Yen Weakens Ahead of BoJ as Policy and Politics Collide

The Bank of Japan’s (BoJ) two-day policy meeting (22–23 January) kicks off today, with a decision due on Friday. Markets expect the BoJ to hold rates at 0.25%.

USD/JPY and GBP/JPY extended gains on Thursday as Japanese Prime Minister Sanae Takaichi pushed fiscal expansion, including the proposed removal of consumption tax. This stance injects demand-side inflation into an economy already grappling with rising import costs.

Markets now turn to the BoJ’s Q4 Outlook Report for fresh signals on the economic trajectory. Any downgrade to growth or inflation credibility risks entrenching Yen underperformance beyond this week.

Importers with Yen liabilities typically focus on the 'Outlook Report' for signs of growth downgrades that could entrench Yen weakness into February.

Sterling Trades Cautiously Ahead of UK Data

GBP/JPY rose 0.22% to trade near 213.00 in early European hours. UK inflation data disrupted expectations of near-term Bank of England easing, forcing markets to reprice the timing of rate cuts and lifting front-end Sterling yields. Japan offers no comparable repricing catalyst.

Friday’s UK retail sales and PMI data will test whether inflation persistence proves structural or transient. These releases will shape expectations ahead of the BoE’s 5 February meeting.

GBP-based importers with JPY liabilities often reassess hedging ratios when inflation delays expected easing. Yield-divergence phases historically compress decision windows.

GBP/USD held near 1.3438, with resistance at 1.3500 and support at 1.3350.

Trump’s Tariff Pause Removes Tail-Risk, USD Reclaims Control

USD/JPY has reclaimed 158.00. The Greenland tariff de-escalation has triggered a sharp unwinding of haven positions, shifting the focus back to the wide US-Japan yield gap.

While details of the framework remain vague, the announcement eased geopolitical tensions between the US and Europe. NATO Secretary General Mark Rutte confirmed discussions on Arctic defence and critical minerals, although Greenland’s sovereignty did not feature.

The Dollar gained broadly as investors unwound haven positions built earlier in the week. Wall Street’s VIX index collapsed towards baseline levels. US Treasuries, sold aggressively earlier in the week, caught a bid as haven demand evaporated.

JPY exporters typically hedge opportunistically during data-driven Dollar strength, particularly when policy divergence rather than risk aversion, drives the move.

USD/JPY support sits at 157.50, with resistance near 159.00. US Q3 GDP, initial jobless claims, and the PCE price index due today could push the pair higher if data beats consensus.

EUR/USD Retreats as Dollar Rebound

EUR/USD retreated towards 1.1700 on Thursday as the Dollar bounced. Descending daily channel patterns signal distribution rather than consolidation, with sellers stepping in at every rally attempt.

“The TACO (Trump Always Chickens Out) is certainly real,” said Damian Rooney, Director of Institutional Sales at Argonaut, referring to Wall Street’s shorthand for the President’s tendency to pull back from aggressive threats.

Trump met NATO Secretary General Mark Rutte, suggesting Western Arctic allies could forge a new Greenland deal covering missile defence and access to critical minerals. Rutte later told Fox News that Greenland’s status with Denmark did not feature in the discussion. Markets removed tail-risk hedges tied to transatlantic tensions, triggering a sharp drop in volatility and renewed demand for US Treasuries.

Euro importers often respond to volatility compression by re-establishing layered hedges, particularly when macro calm strengthens the Dollar’s carry appeal. The current setup — falling volatility, rising US yields, and tariff risk removal — historically favours Dollar strength.

Markets have priced around 45 basis points (bps) of Fed rate cuts this year. Thursday’s core PCE figures will test whether that pricing holds.

