AUGUST REVIEW & SEPTEMBER OUTLOOK

GBP

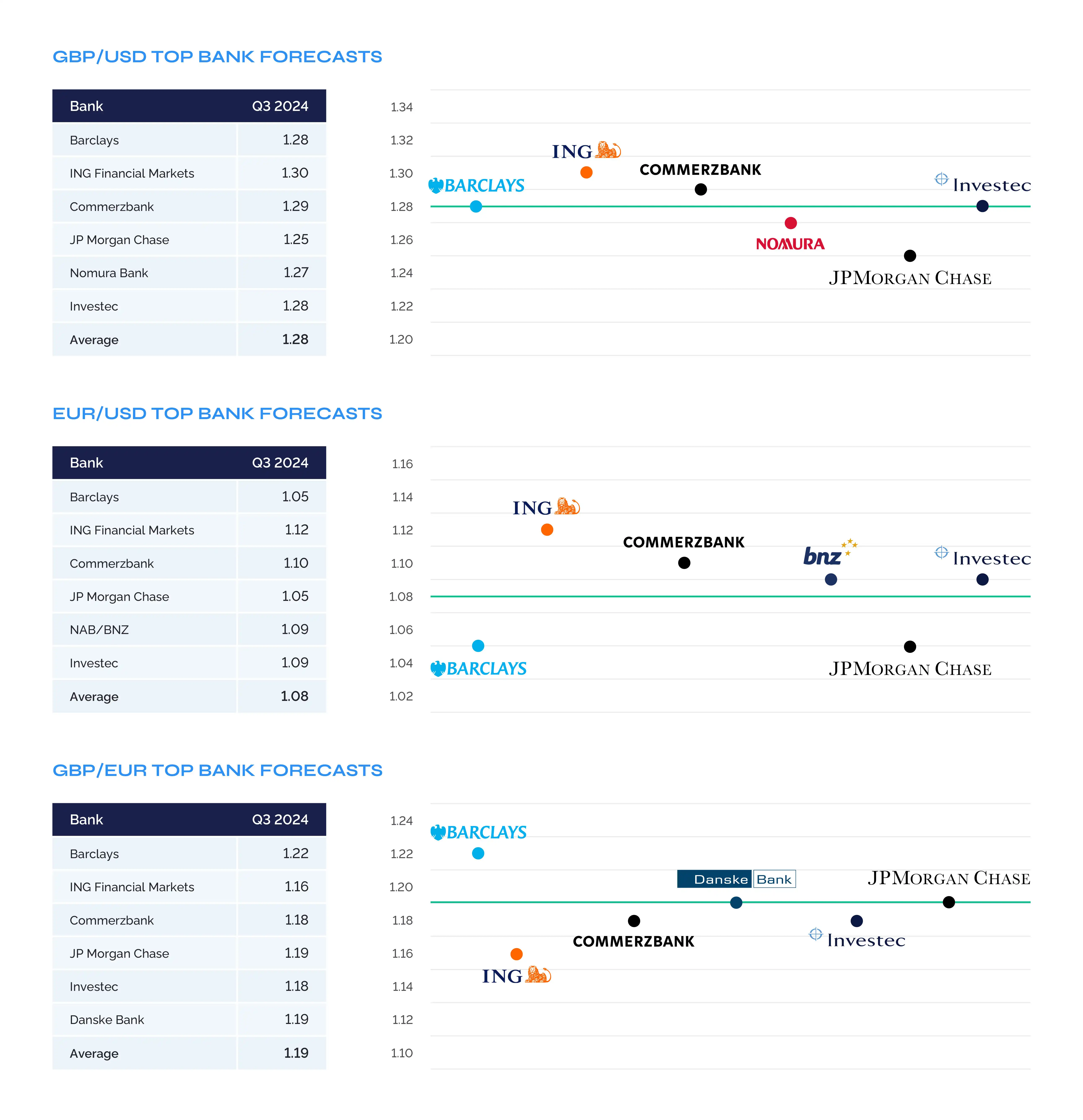

Sterling traded well in August, notching its best month of the year so far, and best month since last November, against the greenback, gaining just over 2%, as cable rose to its best levels in over 2 years, though gains were somewhat pared as the month drew to a close.

