Sterling Moves Higher on Upbeat UK Flash PMIs

The GBP/USD pair jumps above 1.3500 as markets pull back on near-term BoE cuts. UK PMI just hit 53.9 (a 21-month high). January PMI shows private sector activity expanding at its fastest pace since April 2024. Businesses are reporting "post-Budget clarity" and investment is returning.

Policymaker Megan Greene flags wage growth has bottomed and disinflation risks are limited. Strong retail volumes and resilient inflation push the BoE to emphasise data-dependence on 5 Feb.

UK Retail sales increased 0.3% MoM, beating expectations for a 0.1% decline. Annual sales rose 2.5% YoY.

Core retail sales (Ex-fuel) climbed 0.3% MoM and 3.1% YoY, up sharply from 1.2% in November. Consumers spent more in December, yet quarterly retail volumes still fell, signalling softening momentum.

Geopolitical uncertainty tied to Trump’s Greenland tariff plans continues to undermine the greenback.

With the UK private sector expanding at its fastest pace in nearly two years, the 'April rate cut' narrative is weakening. GBP-based exporters may see this 1.3500+ handle as a vital level to secure hedges before the market fully prices in a more hawkish BoE.

PMI Data in FFocus as Markets Assess Growth Momentum

The EUR and GBP face repricing risk if growth momentum slips.

European and UK PMIs are today’s key catalyst.

Today’s calendar brings a full slate of PMI releases. Eurozone HCOB Composite, Manufacturing and Services data land alongside UK and US S&P Global PMIs.

The numbers will test whether recent growth momentum holds or fades. Soft readings could accelerate easing expectations. Strong prints would force markets to reassess the pace of cuts.

ECB minutes from 17-18 December warned against over-reliance on baseline forecasts amid elevated uncertainty. Policymakers highlighted services inflation and wage growth as the critical variables.

The eurozone data will shape expectations into the next ECB meeting. The EUR/USD pair held near 1.1751, close to a three-week high.

Dollar Struggles Despite Strong US Growth Data

The Dollar is reclaiming its carry-trade appeal. The NATO-Greenland 'tariff pause' has collapsed volatility, prompting a rotation out of safe havens and back into US Treasuries.

The dollar index (DXY) traded near 98.38 USD, hovering close to its lowest levels of the year after posting its biggest one-day fall in six weeks.

US GDP Q4 grew 4.4% YoY revised; fastest pace since Q3 2023. Consumer spending strengthened through October and November.

Markets largely overlooked the US macroeconomic data. Investors focused instead on geopolitical risks after US assets sold off amid renewed tensions over Trump’s Greenland plans.

Asian equities advanced following the BoJ decision. The policy pause removed near-term uncertainty and supported regional risk appetite.

Gold and silver pushed to fresh highs as dollar pressure persisted. Haven demand reflects broader concerns over US policy direction and Japan’s fiscal sustainability.

Yen weakness and bond-market volatility continue to keep traders cautious. Markets await clearer central-bank signals before committing to conviction trades.

BoJ Stands Pat Despite Sticky Inflation

The Bank of Japan (BoJ) held rates at 0.75% in an 8 - 1 vote on Friday, pushing back against expectations of an immediate hike. Board member Takata Hajime dissented, calling for a 25bp increase. The Yen is 'crumbling' because a single dissent isn't enough to offset the BoJ's downgrade of 2027 growth. Minutes from Governor Ueda’s commentary to follow.

This pause leaves policy at its highest level in 30 years, even as Japan’s core CPI holds at 2.9% in December, well above the BoJ’s 2% target. A single hawkish dissent keeps tightening risk firmly on the table.

The BoJ upgraded its FY2025 GDP forecast to 0.9% from 0.7%, citing government stimulus measures. It raised the FY2026 outlook to 1.0% from 0.7%, while trimming FY2027 growth to 0.8% from 1.0%.

Headline inflation cooled to 2.1% in December from 2.9% in November. Core inflation excluding fresh food eased to 2.4% from 3.0%. The BoJ expects inflation to dip below 2% in the first half of the year.

