Sterling reels from a dovish 5-4 BoE hold as MPC rifts deepen. Euro trades steady despite ECB caution on currency strength. US dollar finds support from Kevin Warsh’s hawkish lean. Yen faces election-driven fiscal anxiety.

Sterling: BoE Split Votes Break Confidence in Pound

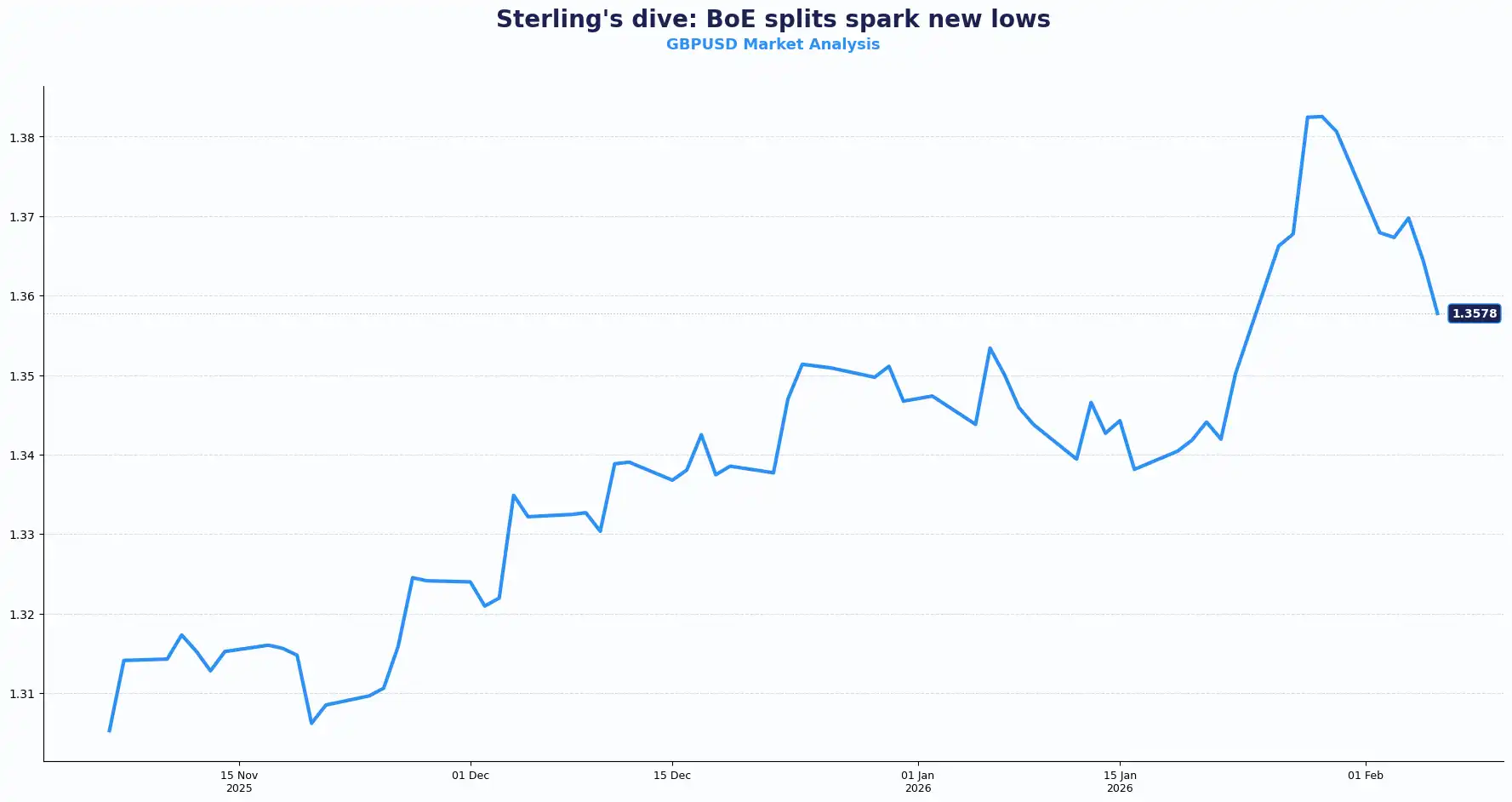

GBP/USD suffered a double whammy, tumbling to $1.3575 mark overnight. Sterling plunged after the Bank of England (BoE) delivered a dovish shock. The Bank of England's Monetary Policy Committee (MPC) left rates unchanged at 3.75% in a tight 5-4 split, with four members voting for an immediate cut, undershooting the seven-member consensus for no move. The result caught markets off guard, as most had positioned themselves for a more decisive hold.

