August Review & Themes

Pound

During August, foreign exchange markets remained in anticipation of an imminent halt to interest rate increases, yet economic factors hinted at which central bank might be the first to hit the pause button.

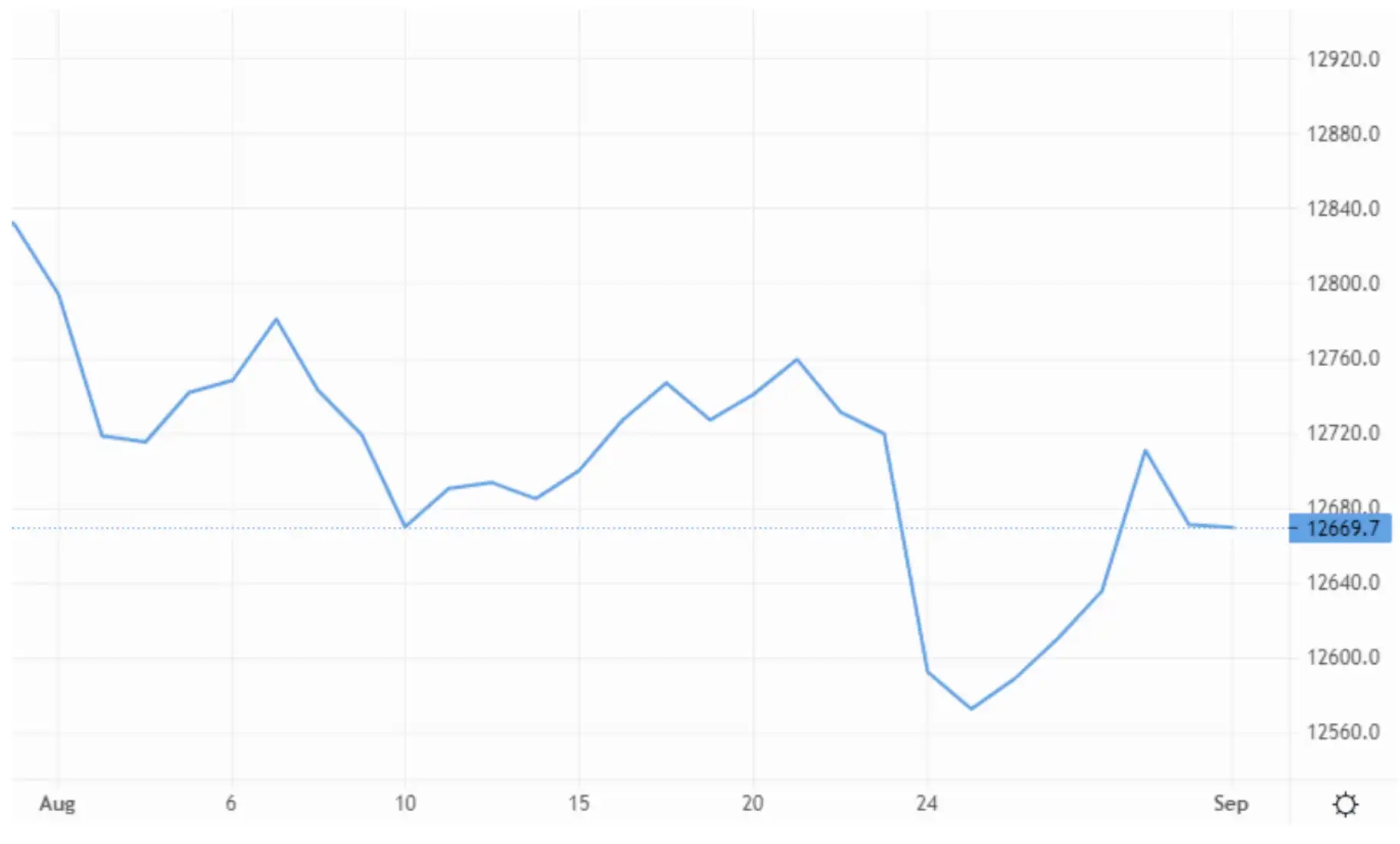

In the middle of the previous month, GBP/USD had just surpassed 1.31 for the first time since the first half of April 2022 – reaching an approximate 16-month high. However, in August, it retreated from those levels. Meanwhile, against the euro, a different narrative unfolded, with sterling displaying strength.

