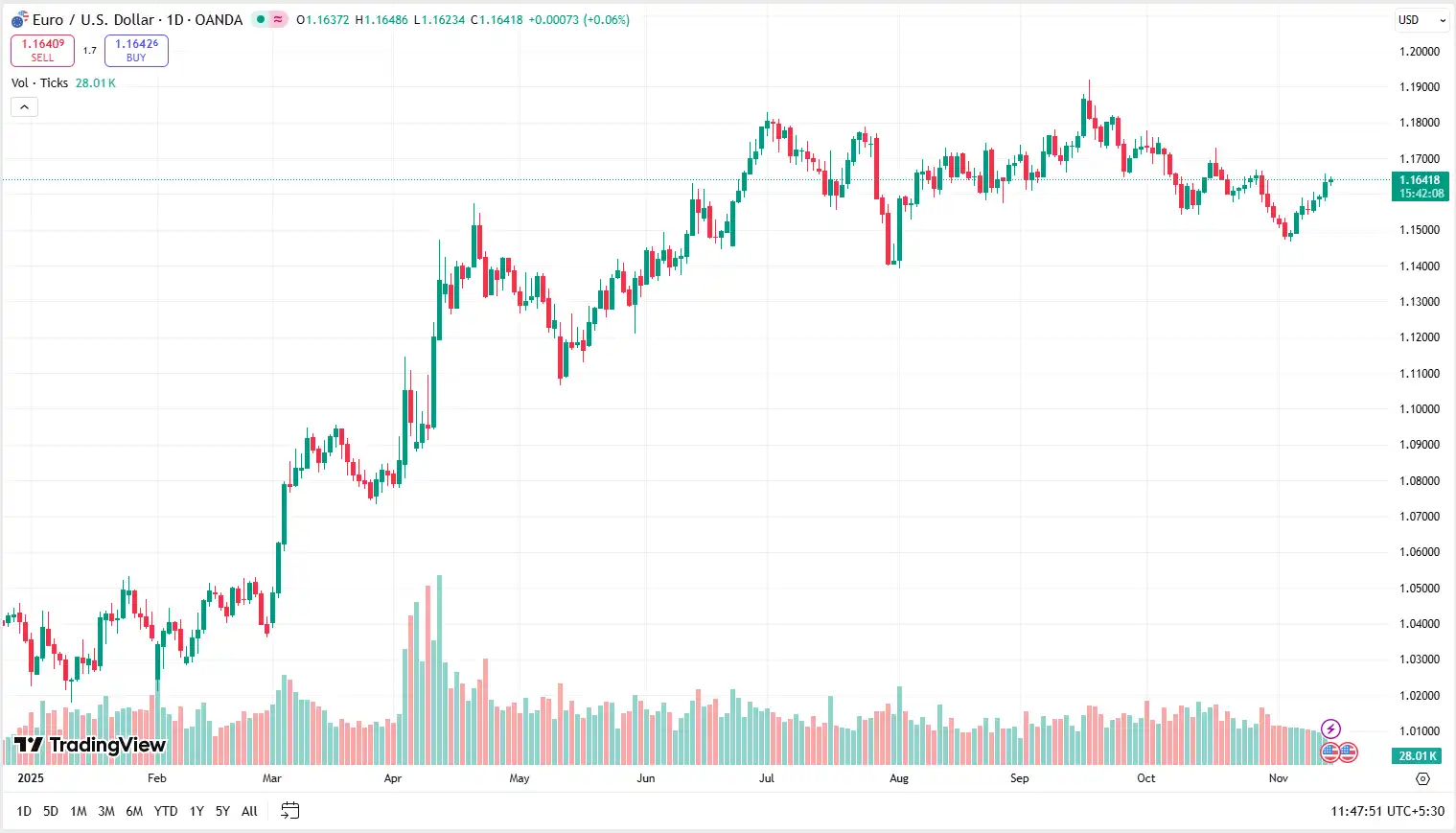

The EUR/USD pair traded near 1.1640[1] in a tight consolidation band in Friday’s Asian session after touching a more than two-week high on Thursday. The pair is believed to be restricted to below the 50-day Simple Moving Average (SMA)[2] despite the recent upswing, which has remained a significant technical barrier. The low intraday action[3] is an indication that markets are re-evaluating the recent sharp upsurge of the pair as they await other new catalysts.