Takata’s dissent and persistent core inflation underline the BoJ’s readiness to hike once conditions align.

Fiscal stress linked to snap elections and rising JGB yields continues to weigh on sentiment. Japan’s yield curve and FX markets now price a clear structural split: policy calm today, hawkish bias ahead.

Higher JGB yields support carry flows. JGB volatility remains the key trigger for abrupt yen swings.

JPY volatility is spiking. For importers with Yen liabilities, the current probe towards 160.00 is a high-risk zone. Hedging here avoids the potential for a sudden, aggressive BoJ intervention if the 160.00 ceiling is breached.

Yen Slides as Fiscal Concerns Override Policy Outlook

USD/JPY edged lower to 158.61 but continues to probe key resistance as fiscal and political uncertainty in Tokyo dominates price action. Intervention concerns are back on traders’ screens.

Japan’s government is running deeper deficits while global investors reprice higher JGB yields. With elections approaching and FX reserves under scrutiny, yen weakness reflects fiscal anxiety more than BoJ policy.

Sustained yen strength requires confidence that Takaichi’s agenda delivers growth and fiscal credibility, not balance-sheet strain.

Support for the USD/JPY pair sits at 158.00. Resistance caps the upside at 160.00. A sustained break above 160 would likely trigger renewed official warnings.

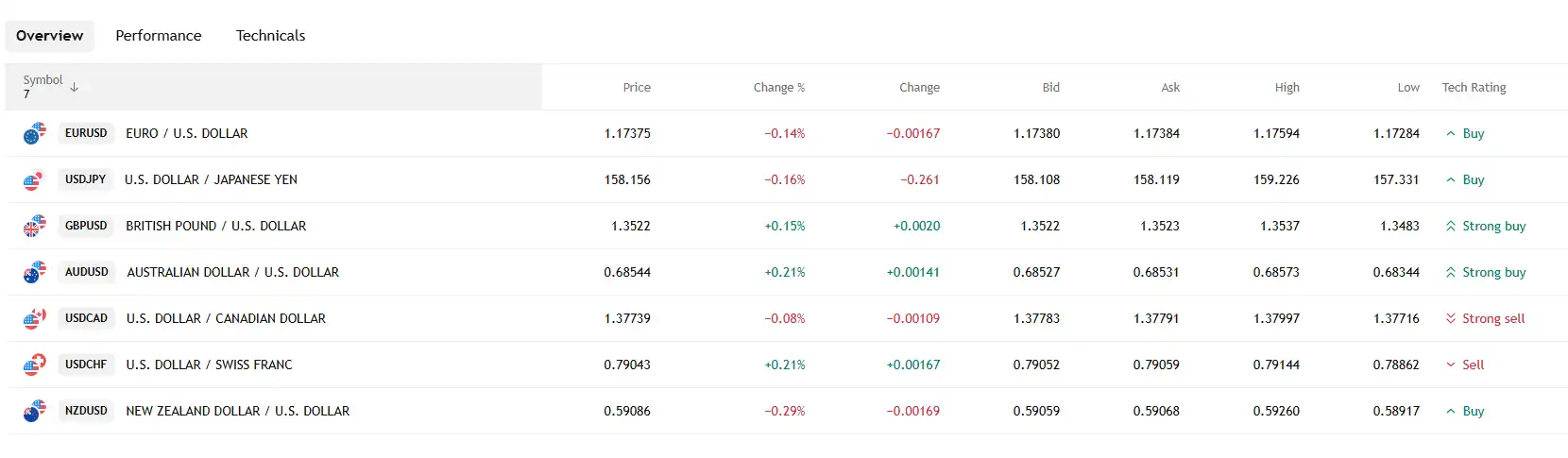

Major Currency pairs overview:

[Source: Tradingview]

[Source: Tradingview]

What to Watch Ahead

- JPY reaction to fiscal headlines, not just BoJ commentary

- BoE Monetary policy minutes

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.