Traders now price in 50bps of BoE rate cuts for 2026 following a shift in expectations after Governor Andrew Bailey gave no guidance on the timing of the next move and did not back 3.25% as a neutral rate. Bailey said the bank is close to neutral territory, suggesting a 50-50 probability for a March cut, prompting a sharp repricing of the UK rate outlook. He needs "more evidence." of sustainable 2% inflation, though wage growth "a little over 3%" aligns with the target.

Political instability compounds Pound’s downside

Domestic leadership challenges further weigh on the pound. Prime Minister Keir Starmer faces scrutiny over his decision to appoint Peter Mandelson as US ambassador amid questions about prior knowledge of Epstein links. Governor Bailey described the potential leak of UK information during the financial crisis as "staggering". Risks of leadership challenges may rise ahead of the May local elections, particularly if the Labour party signals a shift to the left.

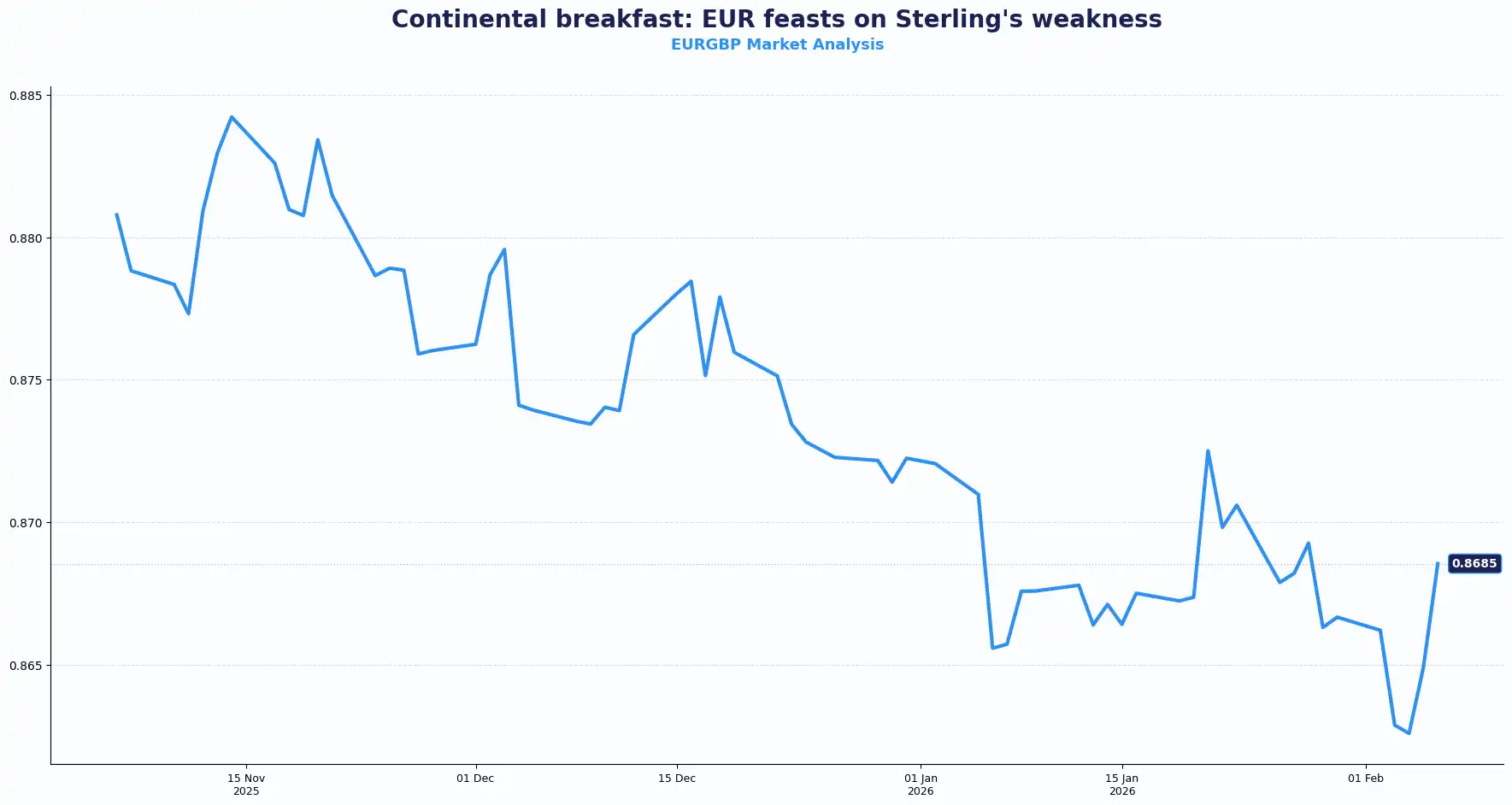

EUR/GBP advanced towards 0.8690 as increased dovish dissent within the BoE signalled the likely end of the UK rate hike cycle. The BoE statement acknowledged risks from inflation persistence are "becoming less pronounced," opening the door for aggressive easing.

ECB President Lagarde welcomed Kevin Warsh's Fed Chair appointment, echoing Bailey's support for Warsh. Both central bank chief officials see Warsh as a steady hand for monetary coordination.

