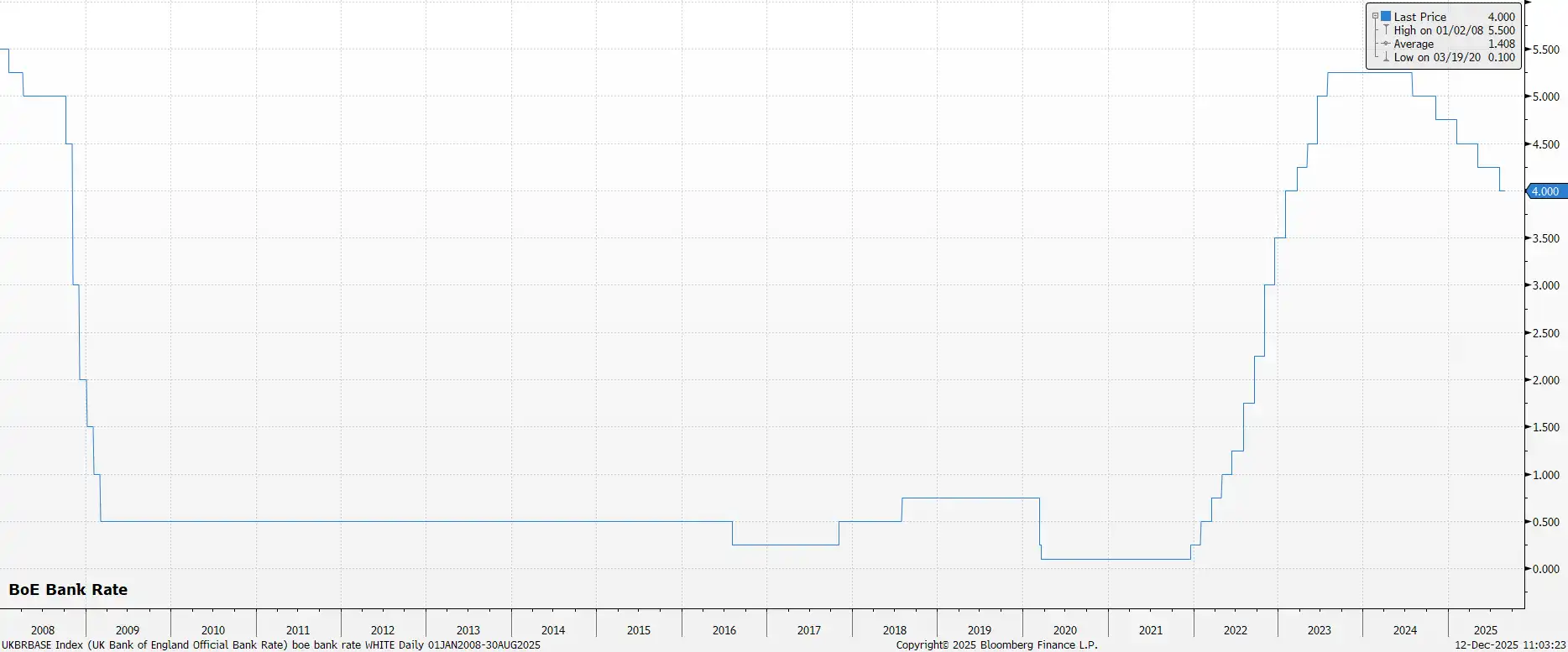

The Bank of England's Monetary Policy Committee are set to resume the easing cycle at their final meeting of the year, with fiscal uncertainty now lifted and policymakers gaining greater confidence that inflation has peaked for the cycle.

The MPC are set to vote for a 25bp cut at the December meeting, lowering Bank Rate to 3.75%, the lowest level since Q1 2023. This aligns with consensus expectations and market pricing, where the GBP OIS curve discounts around a 90% chance of a Christmas rate cut, while pricing 58bp of total easing by this time next year.

The case for another rate reduction, despite the 'Old Lady' holding steady since August, rests on three key pillars.

