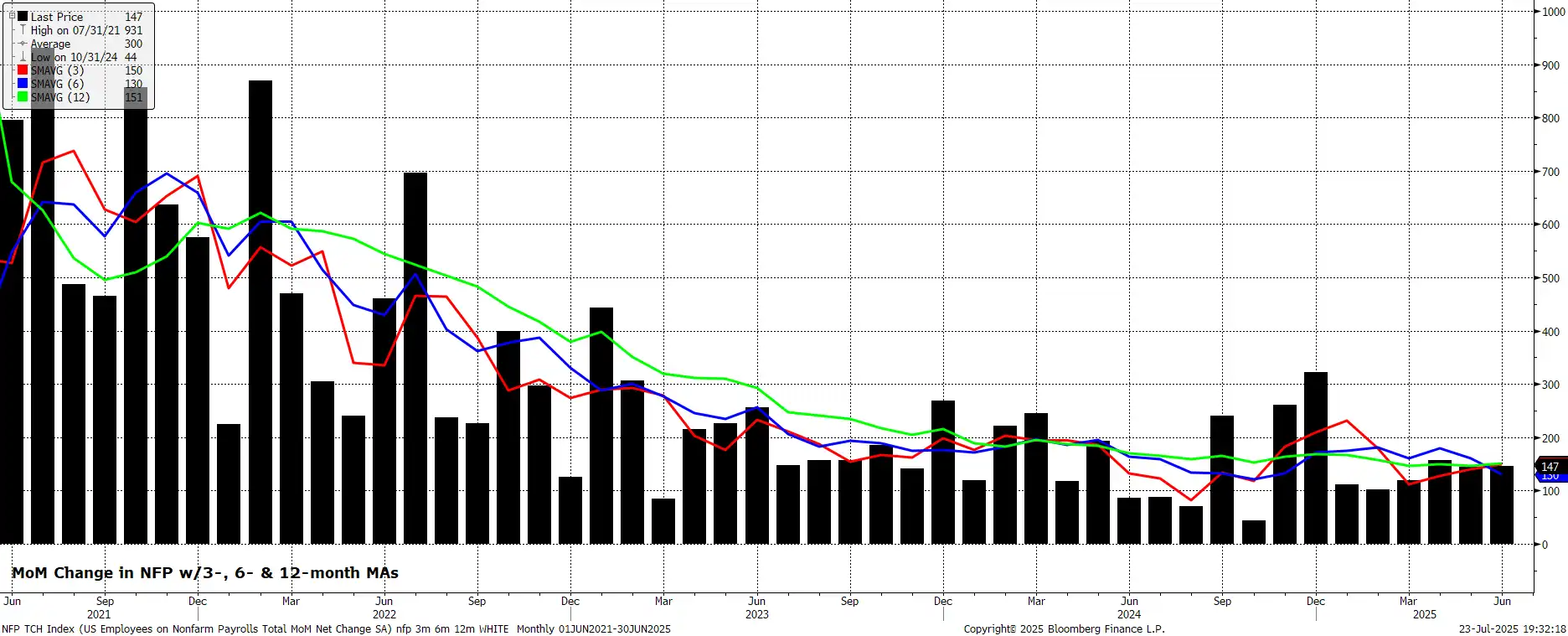

Meanwhile, the labour market remains resilient. Unemployment fell to 4.1% last month, while nonfarm payrolls rose by +147k. This continues to underpin other areas of the economy, with consumer spending healthy and underlying growth solid.

At the press conference, Chair Powell is likely to stress the resilient economy, allowing policymakers to remain patient. Given recent events, including reports of Trump preparing to fire Powell, questioning will likely focus on Powell's future and monetary policy independence.

Two plausible policy paths remain: if inflation stays subdued or labour market cracks emerge, easing could begin in September with two 25bp cuts by year-end. However, if the labour market remains resilient and inflation continues rising, policymakers will likely maintain their 'wait and see' stance, pointing to just one 25bp reduction this year, most likely in December.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.