EUR/JPY struggled near 0.8555 amid a supportive BoE's monetary policy outlook and the release of the UK Preliminary Services PMI. On Thursday, the Bank of England (BoE) reiterated its "gradual and careful" approach to monetary easing after deciding to keep borrowing rates unchanged at 4.25%. In a press conference, BoE Governor Andrew Bailey stated that interest rates continue to follow a "gradual downward path." He also pointed out that the central bank will closely observe the weakening labour market and increasing energy prices, heightened by escalating tensions in the Middle East, as significant risks to the economy. On the data front, the seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers' Index (PMI) improved to 47.7 in June, up from 46.4 in May. This data surpasses the market forecast of 46.6 for the reported period. Meanwhile, the Preliminary UK Services Business Activity Index advanced to 51.3 in June, compared to May's 50.9, matching the expected figure of 51.3. Retail sales declined by 2.7% month-on-month (MoM) in May after rising by 1.3% in April (revised from 1.2%) against the market's expected 0.5% drop. Core retail sales, excluding automotive fuel sales, fell by 2.8% MoM, contrasting with the previously revised growth of 1.4% and the estimated decline of 0.5%. Annual retail sales in the UK dropped by 1.3% in May compared to a 5% increase in April, while core retail sales also decreased by 1.3% in the same month, compared to a previous revision of 5.2%.

On the Euro front, the European Central Bank (ECB) indicated a pause in policy easing this month, even though projections reveal price growth falling below its 2% target. This could provide some support to the shared currency. Recent comments from the ECB's Francois Villeroy de Galhau suggested that the central bank would monitor potential spillover effects from energy prices on underlying inflation and general price expectations, possibly leading to adjustments in monetary policy. The Eurozone manufacturing sector remained in contraction, while the services sector prodded the expansion territory in June, according to data from the HCOB's latest Purchasing Managers' Index (PMI) Survey, published on Monday. The Eurozone Manufacturing Purchasing Managers Index (PMI) remained unchanged at 49.4 in June, missing the market expectations of 49.8. The bloc's Services PMI rose to 50 in June from 49.7 in May. The data came in line with the estimated 50 figure and hit a two-month high. The HCOB Eurozone PMI Composite stayed at 50.2 in June. The market consensus was 50.5. The flash PMI for France's dominant services sector for June stood at 48.7, down from the previous and forecasted 48.9. The June flash manufacturing PMI came in at 47.8, down from 49.8 in May and below the forecasted 50.0. The June flash composite PMI - which comprises both the services and manufacturing sectors - stood at 48.5, down from 49.3 in May and also below the forecast of 49.3 points.

In today's session, the preliminary reading of the Purchasing Managers Index (PMI) for June from the Eurozone and the United Kingdom will drive the EUR/GBP exchange rate.

AUD/USD Weakens Amid Increased Risk Aversion

AUD/USD struggles near 0.6427 amid dampened risk sentiment driven by escalating tensions in the Middle East. US President Donald Trump announced late on Saturday that he had "obliterated" Iran's three nuclear facilities, including Fordow, Natanz, and Isfahan, in strikes overnight, in coordination with an Israeli assault. The Iranian parliament approved a measure to close the Strait. Iran has threatened to close the Strait in the past but has never followed through on this move, according to reports. On the data front, the preliminary reading of Australia's S&P Global Manufacturing Purchasing Managers Index (PMI) was 51.0 in June, remaining the same as the previous figure, as per the latest data published by S&P Global on Monday. The S&P Global Australian Services PMI advanced to 51.3 in June from the last reading of 50.6, while the Composite PMI increased to 51.2 in June compared to the prior 50.5. On Friday, the People's Bank of China (PBOC) decided to maintain its Loan Prime Rates, keeping the one-year and five-year rates at 3.00% and 3.50%, respectively. In May, Chinese retail sales rose by 6.4% year-over-year, well above the expected 5.0% and April's growth of 5.1%. Meanwhile, industrial production rose by 5.8% YoY, slightly falling short of the 5.9% forecast and April's 6.1% figure. In Australia, the unemployment rate remained steady at 4.1% in May, as expected. However, employment fell by 2.5K, a significant miss from the predicted 25K increase and a substantial decline from April's revised 87.6K jobs added. The participation rate dipped to 67.0% from 67.1%. While full-time positions increased by 38.7K, part-time jobs decreased by 41.2K. This weaker labour data strengthens the argument for a potential rate cut by the RBA in July.

On the greenback front, growing safe-haven demand, driven by the US attacks on three Iranian nuclear facilities over the weekend, supported the US dollar. On Friday, Federal Reserve (Fed) Governor Christopher Waller suggested that the US central bank might start easing monetary policy as early as next month, echoing a willingness to adapt amid global economic uncertainty and increasing geopolitical risks. Conversely, Fed Chair Jerome Powell previously cautioned that ongoing policy uncertainty would maintain the central bank's decision to hold rates steady, with any potential rate cuts contingent on improvements in labour and inflation data. The Philly Fed's general activity index remained at -4.0 in June, suggesting persistent weakness in regional manufacturing. The employment index dropped to -9.8, marking the lowest level since May 2020, as more companies reduced their workforce than hired in June. While new orders fell to 2.3, shipments increased to 8.3, indicating mixed but still weak demand signals.

