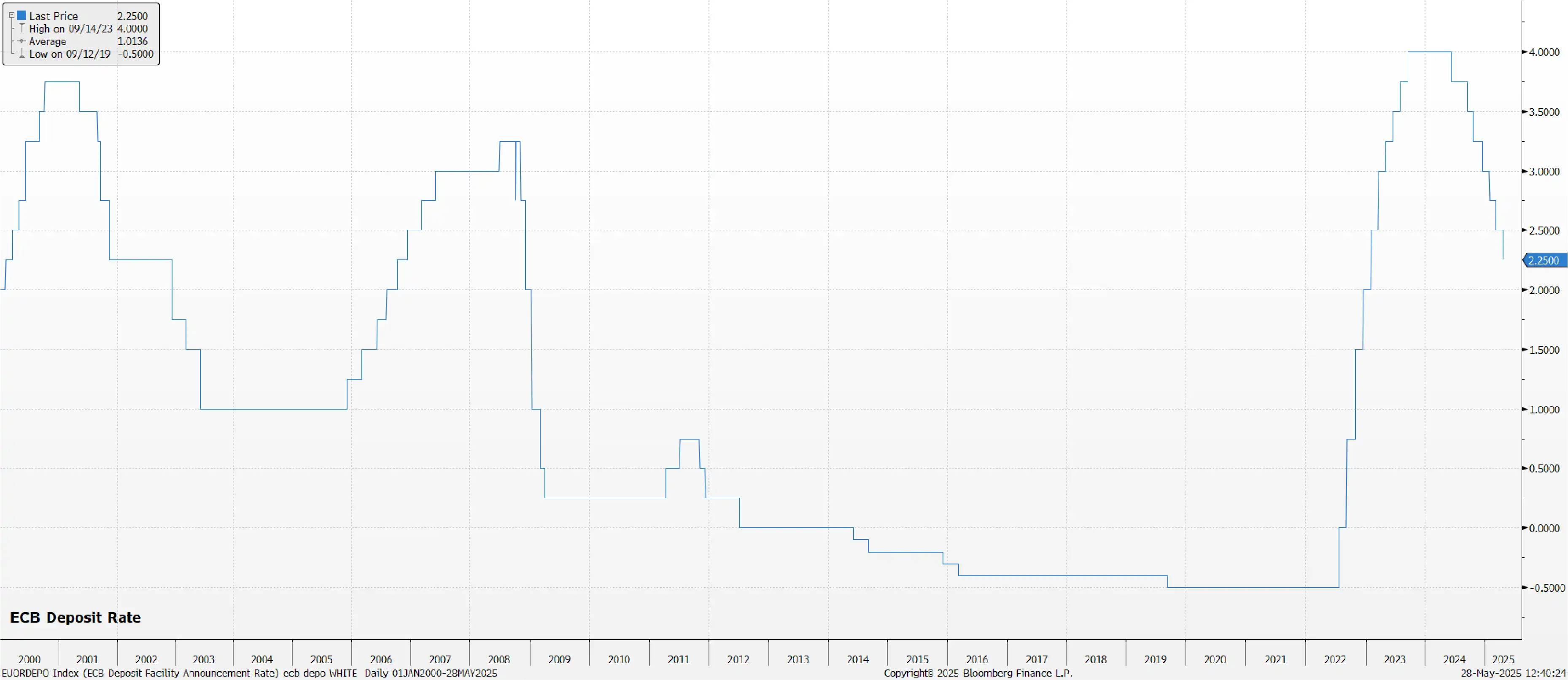

The ECB are near-certain to continue to ease policy at the June meeting, delivering another 25bp cut, lowering the deposit rate to 2.00%, marking the 4th cut of 2025 and the 8th cut of the cycle so far. Money markets fully discount a cut this time around, while also pricing 60bp of easing by year-end.

The accompanying policy statement should remain broadly unchanged from April, with policymakers likely to reiterate that future decisions will be taken using a 'data-dependent' and 'meeting-by-meeting' approach, while stressing that policy isn't on a 'pre-set' course. Language around policy restrictiveness was omitted last time out and is likely to be so again, especially with the deposit rate now sitting in the middle of the 1.75% - 2.50% neutral band.