Market reports[4] point out that the US dollar is under pressure, trading at a two-week low after increasing fears about the economic impact of a long-term US government shutdown. The absence of any major economic releases, following the announcement by officials that the October jobs and inflation figures[5] might be postponed, has added further pressure to the US dollar. The low visibility of data exposes investors to being much preoccupied with the overall sentiment of risk and commentary of policymakers that is currently tilted towards a cautious Federal Reserve (Fed)[6] stance.

Market commentators indicate EUR/USD is still supported by expectations of an expanding policy differentiation between the Fed and the European Central Bank (ECB)[7]. Although a number of Fed officials have pushed against aggressive easing expectations, markets now assign about even odds that it will implement a rate cut by December. Conversely, economists are widely predicting that ECB[8] would keep its deposit rate constant at the end of the year and the beginning of the next year. This break gives the euro near-term bullish bias, but momentum buyers might demand a consistent break above the 50-day SMA to continue the trend.

Analysts[9] note that in future, traders will keep a keen eye on the statements of powerful Fed officials to get a clear picture on the rate cut path. A new directional signal in Europe could be given by the launch of flash Q3 Eurozone GDP[10]. Although these are likely to be of short-term aid to EUR/USD, the medium-term perspective is sensitive to the US fiscal uncertainty[11] and threat of a weak future economic indicator that will once again bring volatility to the pair. Overall, traders remain cautious as they anticipate the next major move in the EUR/USD exchange rate.

EUR/GBP Strengthens as Pound Sentiment Weakens

EUR/GBP traded around 0.8850[12] region in Friday's early European trading, supported by renewed weakness in the pound. The recent surge in the pair is believed to have taken place following anxieties of the fiscal outlook of the UK after Prime Minister Keir Starmer and Finance Minister Rachel Reeves[13] reportedly put off the proposal to hike income tax rates before the November 26 budget. Markets took the move as a possible blow to the process of fiscal consolidation[14], putting a strain on the mood to UK property and providing a temporary boost to EUR/GBP.

Market commentators[15] also note that the pound was also put under pressure as UK initial GDP data that was below expectations heightened concerns about domestic momentum. As growth fell short of expectations, investors raised its likelihood that the Bank of England (BoE)[16] will announce another 25-basis-point rate reduction in December to near 80%. Such dovish policy anticipations keep the UK-Eurozone rate spread constricted and serve as a drag on GBP, sustaining EUR/GBP at comfortably above short-term demand bases.

Market commentators[17] note that focus now shifts to the Eurozone Q3 GDP results later in the trading session, and the bloc is about to record a moderate quarterly growth of 0.2% and an expansion of 1.3% annually. Any negative surprise would be a restriction to upside potential in the cross, particularly in light of wider restriction to Eurozone sentiment. Nevertheless, absence of material disappointing data can continue to trade off EUR/GBP[18] to the upside in the short term, unless the data becomes more disappointing.

Analysts[19] also suggest that traders will also look to the calendar of US data such as consumer sentiment and industrial production that may impact wider risk appetite. The aggressive US releases[20] could also strengthen the global growth worries, indirectly straining the high-beta currencies including GBP. Although EUR/GBP poses a positive tone in the short-term, the risks in the medium-term are balanced since both economies display low-growth trends and changing central-bank directions. In short, short-term market dynamics continue to shape the EUR/GBP exchange rate.

