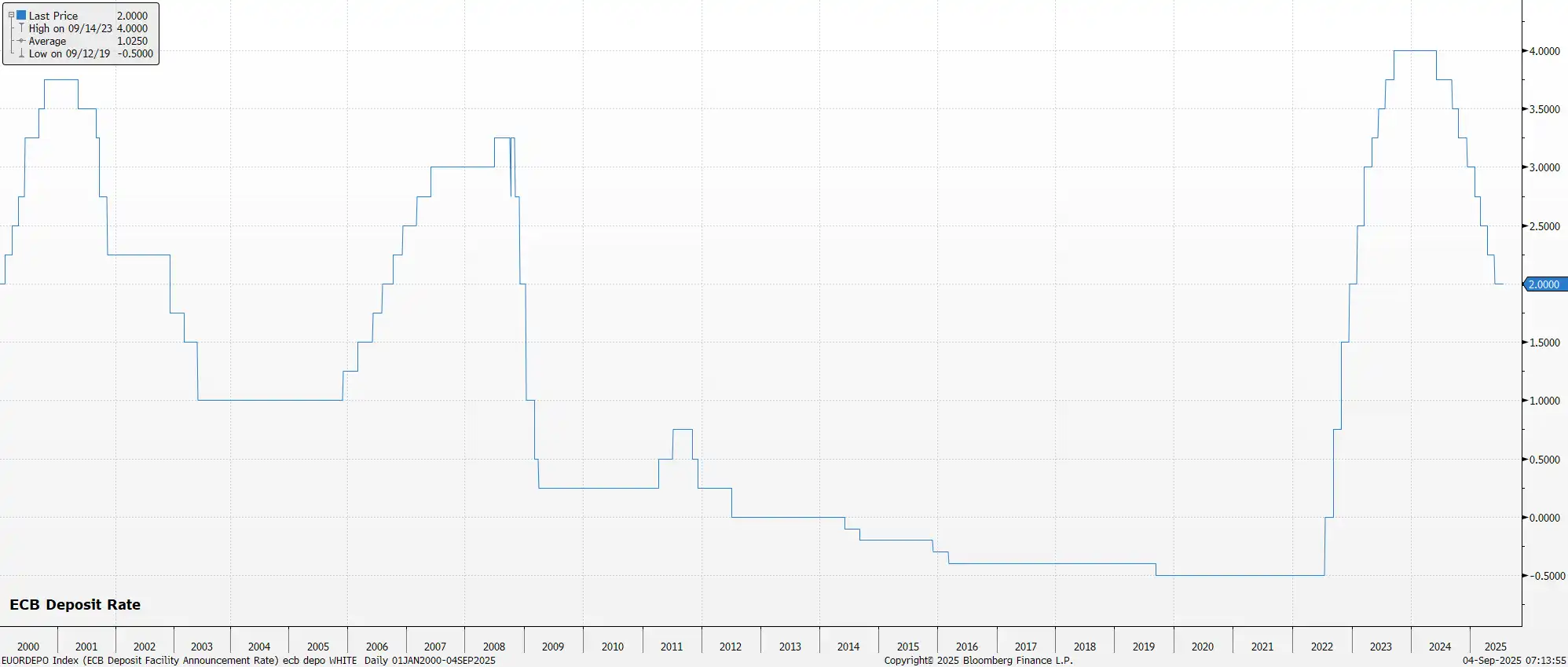

After standing pat in July, the ECB's Governing Council are set to hold rates steady again at September's meeting, with the easing cycle likely now concluded. In fact, the upcoming decision should be a relatively straightforward affair as policymakers return from the summer break, with the deposit rate almost certain to be held steady at 2.00%, and money markets discount next-to-no chance of any policy shifts this time out.

Meanwhile, the accompanying policy statement should also be a rather simple affair, with policymakers likely to repeat the guidance with which market participants have now become incredibly familiar. Namely, that the approach to future decisions will remain a ʻdata-dependent’ and ʻmeeting-by-meeting’ one, with no ʻpre-commitment’ being made to any particular rate path.

Along with that updated statement, the September meeting also brings an update to the ECB’s staff macroeconomic projections.

