Strong US jobs data failed to lift the dollar and trimmed the Fed cut bets. Sterling flat near $1.365, UK data undercuts recent gains, whilst the yen surges on the Japan election boost.

GBP: Sterling Struggles as Growth Loses Energy

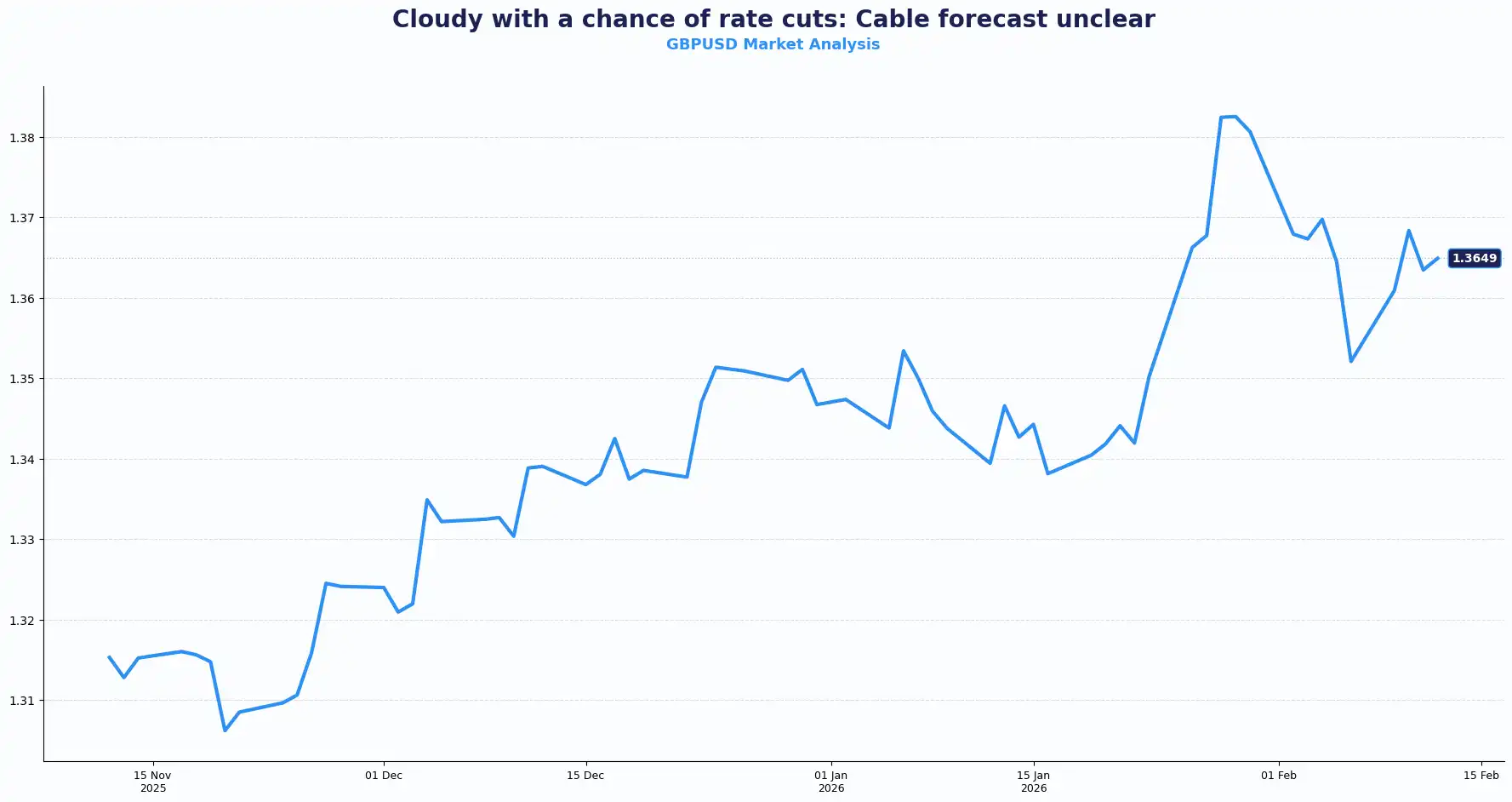

Cable trades flat near 1.365 despite strong US jobs data. The dollar failed to sustain initial gains, allowing sterling to stabilise.

UK political drama continues to weigh on the pound. Starmer's position as PM appears secure until the May local elections. However, the risk of a political crisis worsening into the spring elections keeps GBP under pressure. A leadership change would trigger immediate selling in both the pound and gilts.

Political uncertainty creates a poor backdrop for sterling. The Bank of England (BoE) is one of the few G10 central banks where odds favour rate cuts. Traders now price in a 60% chance of a 25bps cut.

