The dollar strengthened as the ISM Manufacturing PMI climbed to 52.4, its first expansion in a year; signalling U.S. economic resilience. The Aussie dollar jumped after the RBA’s bold 3.85% hike, while EUR & GBP stayed range-bound as markets anticipated no change in policy from the ECB and BoE.

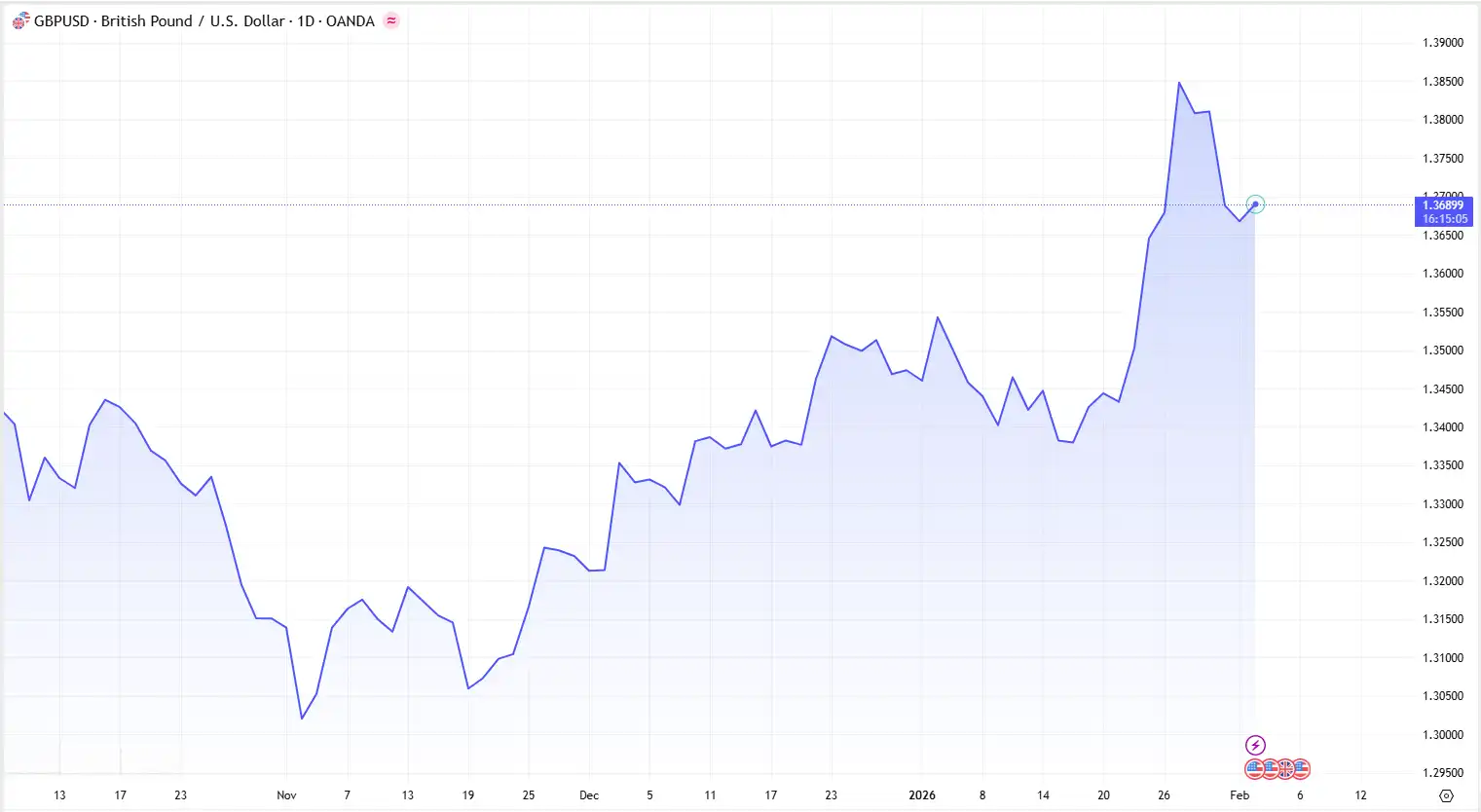

GBP: Sterling steadies as BoE set to hold rates

Cable trades near 1.3696, consolidating below recent peaks. The Bank of England (BoE) is expected to keep rates unchanged at 3.75% this Thursday, with investors now pricing in less than a 50% of more than one cut this year.