For the Cable pair, the month started at around 1.283 before the Bank of England raised interest rates by 25 basis points to 5.25% on the 3rd, marking the 14th consecutive hike and the highest level since 2008. Sterling dipped to an intraday low of 1.2620 against the US dollar. While the hike had been widely anticipated due to diminishing inflationary pressures, some had projected a more substantial increase. Despite a recent decline in inflation, the Monetary Policy Committee (MPC) continued to perceive inflation risks tilted to the upside, with the Consumer Price Index (CPI) expected to ease to only around 5% by year-end, as curbing service-related inflation was deemed challenging.

Over the subsequent three weeks, Cable fluctuated within a narrow range between 1.277 and 1.266, with only brief excursions beyond this channel. These deviations included a spike in response to a weak US inflation report on the 10th, minimal reaction when UK wage growth reached a fresh high on the 15th, and when UK CPI declined to 6.8%, in line with expectations.

The most sustained downward pressure on GBP/USD occurred on the 25th and 26th, following Federal Reserve Chair Jerome Powell's speech at the Jackson Hole symposium. Powell noted that inflation "remains too high" and hinted at the possibility of additional rate hikes. Consequently, the pound slid from 1.273 to 1.255 and remained below 1.27 until softer US economic data later in the month bolstered hopes of a pause in US interest rate hikes.

Against the euro, the pound briefly dipped below 0.85 in the final week of August, breaching this psychological threshold for the first time in a year.

Dollar

August witnessed fluctuations in confidence regarding the US Federal Reserve's success in engineering a "soft landing" for the economy and the potential cessation of rate hikes while maintaining higher rates for an extended period.

