Sterling softens on weak growth as the yen defies election narratives. All eyes now fix on the US CPI release to define the dollar's next move.

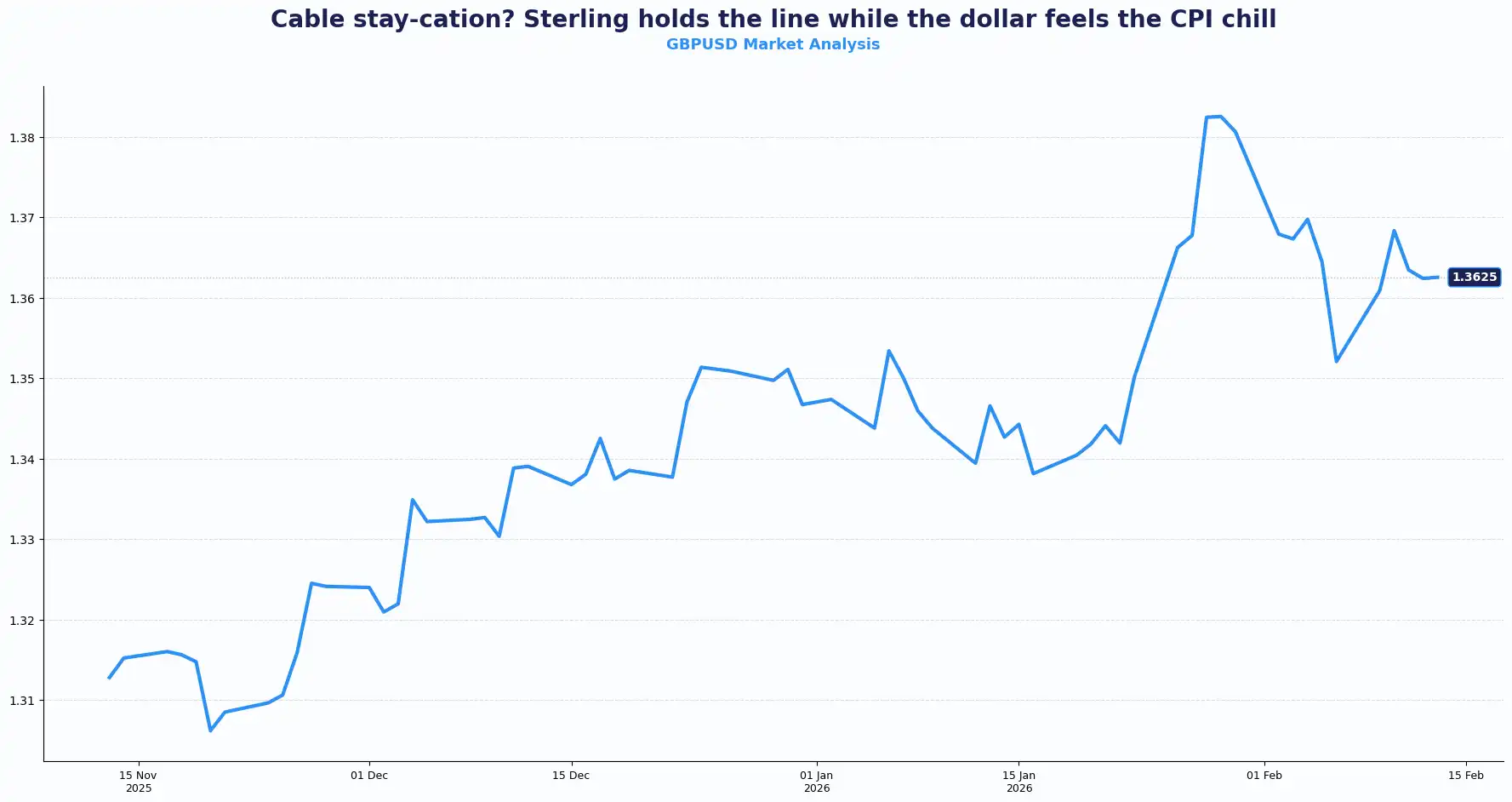

GBP: Sterling Slumps on Weak GDP Data

Cable consolidated near 1.3620. Sterling eased 0.15% as traders eye key US inflation data.

UK Prime Minister Keir Starmer secured support from his cabinet and Labour MPs after pressure tied to the Jeffrey Epstein files and the resignation of a senior aide. The backing reduced the risk of an imminent leadership challenge and stabilised UK political sentiment.

The political reprieve supports sterling, though expectations for a dovish Bank of England (BoE) continue to cap further gains.