Euro: ECB Sticks To The Script, Dollar Weakness Priced In

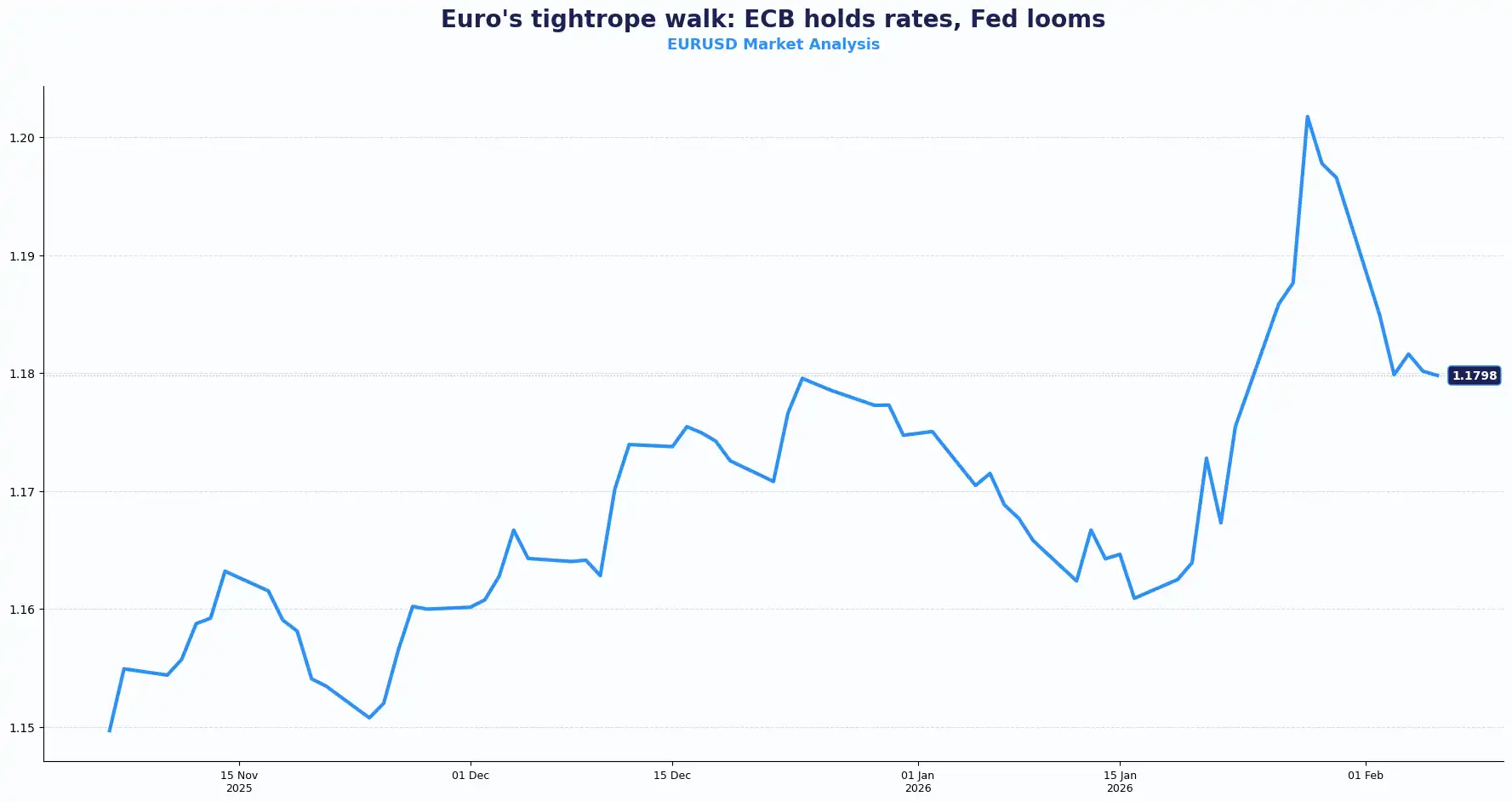

The European Central Bank (ECB) left interest rates unchanged at 2.00% as expected, marking its fifth consecutive meeting without a change. President Lagarde confirmed the rate decision was unanimous and noted euro appreciation versus the dollar is already reflected in baseline forecasts. The EUR trades 13% higher against the greenback than a year ago, adding concern among policymakers about regional price pressures.

EUR/USD tests 1.1800, attempting to regain ground as the dollar ticks lower.The single currency tracks broader dollar positioning as US labour data shifts the narrative for the Federal Reserve. EUR/USD attracted limited bids even as US job openings fell to 6.54 million, highlighting a sensitive environment for dollar-denominated pairs.

Eurozone inflation has dropped to around 1.7%, below the ECB's 2% target. President Lagarde reiterated that "inflation is in a good place" but warned geopolitical risks persist. Lagarde flagged that currency appreciation could weigh on inflation outcomes, signalling a wary eye on euro strength.

EUR/USD hovers near 1.1790, struggling to maintain a foothold above the 1.1800 resistance mark. This stagnation follows the ECB's decision to brush aside the recent dip in eurozone inflation as policymakers continue to warn of elevated geopolitical risks.

Global trade uncertainty caps the euro’s recovery. The single currency stays sensitive to external shocks, particularly volatile trade policies and the impending leadership change at the Fed.

Dollar: Greenback Finds Support In Hawkish Fed Rhetoric

The dollar set for its strongest week since November despite a modest Friday pullback. The US Dollar Index (DXY) trades 0.1% lower near 97.85, close to Thursday's weekly high of 97.98. Softer US labour data has accelerated dovish Fed projections. Despite JOLTS job openings falling to 6.54 million, Governor Lisa Cook has signalled a refusal to support further easing without clearer evidence of cooling inflation.

US Jobless claims rose more than expected. Fed rate cut probability for March surged to 22.7% from 9.4% Wednesday, according to CME FedWatch; with expectations of two Fed rate cuts in 2026.