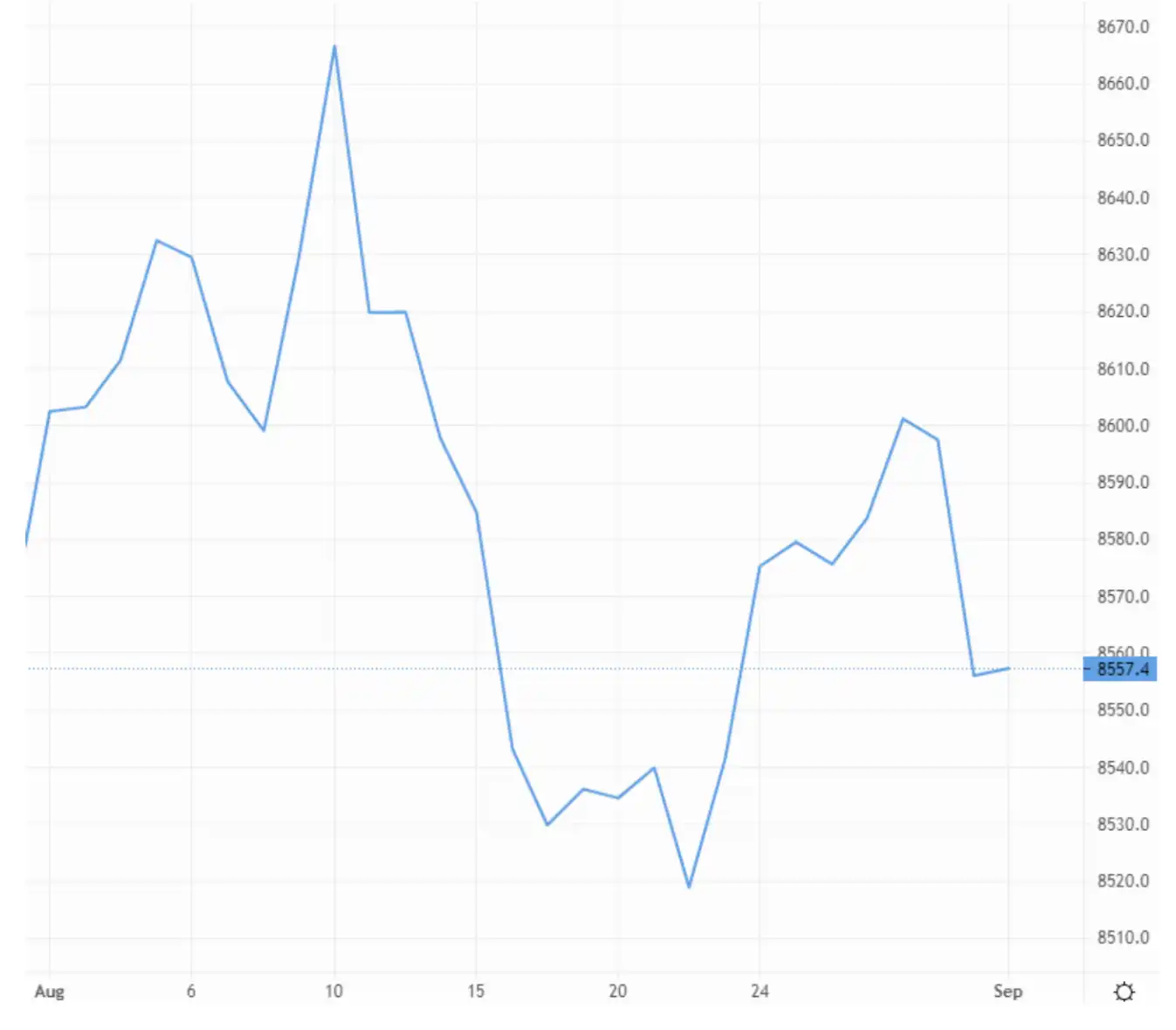

Despite commencing the month with weak US payroll data and tepid CPI figures, the US dollar consistently gained ground against both the pound and the euro. Additionally, the DXY dollar index continued its recovery from 16-month lows in July, ascending from approximately 102 to 103.6 – nearing three-month highs.

At the Jackson Hole symposium, Fed Chair Powell remarked that despite declines in inflation, it "remains too high," and the central bank was "prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective." Powell emphasised that "doing too little could allow above-target inflation to become entrenched."

Following economic data that softened the US dollar's stance slightly, and ahead of the non-farm payrolls report due on the forthcoming Friday, economists at ING observed that "the data have yet to prove the smoking gun that can mark the end of the Federal Reserve's hawkish stance." The potential for a significant miss in August's NFP jobs data or a sharp rise in the unemployment rate could change the outlook and "undermine the thesis that strong employment consumption can keep the Fed in hawkish mode for a lot longer than most think." Futures now suggest that the first rate cut may not materialise until March 2024, with FX analysts at Rabobank noting that the US dollar "has responded to the 'higher for longer' rhetoric."

Euro

Against the pound, the single currency began the month at 0.857 and concluded around the same level, initially testing the 0.866 mark before sliding to a low of 0.849 on the morning of 23 August.

Weak PMI data for the Eurozone confirmed the region's sluggish economy, with the possibility of a recession looming as a downside risk. Nevertheless, services inflation persisted on both sides of the Channel.

Hawkish language from the European Central Bank moderated at its most recent policy meeting, with President Christine Lagarde underscoring that future policy decisions would depend on data, while other ECB members gave mixed signals regarding economic risks.

Rabobank noted that this suggested the ECB might no longer provide strong forward guidance on future policy meetings, reinforcing the view that ECB policy rates may have reached their zenith.