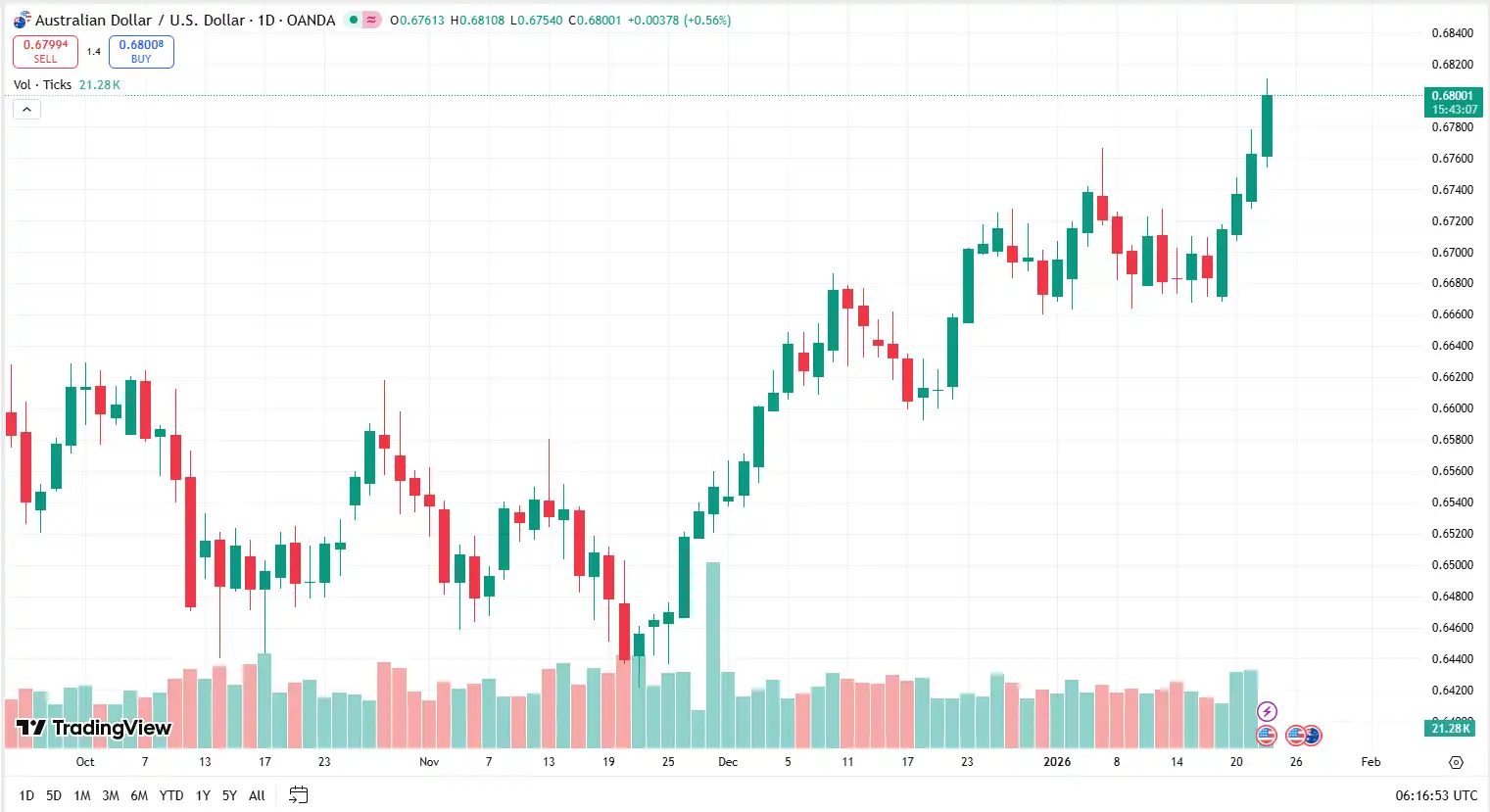

Aussie Hits Fifteen-Month High on Strong Jobs Data

AUD/USD surged to 0.6810 after Australian employment data beat consensus. The Australian Bureau of Statistics (ABS) reported strong hiring alongside a sharp drop to 4.1% in unemployment, while hours worked rose 0.4% to hit an all-time record high (2 billion+ hours).

This proves the Australian labour market is structurally tight, making an RBA hike more likely than a hold on 3 February.

Youth employment led the gains, signalling durable demand rather than temporary distortion. Labour market strength now collides with sticky inflation, creating a policy dilemma for the RBA.

The IMF urged caution this week, noting inflation has remained above the RBA’s 2–3% target for more than two years. Markets largely overlooked this warning and continue to trade probability rather than guidance. Rate optionality now works in the Aussie’s favour, with hike bets replacing hold expectations.

For exporters, AUD/USD testing 15-month highs represents a clear pivot point for evaluating Q1 revenue protection before next week’s CPI data.

Oil Reasserts Influence as USD/CAD Slips

USD/CAD fell below 1.3850 as the Canadian Dollar strengthened on higher oil prices. West Texas Intermediate (WTI) crude traded around the mid-$60s per barrel, supported by easing geopolitical tensions.

The tariff reversal removed downside risk for energy demand, even as supply concerns persist. The International Energy Agency reiterated this week that global crude supply will exceed demand in 2026 despite a modest upgrade to demand growth. US crude inventories rose by 3 million barrels last week, capping oil’s upside.

Canada’s role as the largest crude exporter to the US makes the loonie highly sensitive to WTI moves. The balance favours a range-bound USD/CAD with a mild downside bias driven by commodity stability rather than Dollar weakness.

CAD exporters often capitalise on oil-linked strength to lock in margins when FX support aligns with underlying trade flows. The current 1.3800-1.3900 range offers actionable levels for near-term USD exposure.

What Markets are Watching Next

Thursday’s US calendar features GDP data, initial jobless claims, and the PCE price index - the Fed’s preferred inflation gauge. Stronger readings could reinforce Dollar support and test the market’s pricing of 45 basis points of cuts this year.

The BoJ’s decision on Friday remains the key risk event for Yen crosses. Any dovish language or growth downgrades could entrench Yen underperformance into February.

Markets continue to favour selective exposure over conviction, with policy credibility, political developments, and data resilience shaping FX direction into the next session.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.