The pound also performed relatively well against the EUR, eking out a sixth straight monthly advance against the common currency, the best such run since the start of 2021. This run saw spot GBP/EUR briefly trading above the

1.19 figure, and to its best levels since before the now-infamous ‘mini-budget’ in September 2022.

The pound also performed relatively well against the EUR, eking out a sixth straight monthly advance against the common currency, the best such run since the start of 2021. This run saw spot GBP/EUR briefly trading above the

1.19 figure, and to its best levels since before the now-infamous ‘mini-budget’ in September 2022.

The GBP’s strength came despite the Bank of England’s Monetary Policy Committee beginning the policy normalisation process in August, delivering a 25bp Bank Rate cut, albeit via an incredibly tight 5-4 vote split among MPC members. This tight vote split, coupled with Governor Bailey setting a relatively high bar for further rate reductions, amid continued concerns over the potential persistence of price pressures within the economy, helped to limit the potential headwinds that could’ve stemmed from the easing cycle having got underway, a month earlier than we are likely to see across the Atlantic.

Money markets do price further easing, fully discounting the next 25bp cut by the November MPC meeting, though the 41bp of easing that the curve discounts between now and year-end does still seem overly-ambitious. While the pricing out of some degree of this easing may be expected to be GBP-positive, OIS curves across G10 discount an aggressive pace of easing, which one would expect to be priced out in a relatively synchronised manner, likely limiting the impact of any potential rate-pricing related upside in GBP pairs.

Instead, any additional GBP tailwinds appear more likely to stem from the relative resilience of the UK economy.

While concerns over the accuracy of incoming data persist, unemployment fell 0.2pp to 4.2% in the three months to June, pointing to the labour market having not loosened as much as had been initially feared. At the same time, the pace of average hourly earnings growth continued to slow, with overall pay having risen by 4.5% YoY over the same period, its slowest pace since November 2021. This should continue to allay concerns over potentially stubborn inflationary pressures, though the recent round of above-inflation public sector pay increases do pose a tail risk here.

On the subject of inflation, August brought further pleasing news, despite headline inflation rising to 2.2% YoY, in an increase driven almost entirely by energy prices not falling by the same significant magnitude as seen last year. Core inflation rose by 3.3% in July, the slowest pace since September 2021, while the BoE’s closely-watched services inflation gauge rose by 5.2% YoY, the slowest pace in over two years, and comfortably below the BoE’s 5.6% forecast.

At the same time as inflation continues to ebb, and the labour market appears tighter than first feared, economic growth has remained resilient. GDP grew by 0.6% QoQ in the three months to June, just a touch slower than the 0.7% pace seen in the first quarter of the year. Furthermore, the most recent round of PMI surveys have pointed to this solid-enough pace of expansion having continued, with both the manufacturing and services sectors continuing to grow at a resilient rate, with the PMI gauges reading 52.5 and 53.3 respectively (where, a figure > 50 implies expansion).

All that said, the GBP’s recent run into the low-1.30s has many hallmarks of a move that has gone too far, too fast. Spot GBP/USD, despite having retraced recently, continues to trade almost 4% above its 200-day moving average, and around 3% above the 100-day MA, both of which represent the widest gulf above those key medium-term momentum gauges since the middle of 2023.

There are also fundamental reasons to believe that the GBP’s recent gains are built on somewhat shaky ground. USD weakness, as opposed to outright GBP demand, has played a significant role in cable’s rally, and also appears rather over-done, given the market continuing to price more than 100bp of Fed cuts by the end of this year. Furthermore, the impending fiscal tightening as part of Chancellor Reeves’ autumn Budget is something that markets are likely to increasingly price in during the weeks ahead, with significant tax hikes and spending cuts posing a notable threat to the solid economic performance of UK Plc seen thus far in 2024.

EUR

The common currency also traded well in August, rallying over 2% against the greenback, the best performance since last November, and the first time the EUR has notched back-to-back monthly gains this year. The gains, which did somewhat fizzle out as the month progressed, saw the EUR briefly reclaim levels not seen since last July.