GBP/USD Slips Amid Fiscal and Political Uncertainty

GBP/USD traded near 1.3150[21] in Friday’s Asian session, easing from Thursday’s highs as renewed pressure on the pound weighs on the pair. The pullback is believed to have come after a shift in the mood in the UK, where political and fiscal uncertainty[22] had put investors off the pound. Although there is a slight backtracking of the pair, the short-term falls would be minimal since the US dollar[23] is not able to rebound on the downward trend with a mix of economic indicators and remaining concerns after the US government shutdown.

Market commentators[24] indicate that the weakness of the pound is implied by the fact that there is fresh uncertainty over the fiscal policy of the UK. The fact that the government[25] has reportedly given up on the idea of an increase in the rates of income-tax, even before the November 26 budget, shows the difficulty of bridging a large fiscal gap of around £30 billion without altering direct taxes. Simultaneously, lower UK macroeconomic data[26] have strengthened the anticipation of a BoE rate cut in December, maintaining GBP momentum skewed downwards. Growth in the third quarter was not very high and the year-over-year growth in the GDP in September was negative, highlighting how domestic momentum was shaky.

Market reports[27] indicate that the performance of the dollar in the US has been limited by uncertainty over future economic releases. Authorities have cautioned that not all October data will be complete because the 43-day shutdown[28] has ended, and his near term data may not be reliable. Through early private-sector reports, there is already indication of cooling labour market conditions[29] and less consumer confidence with inflation fears continuing in spite of the improved market sentiment. These have limited the US dollar gains, which has some short-term GBP/USD protection.

Analysts[30] suggest that in the future, traders will keep an eye on future US labour and inflation data to get a clearer route. Although the US dollar will be suppressed in the short run, the overall GBP/USD[31] prognosis will remain threatened by the consolidation in the 1.3100 zone. The rate cut expectations and fiscal uncertainty in the UK still remain in the medium-term risks jeopardizing the duo as the incoming data may support the argument of the BoE unleashing more. Lastly, traders are closely watching how political and economic developments on both sides of the Atlantic will shape the GBP/USD exchange rate.

NZD/USD Holds Firm Amid Mixed Economic Drivers

The NZD/USD pair traded around 0.5680[32] in Friday’s Asian session, with buyers maintaining control despite mixed economic signals from China. The kiwi is believed to have gotten tame backing following China Retail Sales which marginally increased in October to 2.9% YoY[33], though the fifth monthly declining growth constrained wider optimism. Industrial Production had fallen short of expectations at 4.9% YoY with the mixed data set not causing significant effects to the China-proxy New Zealand dollar and NZD/USD[34] punctuated around recent highs.

Market reports[35] indicate that the domestic fundamentals continue to be a head wind against the New Zealand dollar. The recent 50 bps reduction by the Reserve Bank of New Zealand (RBNZ)[36] announced in the environment of low GDP data and increased unemployment highlights growing economic strains. The unemployment rate has risen to a nine-year high of 5.3%, strengthening hopes that the RBNZ[37] will have to go further. These medium-term policy risks keep restraining upside movement in NZD/USD, whilst short term sentiment gains through global data changes.

Market commentators[38] indicate that activities in the US are affecting wider US dollar movement across the Pacific. The solution to the US government shutdown[39] will mean the economic releases that had been withheld will begin flowing again though the government indicated that it might not release October data of jobs. Markets anticipate the data queue to reveal continued softening in the labour-markets, and that might exert pressure on the US dollar[40] in case the signs of declining economic momentum coincide with recent remarks by Fed officials.

Analysts[41] suggest that in the future, future comments by Fed policy-makers, such as Lorie Logan and Raphael Bostic, could give new signals to US dollar movements. Weaker US data and a low-risk attitude of the Fed may provide NZD/USD[42] with short-term support. That said, the New Zealand deteriorating domestic environment and the prospects of further RBNZ easing ensure a bearish medium-term bias, leaving rallies susceptible. In this scenario, traders continue to exercise caution as the NZD/USD exchange rate could be significantly affected by any change in global sentiment.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.