September Risk Events & Key Themes

Dollar

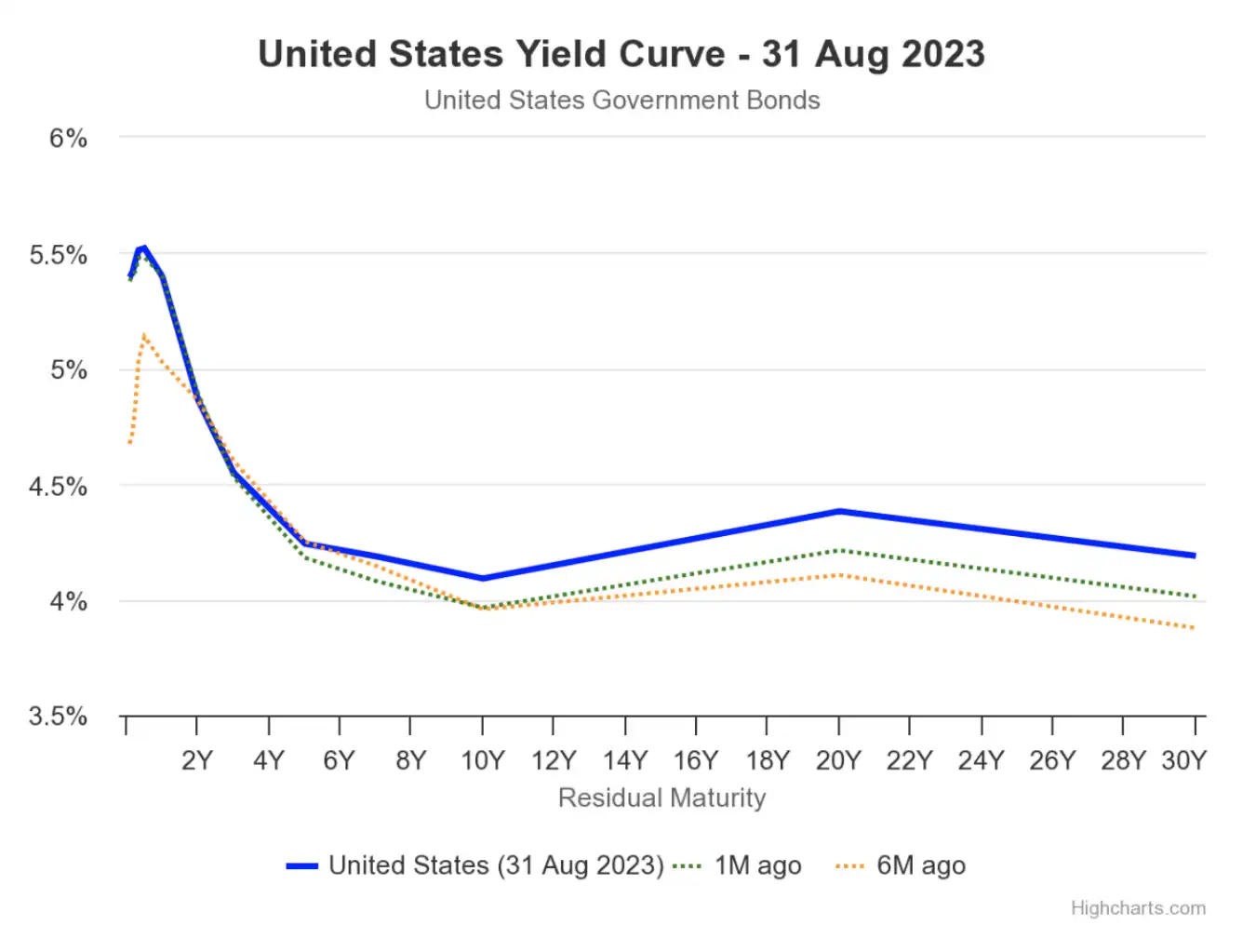

The Long-End of the Yield Curve: UBS analysts observed that in recent weeks, "the long end of the yield curve hit new highs, though the short end remained relatively stable, influenced by rate cut expectations for next year." Specifically, the 10-year yield rose from 3.958% to 4.091%, while the two-year yield hardly budged, inching up from 4.860% to 4.865%. This phenomenon indicated a return to the conventional yield curve shape, which typically implies a reduced likelihood of recession being priced into the bond market. Historically, the long end should carry higher risks, and consequently, higher yields, than the short end. While this wasn't the case in recent quarters, the ongoing trend suggests that the prospects of a soft landing may be growing. Monitoring the yield curve in the months ahead will be crucial for assessing US economic sentiment.

Jobs Data versus Rate Hikes: Concurrent with the above, expectations of another Federal Reserve interest rate hike have softened as positive economic data continue to reduce pressure for further tightening. Notably, jobs data worsened in August, with only 177,000 new private jobs added, falling below expectations and less than half the figure reported in July. Additionally, gross domestic product was revised downward in August, implying that prior Fed rate hikes have been effective in cooling the economy, which, in theory, should exert downward pressure on the dollar. Whether this is sufficient to deter additional rate hikes will be determined on September 14, when the Fed convenes to decide whether to maintain the base rate at 4.25% or implement another 25-basis-point hike. It is worth noting that, as recently highlighted by Mohamed El-Erian in The Guardian, the US economy has continued to exhibit robust growth compared to other major economies, despite its higher interest rates and external challenges.