Odds of a 25bps BoE rate cut as early as March increased after Thursday's UK macro data missed expectations. Weak GDP figures supported the case for near-term easing.

UK gilts outperformed after Q4 GDP missed expectations. The economy expanded just 0.1% QoQ vs the 0.2% consensus, reinforcing the case for BoE easing. Policymakers flagged that inflation is on track for the target, and a further rate cut is seen as "reasonable." The disappointing GDP data shifts the focus back to the need for monetary support to jump-start a stalling economy.

The GBP/USD pair lacks momentum as traders await the US Consumer Price Index (CPI). The release will play a key role in influencing expectations about the US Federal Reserve's (Fed) rate-cut path.

Fed rate cut bets and threats to the Fed's independence keep the dollar bulls on the defensive. Growing concerns about the Fed's independence fail to help the dollar build on the blowout US Nonfarm Payrolls (NFP) - inspired bounce from a two-week low touched on Wednesday.

The risk-off impulse offers some support to the safe-haven greenback and acts as a headwind for GBP/USD.

EUR/GBP rose to 0.8719 in early Asian trade sessions, painting sterling as the weaker currency on recent cross action.

Weaker growth figures have raised the probability of earlier BoE rate cuts, with investors seen adjusting expectations accordingly. A shift toward lower rates erodes sterling's yield premium, a dynamic that traders are watching closely.