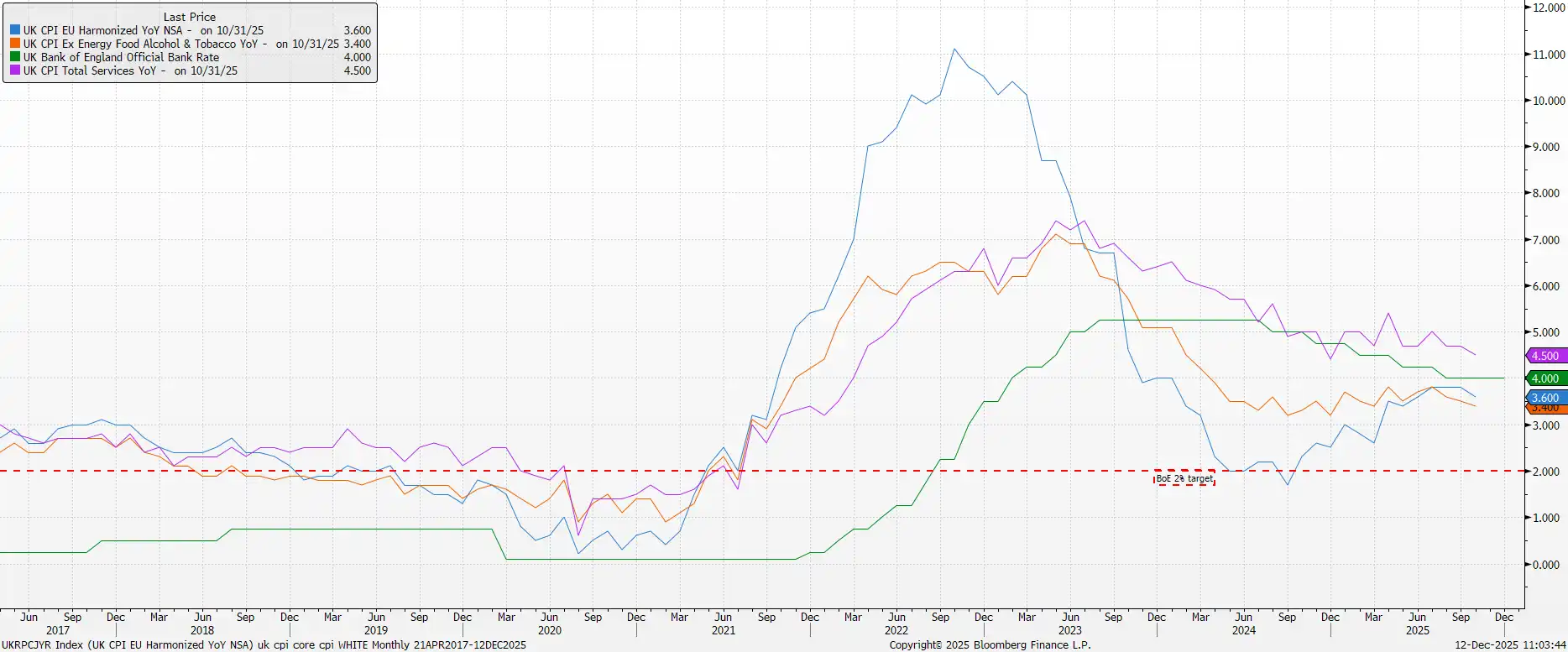

Firstly, and most importantly, policymakers now have increased confidence that inflation has peaked. Headline prices rose 3.8% YoY in August and September before easing to 3.6% in October, with the MPC forecasting continued disinflation back to the 2% target by early-2027. The risk of persistent price pressures has subsided considerably, with core CPI at a YTD low 3.4% YoY and services CPI at its lowest level in a year at 4.5% YoY. Note that the MPC will have advance sight of November inflation data during their deliberations.