The big question swirling around the dollar now is whether it will simply drift along or surprise us with a dramatic rebound. With inflation still running high and the economy holding strong, the Fed has little reason to rush. The scene is set for the Warsh transition to unfold.

The dollar’s recent resilience has kept USD/JPY elevated near 157.00, as the dollar benefits from its role as a yield-advantage play. Traders currently price a low probability of a March Fed cut, with all eyes on whether upcoming CPI data validates this cautious stance.

Snap election risks weaken Japanese Yen

The Yen softened as fiscal concerns resurfaced ahead of Japan's February 8 election. Prime Minister Takaichi’s pledge to suspend consumption taxes on food has raised fears regarding debt-funded spending, further dampening demand for the JPY. USD/JPY rebounded from its 156.40 support level, reflecting a market that anticipates continued divergence between a hesitant BoJ and a steady Fed. Traders now watch the 158.20 resistance level, as election-driven volatility could test the Ministry of Finance's tolerance for further Yen weakness.

Softer Tokyo consumer inflation tempered bets for an early BoJ hike, undermining the yen. Speculation that authorities would intervene to stem further JPY losses warrants caution for bears. BoJ board members maintain hawkish views amid mounting price pressures from yen weakness. BoJ's Masu says the central bank is "not behind the curve" on inflation.

Aussie eases as hawkish RBA pivot caps upside

AUD/USD slipped toward 0.6950 after RBA Governor Bullock's hawkish message. The commodity-linked Aussie came under pressure as a tech-driven stock sell-off rattled global risk sentiment. Bullock explained Tuesday's RBA rate hike to 3.85% reflects an economy "more capacity-constrained than previously judged." Investors price 40 bps of additional RBA tightening this year, with May hike probability surging.

Markets look ahead:

-

SUNDAY, FEB 8: Japan Snap Election

-

WEDNESDAY, FEB 11: US Nonfarm payrolls and Unemployment rate

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.