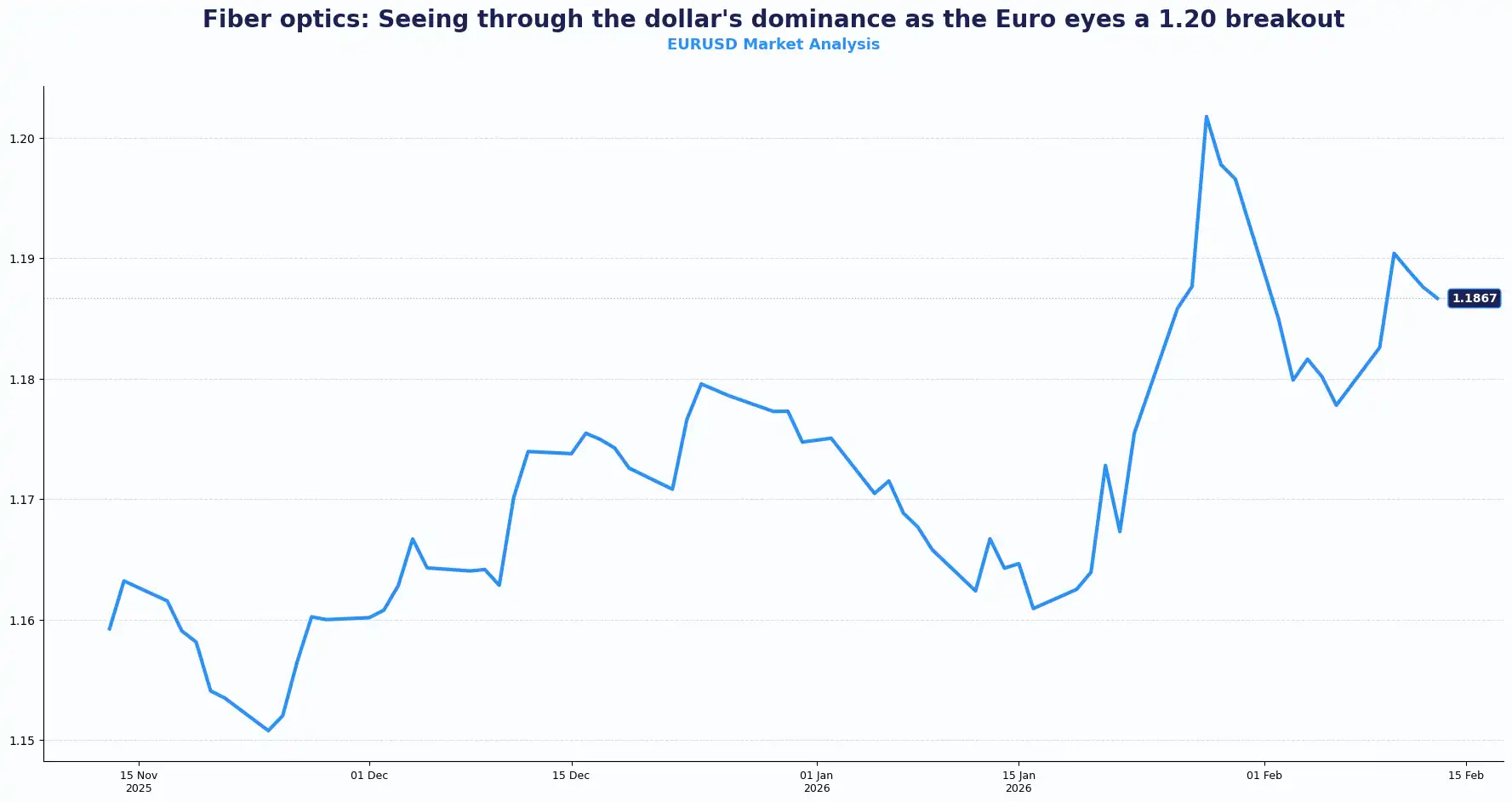

EUR: Euro Holds Below Key Resistance on GDP Beat

EUR/USD hovers near 1.1870 during Asian hours, trading just under 1.1900. The pair shows minimal movement as traders position for eurozone Q4 GDP data and US CPI.

US data continues to dominate this pair. Strong labour figures earlier in the week reduced expectations of early Fed easing, lifting the dollar and capping euro gains.

The European Central Bank (ECB) held its benchmark rate at 2.0% for the fifth consecutive meeting last week. Traders price in steady policy through year-end before potential hikes in 2026.

Eurozone GDP is expected to grow at 0.3% QoQ and 1.3% YoY growth in Q4. Any downside surprise could pressure the single currency in the near term.

Although the ECB appears comfortable with the current exchange rate, the lack of a strong cyclical rebound in Europe leaves the euro vulnerable. The euro lacks a clear independent driver, making today’s US inflation data the primary risk factor for the pair. Volatility often spikes around these releases, and market participants are typically seen evaluating their hedging requirements.

The EUR/USD pair could test multi-year highs at 1.2082, though progress will be gradual without a convincing cyclical rebound in the eurozone. Resistance for the pair sits at 1.1950 with support at 1.1800.

USD: Greenback Braces Ahead of Inflation Test

The dollar index (DXY) edged up slightly to 97.01, though it sits 0.7% lower for the week. The dollar faces a testing session as January CPI data arrives. Recent mixed economic signals have clouded the outlook.

Data showed the number of Americans filing new applications for unemployment benefits decreased less than expected last week; while jobless claims edged down to 227k, existing home sales slumped 8.4% to their lowest level since September 2024. These conflicting data points have kept the dollar in a consolidation phase.

The January CPI is expected to be 2.5% YoY. Core inflation is expected to ease but might still stay above the Fed’s 2% target. Monthly CPI is forecast at 0.3%; while CPI is not the Fed’s preferred gauge, it strongly influences short-term dollar direction.

A reading in line with expectations will have no material impact on the dollar trend. The closer the CPI figure is to the Fed's 2% target, the higher the likelihood of an imminent interest rate cut.

A higher CPI reading near 3% would likely force the Fed to keep rates higher for longer, challenging President Trump’s public calls for easing. The nomination of Kevin Warsh to lead the Fed adds a layer of political intrigue, as he must balance his hawkish reputation with the administration's growth-focused agenda.

The "no-fire, no-hire" environment makes the dollar sensitive to any inflation surprise. Today's CPI print will likely dictate whether the dollar ends the week on a high or continues its recent slide. Inflation data continues to anchor near-term moves in the dollar and major pairs.

Yen Posts Strongest Week in 15 Months

USD/JPY trades near 153.35 as the yen heads for its best week in almost 15 months. The yen surged more than 2% against the dollar this week.

Against the euro, the currency jumped 2.3% for its strongest weekly performance in a year, with EUR/JPY at 181.86, while the yen gained 2.7% versus the pound with GBP/JPY at 208.59.

The currency strengthened even after the LDP’s sweeping election win, directly challenging the "Takaichi trade" narrative that suggested a weaker yen would follow a pro-growth mandate.

Traders are rapidly unwinding short-yen positions as political stability returns to Tokyo. The election results appear to have ended the uncertainty that plagued the currency since last July. Despite Sanae Takaichi's dovish fiscal reputation, the market is prioritising the removal of political risk and the potential for a more structured policy environment.

The scale of the repositioning suggests further appreciation cannot be ruled out if the unwind continues. The yen’s aggressive recovery caught many off guard. Market participants have adjusted their risk management strategies as the currency shows signs of a more sustained appreciative trend.

The threat of intervention around 160 to the dollar has traders expecting that downside yen risks are protected.

In the broader market, currencies were range-bound ahead of the release of US inflation data later in the day. The data will shape expectations for the Fed's rate outlook.

Markets look ahead:

Friday, 13 Feb(Today):

Eurozone GDP Q4 data

US CPI data

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.