The Dollar finds a floor after Bessent comments, but still weak as reaffirmation of a strong dollar policy proved short-lived. Political uncertainty drives dollar selling. Fed rates remain unchanged. Sterling remains resilient near peak highs; the Euro strengthens.

GBP: Sterling Hovers Near Peaks on Hawkish BoE Backdrop

The British pound remains near $1.3850, its highest level since Aug 2021. Domestic price pressures intensify with UK inflation hitting 3.4% and retail data pointing to accelerating costs. The BoE (Bank of England) is widely expected to maintain its rate at 3.75% in the Feb 5 meeting.

The pound is effectively acting as the G10’s "high-yield" alternative to the dollar. If the BoE maintains its restrictive stance while the Fed remains on hold, the pound's appeal grows.

The GBP/USD pair tests resistance at 1.3850. A break above could propel the pair toward 1.4000, while the 21-day EMA at 1.3650 serves as a primary floor.

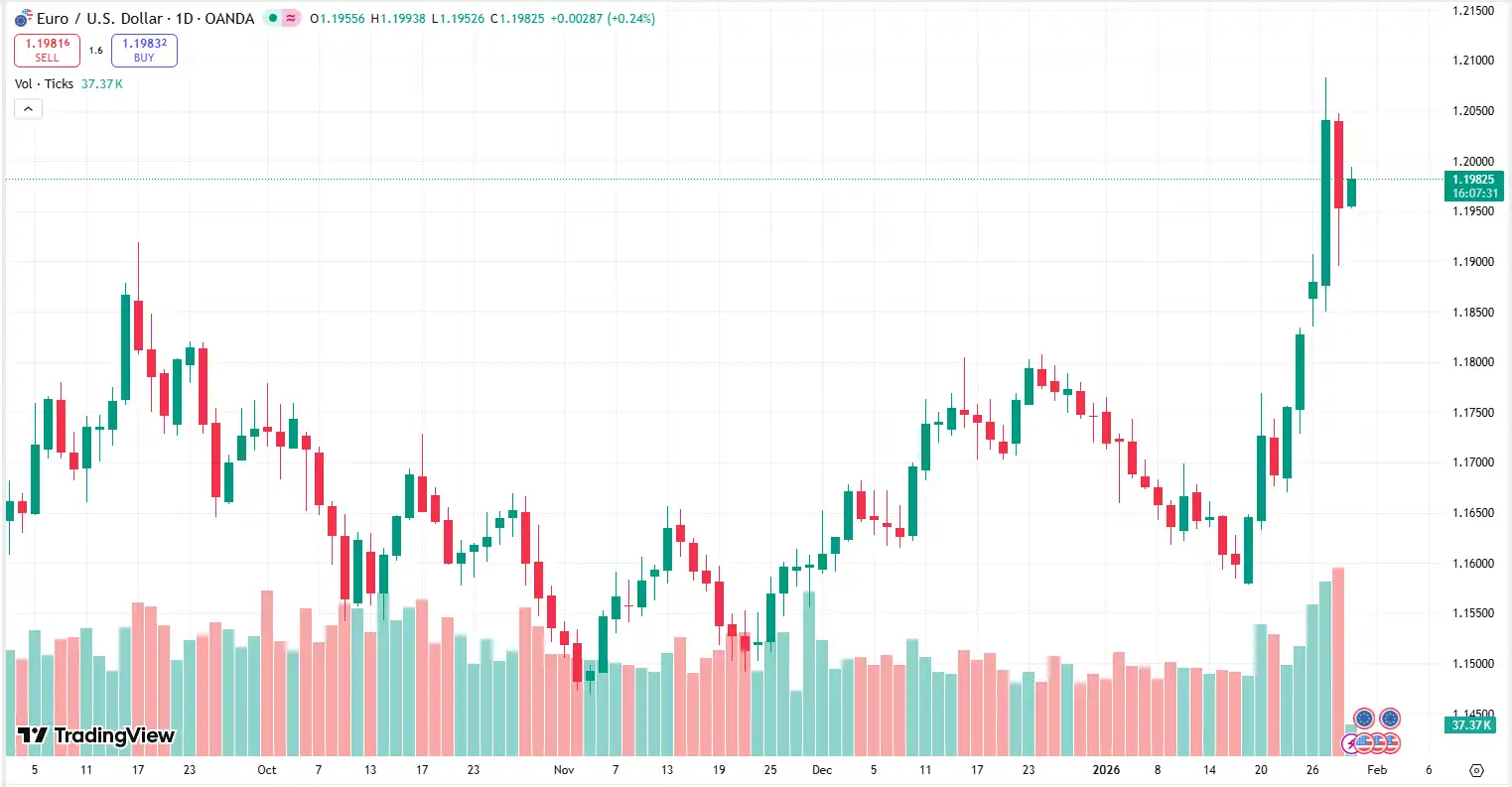

EUR: ECB navigates euro strength risks

EUR/GBP holds above 0.8650. European equities stabilised Thursday after Wednesday's luxury sector disappointment. The pair trades narrowly as central banks' stances diverge. ECB (European Central Bank) officials warn euro strength may force resumed rate cuts, whilst the BoE maintains a restrictive stance. ECB's Kocher emphasised keeping all rate options open, a dovish tilt that caps euro rallies if disinflation confirms

The currency is under pressure from bank rhetoric and eurozone sentiment data including German GDP, Spanish retail sales, and Italian production figures.

The ECB is in "verbal intervention" mode, effectively jawboning the currency lower to protect export competitiveness.

The EUR/USD pair slipped to 1.1950 after breaching 1.2000. Key support lies at 1.1850.

USD: Fed risks & Political uncertainty drives dollar selling

The dollar index slipped 0.3% to 96 on Thursday, surrendering gains from Treasury Secretary Bessent's strong-dollar reaffirmation in the previous session. The FOMC kept rates at 3.50% to 3.75% on Wednesday, citing a "solid" economy, yet the market is only pricing a 50% chance of a cut by June i.e. after Powell's May term ends.

Flight to real assets accelerated gold, silver, and copper hit fresh record highs as geopolitical and trade risks undermine reserve currency confidence. Criminal investigations into Powell and efforts to remove Fed Governor Cook intensify central bank independence concerns.

The greenback found a floor after Secretary Bessent dismissed intervention speculation to support the yen, but structural risks remain.

USD/JPY is tracking the 153.00 level. Japan’s Lower 10-year Treasury yields and intervention talk from Tokyo are keeping a lid on any major recovery.

Economic reality is clashing with political noise. The Fed’s 'solid' outlook has prevented a collapse, but it hasn’t sparked a rally. The Dollar is now stuck in a grind—supported by fundamentals, but capped by the White House.

Markets look ahead:

Thursday: US Initial Jobless Claims, Japan unemployment rate and retail sales.

Friday: Japan CPI, Eurozone German GDP data

Feb 5: Bank of England rate decision (hold at 3.75% expected)

BoE commentary next week will determine whether sterling can hold $1.38 or if dovish undertones emerge. ECB officials' response to euro strength and Friday's German GDP print could catalyse eurozone volatility. Dollar direction hinges on US jobless claims data and any further White House policy signals from President Trump's 4:30pm ET announcement. Gold's rally continues to weigh on dollar safe-haven appeal.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.