Seasonal Dollar Strength: Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank, noted on August 31 that empirical data indicates the US dollar has outperformed its peers for six consecutive Septembers since 2017, with an average gain of 1.2%. This phenomenon is attributed to increased dollar demand towards quarter-end and heightened safe-haven flows in anticipation of October, traditionally a volatile month for stocks. While not infallible investment advice, it does provide an interesting anecdote.

Euro

To Pause or Not to Pause? Expectations have vacillated around a 50-50 chance of another interest rate hike by the European Central Bank. However, the release of softer bloc-wide inflation data in late August has tilted sentiment towards the dovish side. Craig Erlam, Senior Market Analyst at Oanda, remarked that "another hike in September still strikes me as more likely than not, but following this release, markets are leaning the other way, pricing in a near 70% chance of no increase." The ECB will unveil its decision on September 14, determining whether to proceed with another base rate hike.

Der Kranke Mann von Europa: While the UK has previously held this dubious title (translating to the “Sick Man of Europe”), recent narratives have shifted towards Germany, marked by a contracting gross domestic product and sluggish output. Analysts Stefan Schneider and Marc Schattenberg from Deutsche Bank anticipate that this trend will persist, stating in a research note that "after only stagnating in Q2, GDP will most likely shrink by some 0.3% quarter on quarter in Q3, given the setback to sentiment indicators in July and August." Projections suggest that German GDP will contract by 0.5% for the entire year, a worse outcome than earlier forecasts of 0.3%. Key dates to monitor in September include manufacturing PMIs on the first, construction PMIs on the 6th, producer prices on the 20th, and consumer confidence on the 27th.

Pound

Property Pressures: The UK housing market currently faces considerable challenges. With fixed rates at their highest level in fifteen years, net mortgage approvals have declined by approximately 25% since August 2022. It is expected that completed house sales will drop by 21% year-on-year to around one million by the end of 2023, marking a nine-year low if these forecasts hold true, according to a recent report from the property website Zoopla. There is a prevailing sense that short-term improvements in the market are unlikely. However, the Halifax house price index on September 7 and Nationwide housing prices on September 29 should provide clarity on the situation.

Will Business Confidence Withstand Another Rate Hike? Despite recent discouraging figures, optimism persists in the business sector. The latest assessment of businesses by Lloyds Banking Group indicates that confidence has reached an 18-month high. According to the Lloyds Bank Business Barometer for August, business confidence surged by 10 points, reaching 41% in August. This is the highest level since February 2022, when it stood at 44%, just prior to Russia's invasion of Ukraine. This boost in confidence was partly driven by a 25-basis-point rate hike in August, even though some had expected a more substantial 50-basis-point increase. The ability of business confidence to withstand another rate hike will be closely watched when the Bank of England convenes on September 21. One thing is certain: If the BoE opts for a complete cessation of rate adjustments (although this is considered unlikely), UK businesses will have cause for celebration.

KEY DATES IN SEPTEMBER

United Kingdom

- September 1: Nationwide housing prices YoY (exp -3.9%)

- September 5: BRC retail sales; new car sales

- September 7: Halifax house price index YoY; BBA mortgage rate

- September 12: Unemployment rate

- September 13: GDP YoY; Balance of trade

- September 20: Inflation rate YoY; Retail price index

- September 21: Interest rate decision (5.5% exp)

- September 22: Retail sales YoY

- September 29: GDP growth rate YoY; Nationwide housing prices YoY; Mortgage approvals

Eurozone

- September 1: Manufacturing PMIs

- September 5: Services PMIs; PPI YoY

- September 6: Construction PMIs; Retail sales YoY

- September 7: GDP growth rate

- September 13: Industrial production YoY

- September 14: Interest rate decision (stay at 4.25% exp)

- September 15: Balance of trade

- September 19: Inflation rate YoY

- September 20: Construction output YoY

United States

- September 1: Non-farm payrolls (170,000 added exp); Unemployment rate (3.5% exp)

- September 6: Balance of trade

- September 7: Initial jobless claims

- September 11: Consumer inflation expectations

- September 13: Inflation rate YoY; CPI

- September 14: Retail sales YoY

- September 20: Interest rate decision

- September 21: Current account figures

- September 22: Manufacturing PMIs; Services PMIs

- September 26: House price index YoY; New home sales

- September 27: Initial jobless claims

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our dedicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.