Dollar reclaims ground as Warsh nomination reshapes Fed outlook; whilst the British pound consolidates ahead of BoE. Euro retreats from highs. Commodity-linked currencies are pressured by risk-off sentiment and falling oil prices.

GBP: Trading near key resistance ahead of BoE

Cable treads water at 1.3695, consolidating after last week’s sharp moves. External forces, not domestic data, are driving the pound. Sterling's stability masks underlying cross-currents: particularly renewed dollar strength following Kevin Warsh's Federal Reserve (Fed) nomination, though attention is now shifting to next week's Bank of England (BoE) meeting on February 5.

The BoE is all but certain to hold interest rates steady at 3.75%. However, updated economic projections and the MPC's (Monetary Policy Committee) voting split will determine whether Cable can sustain gains or faces fresh pressure. The slightly less dovish communications from Dave Ramsden and Sarah Breeden anchor expectations for a 7-2 vote split in favour of holding rates. The key tension: a small majority of economists now expect a rate cut to 3.50%, betting on dovish follow-through that could lift the GBP/USD pair in the near term.

The technical picture for Cable remains constructive. GBP/USD is holding above its key short-term moving averages, signalling that the broader uptrend remains intact despite Friday's pullback. The euro is also showing a mild upside bias against the British pound. The EUR/GBP pair is trapped between 0.8645 and 0.8670 amid increasingly diverging monetary policy paths between the BoE and the European Central Bank (ECB).

Today's UK S&P Global Manufacturing PMI expected in line with the previous month at 51.6, will offer the first clue on economic momentum heading into the BoE decision. While a leading indicator of business activity, the reading is unlikely to shift rate expectations materially unless it delivers a significant surprise.

The key test is 1.3700. Sterling needs a hawkish BoE surprise to break this ceiling. Still, the pound's resilience against both the dollar and euro suggests traders remain constructive on the outlook, particularly if next week's meeting delivers a less divided vote than feared.