Nevertheless, owing to the huge amount of trade and tariff related uncertainty, primarily the threat of the US imposing 50% tariffs on EU goods, the latest round of staff macroeconomic projections are likely to be significantly revised compared to those issued at the end of Q1.

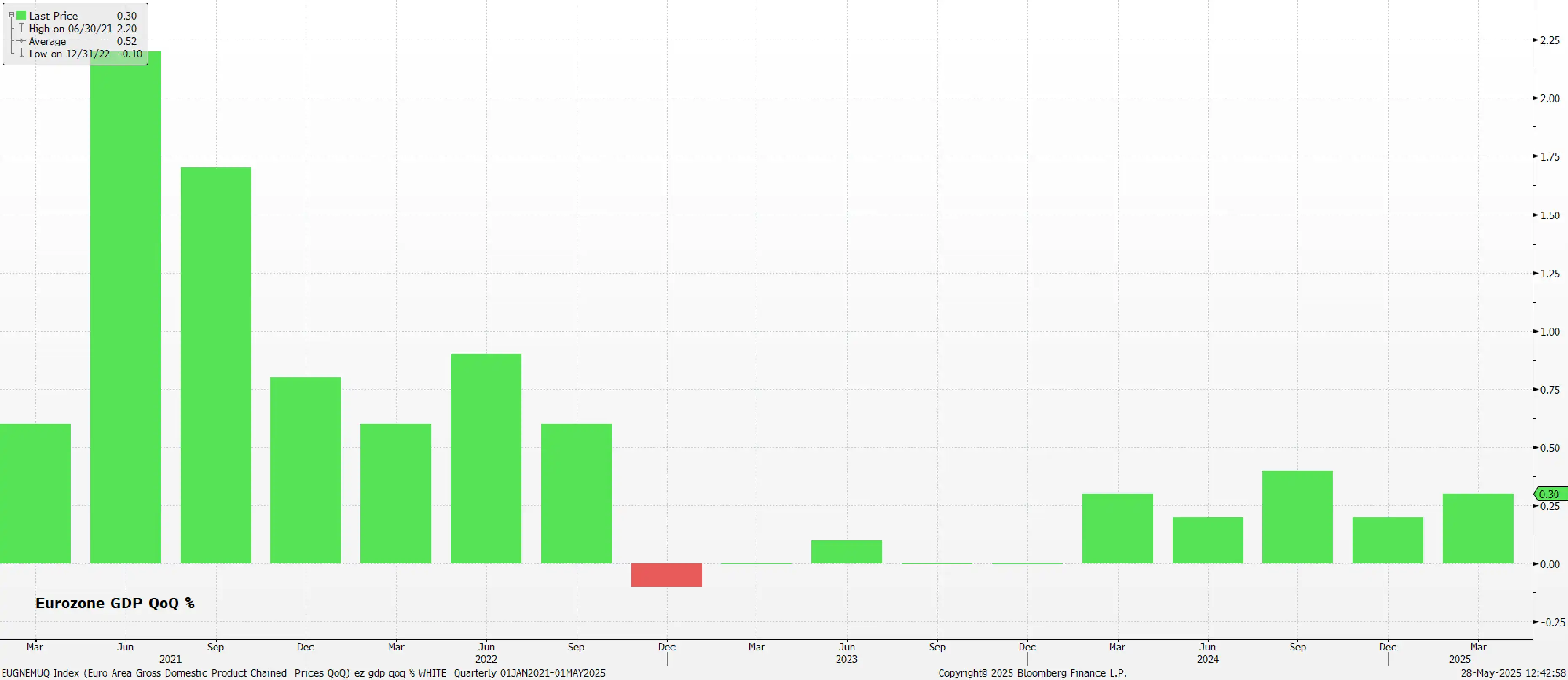

As such, the GDP growth profile is set to be revised lower in both this year and next. While Q1 output was boosted by firms attempting to 'front-run' tariffs, growth headwinds are intensifying, as shown by the May composite PMI slumping below 50 to a 6-month low.