The sterling edged slightly lower in an immediate reaction to the UK GDP data figures released today. UK GDP declined to 1.0% missing forecasts of 1.2% and down from the previous quarter's 1.2%. The QoQ, GDP came in at 0.1% versus expectations of 0.2% (Q3 printed 0.1%). Both readings missed estimates and show slower growth. The BoE expects the economy to expand by 0.9% in 2026. Flat price action after a miss often signals that the outcome was already priced in. The market braced for softness and got softness.

The weak GDP print strengthens the case for BoE easing. The cooling labour market, slowing domestic inflation, and disappointing growth figures all point towards the anticipated 25bps rate cut from the Old Lady at its 19 March meeting.

For the GBP/USD pair, immediate technical support sits around 1.3550, while a sustained push above 1.3700 would signal renewed upside momentum for sterling bulls.

Inflation is the more uncomfortable part of the picture. Despite the slowing inflation, the UK maintains its leading position in the inflation league table amongst its major peers. This divergence in inflation paths between the UK and other G7 economies has influenced recent currency movements.

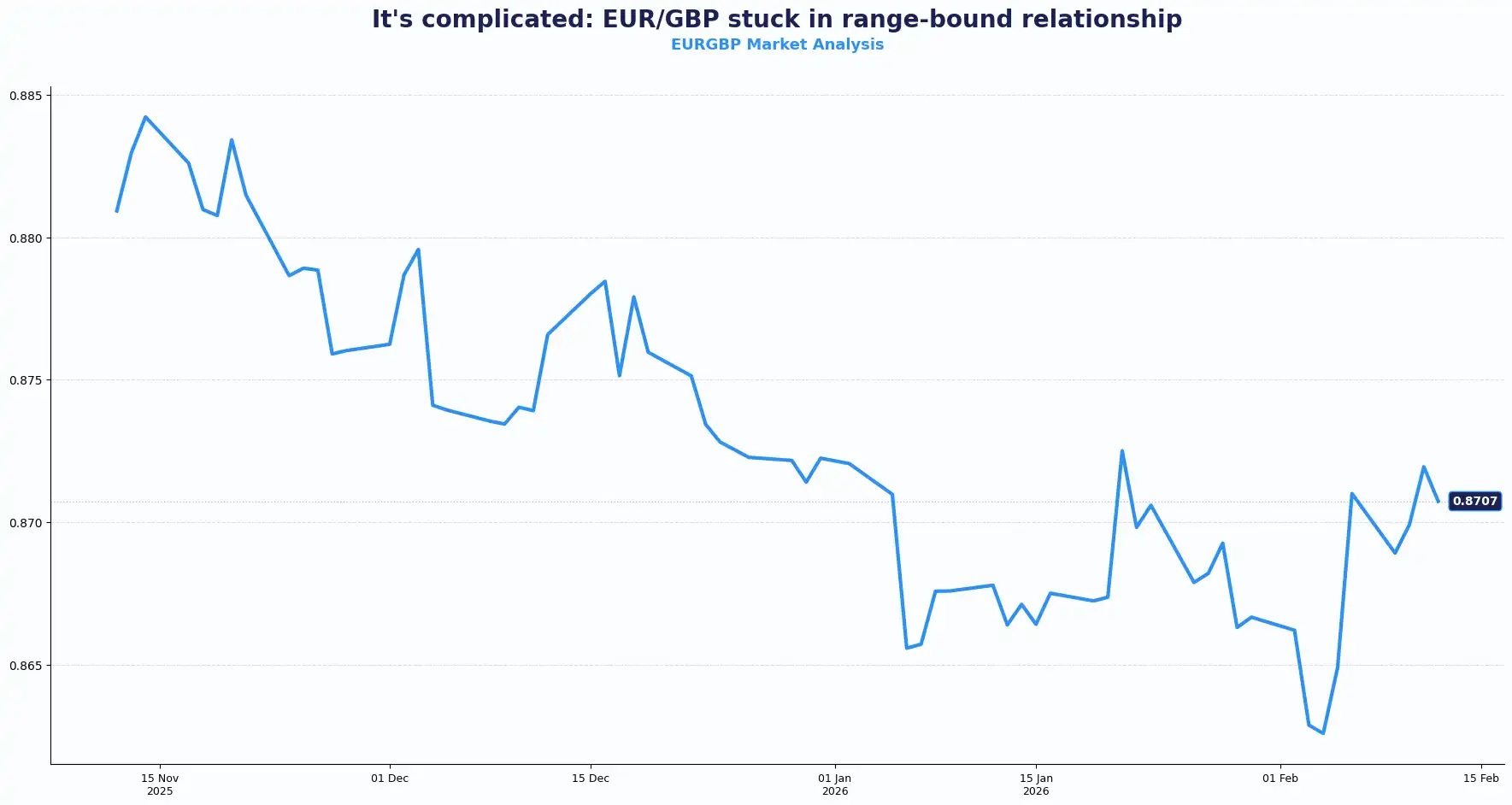

EUR: Cross Dynamics Favour Range-Bound Trade

EUR/GBP trades flat near 0.8710, sitting below the week's highest level. The sterling posts as the weakest G10 currency on a five-day view. The pair has the potential to trade range-bound between 0.8600–0.8700 levels near-term. UK politics shifting to the back seat in upcoming weeks could allow the currency pair to grind higher into mid-year.