In the upcoming sessions, broader market sentiment around the Middle East tension and US PMI numbers will influence the AUD/USD exchange rate.

EUR/JPY Buoyed by Eurozone PMI Data

EUR/JPY edged higher near 169.43, following the release of Eurozone and German Preliminary Manufacturing PMI data. Monday's preliminary business activity indicated that a contraction in Germany's manufacturing and services sectors lessened in June. The HCOB Manufacturing PMI for the Eurozone's largest economy climbed to 49 this month, up from May's 48.3, matching the predicted reading of 49, reaching a 34-month peak. In contrast, the Services PMI surged to 49.4 in June from 47.1 in May, exceeding the market forecast of 47.5, marking a three-month high. The HCOB Preliminary German Composite Output Index increased to 50.4 in June, compared to 48.5 in May and an expected 49, achieving its highest point in three months. While the Eurozone manufacturing sector remained in contraction, the services sector moved into expansion territory in June, as indicated by the latest Purchasing Managers' Index (PMI) Survey from HCOB. The Eurozone Manufacturing PMI held steady at 49.4 in June, falling short of market expectations of 49.8. Conversely, the bloc's Services PMI rose to 50 in June from 49.7 in May, aligning with the estimated figure and reaching a two-month high. The HCOB Eurozone PMI Composite remained at 50.2 in June, while the market consensus was 50.5.

On Japan's front, market anticipations surrounding the timing of the next interest rate hike by the Bank of Japan (BoJ) to Q1 2026 continue to influence the Japanese yen. Additionally, concerns about the potential economic impact of the existing 25% US tariffs on Japanese vehicles, coupled with 24% reciprocal duties on other imports, are undermining the JPY. Friday's Japan's core inflation has exceeded the central bank's 2% target for over three years, reaching a more than two-year high in May, leaving room for additional rate hikes by the BoJ; however, it failed to trigger any momentum in the yen. Furthermore, the au Jibun Purchasing Managers' Index (PMI) reported on Monday that Japan's manufacturing sector returned to expansion for the first time since May 2024. The Manufacturing PMI surged from last month's 49.4 to 50.4 in June. Moreover, the services sector index increased to 51.5 in June from 51.0 in May, while the Composite PMI rose to 51.4 in June from 50.2 in May.

On the geopolitical front, the US's collaboration with Israel to conduct military strikes on Iran, targeting three nuclear facilities on Sunday, injects volatility in the market. It involved the launch of 75 precision-guided munitions, which included over two dozen Tomahawk missiles and the deployment of more than 125 military aircraft. Additionally, US Defence Secretary Pete Hegseth cautioned Iran against acting on its previous threats of retaliation. Furthermore, Vice President JD Vance clarified that the US was not in conflict with Iran itself but rather with its nuclear programme.

Broader market sentiment around the Eurozone and the US Preliminary Manufacturing PMI will influence the EUR/JPY exchange rate in today's session.