In a similar manner to the aforementioned moves in the GBP, the EUR was driven higher primarily by a broadly softer USD, as opposed to any specific domestic catalysts stemming from within the single currency bloc.

Catalysts of that ilk were, frankly, rather thin on the ground, particularly as ECB policymakers observed their typical summer break in almost complete silence, offering little by way of fresh policy guidance.

In a similar manner to the aforementioned moves in the GBP, the EUR was driven higher primarily by a broadly softer USD, as opposed to any specific domestic catalysts stemming from within the single currency bloc.

Catalysts of that ilk were, frankly, rather thin on the ground, particularly as ECB policymakers observed their typical summer break in almost complete silence, offering little by way of fresh policy guidance.

Nevertheless, another 25bp deposit rate cut does seem likely at the September meeting, following this cycle’s first cut in June, though policymakers have been significantly more non-committal with their language ahead of the meeting, presumably learning their lesson from pre-committing to the timing of this cycle’s first rate cut as far back as March. Recent inflation data, though, continues to show the bloc making progress towards the 2% target, with headline HICP having risen 2.2% on an annual basis in August, a more than 3-year low. This leaves further cuts on the table beyond September though, in keeping with other G10 economies, the 63bp of easing that markets price by year-end seems ambitious.

More broadly, though, risks to the eurozone economy – and, by extension, the currency – continue to point to the downside. Ongoing geopolitical tensions show little sign of cooling, particularly with Houthi attacks in the Red Sea, a vital shipping channel for the bloc, continuing apace.

Downside risks also continue to stem from the sub-par performance of the Chinese economy, where in particular industrial activity remains a concern, with the NBS manufacturing PMI having slipped to a six-month low in August, amid a continued dearth of new orders. The debt-deflation doom loop in which the Chinese economy finds itself trapped is also certainly not helping proceedings.

The French political situation also continues to deserve attention, even if it has faded from the front of participants’ minds of late. The eurozone’s second-largest economy is still yet to appoint a Prime Minister, following snap legislative elections in July, and is still yet to unveil any notable plans to tackle a ballooning budget deficit – a feature that is in common with a range of other eurozone economies. A renewed widening of core-periphery spreads, were these concerns to again come to the fore, likely stands as the biggest potential headwind facing the single currency into the remainder of the year.

USD

The dollar traded broadly softer against most G10 peers last month, with the Dollar Index (DXY) declining by just under 2.5% during August, marking the greenback’s worst month of the year so far, as the index slipped to year- to-date lows, just above the 100 figure, allowing most other DM currencies to gain ground.

The greenback’s decline, which began in early-July, accelerated in August due to a couple of factors.

The greenback’s decline, which began in early-July, accelerated in August due to a couple of factors.

First was a substantially cooler-than-expected labour market report, which pointed to just 114k new jobs having been added in the month of July, as unemployment rose to 4.3%, triggering the so-called ‘Sahm Rule’ recession indicator. Caution is required here, however, given that the employment report’s survey week coincided with Hurricane Beryl making landfall, thus leading to significant weather-related disruptions to employment, and the biggest MoM rise in temporary layoffs since the height of the covid pandemic. Subsequently, one would expect much of the labour market weakness to reverse in the August report.