The ECB’s Isabel Schnabel recently highlighted that weak domestic demand makes Germany more vulnerable to foreign crises. The traditional export-driven business model faces challenges in a fragmented global economy. While Germany possesses the fiscal space for reforms, these structural shifts influence long-term euro valuations. This signals a structural debate inside the euro area. External shocks hit harder when domestic demand stays weak. Fiscal flexibility offers a counterweight but execution matters.

The euro plummeted to $1.185 after the dollar erased initial NFP-driven gains. European earnings took centre stage for investors on Thursday after the surprisingly strong US jobs report firmed expectations that the Federal Reserve (Fed) will hold rates steady at least until the second half of the year.

The outlook for policy depends on the upcoming labour market and consumer prices. Investors are cutting wagers of a near-term move by the Fed. The spotlight shifts to Friday's US CPI inflation report.

The euro now reacts more to external growth signals than internal tightening cycles. Policy divergence with the US shapes near-term direction for the pair. Cross-currency volatility often clusters around such divergence phases.

USD: Payrolls Beat Fails to Rescue Stumbling Dollar

The dollar (DXY) slipped to around 96.8 on Thursday after facing heightened volatility. The greenback struggled to gain traction even as robust jobs data lowered the odds for near-term Fed rate cuts.

January's US Nonfarm Payrolls (NFP) rose by 130k, surpassing forecasts of 70k and the previous month at 48k. This is the largest rise in over a year.

Wage growth inflation held steady at 3.7%, in line with forecasts. The unemployment rate declined to 4.3% versus 4.4%, better than estimates. This reinforces the Fed's outlook to hold onto current bank rates.

The US Dollar Index (DXY) initially spiked before erasing all gains and turning negative. This price action defied conventional market logic. Several interconnected factors contributed to this weakness.

Strong jobs data bolstered confidence in the US economic soft landing narrative. Global investors rotated capital out of safe-haven assets like the USD and into higher-risk, higher-yielding currencies and equities. The dollar entered the event heavily bought.

Markets have repriced sharply following the prospect of Kevin Warsh's confirmation as Fed chair, with his first meeting expected in June. Rate cut odds have dropped to 70% from 97%, while the probability of a March move has slipped below 5%.

US Inflation data is due on Friday and will provide the next test for interest rate cut views. Most Fed officials are unwilling to resume interest rate cuts yet.

Fed official Schmid signalled that it's too soon to expect productivity to meet elevated inflation. The US central bank needs to keep a tight monetary policy in place amid continued strong economic growth.

Schmid noted that structural shifts in the labour market are likely to weigh on monthly payroll growth, highlighting the importance of aligning education with future workforce needs. He emphasised the complexity of the inflation outlook, citing numerous contributing factors that make precise attribution challenging. "I will miss Jay Powell, a principled public servant. Don't know much about Warsh; he knows the system, goals clear."

Headline inflation is projected to slow to 2.5% YoY from 2.7%, with the monthly print steady at 0.3%. Core CPI, excluding food and energy, is expected to ease to 2.5% YoY from 2.6%, while the monthly figure is seen rising to 0.3% from 0.2%. Stronger readings would likely support the US dollar, while softer prints could weigh on the currency.

The Fed inflation target sits at 2% and has implemented measures to curb price pressures. Policymakers are expected to maintain a firm stance in the near term. Markets are pricing in roughly 54 basis points of US rate cuts across 2026.

Geopolitics adds background risk. President Trump met Israeli Prime Minister Netanyahu this week as US-Iran tensions rise. Energy sensitivity could feed into inflation expectations.

US data now anchors global rate expectations. When payrolls and inflation surprise, cross-asset volatility typically follows. That pattern has reappeared this week.

Yen Surges on "Buy Japan" Sentiment

A resurgent yen is tracking toward its largest weekly gain in over twelve months, pushing USD/JPY down to 153.25. The yen has also gained 2% against the euro, with EUR/JPY hitting 181.75. The Liberal Democratic Party’s landslide victory under Prime Minister Sanae Takaichi has shifted market mood. Investors are now favouring the yen as the primary vehicle rather than the euro for betting against a falling dollar.

A break below 152.05 would signal a significant momentum shift for a currency that has slid for years. The threat of intervention around 160 also suggests protected downside risks. Many participants are watching these levels closely as Japan attracts renewed interest in its stocks and bonds.

Markets look ahead:

-

Thursday, 12 Feb: US Initial Jobless Claims

-

Friday, 13 Feb: US CPI

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.