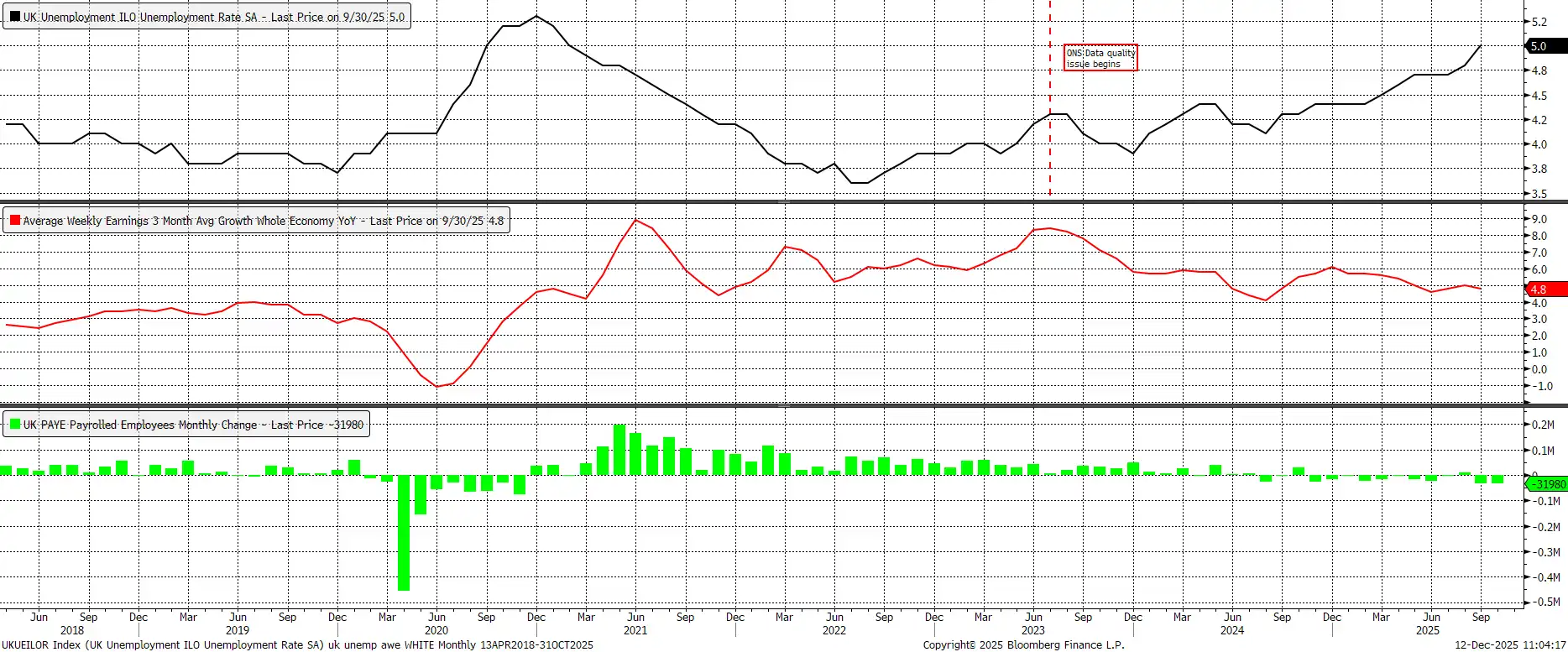

Secondly, increasing slack continues to emerge in the UK labour market. Headline unemployment stood at 5.0% in the three months to September, a 4-year high, while the economy has shed jobs in eleven of the last twelve months per PAYE payrolls data. Though earnings pressures remain relatively intense at just shy of 5.0% YoY, the vast majority are concentrated in the public sector, with private sector earnings moderating notably.

Lastly, the autumn Budget has passed. While containing nothing to boost growth, its announcement lifts significant uncertainty that had clouded the outlook. More importantly, the Budget contained little to fuel inflation and incorporated disinflationary measures including consumer energy bill cuts and a rail fares freeze.

Although another 25bp cut is on the cards, the December call is unlikely to be unanimous. Having voted 5-4 to hold at the November meeting, it would only take one member flipping to deliver a cut. Governor Bailey seems near-certain to join the doves, with potential support from Deputy Governor Lombardelli or Chief Economist Pill. The base case is a 6-3 vote for a 25bp cut, given the slim chance of external members Greene and Mann voting for easing.

The policy statement and forward guidance are unlikely to change. The MPC will likely reiterate that Bank Rate is set to remain on a 'gradual downwards path' if disinflationary progress continues, with further cuts hinging on how the inflation outlook evolves—maintaining a 'data-dependent' and 'meeting-by-meeting' approach.

Further Bank Rate reductions are possible moving into 2026, potentially as soon as February if the labour market weakens materially and disinflation continues. However, with the Bank estimating neutral rate could be as high as 3.50%, there may be limited room for significant cuts over the next twelve months, especially as policymakers will likely seek to maintain a positive real Bank Rate while headline CPI remains above 2%.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.