Those projections, however, are likely to be very little changed from those issued at the conclusion of the June meeting, particularly with downside risks to the outlook having marginally diminished, since the agreement of a US-EU trade deal. Consequently, and with leading indicators such as the recent round of PMI surveys having pointed to an uptick in activity within the bloc, the ECB’s should again forecast GDP growth of around 0.9% this year, and around 1.1% next.

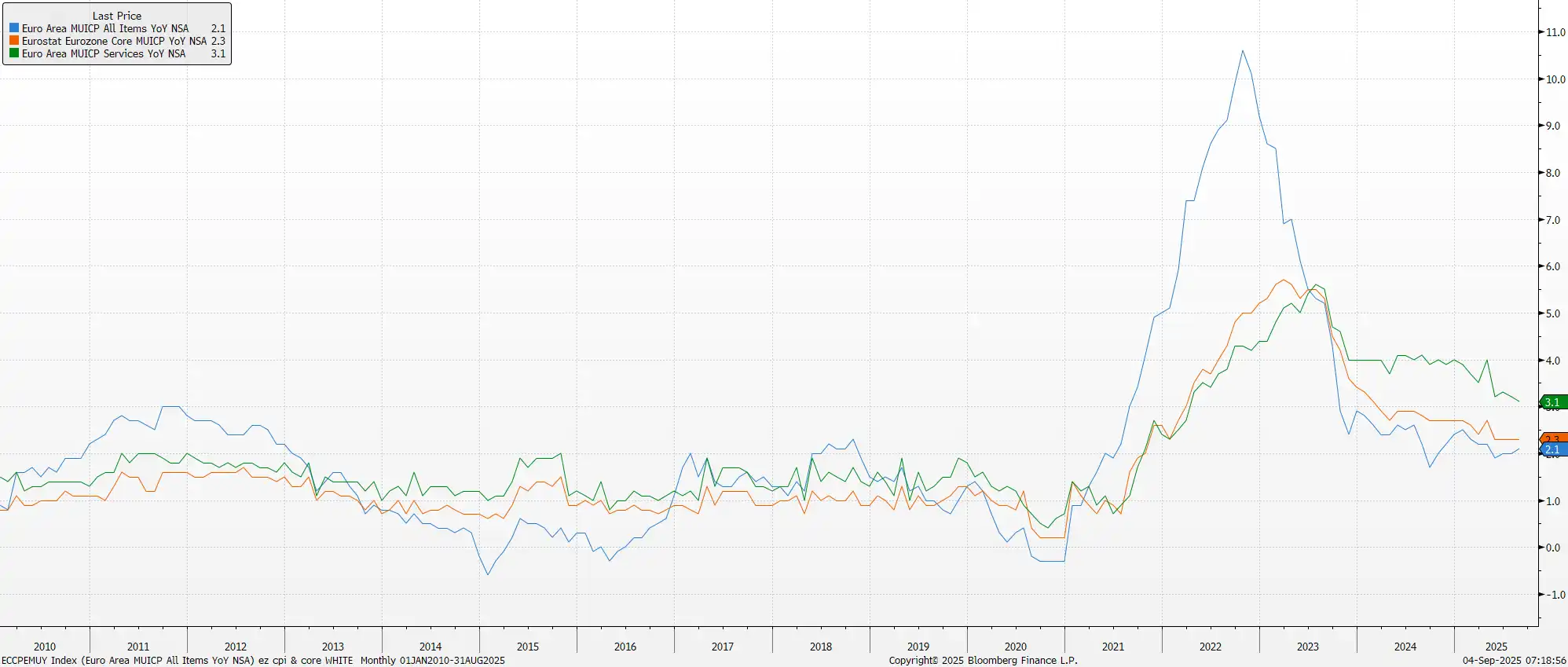

That inflation undershoot, however, shan’t be enough to force the ECB into delivering another rate cut, even if some of the more dovish Governing Council members may attempt to argue that point towards the end of the year. In fact, it seems highly unlikely that policymakers will deliver any further easing at this stage, barring a re-escalation in US-EU trade tensions, or a further strengthening in the EUR, with a move north of $1.20 likely to trigger some concern.

With that in mind, the post-meeting press conference is likely to see President Lagarde repeat her view that policy is in a ʻgood place’, while also reiterating the long-running view that policy is not on a pre-set course. Nevertheless, as things stand, the ECB’s easing cycle looks to be over, with the deposit rate set to remain at 2.00% through to the end of next year.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.