The case for BoE patience is getting stronger. UK inflation is stubbornly leading the G7, and the real economy is finally responding. UK Manufacturing PMI just hit levels not seen since mid-2024, signalling that the Q4 slump is over. This resilience gives the Monetary Policy Committee plenty of cover to hold the line on rates.

The BoE’s last two meetings saw policymakers deeply divided, yet the current data mix supports a steadier stance. Resilient data and persistent price pressures lock the BoE in place.

External forces continue to shape price action. A firmer US dollar and reduced (Federal Reserve) Fed rate cut bets have pressured the pound lower. GBP/USD consolidates within a 1.3640 to 1.3710 range. The pair shows signs of stabilisation rather than directional conviction. Further declines look unlikely in the near term.

(The Waiting Room: Cable stuck in 1.3640–1.3710 consolidation)

(The Waiting Room: Cable stuck in 1.3640–1.3710 consolidation)

Against the euro, GBP/EUR remained anchored near 0.8627.

Against the euro, GBP/EUR remained anchored near 0.8627.

EUR: Euro hovers near four-year high ahead of ECB decision

The EUR/USD pair rose above 1.1810 in the Asia session. The pair hovers near the four-year peak of 1.2000 touched last week. The euro found support as the dollar stabilised after last week's sharp dollar sell-off.

The European Central Bank (ECB) expected to leave rates unchanged on Thursday. As policymakers assess the combined impact of euro strength, weaker US dollar dynamics, and an influx of low-priced Chinese imports. The ECB has held policy steady since June, supported by resilient growth and inflation near target.

ECB Officials acknowledge that policy sits in a “good place”, yet recent comments signal growing sensitivity to further appreciation. ECB policymaker Martin Kocher warned last week that further euro strength could trigger resumed rate cuts. François Villeroy de Galhau flagged the dollar's recent depreciation as a key factor for shaping policy deliberations. Thursday's ECB statement will determine any shift in currency rhetoric, which may temper momentum without reversing the broader trend. Although tolerance for sustained euro strength appears limited.

(Euro hovers nears four-year peaks)

(Euro hovers nears four-year peaks)

USD: Dollar rebounds on Warsh Fed pick & manufacturing surge

The US dollar has reclaimed its footing as the dominant force in FX markets, supported by a surge in US factory data and Fed policy signals.

The US ISM Manufacturing PMI jumped to a 41-month high at 52.4 in January, marking the first expansion in a year , lifting Treasury yields modestly. The robust data was driven by sharp gains in new orders and production.

January strength reflects seasonal restocking. Market survey details paint a more complex picture. Firms highlight tariff uncertainty as a persistent constraint, with restocking activity partly driven by efforts to front-run potential tariff-driven price increases. One firm cited tariff threats on the EU as a "huge negative impact on our profits." Anti-American buyer sentiment erodes export demand. Atlanta Fed's Bostic warns tariff effects on prices will linger longer than many expect. He does not anticipate any rate cuts this year.

The data-driven dollar strength is playing out against a backdrop of easing geopolitical friction, as progress on a US-India trade deal and resumed Iran nuclear talks dampen safe-haven premiums. However, the optimism remains fragile.

In the G10 space, the dollar's rebound has forced a tactical retreat in major pairs. The USD/JPY pair held near 155.5, retracing half its recent gains as US-Japan intervention speculation faded. The yen holds losses as dollar strength dominates. While the broader risk-on sentiment lifted Asian equities, the greenback’s yield advantage remains the primary anchor for the pair as markets digest the implications of a "Warsh Fed" and a potential return to US exceptionalism.

AUD: The Hawk Flies Alone

The AUD/USD pair outperformed, rising to 0.7011 after the RBA raised rates to 3.85%. The Reserve Bank of Australia joins Japan as the only developed-world economy tightening central bank policy. The above-target inflation and a tight labour market justified a unanimous decision to lift the cash rate.

The BLS delaying Friday’s jobs report due to the partial government shutdown, the market is flying partially blind on labor trends, leaving the PMI data as the primary driver of near-term momentum. Expectations around new Fed Leadership continue to support the dollar’s rebound.

Markets look ahead:

Thursday: BoE rate decision, ECB rate Decision

Friday: US Non-Farm Payrolls now postponed due to government shutdown

In the week ahead, central bank decisions will likely drive the currency market volatility.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.