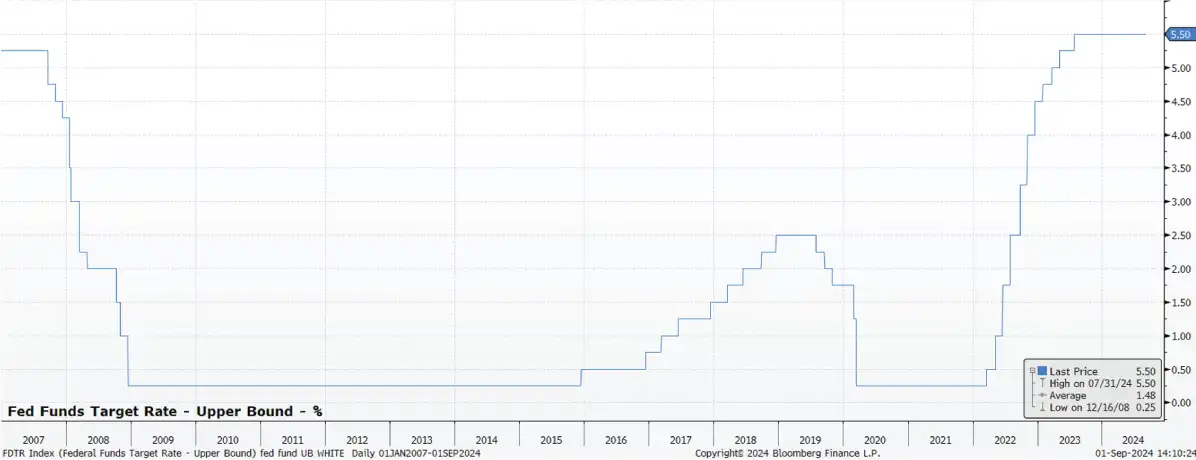

Secondly, Fed Chair Powell’s annual address at the Jackson Hole Symposium was a tad more dovish than participants had anticipated. Powell used the speech to take something of a victory lap, noting that “the time has come for policy to adjust”, and that his confidence “has grown” in inflation being on a sustainable path towards 2%.

The remarks also brought a notable change in the FOMC’s reaction function, with the labour market now likely to be the key determinant of both the speed, and magnitude, of reductions in the fed funds rate, with the first cut foreseen at the September meeting. Powell flagged how policymakers neither “seek or welcome” further labour market cooling, suggesting an aggressive policy response if unemployment were to rise further, with a now- familiar data-dependent stance continuing to prevail overall.

Markets, once again, appear to have become rather over-excitable about the prospect of near-term rate cuts, pricing around 100bp of easing by year-end, and a substantial 200bp of cuts by the middle of next year. This latter pricing implies a belief that rates will, within 10 months, be back at their ‘neutral’ level, which would likely only occur so soon if the economy were to slip into recession; a fact that does not appear to be borne out by incoming economic data.

GDP grew by 3.0% on an annualised QoQ basis in the three months to June, marking the seventh quarter in the last 8 during which the economy has grown by 2% or more, a solid clip in anyone’s book. At the same time, a range of leading indicators, such as the most recent PMI surveys, and retail sales report, point to this solid momentum having continued into Q3. The USD, hence, retains a significant growth advantage over its G10 peers, which may help to fuel a further rebound in the currency, which looks to have begun at the tail end of August.

Of course, the final consideration for the USD in the months ahead will be the upcoming presidential election, with the campaign typically stepping up into a higher gear after Labor Day weekend. The first Trump vs. Harris debate, scheduled for 10th September, will likely grab plenty of headlines, but there remains around 2 months to go until polling day comes around, even if early voting, via post, will commence significantly earlier than this.

The FX implications of the election are always somewhat diffcult to determine though, in the run up to polling day, the greenback could well find some demand as a haven, if participants seek to hedge political risk. After polling day, the FX market’s principal concern is likely to fall on governmental stability, meaning that a repeat of the current situation of a divided Congress, could well pose some modest USD headwinds over the medium term.

GBP/USD TOP BANK FORECASTS

KEY DATES IN SEPTEMBER

GBP

- September 4:Services PMI (Aug F)

- September 10:Labour Market Report (Jul)

- September 11:GDP (Jul)

- September 18:CPI (Aug)

- September 19:BoE Decision

- September 20:Retail Sales (Aug)

- September 23:‘Flash’ PMIs (Sep)

- September 30:GDP (Q2, final)

EUR

- September 4:Services PMI (Aug F), PPI (Jul)

- September 5:Retail Sales (Jul)

- September 6:GDP (Q2, final)

- September 12: ECB Decision

- September 18: CPI (Aug, final)

- September 23:‘Flash’ PMIs (Sep)

USD

- September 3:ISM Manufacturing PMI (Aug)

- September 4:JOLTS Job Openings (Jul)

- September 5:ISM Services PMI (Aug)

- September 6:Labour Market Report (Aug)

- September 11:CPI (Aug)

- September 12:PPI (Aug)

- September 17:Retail Sales (Aug)

- September 18:FOMC Decision

- September 26:GDP (Q2, final)

- September 27:Personal Income & Spending, PCE (AUG)

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.