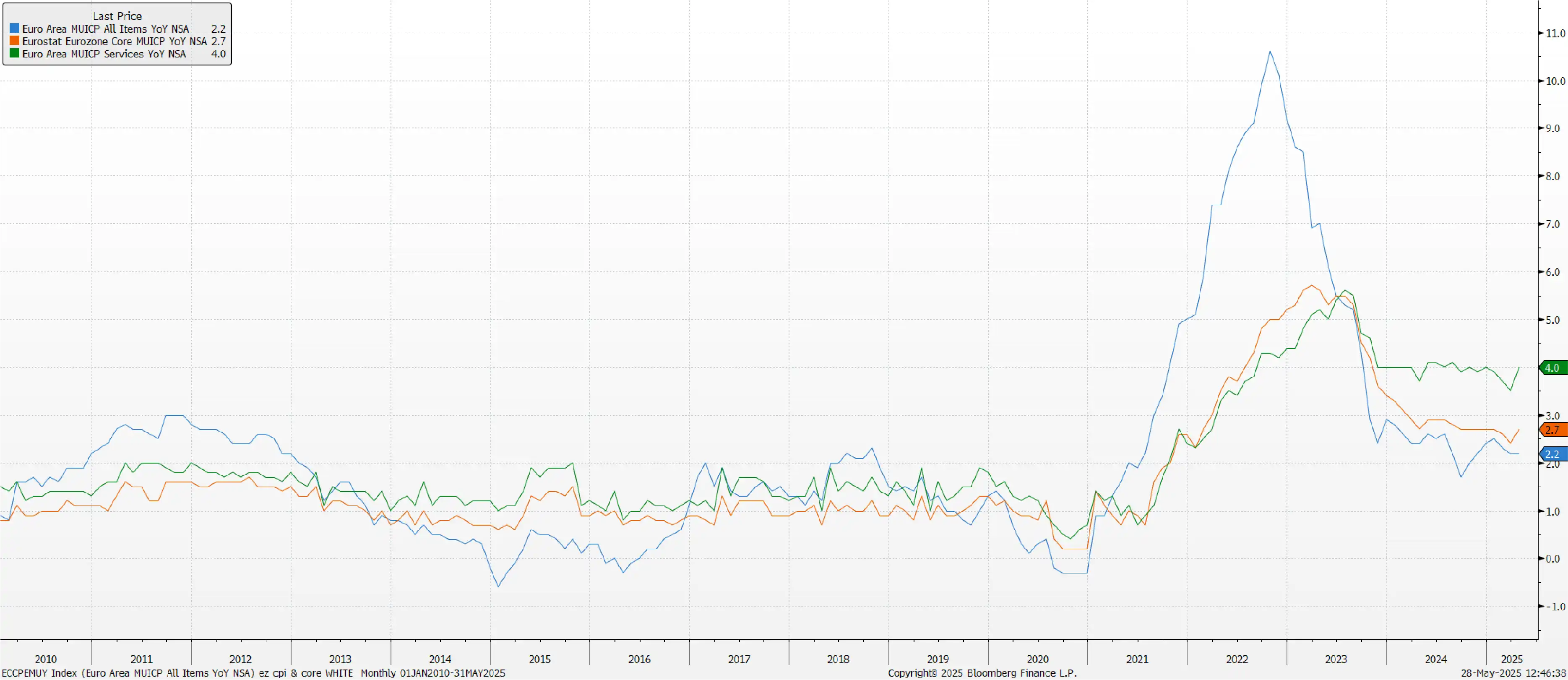

Meanwhile, on inflation, the drop in demand from trade tensions, coupled with potential goods 'dumping' from countries like China, are notable disinflationary forces. Their impact is likely compounded by significant EUR strengthening, with EUR/USD rallying towards 1.15 versus the March projection assumption of 1.04, while the ECB's EUR NEER index approaches record highs around 129.25. Together, all this is likely to see the inflation profile nudged a touch lower.

President Lagarde's post-meeting press conference is unlikely to add significant new information. She will likely stress the data-dependent nature of ECB policy while reiterating a need for 'agility' owing to huge uncertainties. There will be no overt pre-commitment to a particular policy path.

Taking a broader view, mounting downside growth risks, a lower inflation profile, and continued elevated trade uncertainty will likely lead to further rate cuts ahead. Another cut seems nailed on before summer's end, with a move below 1.75% increasingly likely before year-end.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.