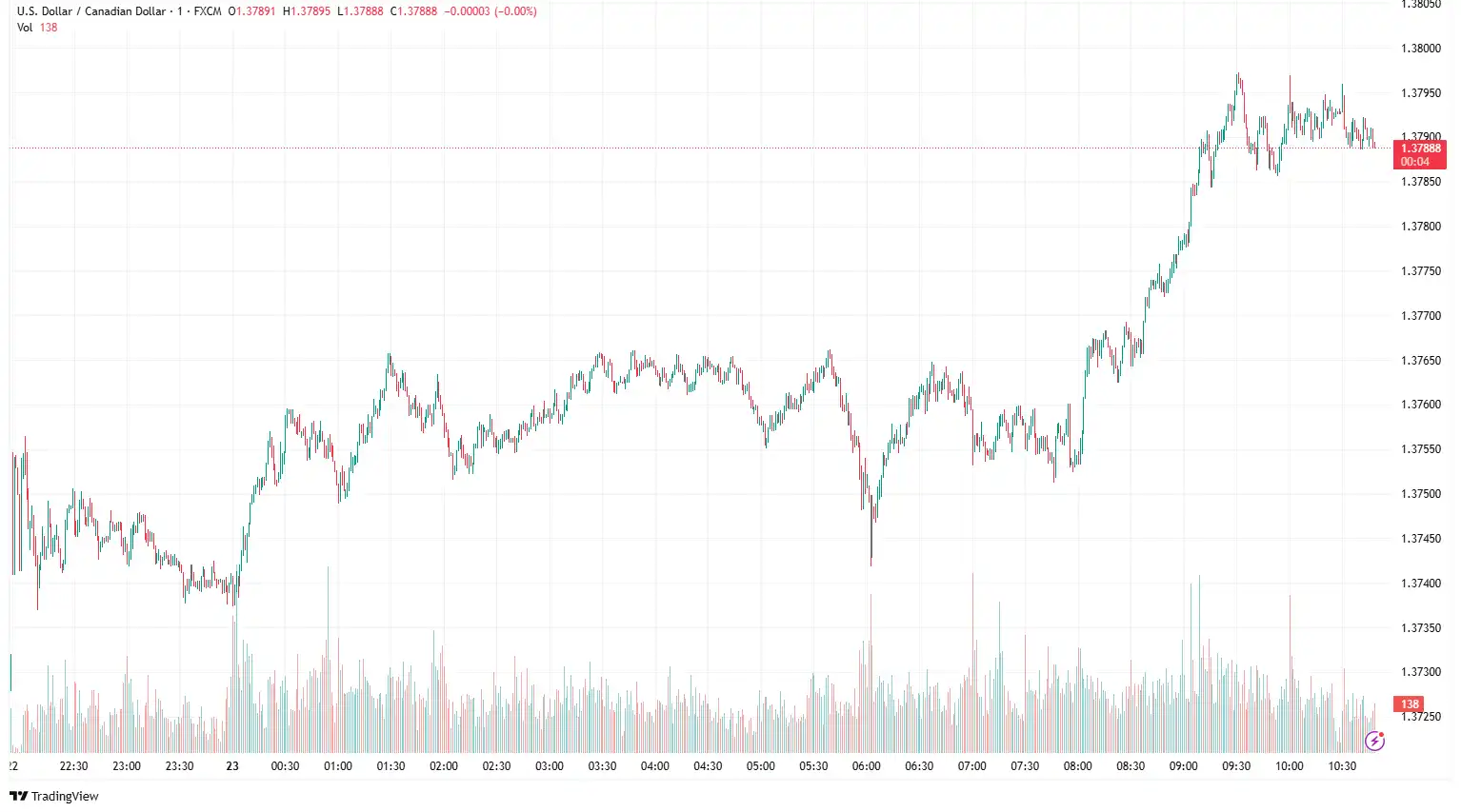

USD/CAD Rebounds Ahead of US PMI Data

USD/CAD recovered near 1.3765 as the brighter market mood, coupled with high oil prices, supported the commodity-linked loonie. In May, prices for goods produced in Canada, as reflected by the Industrial Product Price Index (IPPI), decreased by 0.5% from the previous month while rising by 1.2% compared to the same month last year. This decline marks the second consecutive month of a 0.5% drop in the IPPI. Concurrently, the prices of raw materials acquired by Canadian manufacturers, indicated by the Raw Materials Price Index (RMPI), experienced a 0.4% month-on-month decrease and a 2.8% year-on-year decline. This also represents the third straight month of a 0.4% drop in the RMPI. However, when excluding crude energy products, the RMPI saw a 1.6% increase in May. Additionally, Canadian retail sales are anticipated to show a slowdown in consumption to 0.4% in May, down from 0.8% in April, although when excluding automobile sales, sales of other products rose by 0.2% following a 0.7% decrease in the previous month. Meanwhile, concerns that a broader Middle East conflict would disrupt supplies push crude oil prices to over a five-month high and support the commodity-linked loonie. Moreover, hopes that the US and Canada could secure a trade deal soon, along with diminishing odds for further rate cuts by the Bank of Canada (BoC) amid a reacceleration in domestic inflation, bolster the Canadian dollar (CAD).

Conversely, global risk sentiment weakened following the US attack on Iran's nuclear facilities on Sunday, heightening the potential for escalating conflict in the Middle East. Nonetheless, the increasing expectation that the Federal Reserve (Fed) will begin cutting rates in September tempers any additional advances for the USD. On Friday, Fed Governor Christopher Waller indicated that the US central bank might initiate interest rate cuts as early as next month, demonstrating a willingness to adapt in response to global economic uncertainties and escalating geopolitical risks. The United States conducted extensive strikes on three significant nuclear sites in Iran, including the Fordow underground facility, which, as stated by President Donald Trump, has severely impacted Iran's nuclear programme. Trump's further remarks imply that this operation was singular and that broader escalation could be avoided if Tehran does not retaliate. Thus far, the market response has been muted. In retaliation, Iranian authorities have launched missiles at Israel, and its parliament has approved the closure of the Strait of Hormuz, a crucial oil transport route, potentially pushing crude prices above $100 per barrel. Although Iran has not targeted US interests in the region yet, any such actions could trigger a larger regional conflict.

Upcoming Canadian consumer inflation figures, Fed Chair Jerome Powell's two-day congressional testimony starting on Tuesday, along with geopolitical developments and global flash PMIs, will drive the risk sentiment and USD/CAD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.