EUR: Euro slips as Warsh nomination strengthens dollar

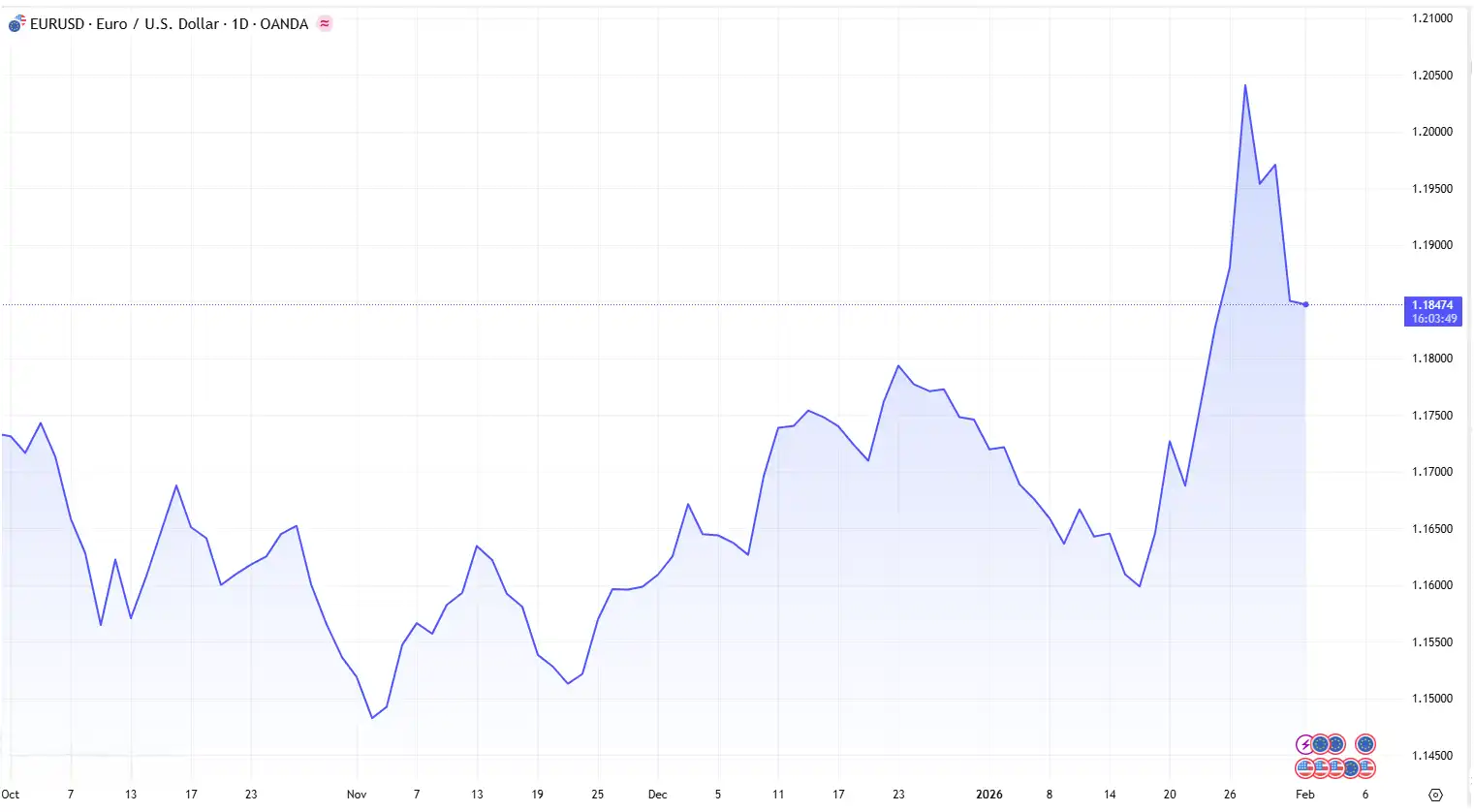

The EUR/USD pair retreated near 1.1847, firm below 1.2000 level from testing multi-year highs above 1.1900 just days earlier. The sharp reversal came as the dollar reasserted strength following President Trump's nomination of Kevin Warsh as the next Fed chair, a decision that has fundamentally reshaped market expectations around US monetary policy and triggered a wave of selling of risk assets.

The greenback surged on expectations that Warsh will shrink the Fed's balance sheet even as he pursues rate cuts. That combination typically supports the dollar by reducing money supply in the market , even as the rate cuts approach. This nuanced dynamic caught many traders off guard on Friday, accelerating positioning unwinds and pushing EUR/USD below its short-term moving averages.

The euro faces its own headwinds as investors await the flash Eurozone Harmonised Index of Consumer Prices (HICP) data for January, scheduled to be released Wednesday. The headline HICP is expected to come in lower at 1.7% YoY from the prior release of 1.9%.

Signs of price pressures cooling down would boost expectations of an interest rate cut by the ECB in the near term, further widening the policy divergence with the Fed and limiting the euro's upside potential against the dollar.

The technical picture has shifted decisively. EUR/USD now sits below its short-term moving averages, and momentum indicators suggest further downside risks unless the narrative around Warsh softens or European data surprises to the upside. The EUR/USD pair's inability to hold above 1.1900 despite weeks of dollar weakness earlier this month signals that 1.1800 may reassert itself as a firm ceiling once fundamentals regain control.

This week promises heightened volatility for both currencies. The US dollar trades highly volatile as a series of employment-related and ISM Purchasing Managers' Index (PMI) data are due for release today, and the Nonfarm Payrolls (NFP) data scheduled for Friday. A stronger NFP print would likely reinforce the dollar's strength and push EUR/USD toward the 1.1700 handle, while a softer reading could offer temporary relief and allow the pair to stabilise near current levels. Still, with the ECB expected to ease further and the Fed on hold until at least June, the medium-term outlook favours a stronger dollar.

USD: Dollar gains as Warsh nomination reshapes Fed outlook

The dollar index steadied at 97.19 after jumping 1% on Friday, as investors recalibrated for a Fed that may cut rates but tighten financial conditions through quantitative tightening. Expectations remain anchored at two Fed cuts for 2025, with the first move unlikely until June i.e when Warsh would assume the chair if confirmed by the Senate. This timeline gives the dollar breathing room to consolidate recent gains, particularly if upcoming data reinforce the economy's resilience.

The dollar's strength has rippled across major currency pairs.

Yen pressured by dollar strength and election uncertainty

The yen wobbled at 154.82 per dollar, caught between renewed dollar strength and growing political uncertainty ahead of Japan's snap election. Prime Minister Sanae Takaichi's weekend comments talking up the benefits of a weaker yen added complexity to an already fragile currency, particularly as her tone sits at odds with the finance ministry's efforts to stem the yen's declines. The February 8 election shapes up as the next key catalyst, with an LDP majority likely pushing USD/JPY toward 160, whereas a coalition outcome could leave the pair near 155.00. Still, traders remain on alert to the prospect of coordinated intervention after last month's rate checks, keeping volatility elevated and limiting the yen's downside for now.

Commodity-linked currencies faced particular pressure, with the AUD/USD pair falling 0.6% to 0.6922 ahead of the RBA rate decision on Tuesday, with markets anticipating 25bps hike to 3.85%.

Loonie weakened as oil prices dropped over 5% as traders monitored US-Iran talks that could ease geopolitical risk premiums. USD/CAD firmed towards the 1.3600 handle. A sustained break above 1.3600 would open the door to further gains towards 1.3700.

For the US dollar, a decisive break below 96.50 on the Dollar Index would signal that Friday's move was an overreaction, while a sustained hold above 97.00 could open the door to a retest of the 98.00 handle.

This week's employment-related US data and Friday's Nonfarm Payrolls will prove critical in determining whether the dollar's resurgence has staying power or represents a temporary repositioning ahead of the Fed's next policy decision.

Markets look ahead:

Today: UK S&P Global Manufacturing PMI, US ISM Manufacturing PMI

Tuesday: Australia RBA rate decision

Wednesday-Friday: US Nonfarm Payrolls (NFP) data,

Eurozone Harmonised Index of Consumer Prices (HICP)

Japan household spending data,

ongoing US-Iran diplomatic developments

February 5: Bank of England and European Central Bank rate decision

February 8: Japan snap election

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.